🧠Quote(s) of the week:

Ray Dalio: The U.S. dollar used to be backed by gold — and it’s not far-fetched to think we may be headed there again in the future. History shows us that the same cycles repeat time and time again. One such cycle is related to currency devaluation. Once people start to lose trust in the fiat system, we see a specific cause-and-effect reaction occur.

- Governments print a lot of money

- They pay off the debt with the cheap money

- Nobody wants to hold the devalued currency

- Governments go back and link money to gold

Will this same pattern happen again? It’s hard to say, and it wouldn’t happen anytime soon. But it is conceivable.

ERGO: 'JUST BUY BITCOIN AND HOLD IT FOR TEN YEARS YOU DUMB FUCK.' - HodlMagoo

🧡Bitcoin news🧡

The 10 BTC Commandments.

On the 5th of August:

➡️’Indonesia's vice president's office considers adopting Bitcoin as a national reserve asset. Bitcoin game theory is playing out.’ - Bitcoin Archive

➡️Warren Buffett's BERKSHIRE now underperforms the S&P500 by 26% percentage points.

With a 5% Bitcoin allocation, he would outperform all Indices and ETFs. Everyone needs Rat Poison Squared.

➡️Daniel Batten: "Do we need a better example of why we should separate money from the State? The UK Government is thinking of trading its Bitcoin for Pound sterling. Like living in Venezuela and trading USD for the Bolívar. Imagine rushing to get in on an asset that had lost 99.15% of its value since 2017."

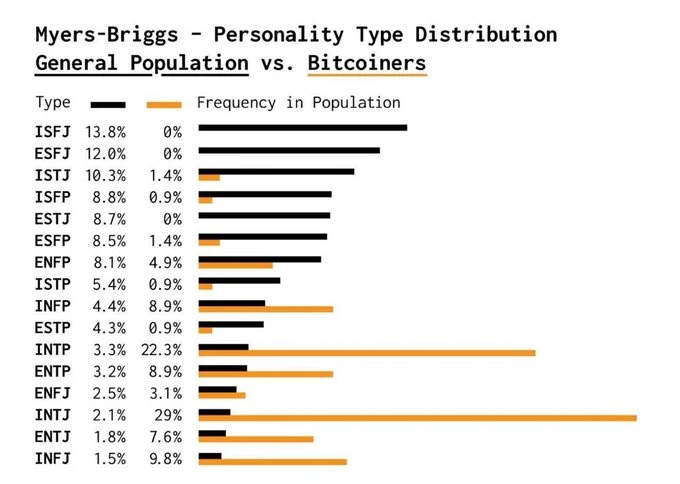

➡️Data shows Bitcoiners are built differently.

INTJ: 2% of the population, 29% of Bitcoiners

INTP: 3% of the population, 22% of Bitcoiners

The rarest types dominate the Bitcoin world.

Fascinating study, although I am an ENTJ.

My Myers-Briggs personality type is INTJ, which is the most common one for Bitcoiners (29%), but only 2.1% of the general population has it. I guess that explains why most people never bought Bitcoin.

➡️Coinbase plans to raise $2 billion through a convertible notes offering.

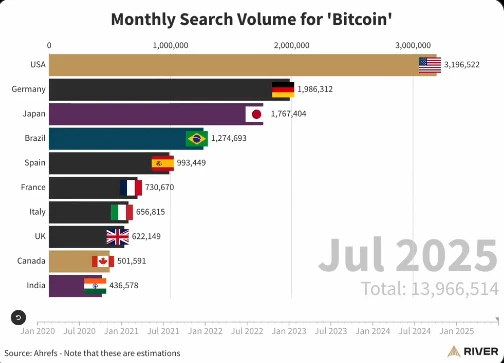

➡️River: The US is the biggest Bitcoin country in the world. But Bitcoin search volume has been rising globally.

➡️New Record Global Bitcoin Network Hashrate 930,000,000,000,000,000,000x per second.

➡️'Brazil to hold first Bitcoin strategic reserve hearing on August 20th. Nation-states are starting to FOMO into Bitcoin.' - Bitcoin Archive

➡️The State of Michigan Retirement System tripled its holdings of the ARK Bitcoin ETF from 100K to 300K shares between Q1 and Q2.

➡️$18,000,000,000 worth of Bitcoin shorts to be liquidated at $125,000 NEVER SHORT BITCOIN

➡️Bitcoin's total unrealized profit reaches a new high of $1.4 trillion.

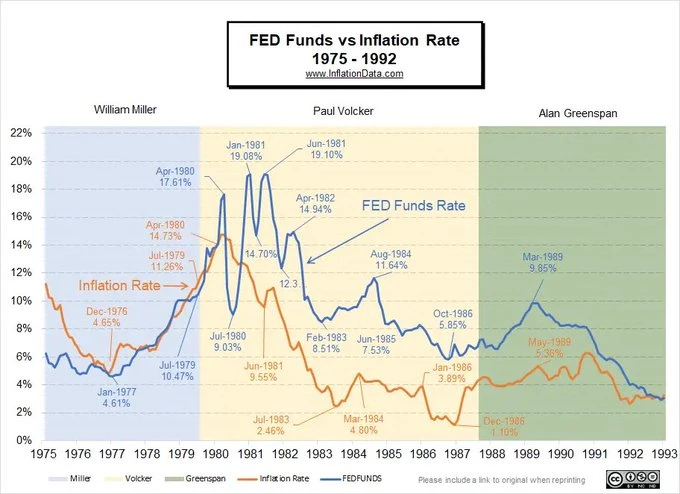

➡️Pierre Rochard: Bitcoin growth could only be slowed by 20% interest rates. Jerome Powell is not Paul Volcker. Rates are going lower, not higher. Position accordingly.

➡️Goldman Sachs expects three consecutive 25bps rate cuts starting in September. More liquidity is coming. Good for 'risk' assets like Bitcoin.

➡️'DOMINATES in risk-adjusted returns, and it’s a blowout.

There. Is. No. Second. Best.' - CarlBMenger

➡️Italian MP says it's inevitable that they will have to discuss establishing a Strategic Bitcoin Reserve.

➡️'Despite increased regulatory clarity in Europe, interest in Bitcoin among the next generation of bankers is fading fast. Only 12% of Morgan Stanley EU interns this summer own Bitcoin, a sharp drop from 63% in 2022.' - Bitcoin News

➡️US Treasury's FinCEN issues an urgent alert on fraud schemes exploiting Bitcoin kiosks, with victim losses rising 31% to nearly $247M in 2024. Bitcoin ATMs surged 99% last year, with over 10,956 incidents reported to the FBI's Internet Crime Complaint Center

➡️Capital B confirms the acquisition of 62 BTC for ~€6.2 million, the holding of a total of 2,075 BTC, and a BTC Yield of 1,446.3% YTD

➡️'The Bitcoin circulating supply has just passed 19.9 million BTC. With 95% of the supply already mined, there will only ever be 1.1 million more BTC issued. Simple sentences, but few understand the importance behind the words.' - On-Chain College

➡️Daniel Batten:

8th independent report finds significant environmental benefits in Bitcoin mining details in linked tweet "Bitcoin mining can be a practical way of cutting carbon and costs while keeping communities warm.

Key finding: "Electrifying heat in regions with low-carbon electricity... reduces [s] emissions from district heating. The heat from bitcoin mining could significantly advance this electrification, transforming digital energy into a source of high-temperature, low-carbon heat."

The report highlights MARA, who use Bitcoin mining to supply heat to 80,000 residents in Finland (1.6% of the population). Each MW of bitcoin mining means 455 fewer metric tons of CO2 emissions/year than the average district heating facility in Finland."

The report comes three months after Cambridge also released a study showing similar decarbonizing potential through Bitcoin mining recycled heat jbs.cam.ac.uk/2025/cambridge-study-sustainable-energy-rising-in-bitcoin-mining Source: District Energy, Q3 Report 2025

This is just one of the ways that Bitcoin mining has been found to reduce emissions and promote climate action. Other uses include methane mitigation, obviating gas peaker plants, accelerating the clean energy transition, and stabilizing grids. batcoinz.com/why-climate-action-doesnt-just-benefit-from-bitcoin-mining-it-requires-it

➡️Cyprus-based shipping company Robin Energy has completed a $3M Bitcoin allocation, with Anchorage Digital Bank as its custodian.

➡️Michigan's state pension buys another 200,000 shares of ARK’s Bitcoin ETF. $10m total holding.

On the 6th of August:

➡️I truly believe Bitcoin is, and will be, the base layer of the next generation monetary/finance system.

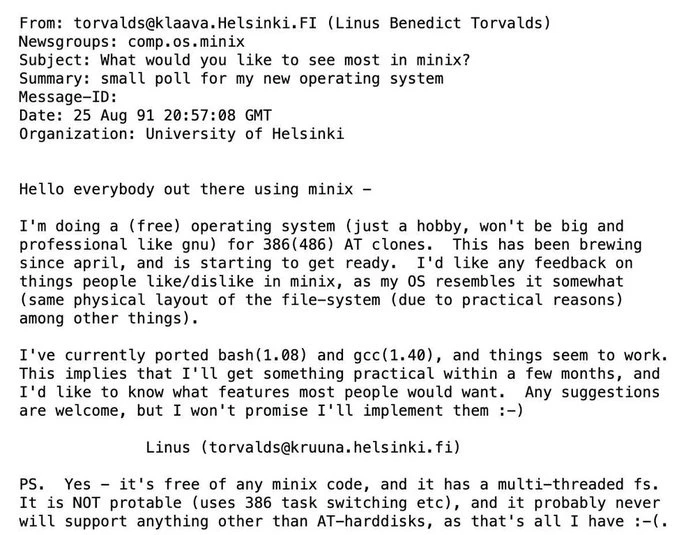

If you don't believe in Bitcoin yet, I recommend learning some computer and technology history.

Written in 1991

Just like Linux, Bitcoin is freedom tech! Grubles: "If you're skeptical about Bitcoin being the foundation of the world's new monetary and financial system, remember Linux was once a mere hobby project and is now the foundation of the Internet and modern computing as we know it."

➡️An SEC commissioner quoting A Cypherpunk’s Manifesto. Written in 1993 cdn.nakamotoinstitute.org/docs/cypherpunk-manifesto.txt

➡️On X, Pareto Optimist wrote a must-read essay on stablecoins.

"A simple guide to stablecoins The GENIUS Act and what it means for the future of the dollar."

Inside this issue:

- An extremely stable GENIUS bill

- There is no such thing as a dollar

- If it quacks like a bank account …

- America is a club promoter

- Winners love it when a winner-takes-all

- The stable future and what to do about it

Click here: knifefight.substack.com/p/a-simple-guide-to-stablecoins?r=dv2f9&showWelcomeOnShare=true&triedRedirect=true

➡️$3 Billion YouTube competitor Rumble announces it will integrate the Bitcoin Lightning Network for tips.

On the 7th of August:

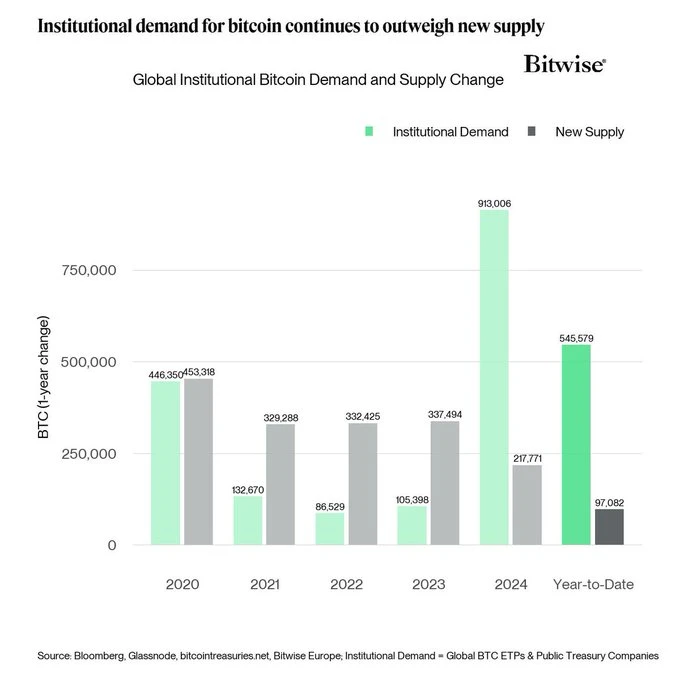

➡️Institutions have bought 545,579 Bitcoin while miners have only mined 97,082 new Bitcoin in 2025. Demand is far exceeding supply.

➡️U.S President Trump signs an executive order allowing 401(k) retirement accounts to invest in Bitcoin.

➡️'Sheetz, the popular convenience store chain with 750+ locations, is now offering 50% off purchases paid with Bitcoin and crypto daily from 3 PM to 7 PM.' -Bitcoin News

On the 8th of August:

➡️New Record Global Bitcoin Mining Hashrate 935,000,000,000,000,000,000x per second

➡️Daniel Batten: EEP (Ethiopia Electric Power) revenue from Bitcoin mining for the last year is estimated to be $220 million.

The revenue allowed EEP to progress with building the Transmission network, with 28,571 km of new power lines constructed and over 8,700 substation bays installed. The new infrastructure delivers energy to parts of rural Ethiopia that previously had no electricity access. Along with @gridless micro-hydro/Bitcoin mining projects in Kenya, Malawi, and Zambia, this provides another tangible example of where Bitcoin mining is reducing energy poverty in Africa at scale. This is something much talked about, but which no other technology has managed to do at scale until now.'

Sources for renewable Bitcoin mining in Ethiopia: addisinsight.net/2025/08/07/ethiopian-electric-power-reports-record-75-4-billion-birr-revenue-as-gerd-powers-energy-boom

birrmetrics.com/ethiopia-electric-power-revenue-hits-br75-4-bln-amid-surge-in-data-mining-demand

Sources for renewable Bitcoin mining in Kenya, Malawi, Zambia: cnbc.com/2024/04/20/bitcoin-miner-gridless-backed-by-block-builds-site-at-kenya-volcano.html

unherd.com/2024/01/the-african-village-mining-bitcoin

emurgo.africa/blog/posts/10-countries-bitcoin-mining-takes-off-in-africa-powered-by-green-energy

On the 10th of August:

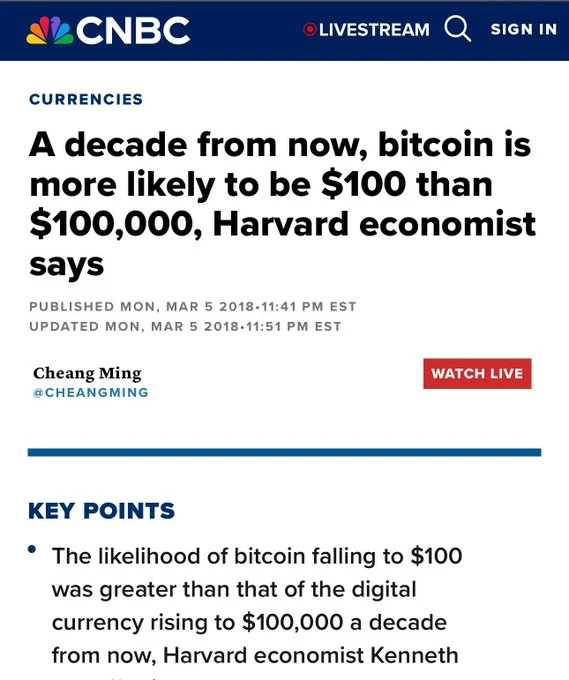

➡️Harvard owns more Bitcoin than Google shares.

Remember: 2018: Harvard says Bitcoin is more likely to hit $100 than $100K.

2025: Harvard buys $116M Bitcoin at $116K.

Everyone gets Bitcoin at the price they deserve.

➡️They want you to buy XRP while they sell it. Don't do shitcoins, ladies & gents.

➡️Bitcoin treasury companies now hold 1.85 MILLION Bitcoin worth $219 BILLION.

On the 11th of August:

➡️Bitcoin MVRV-Z Topping Cloud - Next stop at $124k. The market is still a long, long way from being overheated.

➡️$30,000,000 worth of Bitcoin shorts liquidated in the past 60 minutes. Nice! Liquidate them all!

➡️Strategy has acquired 155 BTC for ~$18.0 million at ~$116,401 per bitcoin and has achieved BTC Yield of 25.0% YTD 2025. As of 8/10/2025, we hodl 628,946 Bitcoin acquired for ~$46.09 billion at ~$73,288 per Bitcoin.

💸Traditional Finance / Macro:

On the 5th of August:

👉🏽S&P 10 vs S&P 490

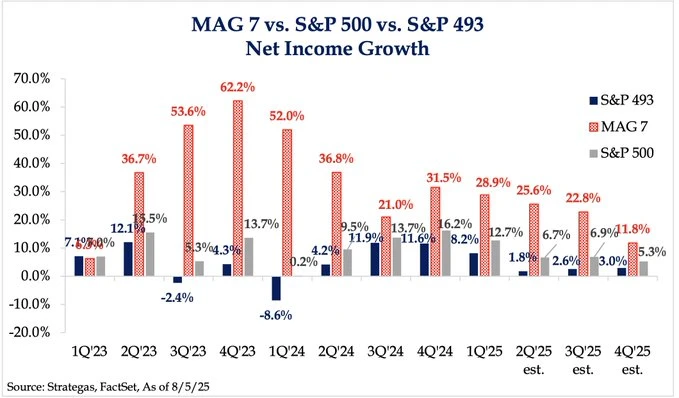

'The top 10 S&P 500 companies have seen their net income grow by 180% since 2019. At the same time, the remaining 493 firms' profit growth was just 45%, or 4 times less. The top 10 companies' earnings growth began accelerating in 2023 and nearly DOUBLED since then. The gap continues to widen this earnings season. From the 70% of S&P 500 companies that have reported Q2 results, 52% have posted declining profit margins. Meanwhile, Apple, Meta, Microsoft, and Google all beat earnings expectations. Big tech is getting bigger.' - TKL

👉🏽Suspicious Stock Trades Raise Questions About Congressional Corruption

Concerns over conflicts of interest in U.S. politics resurfaced this year after unusual stock trades by two members of Congress, April McClain Delaney and Robert Bresnahan.

Both lawmakers disclosed purchases of shares in IDEXX Laboratories ($IDXX), a biotechnology company with a strong focus on agriculture. Notably, both also serve on the House Agriculture Committee — the very body overseeing legislation that directly affects companies like IDEXX.

Only days after their trades, on April 9, 2025, the National Biotech Initiative Act of 2025 was introduced. The bill, which channels federal subsidies into the biotechnology sector, was referred to committees including Agriculture — meaning these lawmakers were directly involved in shaping and approving the policy framework that could benefit IDEXX.

Then came the payoff: on August 4, 2025, IDEXX reported quarterly results far above expectations, with earnings per share of $3.63 and revenue growth of 11%. The market reacted immediately, sending the stock soaring 24–27% in a single day. The sequence of events — committee members buying biotech stocks shortly before voting on billions in federal subsidies, followed by a major price surge — raises sharp questions. Was this simply good timing, or yet another example of lawmakers profiting from insider knowledge while shaping the very policies that enrich them?

I think we all know the answer, right, Nancy "caugh" Pelosi...

As mentioned in my previous Weekly Recap...

Nancy Pelosi's portfolio grew (70%) just last year...she outperformed every single hedge fund and more than doubled Warren Buffett. Pelosi has a net worth of $413M dollars..., while earning $174K a year in Congress.

On the 7th of August:

👉🏽TKL: "The top 10% largest US stocks now reflect a record 76% of the US equity market. This has officially surpassed the previous record set before the Great Depression in the 1930s. By comparison, at the 2000 Dot-Com Bubble peak, the top 10%'s share was at ~73%. In the 1980s, this figure was below 50%. Meanwhile, the top 10 stocks in the S&P 500 now represent a record 40% of the index’s market cap. We are witnessing history."

🏦Banks:

👉🏽No news

🌎Macro/Geopolitics:

'The house didn't change. The money did.

Most people still haven’t figured this out.' - Jordan Walker

On the 5th of August:

👉🏽Today's ISM Services data reported weakening activity, lower employment, and higher prices. The Fed's worst nightmare: stagflation.

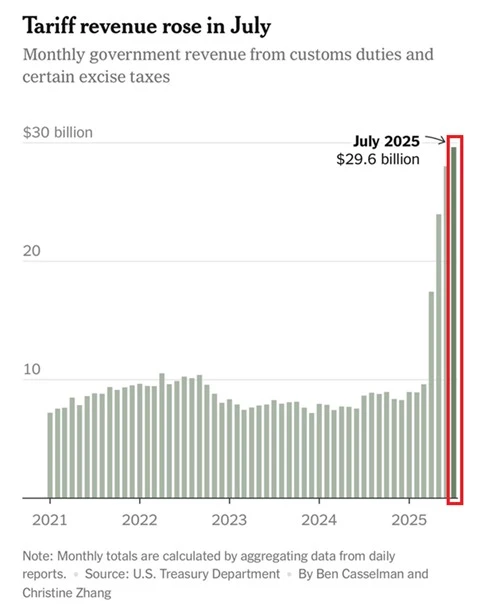

👉🏽US tariff revenue surged to a record $29.6 billion in July. This follows $26.6 billion in June, $22.2 billion in May, and just $8.2 billion in March when new tariffs began. Over the last 3 months, customs and certain excise taxes have reached $78 billion, more than the entire Fiscal Year 2024. At this pace, annual tariff revenue could reach $308 billion, a $231 billion increase compared to 2024. For perspective, corporate income taxes collected last fiscal year were ~$366 billion. Tariff revenue is skyrocketing.

👉🏽The stupid Dutch government is going to finance the American war ... the Trump effect with Rutte as the tribute collector.

Brekelmans: What decisiveness. That 500 million is separate from the additional billions for NATO, you know. This comes on top of it. Can someone explain how it is that in the US, every penny to be spent must be approved by Congress, while in the Netherlands, billions are siphoned off without any parliamentary approval?

More context on why I said the American War:

"The Partnership: The Secret History of the War in Ukraine This is the untold story of America’s hidden role in Ukrainian military operations against Russia’s invading armies." - NY Times.

Read here: archive.ph/ALt6u

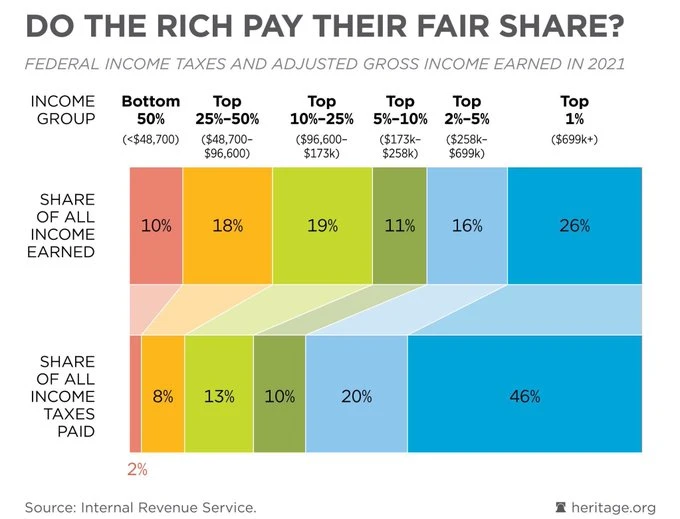

👉🏽Michael A. Arouet: "As socialists are not able to create anything, they always follow two paths: more debt, and 'tax the rich“. The top 1% in the US already pay almost as much in income taxes as the remaining 99%. Comrades, if you want to contribute to society, get a real job."

Now, although I like the deeper meaning of the statement by Michael, I don't like the graph and statement. For one, income is not wealth.

According to Federal Reserve data (Q1 2025), the top 1% hold 30.8% of US household net worth. Per the Tax Foundation (2022 data), they paid 40.4% of federal income taxes—exceeding their 22.2% share of adjusted gross income that year.

In the Netherlands, the top 1% earn ~10% of pre-tax income but face a 21% effective tax rate (vs. 40% average), contributing roughly 5-6% of total tax revenue—far less than their income share. This contrasts with the US, where they pay 46% of income taxes while earning 26%. Sources: CPB (2022), World Inequality Database.

Anyway, high incomes simply pay a lot of taxes; don’t confuse them with the extremely wealthy. That’s something very different.

👉🏽'In the first two years of his presidency, Javier Milei is set to achieve a budget surplus of $71 billion. During Donald Trump’s first term, he had an $8.4 trillion budget deficit. In his second term, Trump is on pace for a $10 trillion budget deficit. Libertarianism > Populism' - Bryce Lipscomb

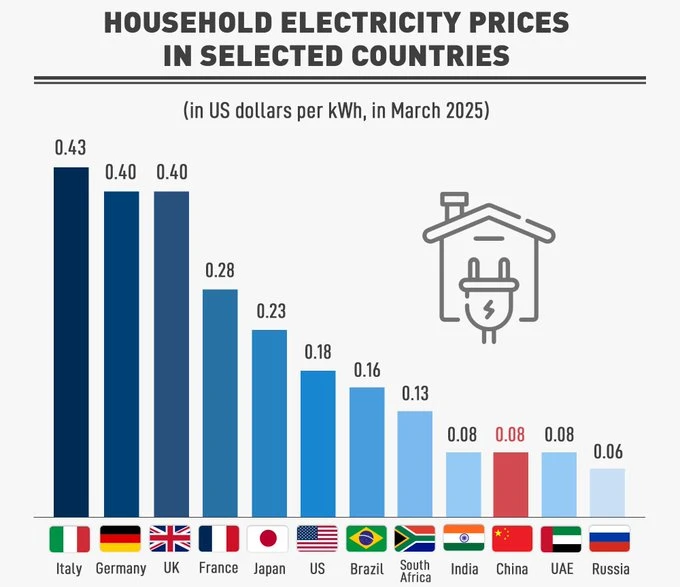

👉🏽 Green insanity! It is the cheapest form of energy, but somehow ends up as the highest kWh price.

Now, one tiny disclaimer, though, from my side. More than half of the price per kWh in the Netherlands consists of taxes. Half of this problem is the fault of politicians, because why would you shut down your domestic gas fields? The other half...Infrastructure cost is one thing, and storing on the grid is expensive. Anyway, every time they say wind and solar are cheap, my electricity bill gets more expensive. Amazing how that works, innit?

As mentioned in my previous recap. Energy is a strategic asset and the driver of growth and development.

Remember:

Stable energy = cheap energy.

Cheap energy = competitiveness.

Competitiveness = prosperity.

And if you don't believe me...

Bjorn Lomborg:

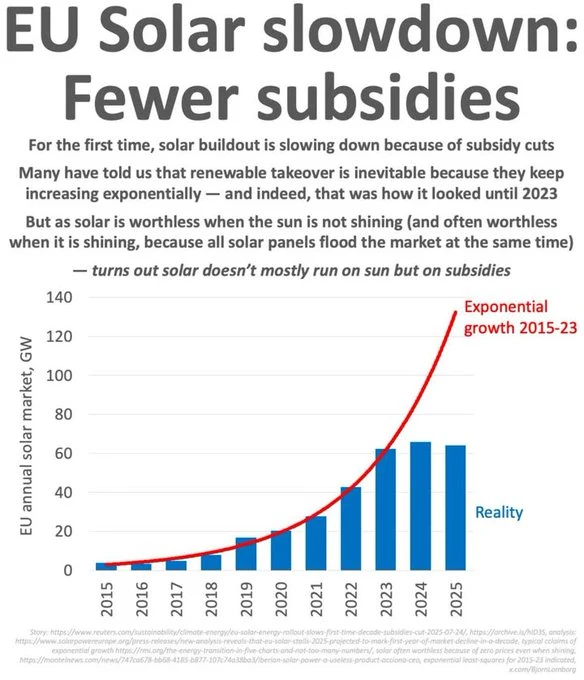

Turns out solar runs less on the sun, more on subsidies. EU solar rollout is slowing due to subsidy cuts. So much for "cheap power", "exponential growth," and "taking over the world" claims for renewables.

Sources:

reuters.com/sustainability/climate-energy/eu-solar-energy-rollout-slows-first-time-decade-subsidies-cut-2025-07-24 archive.is/hlD3S

👉🏽U.S. Housing Market Home Sellers outnumber Buyers by more than 500,000, the largest gap ever recorded.

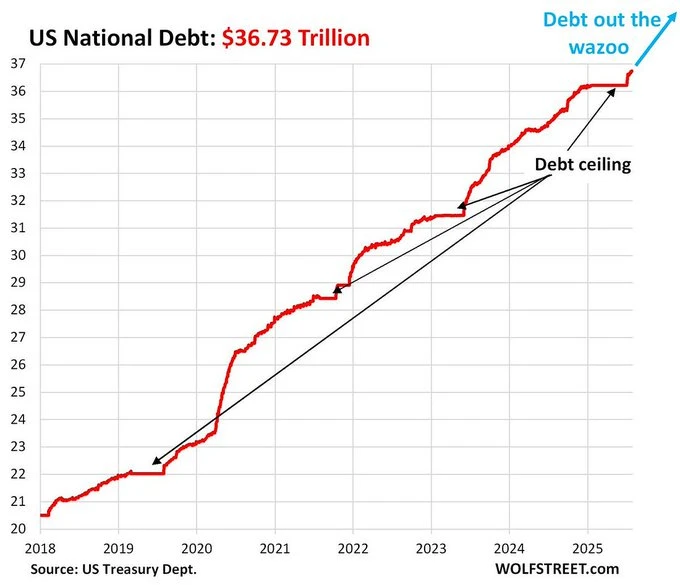

👉🏽New data suggests the debt ceiling, which is supposed to limit how much the government can borrow, may actually contribute to a higher national debt over time. You can see in this chart from Global Markets Investor on X that the national debt explodes higher as soon as the debt ceiling is raised or removed every few years.

No really! Who would’ve thought! haha

The math is pretty simple: every time the ceiling is raised, the debt goes up. Macro Jack: 'Tell me again how Bitcoin is a Ponzi scheme. The debt ceiling has been raised 79 times since 1960. Federal debt is now $37 trillion. Every time it's framed as a crisis, then quietly extended so the can gets kicked further. But somehow Bitcoin is the thing we’re supposed to be scared of, which makes you think?'

Anyway, with the National Debt at $37 trillion and doubling every ten years, the US will owe $100 trillion to the world in approximately 14 years. The same time distance as mid-2011 to today. Got Bitcoin?

👉🏽Study Bitcoin (Once you see it, you can’t unsee it)

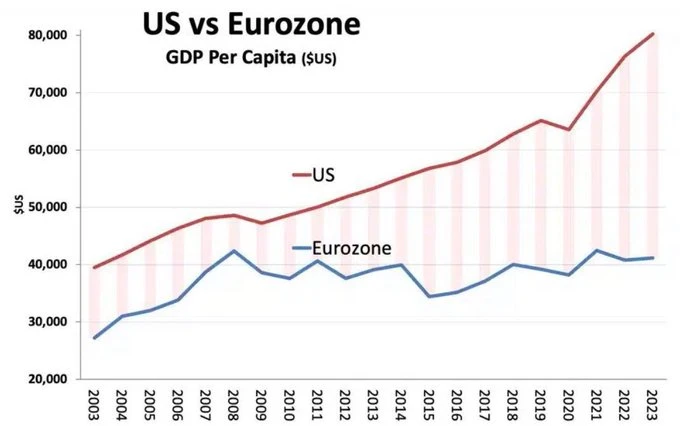

GC7 Analizador: "US model: rewards innovation, risk-taking, and entrepreneurship. Capital flows fast, tech scales globally, and the private sector leads growth.

Eurozone: often prioritizes regulation, redistribution, and “fairness” over competitiveness. That sounds noble, but when overdone, it kills incentives and slows productivity. Many Europeans prefer stability over ambition, and fear inequality more than stagnation. The result? Slow decline wrapped in good intentions. Prosperity doesn't survive on autopilot."

The Europeans are forgetting that wealth creation is necessary for wealth distribution. The welfare state cannot survive without confiscating wealth. Thus, with no wealth, there is no welfare state. When they realize this, it'll be too late. Europe risks learning that too late.

On the 6th of August:

👉🏽'Free speech in Europe is disappearing. A controversial European Union proposal dubbed “Chat Control” is gaining momentum, with 19 out of 27 EU member states reportedly backing the measure. The plan would mandate that messaging platforms, including WhatsApp, Signal, and Telegram, must scan every message, photo, and video sent by users starting in October, even if end-to-end encryption is in place. Denmark reintroduced the proposal on July 1, the first day of its EU Council presidency. France, once opposed, is now in favor. Belgium, Hungary, Sweden, Italy, and Spain are also in favor, while Germany remains undecided. However, if Berlin joins the majority, a qualified council vote could push the plan through by mid-October. A qualified majority in the EU Council is achieved when two conditions are met. First, at least 55 percent of member states, meaning 15 out of 27, must vote in favor. Second, those countries must represent at least 65% of the EU’s total population.' -WallStreetMav

👉🏽New report reveals Argentina's middle class grew by 7.7 million people in the first quarter of 2025. The legacy media aren't telling you about Argentina's economic miracle. I wonder why? Clearly, the government is the problem. Not the solution.

On the 8th of August:

👉🏽Gold prices officially surge above $3,500/oz and enter record high territory. This puts gold prices up +43% over the last 12 months, more than DOUBLING the S&P 500's return.

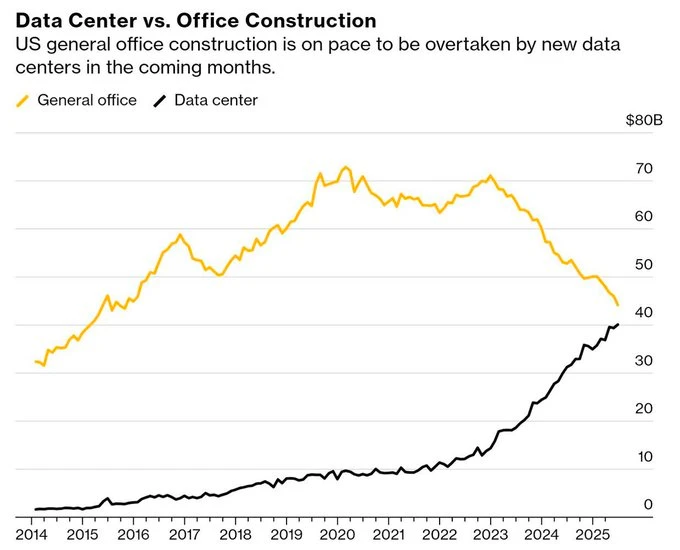

👉🏽'Data centers vs. office construction. This chart perfectly illustrates where we are heading.' - Michael A. Arouet

Fun or concerning stat though: TKL: "Data center energy consumption has reached a record 5% of total US power demand. This increase has been driven by the rapid adoption of digitalization and AI technologies.

This percentage is now estimated to more than DOUBLE over the next 5 years, according to McKinsey. Additionally, data center load is set to account for up to 40% of net new demand added until 2030.

Overall, electricity demand for data centers is expected to grow at a compounded annual growth rate of +23% through 2030. Energy will soon be the AI bottleneck."

👉🏽A taxpayer rights lobby group has asked Europe's top prosecutor to investigate two of the key architects of the European Green Deal, accusing them of illegally funding nongovernmental organizations.

www.politico.eu/article/taxpayer-group-demands-probe-into-eu-green-deal-architects-over-ngo-funding

Or for the Dutch readers: opiniez.com/2025/08/09/het-brusselse-ngo-schandaal-breidt-zich-steeds-verder-uit/pcleppe

Former EU climate chief Frans Timmermans is among those targeted in the complaint. Under his direction, billions in taxpayer money were apparently used to buy the loyalty of various organizations and to prepare politics and the public for his Green Deal.

Now the real question would be? How many NGOs does the EU fund that are opposed to the Green Deal? Answer Zero. They are all activist groups aligned with the "left-wing" policies.

👉🏽Holger Zschaepitz: Germany: where an increasing number of companies are being forced to shut down. According to preliminary data from the Federal Statistical Office, the number of regular insolvency filings in July 2025 rose by 19.2% YoY.

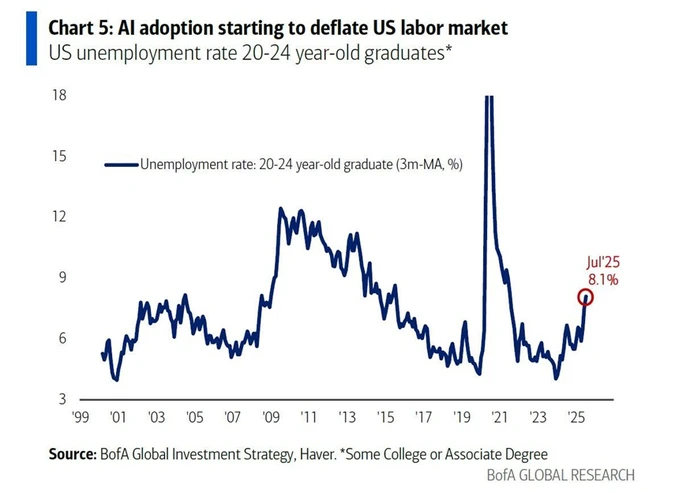

👉🏽TKL: "The US unemployment rate for youth graduates aged 20-24 has averaged 8.1% over the last 3 months, the highest in 4 years. It has risen by ~2 percentage points over the last 19 months. This matches levels seen in 2008, which is far above levels seen in 2001. Additionally, the unemployment rate for youth aged 16-24 has averaged 9.9% over the last 3 months, the highest since May 2021. Since the April 2023 low, the youth jobless rate is up 3.4 percentage points. Young Americans can't find jobs."

👉🏽Le Pen's RN Party has smashed their all-time polling record this month, and is now leading Emmanuel Macron's party by 18%

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Is MSTR a Ponzi? | Lyn Alden & Andy Constan

Lyn Alden and Andy Constan go deep on Bitcoin treasury companies like Strategy, debating whether they’re outright Ponzi schemes or legitimate vehicles for leveraged Bitcoin exposure.

They dig into how these companies actually generate returns, why premiums to NAV exist, and the conditions that could cause the model to unravel. Lyn lays out her cautiously bullish case for well-run treasuries, while Andy argues the structure depends on new capital in ways that can’t last forever.

In this episode:

- What makes a Bitcoin treasury company different from an ETF

- Why premiums to NAV exist

- How Strategy’s capital structure works

- Whether treasury companies can generate income without selling Bitcoin

- The Ponzi-adjacent” problem

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃