🧠Quote(s) of the week:

"So let me get this straight… All currencies are pegged to the US dollar… but the US dollar is backed by nothing but debt… and that debt is running out of control at an unsustainable rate. So the entire global financial system is basically bullshit? Got it… buy Bitcoin." - Mark Wlosinksi

“Governments make life more expensive with more and more regulations,” writes @PeterDeKeyzer. “Then they ease the pain with subsidies.” And: “Regulations kill growth, innovation, competition, and prosperity.”

Divide et impera. Politicians (still) love it.

🧡Bitcoin news🧡

Last weekend we, Noderunners, had a great bbq. Great conversations about Bitcoin, love, politics, but above all about life. Man, woman, Black, white… from Fryslan or from Limburg. None of it matters at all… because:

Tiny reminder:

Noderunners conference, November 1st.

This is your chance to join the most hardcore Bitcoin maximalists in Europe. No shitcoin talk. No VCs, Bitcoin ETF/stonks/treasury crowd. No compromise. Just pure Bitcoin signal from the brightest minds in the space.

Network with Lightning developers, node runners, miners, and the orange-pilled elite who are actually building the Bitcoin future.

So does your heartbeat orange?

Fixing the world on your mind?

Join us! Plebs, talks, workshops, beer & more!

Tickets: noderunners.network/en

On the 12th of August:

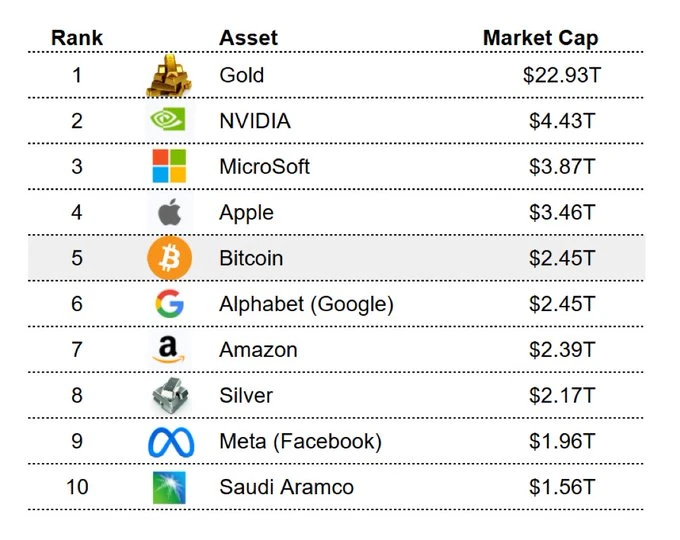

➡️World's largest pension fund increases its Bitcoin exposure by 192% in Q2.

On the 13th of August:

➡️Charles Edwards: "Shut the front door. Yesterday, institutional Bitcoin buying represented 75% of Coinbase's volume. All readings above 75% have seen higher prices one week later."

"80% of the time in the last decade, when Bitcoin long-term holders' share of supply pulls back from a peak (like today), the price skyrocketed. When price was already rallying (like today), it was a 100%" t.co/dKkyMoJ6gF

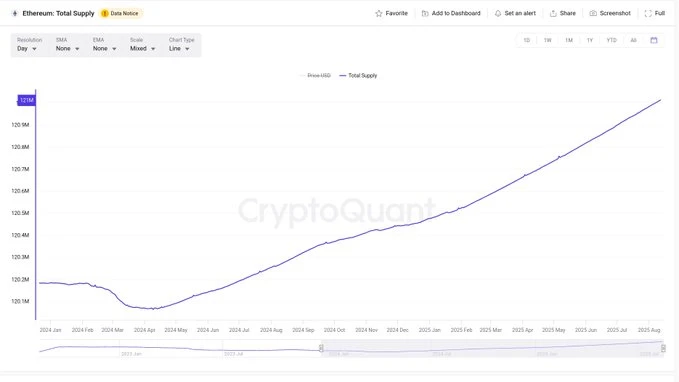

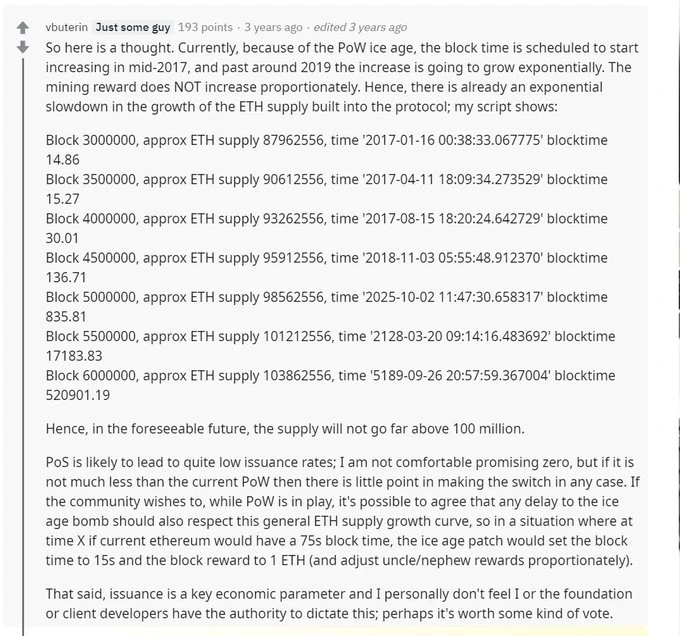

➡️Pierre Rochard: 'ETH supply is 120 million, far above 100 million. There is no ceiling, you will get diluted.'

➡️Kazakhstan approves Central Asia’s first spot Bitcoin ETF. Trading begins tomorrow.

➡️Stocks are near record highs, up 90% in dollars over 5 years but down 81% priced in bitcoin. - Priced in Bitcoin

On the 13th of August:

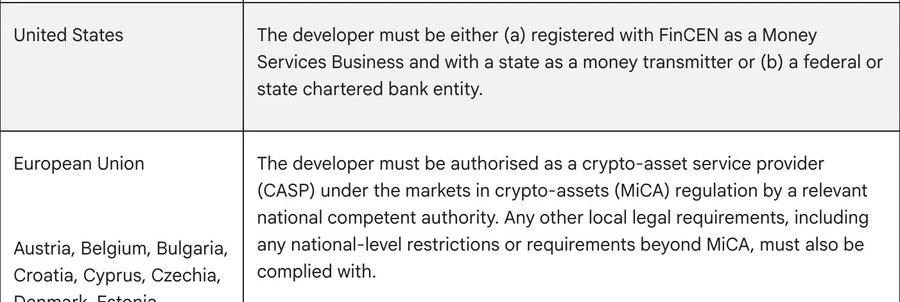

➡️Google bans unlicensed Bitcoin wallets in the U.S. and EU. The war on self-custody has begun. Google Play’s new policy could remove non-regulated wallets in the U.S. and EU starting December 2025 — hitting millions of users.

Google Play will ban non-custodial wallets unless developers hold a FinCEN, state banking, or MiCA license. In the EU, MiCA rules effectively block such wallets entirely from the store.

On a funny note...the reason why Google just attacked Bitcoin...

On the 14th of August:

➡️Pledditor: "Bitcoin just made a fresh new all-time high. Let's check in on how those treasury stocks that pitched 'bitcoin as the hurdle rate' are doing: $MSTR -29% $CEPO -35% $H100 -36% $CEP -51% $MTPLF -59% $NAKA -62% $SWC -66% $MATA -69% $LQWD -79% $SQNS -79%.

Whoops."

➡️"Ethereum inflated by nearly 1,000,000 ETH in just ~1 year. It's worse than I thought, and there are no signs of stopping.

Vitalik sold you Proof-of-Stake, saying ETH will become "ultra sound money". Instead, you get an unexpected 1 MILLION new ETH printed out of thin air in just 1 single year. It's no different than holding fiat currency." -Grubles.

Oh, and by the way, about $3.31B in ETH (718,351 ETH) is currently stuck in Ethereum’s exit queue, with withdrawals estimated to take over 12 days. If some of you are still doing shitcoins, well, oh well, don't do shitcoins.

➡️US Treasury Secretary Scott Bessent says “we are not going to be buying”. Great! Would rather have Bitcoin in the hands of individuals.

➡️Jack Dorsey’s Block has released the first-ever American-made Bitcoin mining ASIC!

On the 15th of August:

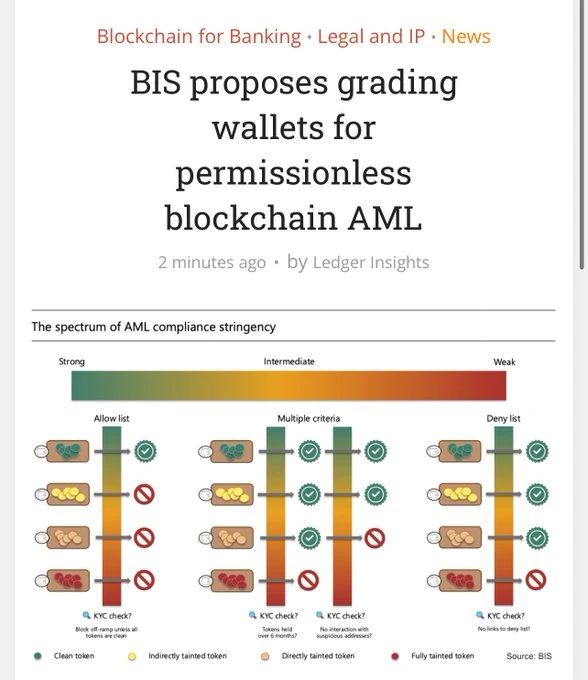

➡️BowTiedMara: "The Bank of International Settlements (BIS) wants to start marking bitcoins. The central bank of central banks is essentially proposing to create a grading system from 0 to 100 for each satoshi, based on transaction history. If the score is low, companies and even users could refuse to accept that bitcoin, claiming it would be "tainted" by links to illicit activities. If this were implemented globally, it could create a parallel market where "clean" bitcoins would have different values than "marked" bitcoins. How about you grade deez nuts?"

Source: www.ledgerinsights.com/bis-proposes-grading-wallets-for-permissionless-blockchain-aml

➡️Wells Fargo increases Bitcoin exposure from $26M to $160M in Q2. The banks are quietly buying.

➡️ Bitcoin accumulation demand reaches its highest level ever.

➡️Hedge fund Brevan Howard just disclosed ownership of $2.3 BILLION worth of Bitcoin ETFs. Brevan is now the largest institutional holder of BlackRock's Bitcoin ETF.

➡️ Federal Reserve to scrap program devoted to policing banks on Bitcoin, crypto, and fintech activities.

Joe Consorti: "The Fed just killed all unlawful supervision of banks engaging in Bitcoin activities. Bitcoin as collateral, the biggest 21st-century unlock for financial institutions, is now on the table."

On the 16th of August:

➡️'Norges Bank, Norway’s central bank, increases its Bitcoin equivalent exposure from 6,200 to 11,400 BTC in Q2, an 83% jump. The position is almost entirely in Strategy (formerly MicroStrategy), with a small addition in Metaplanet.' - Bitcoin News

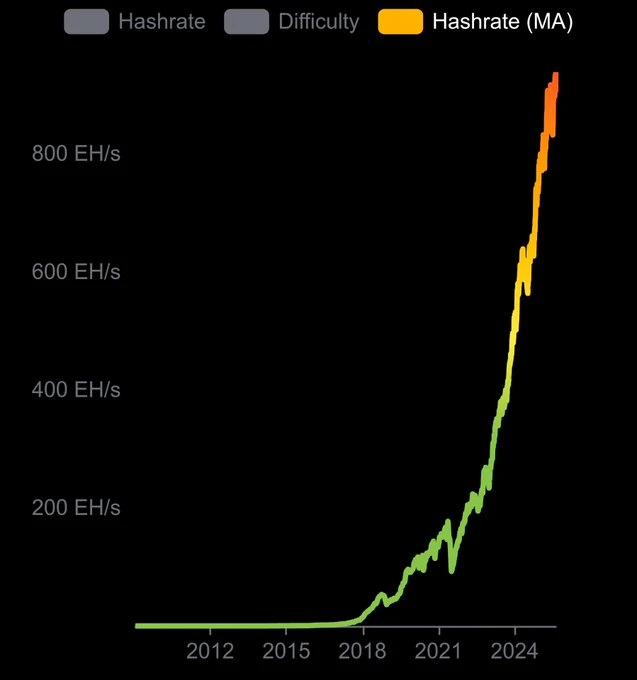

➡️New Record Global Bitcoin Mining Hashrate 940,000,000,000,000,000,000x per second.

➡️BlackRock’s Larry Fink is now interim co-chair of the WEF. He controls Wall Street. Now he controls Davos. Fink’s BlackRock currently holds nearly 750,000 BTC in its IBIT ETF. Kinda crazy and dangerous if you would ask me.

➡️Bitcoin 200-day moving average breaks above $100k for the first time EVER!

On the 17th of August:

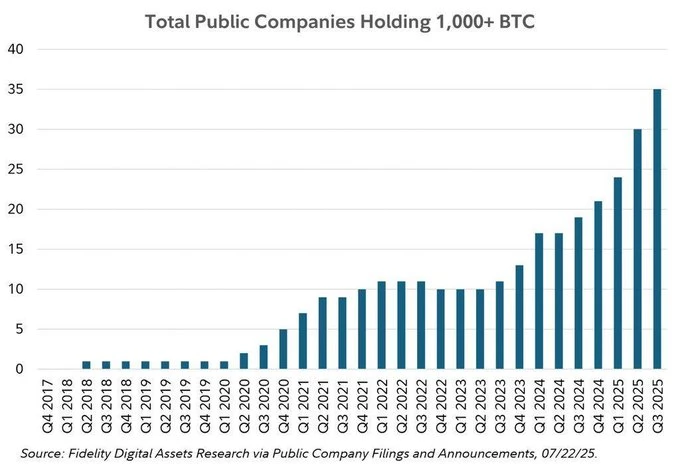

➡️Bitcoin is becoming a corporate treasury standard. 35 public companies now hold 1,000+ BTC.

➡️'Calling a Bitcoin top here is fighting history and probability. Every prior Bitcoin bull cycle topped at the overextended MVRV +2SD line. This cycle hasn’t even reached the 1.5 SD level. The bull market continues.' -On Chain College

➡️Thailand launches a program to allow foreign visitors to convert Bitcoin and crypto into local currency.

➡️Strategy has acquired 430 BTC for ~$51.4 million at ~$119,666 per bitcoin and has achieved BTC Yield of 25.1% YTD 2025. As of 8/17/2025, we hodl 629,376 Bitcoin acquired for ~$46.15 billion at ~$73,320 per Bitcoin.

💸Traditional Finance / Macro:

On the 11th of August:

👉🏽Nvidia, $NVDA, now accounts for over 8% of the S&P500, the highest weighting for any single stock in index history.

On the 12th of August:

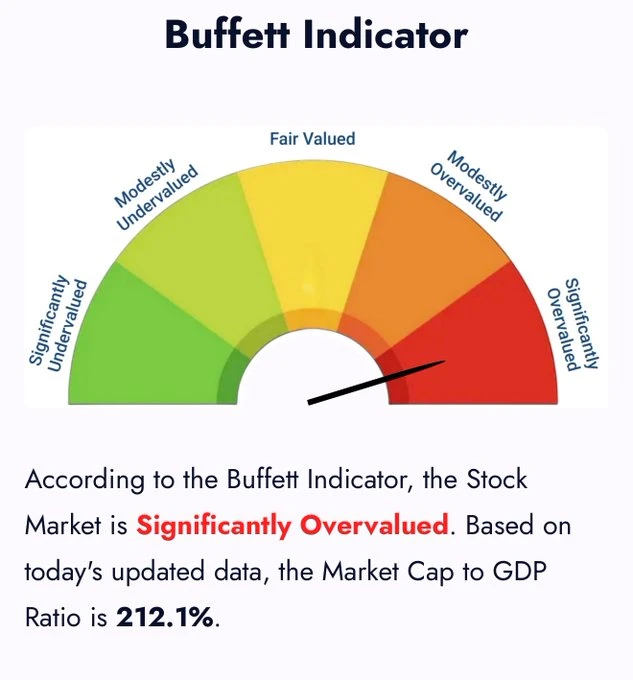

👉🏽'Ladies and gentlemen, the Warren Buffett indicator just hit 212, the highest number ever recorded. Thanks for listening.' - The Great Martis

👉🏽The S&P 500 officially closes above 6,400 for the first time in history. This puts the S&P 500 up +33% from its April 2025 bottom. That's +$13.5 TRILLION in 4 months.' -TKL

🏦Banks:

👉🏽No news

🌎Macro/Geopolitics:

This week could rewrite the 2025 market script. Housing, jobs, oil, Fed minutes, earnings, and Powell’s Jackson Hole speech, the Super Bowl of central banking.

On the 12th of August:

👉🏽James Lavish: 'And congratulations, everyone. After adding nearly $1T so far this year, the US National Debt has officially passed $37 trillion. A job well done, all around.'

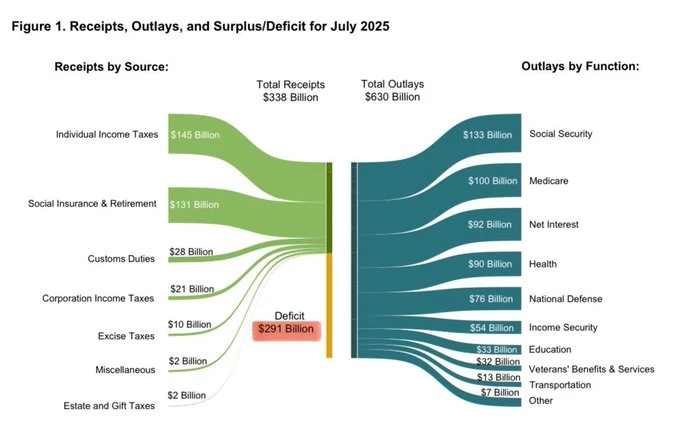

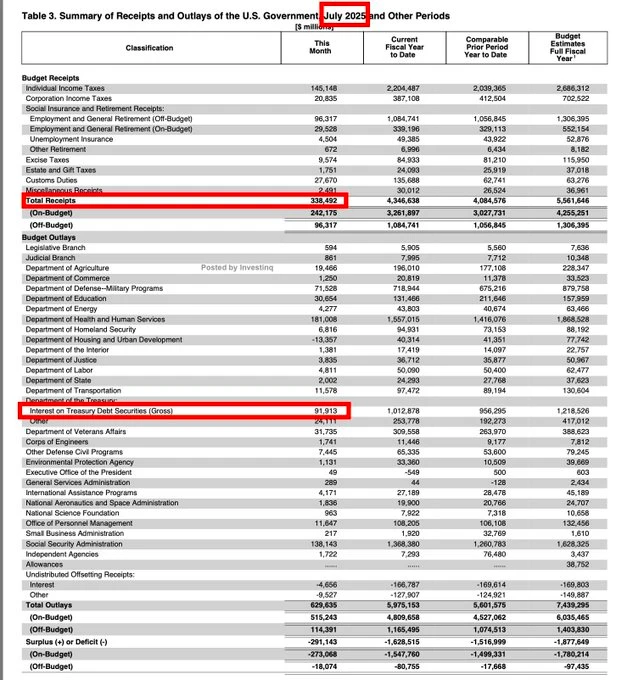

Just to show you how fucked up the situation is. In the month of July, the US Government collected $338 billion. Just one problem… They spent $630 billion. A $291 BILLION deficit. In one month.

It seems like an entire country is being run off a credit card.

👉🏽'Yet another crazy plan from Trump: he wants to give the government unlimited access to private messages of its citizens, even when there is no suspicion of a crime. Oh wait, no — that’s the EU with its chat control. Which is probably why we hardly read anything about it in our so-called “critical” media.' - Christophe Lambrechts

👉🏽'For the first time, AfD is leading in German polls. It’s not really surprising as other parties, instead of seriously addressing the burning issues concerning many Germans, prefer to discuss if AfD should be banned.' -Michael A. Arouet

👉🏽'US Auto Insurance rates have increased by 94% over the last decade, far above the 35% increase in overall consumer prices.' - Charlie Bilello

Here's why the CPI numbers are B.S. Everything most Americans pay for: car insurance, childcare, college, homeowners insurance, property taxes, and healthcare increased 90%+ over the last few years. So, government inflation numbers are laughable, don't reflect reality!

👉🏽'The US Treasury just dropped its July 2025 report. More than 1 out of every 4 tax dollars last month went to interest payments. No new projects. No added benefits. Just interest.'

Great thread on this topic: x.com/_Investinq/status/1955374300376035761

👉🏽The Netherlands: Inflation falls to 2.9 percent in July | CBS

In July 2025, inflation in the Netherlands was 2.9%, a slight decrease compared to 3.1% in June.

Better headline: Inflation remains persistently too high.

www.cbs.nl/item?sc_itemid=03ee5843-123e-4f22-9238-36a03cb487ff&sc_lang=nl-nl

On the 13th of July:

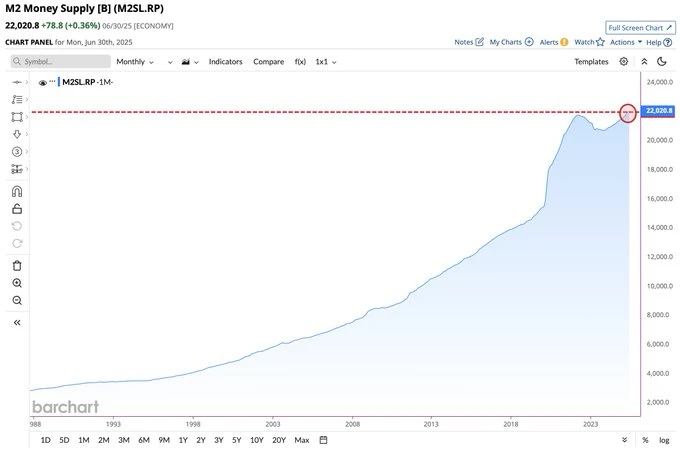

👉🏽M2 Money Supply jumps to a new all-time high of $22 trillion.

Talking about inflation, this is the actual inflation rate.

👉🏽For the 7th time in 3 years, the EU Commissioners are raising their salaries. This time by €2,700. Von der Leyen ‘earns’ €35,000. Per month.

👉🏽 R. Genis: " A large offshore wind farm in the North Sea is not profitable. The Dutch government has therefore decided to adjust the permit for the project Zeevonk. Keep in mind: a significant share of the electricity won’t go to households at all. It has been going to Google for 15 years straight. You won’t read ANYTHING about this in the documents the government sent to @2eKamertweets.

Once again, this drives up electricity prices for ordinary citizens, since the costs will be compensated through grid fees. Without government intervention, would the park have to shut down? According to the government: yes.

Yet again… → PROFITS FOR INVESTORS, RISKS FOR CITIZENS.

The green climate church has truly lost its way.

Source: www.tweedekamer.nl/kamerstukken/brieven_regering/detail?id=2025Z15066&did=2025D34798

In the tender process, Google partnered with Vattenfall… Now Vattenfall and its partners are failing to deliver what they promised in their bid documents — and society is left to pick up the bill.

This is a massive blow to trust in European procurement rules. You promise the world as a bidder, you win the project, you don’t deliver, and the taxpayer has to pay???

Why isn’t this front-page news — while all we see are those silly heat warnings???"

Genis is spot on! You’re supposed to “believe” in it — but when it comes to the 💰💰, the bill is handed to the common people.

👉🏽Arnaud Bertrand: " This is, without exaggerating, one of the most extraordinary things a US Treasury Secretary ever said. It should be mandatory viewing for all citizens of US "allies", Europeans first and foremost. What Bessent is saying is that the US will now treat US allies' wealth as an American "sovereign wealth fund" (his words), "directing" them, "largely at the [US] president's discretion", how to use their money to build American factories and reshore American industries. Even the Fox News host can't believe it, calling it "offshore appropriation", another word for theft. That's exactly what it is: straight-up, unabashed colonial plunder. That's the pattern we see emerge: unable to extract wealth or win wars against an increasingly strong Global South, the US has turned inward to feast on its own "allies" - who can't resist precisely because they depend on their exploiter for military "protection". They're as defenseless against American wealth extraction as any 19th-century colony was against its colonial "protector."

That's exactly what I wrote in my latest article on "Europe's colonial moment":

I must share one comment on this post by Theo Mogenet, as he is spot on:

"Since the end of WWII, the US has benefited from the 'deficit without tears' thanks to the USD GRC status.

This global (dis)equilibrium pushed deindustrialisation in the US and USD balance accumulation in exporting countries. Now, the US wants to reindustrialize, but due to its structural twin deficits, it lacks the capital to finance it, so it wants its allies to finance it.

In other words, we, their allies, were forced to finance their self-destruction, and now, they want us to fund the cure. We must recognize that this monetary system is utterly broken and can only cause large disequilibria that destroy economies and eventually lead to coercive "solutions."

Just dump the USD & buy Bitcoin to get out of this lose-lose situation."

Click here to watch the clip on X:

x.com/RnaudBertrand/status/1955575252324433977

👉🏽The Netherlands:

These are companies that have announced closures, major downsizing, or plans to leave the Netherlands:

Dow Chemicals

Tata Steel

Boskalis

DSM

Shell

LyondellBasell

Covestro

Tronox

Indorama

Gunvor

Westlake

AluChemie

Damco Aluminium

Aldel

Nyrstar

BMW (Born)

Signify

Umincorp

Droste

Vredestein Tires

NXP

Van Geloven

Akzo Nobel

Gunvor Rotterdam

Vynova

BP (all gas stations in NL)

Damen? (rescue plan @ €270m)

CelaVita

Van Lier

And they are absolutely right — and the real exodus of companies will only begin if Timmermans becomes Prime Minister.

And no! This isn't completely the fault of the left in the Netherlands. This already started years ago.

Matthijs Weeink: "The underlying monstrosity, the one we are all suffering from now, is the Climate Act of 2019. In addition to the governing parties D66, VVD (the so-called entrepreneurs’ party 🤡), CDA, and ChristenUnie, the PvdA, GroenLinks, SP, and 50Plus also gave their support. Environmental groups such as Milieudefensie and Natuur & Milieu actively pushed for the law’s adoption and even drafted a concept text themselves. They are all guilty of this debacle."

On top of that. Overloaded power grid threatens tech sector: 'Companies consider leaving'

For the Dutch readers: nos.nl/nieuwsuur/artikel/2578544-overvol-stroomnet-bedreigt-techsector-bedrijven-overwegen-te-vertrekken

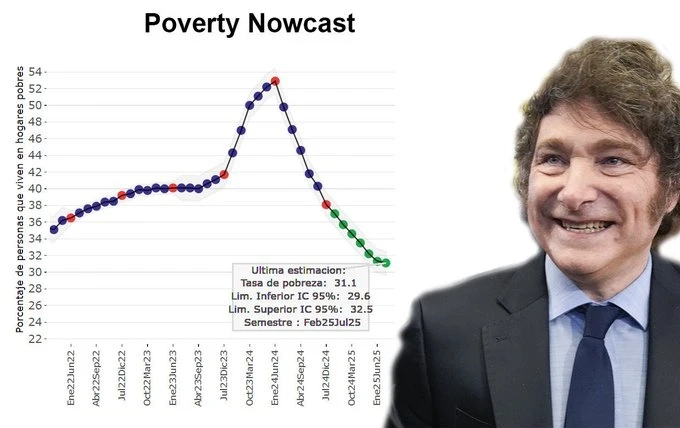

👉🏽Argentina's 3-Month Inflation Hits 8-Year Low.

You're saying if we cut public spending, deregulate, and let the markets do their thing, the economy will improve? Fascinating!

Argentina:

- Inflation down from 211% to 47%

- First budget surplus in over a decade

- New $500K citizenship-by-investment program Previously socialist, it's now THE libertarian experiment in the Americas.

Within just one and a half years, Milei reduced poverty, slashed rampant inflation, and Argentina became a global growth champion. Free market works, and it works fast. Will other countries follow, or will they stick to their left policies, damaging their economies and societies?

On the 14th of August:

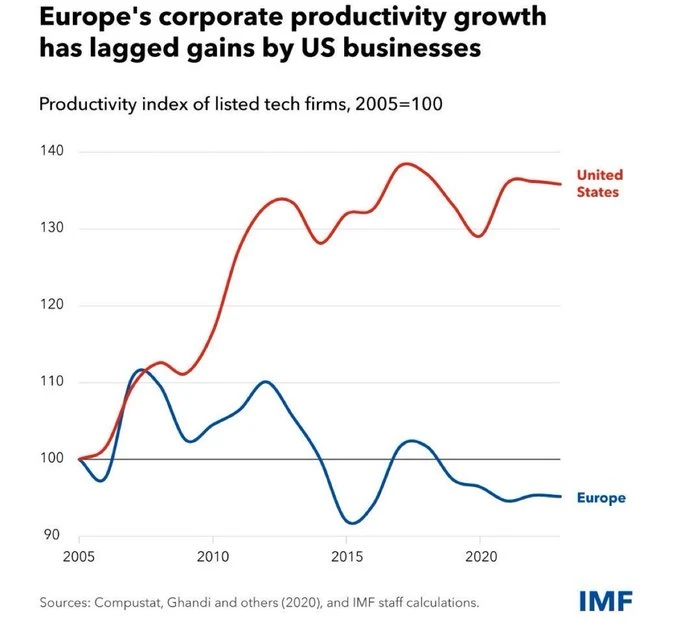

👉🏽Overregulation stifles growth, and debt won't fix a flawed mindset. Two lost decades. Grotesque overregulation, bureaucracy, lack of innovation, and left redistribution ideology have their price. Europe is on its way to becoming an open-air museum.

Just to show you how bad it is. In 2024, I already shared this multiple times, but Germany's economic decline is much more severe than most people think. The country is actually in free fall.

Germany’s industrial production is now back at the level of 2005. Remember, Germany is (was) the engine of Europe.

👉🏽Hottest PPI reading in over three years. Producer Price Index rises 0.9% in a month, way, way higher than 0.2% expected (!!) US PPI came in at 3.3% above expectations of 2.5%.

On the 15th of August:

👉🏽The EU will vote on a Chat Control law on October 14 to allow scanning of all private messages sent online. It aims to detect child abuse, but three countries publicly oppose it over privacy risks.

👉🏽Ricard: 'These reckless, arrogant, and unelected EU bureaucrats are the true architects of conflict. "If Europe cannot defeat Russia, how can we defeat China?" (Kaja Kallas, the Chief Diplomat of the EU)'

x.com/ricwe123/status/1956280376852197662

She’s an incompetent disgrace!

On the 16th of August:

👉🏽The Netherlands:

PS: The guideline was drafted by the Police Knowledge Center CTERT, in cooperation with regional intelligence services. The orders come from the police leadership, under the responsibility of Minister of Justice and Security D.M. van Weel, inspired by NCTV and AIVD strategies against extremism.

When a government is so fervently focused on fighting conspiracy theories, there is only one party that is actually radicalizing — and that is the government itself. That should be the real topic of discussion. Every form of criticism of politics and policy is being discredited in this way… I thought that in a democratic state governed by the rule of law, only actions could be punished, not viewpoints or opinions.

Apparently, according to the Dutch Police, you are now considered suspicious if you have a vegetable garden or read a booklet about nitrogen. For 15 years, they knowingly crushed thousands of families, acted lawlessly, and even took children away. (Toeslagenaffaire - benefits scandal) But if you say “benefits scandal,” you’re called a conspiracy theorist — and if you say “this isn’t right” or “enough is enough,” they claim you’re about to start throwing bombs? This really crosses the line. Time for parliamentary questions.

I truly hope Tom van Lamoen - Party Leader - LP will get a 'seat at the table in Den Haag' after the upcoming elections...why, well I let him explain...

Tom van Lamoen: "On the police document: This police guideline is a prime example of state arrogance and authoritarian madness. The document reduces critical citizens to “conspiracy theorists” and shamelessly places anyone who raises fundamental questions about government, institutions, or media on a slippery slope toward radicalization and extremism. That is not neutral analysis — it is outright state propaganda. What is happening here is downright dangerous: the refusal to distinguish between willingness to use violence and legitimate criticism. Citizens who object to tax burdens, resist centralised power, or simply choose self-determination are lumped together with extremists. The rejection of authority structures is framed as a threat when, in fact, the freedom to detach oneself from imposed structures is the very essence of self-determination. The document breathes a deeply authoritarian reflex: “every victory over the state” must, according to this guideline, be suppressed at all costs, because otherwise the citizen might feel “confirmed.” In other words, the state declares itself infallible and labels civil disobedience as hostile behaviour. But in a free society, it is precisely necessary for citizens to be able to call the government to account. Power without counterbalance is pure tyranny. The libertarian argument is irrefutable: the state can never be the referee of which ideas are or are not permissible. Once distrust of authority is dismissed as radicalization, the door is opened to the criminalization of opposition and protest. This guideline is not a tool for safety, but a weapon against freedom. It elevates the state to the role of ultimate truth. And whoever refuses to bow is branded an extremist. That is not security — that is oppression in its purest form."

On the 17th of August:

👉🏽So Europe uses 100 times more energy to keep warm than it does to keep cool - and they are panicking about "global warming"? Bjorn Lomborg: "Climate hypocrisy. Many Europeans disapprove of keeping cool with air conditioning because of its climate impact. But most have no problem using 100x more energy on heating to keep warm. Climate change emotion often trumps logic, as France’s environment minister says: “We need air-conditioning to give vulnerable people some respite. But we mustn’t do it everywhere.”

nytimes.com/2025/08/12/world/europe/heat-waves-france-air-conditioning.html

Mathematics and logic - two tragically scarce resources for the global Climate Hysterics!

On the 18th of August:

👉🏽Hup Holland Hup:

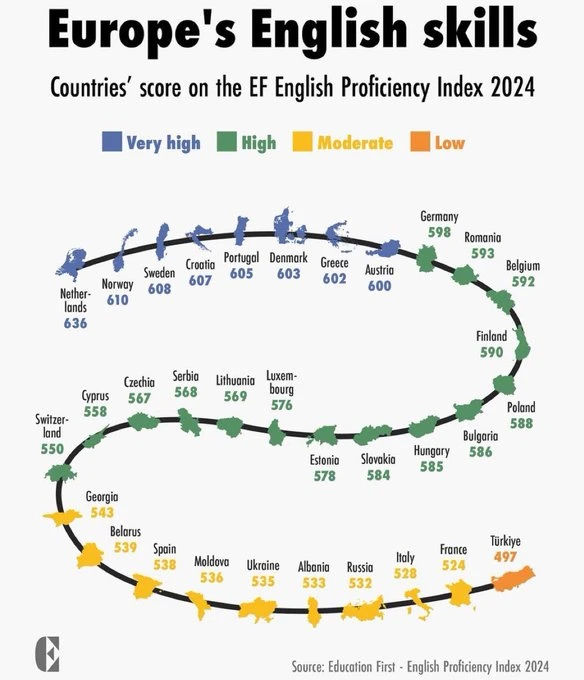

That’s interesting, it seems that Italians and the French simply don’t care, despite Italy and France being top tourist destinations.

👉🏽'Ukraine will offer President Trump a $100 billion weapons deal in exchange for a security guarantee. The deal would include Ukraine promising to buy $100 billion worth of American weapons and would be financed by Europe.' -TKL Either way, Europe got fucked! Great.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: The Bitcoin Treasury Playbook | Preston Pysh

Preston Pysh gives us a masterclass on Bitcoin treasury companies, unpacking the mechanics behind Michael Saylor’s strategy and why it has outperformed Bitcoin since 2020. He explains how preferred stock and convertible debt are being engineered to funnel Bitcoin onto balance sheets, why the unraveling of the fixed-income market is the hidden fuel behind this model, and the risks investors face in treating treasury companies as a proxy for holding Bitcoin. Preston gets into the accounting controversies around MicroStrategy, the looming threat of government nationalisation, and why self-custody Bitcoin is the ultimate safeguard.

In this episode:

- Why self-custody Bitcoin is important

- How preferred stock and convertible debt power treasury growth

- The collapse of the 40-year fixed-income bull market

- Understanding premiums to NAV and dilution risks

- “Ponzi-adjacent” Bitcoin treasuries

- Nationalisation and centralisation risks for Bitcoin

- Why the STRC issuance may be one of the most brilliant financial products ever designed

Watch here: youtu.be/dfHkgYOsiFI

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃