🧠Quote(s) of the week:

"People don't realize that Bitcoin can conquer a $100+ trillion market simply because of multisig and the unbreakable reliability of its settlement. No collateral can even come close to any of the 5 most important traits you want in a perfect collateral. Bitcoin destroys all of it. - quick to exchange - easy to verify - easy & quick to liquidate at any time on any day - can't be damaged, perfectly portable - completely unmatched in mitigating trust and custody concerns Literally nothing is even in the same ballpark." - Guy Swann

Photos hosted by Azzamo (azzamo.net)

🧡Bitcoin news🧡

On the 18th of August:

➡️Thailand launches a program to allow foreign visitors to convert Bitcoin and crypto into local currency.

➡️I hate dumbducks like Jacob King:

Ah, the great panic of the faithful—Foundry burps out eight blocks in a row and suddenly the sky is falling. Eight in a row with ~40% of the hash? That’s not black magic, that’s probability yawning and stretching. The White Paper told you plainly in Section 5: miners and nodes are the same, and there have never been more than a dozen or two in operation at any given time. Right now, you’re looking at about 13. So the spectacle here isn’t proof of decentralisation’s corpse; it’s just mathematics paying its rent on time.

Shanaka Anslem Perera: "Everyone screaming 'centralization' at 8 Foundry blocks in a row is missing the actual signal. Bitcoin is not a stock you hold; it is a thermodynamic truth encoded in math. Mining is probabilistic … streaks happen. Fees collapsing and empty blocks don’t mean “Bitcoin is dead,” they mean the network is clearing, like the ocean at low tide before the next wave. The real centralization risk isn’t Foundry or Antpool. It’s the fiat system you’re still trapped in. Bitcoin is the only network where power is checked by physics itself: SHA-256, difficulty adjustment, and block time. No CEO, no government, no central bank can override it. Eight blocks in a row isn’t a death knell. It’s a reminder. Bitcoin doesn’t care about your fear. It runs on a clock deeper than nation-states, deeper than empires. The longest chain always wins."

Spot on!

On the 19th of August:

➡️Royal Bank of Canada increased its MSTR stake by nearly 16% in Q2 2025, per new SEC filing.

➡️Bitcoin is dead, again!

Joe Consorti: Bitcoin has spent 131 days above $100k since it first broke it, with 43 days spent above $110k. Last cycle, BTC only spent 39 days above $60k. This consolidation above $100k is extremely healthy relative to prior cycles. Zoom out, and relax.

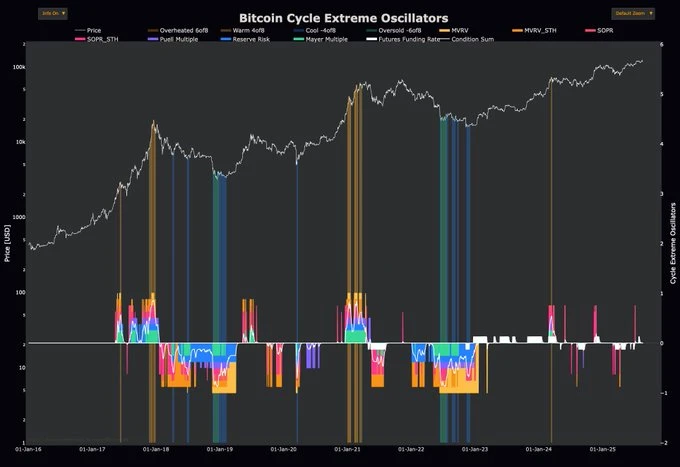

➡️On-Chain Collega: Let me be clear: This is not what Bitcoin cycle tops look like.

➡️Air Canada pension fund reveals $161 MILLION Bitcoin allocation. This is Canada's first large pension fund with a Bitcoin allocation.

➡️David Bailey’s KindlyMD acquires 5,744 Bitcoin for $678.9 MILLION.

➡️Tether appoints former white house crypto council executive director Bo Hines as strategic advisor for digital assets and U.S. strategy

➡️Tech Giant Google increases stake in Bitcoin miner TeraWulf to 14%.

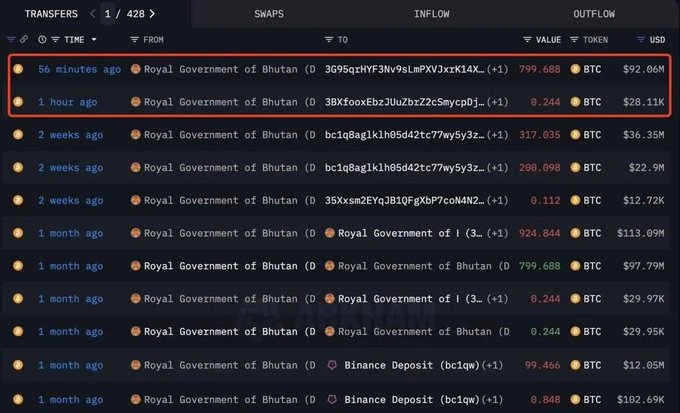

➡️Bhutan government transfers 800 BTC ($92M). Bhutan holds 9,969 BTC ($1.15B).

➡️Ark 21Shares sells 559.85 Bitcoin worth $64.4 million.

➡️$829 billion Bernstein predicts the bull market extending into 2027 and bitcoin hitting $150,000–$200,000 in the next year

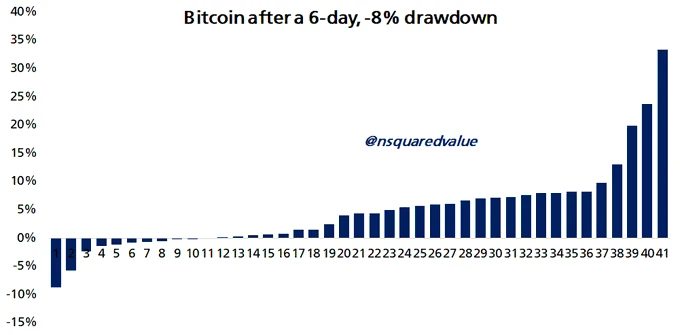

➡️Timothy Peterson: 'Bitcoin is down -8% in the past 6 days. This has happened 41 times since 2022. What happens next? In the following 6 days, Bitcoin was up 66% of the time. The average gain was 8%. If it did lose money, the average loss was only -3%.'

On the 20th of August:

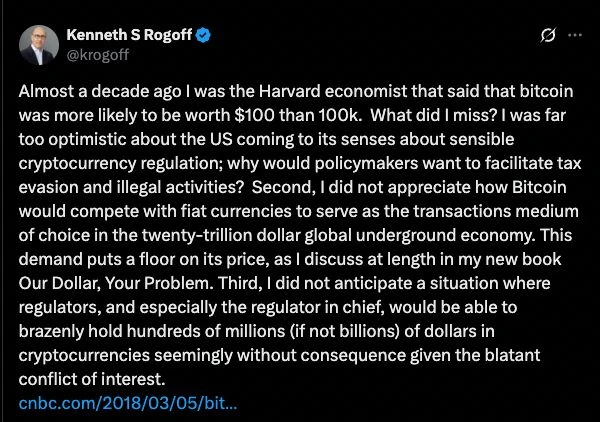

➡️Harvard economist who was wrong about Bitcoin crashing to $100 in 2018 now says the world is wrong, he's still right.

Translation: I wasn't wrong; everyone else is stupid.

Bravo, everyone. We're all more intellectually honest than a Harvard economist. This Harvard economist still proclaims that BTC, now the 6th largest global asset, is worthless. His thesis for the last 7 years has been thoroughly gutted, yet he refuses to accept new information.

James Lavish: "Understanding Bitcoin requires you to check your ego at the door and forget everything you have been programmed to believe about fiat and inflation."

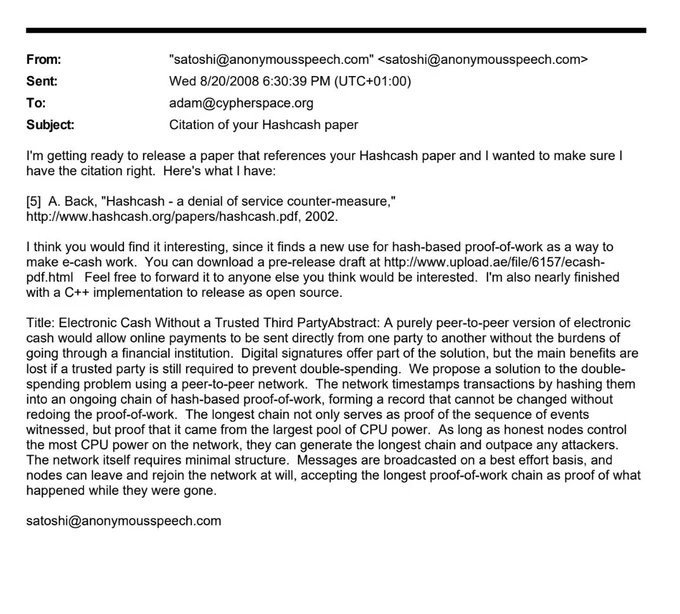

➡️'BITCOIN HISTORY: Satoshi first emailed Adam Back about Bitcoin 17 years ago today.' - Bitcoin Archive

➡️SoFi partners with Lightspark to launch Lightning-enabled international money transfers.

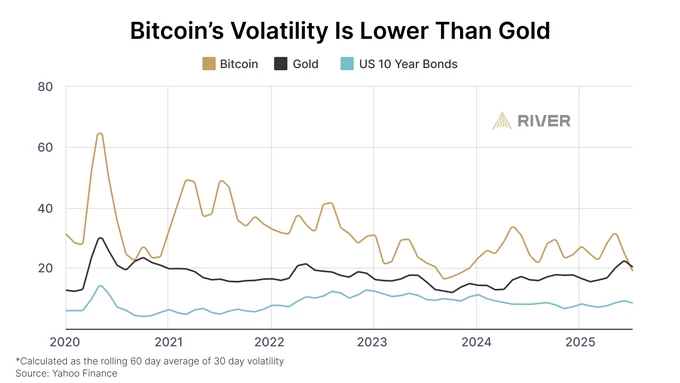

➡️River: Bitcoin's volatility has been lower than gold's for the longest period in history.

➡️Swedish health tech company H100 Group acquires 102 BTC, bringing its total holdings to 911 BTC.

On the 21st of August:

➡️Pennsylvania lawmakers introduce House Bill 1812, which would ban public officials from owning Bitcoin or crypto. Violations could bring fines or even jail time.

➡️One of the world’s LARGEST financial institutions, Allianz, has gained Bitcoin exposure through MicroStrategy.

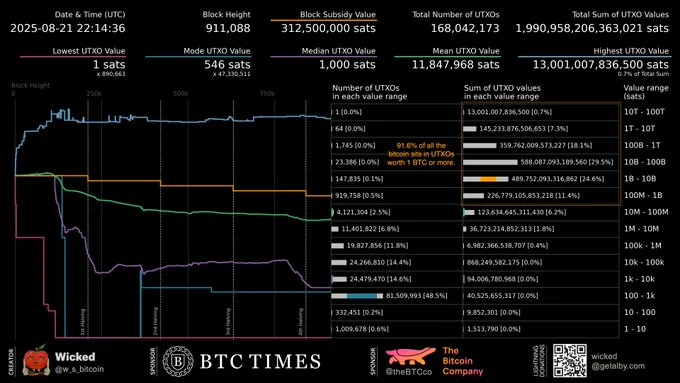

➡️Wicked: 91.6% of all the bitcoin sits in UTXOs worth 1 BTC or more.

Now I hear you say, UTXOs? What? Here you go: river.com/learn/bitcoins-utxo-model

On the 22nd of August:

➡️CarlBMenger: 'EU accelerates plans for digital euro stablecoin with potential rollout on Ethereum or Solana blockchain. European bureaucrats worship control, that’s why they push those centralised shitcoins, and build their own on top. FUCK THEM, embrace Bitcoin.'

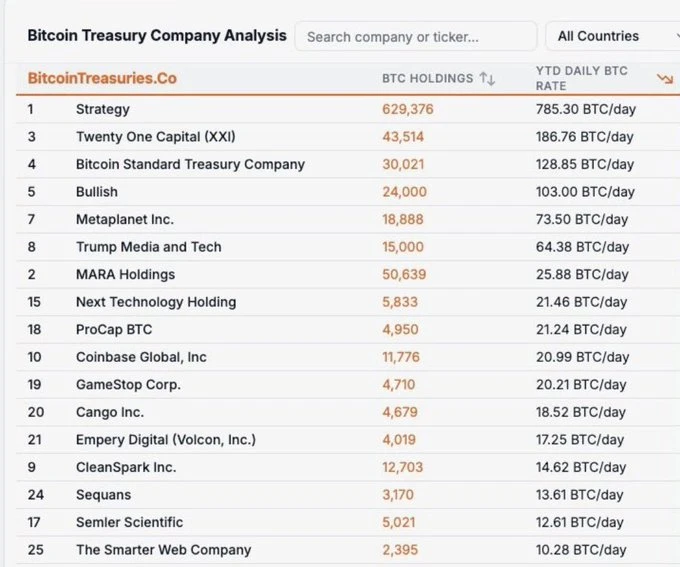

➡️Strategy is BUYING around 785 Bitcoin per day.

On top of that, Michael Saylor’s STRATEGY now meets all criteria for S&P 500 inclusion. If added, it could trigger $10B+ of passive inflows.

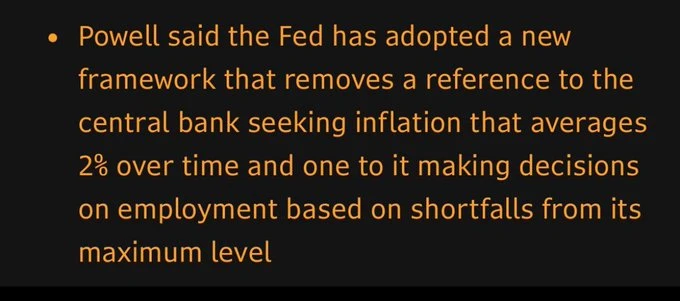

➡️'Powell, Chair of the Federal Reserve, says the Fed is moving away from its strict 2% inflation framework. They’re going to let inflation run hot. Buy as much Bitcoin as you can.' - Bitcoin Archive

James Lavish is spot on: 'And just like that, a 'target' becomes a 'feeling', and one that won't feel good to the vast majority of Americans.'

On top of that, Powell suggested current conditions 'may warrant' interest rate cuts. Bitcoin rose 76.9% from last September to December when the Fed cut rates. Today, the Fed opened the door to cut rates in September, once again. I know, different market, no elections, etc, but still.

Preston Pysh on Powell's statements: "Fiat is so fragile and manipulated that some old dude can mutter 15 words and markets around the world whip-saw to the tune of trillions of dollars in a matter of minutes. Humans have built their entire exchange of energy between each other on this scheme of a system. Decades later, we will truly laugh at how primitive it all was."

Anyway, if you are new to all this...let me explain how this will unfold:

- The market goes down, people panic

- The Fed lowers rates and prints money

- Markets boom and people are happy

- Printed money causes too much inflation

- The Fed (central banks) hikes rates

- Repeat until (hyper)inflation

Rinse and repeat, as we sit back & stack sats.

➡️ The Philippines House introduces a bill to establish a strategic Bitcoin reserve.

➡️First-time Bitcoin buyers added 50,000 BTC last week. Large holders bought another 16,000 BTC. Accumulation is accelerating.

➡️$250 MILLION Bitcoin and crypto shorts liquidated in the past 4 hours.

On the 23rd of August:

➡️Spot Bitcoin ETFs surged to a record $134.6 billion in Q2. Institutions reported $33.6 billion in holdings via 13F filings.

On the 24th of August:

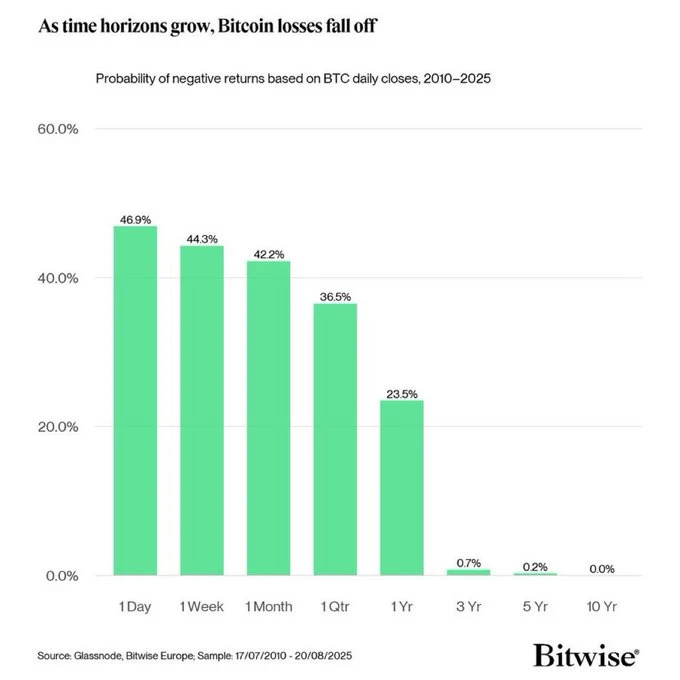

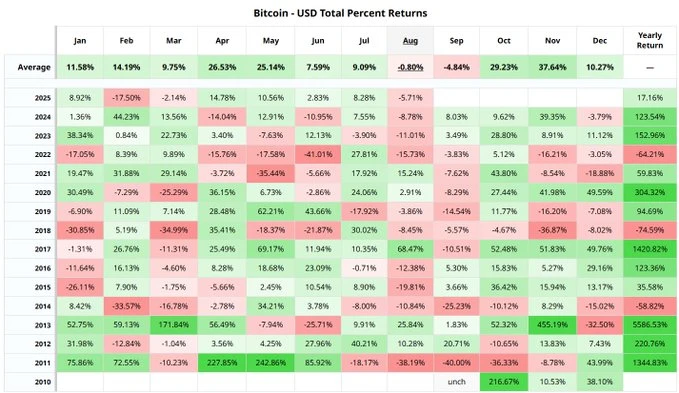

➡️Probability of Positive Bitcoin Returns Per Holding Period: •1 Day: 53.1% •1 Week: 55.7% •1 Month: 57.8% •1 Qtr: 63.5% •1 Yr: 76.5% •3 Yr: 99.3% •5 Yr: 99.8% •10 Yr: 100%

➡️The largest bank in Norway (DNB) is now creating a Bitcoin fund for customers to buy. 20% Bitcoin exposure and 80% Bitcoin companies. Gradually, then suddenly.

➡️'For all the anticipation of nation state adoption, it's funds and corporate treasuries who've been driving this cycle Wild, when you consider that US Investment Advisors allocate just 0.006% of their portfolio to Bitcoin. We are so early' - Daniel Batten

➡️A Bitcoin whale sold 24,000 BTC worth over $2.7 billion, causing today’s -$4,000 crash in minutes. They still hold 152,874 BTC worth more than $17 BILLION.

ZeroHedge: "Now why would someone want to sell a huge block and take out the entire bid stack (3 times in a row) so that they can trigger sell momentum and accumulate much lower?"

SightBringer: "ZeroHedge nails it here: this wasn’t just a random liquidation - it was a strategic flush.

•Instead of trickling sales into ETF absorption, this whale (or entity) stacked blocks at size to nuke the bid wall, three times in a row. That’s not dumb money - that’s deliberate.

•Why? Because taking out the bid stack triggers cascading liquidations (perps, leverage longs, weak hands). That lets the same entity reload lower while ETFs, sovereigns, and corporates keep buying the net supply.

•Context: they still hold 152,874 BTC (~$17B). They’re not exiting Bitcoin - they’re playing a reflexive reset to shake out leverage and reposition.

This whale is showing us something bigger; they know the ETF/sovereign bid is infinite. So the only way to win is to force weak hands to puke and then accumulate back into the structural wall.

Deeper Truth: This isn’t bearish. It’s proof. We’re watching the old guard play their last weapon, forced volatility, against an orderbook now backed by ETFs and sovereign flows."

Even after reading all the above, ask yourself, which asset in the world can go liquid USD on a Sunday in one ≈$2.7B transaction? Bitcoin!

On the 25th of August:

➡️Strategy acquires 3,081 BTC for $356.9 million at $115,829 per Bitcoin. They now hodl 632,457 BTC acquired for $46.50 billion at $73,527 per Bitcoin.

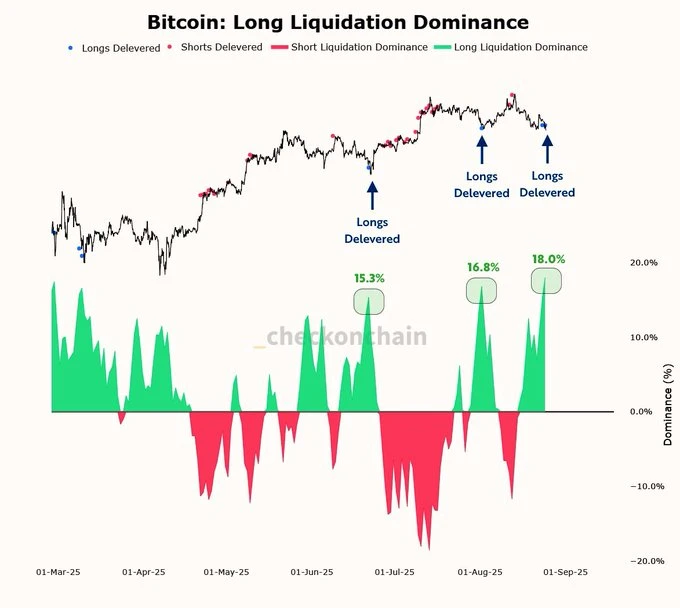

➡️Yesterday’s Bitcoin flash crash was a bigger long-deleveraging event than the tariff-driven crash we saw back in April. The clearing of leverage should allow for a healthy bounce.

➡️$37,234,066,149,278.96 (+) US National Debt.

Alex Gladstein: 'There are at least 37 trillion reasons why Bitcoin will continue to increase in value.'

➡️US banks are lobbying to block stablecoin interest, warning it could trigger trillions in deposit outflows - Financial Times. Wall Street is realizing that Bitcoin and crypto are beating them at their own game.

➡️'Bitcoin has spent less than ~3 days at this price level. It's healthy to revisit and spend some time here. We're entering the weakest month for BTC seasonally, which is followed by its (historically) two best months. Go outside, touch grass, breathe, enjoy life.' - Joe Consorti

➡️Financial Times: Opinion: Bitcoin is either a brilliant innovation to move the world away from corruptible fiat currencies or a vast confidence trick.

Source: archive.ph/zWwWG Poor journalism.

"If you still think that digital scarcity, absolute fixed supply, incorruptible, censorship-resistant, Internet native, unhackable, stateless, trustless, Peer to Peer payment system/money isn't a brilliant innovation, there's no hope for the future of your publication."

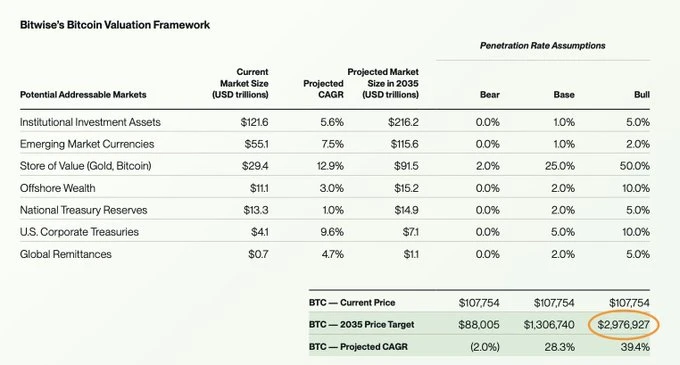

➡️In its inaugural “Bitcoin Long-Term Capital Market Assumptions,” Bitwise lays out its bull case: Bitcoin hitting $2.9 million by 2035.

💸Traditional Finance / Macro:

James Lavish: 'On the eve of Powell’s last Jackson Hole speech, just remember. Regardless of what he says, they have no choice but to continue to manipulate the money supply. And so, they will print again. Even more than the last time. And Bitcoin will soar. Have a great night.'

On the 19th of August:

👉🏽'The Nasdaq 100 extends its decline to -1.4% in the day. Now on track for the biggest drop since August 1st.' -TKl

On the 22nd of August:

👉🏽Charlie Bilello:

- Stocks: all-time high

- Home Prices: all-time high

- Bitcoin: all-time high

- Gold: all-time high

- Money Supply: all-time high

- National Debt: all-time high

- CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target"

- Fed: cutting interest rates next month

On the 25th of August:

👉🏽TKL: "Earnings of the Magnificent 7 companies have surged +145% since ChatGPT was introduced in November 2022. By comparison, profits of the remaining 493 S&P 500 firms have increased just +4% over the same period.

Furthermore, the Mag 7’s EPS has risen 700% since 2020, while the remaining S&P 500 components have seen +31% EPS growth. That marks 22 TIMES higher earnings growth in just 5.5 years. Over the last decade, the Magnificent 7 has seen a massive +2,134% growth in earnings. Magnificent 7 stocks are making history."

🏦Banks:

👉🏽No news

🌎Macro/Geopolitics:

Absolutely phenomenal photo on the 18th of August. Trump, with all the world leaders sitting around his desk, is the best photo of 2025.

Not A Single "Leader" here is Popular in their Home. None Have Even 50% of Seats in their Governments. All have Coalitions. Some Were Not Even Elected.

How it started vs How it's going:

On the 18th of August:

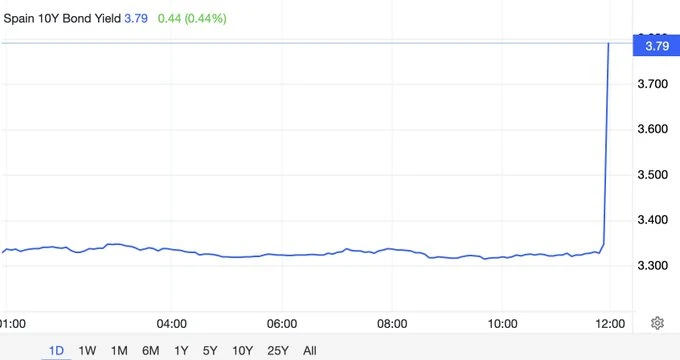

👉🏽Spain:

Spain's 10-Year Yield is going parabolic. Next week EU bondmarket will be interesting.

👉🏽'Ukraine will offer President Trump a $100 billion weapons deal in exchange for a security guarantee. The deal would include Ukraine promising to buy $100 billion worth of American weapons and would be financed by Europe.' -TKL Either way, Europe got fucked! Great.

Remember, Europe will spend $100 billion it does not have (the EU will issue eurobonds and borrow money from international Banks) to buy weapons from America that it does not have to arm soldiers that Ukraine now lacks. This is to confront Russia, which for 30 years warned it would respond to NATO militarising its borders. en.wikipedia.org/wiki/Enlargement_of_NATO#/media/File:History_of_NATO_enlargement_animation.gif

If you want to know more about why we have NATO and the history behind it, I recommend the following: On Netflix - Turning Point "The Bomb and the Cold War"

On the 19th of August:

👉🏽 Eric Daugherty: HOLY CRAP! President Trump just revealed that during the negotiations, one of the leaders asked him to meet again on the war in "a month or two..."

"I said, 'A MONTH OR TWO? You're going to have another 40K people D*AD! You have to do it TONIGHT." "And I did. I called Putin, we're trying to work out a meeting with President Zelensky." The old way of doing things is OVER.

“A month or two,” They don’t even see human life, some of these people.

👉🏽'In the EU last year, deaths outnumbered births by a stunning 1.26 million people. Our societies have become incredibly child-unfriendly.' - David Quinn

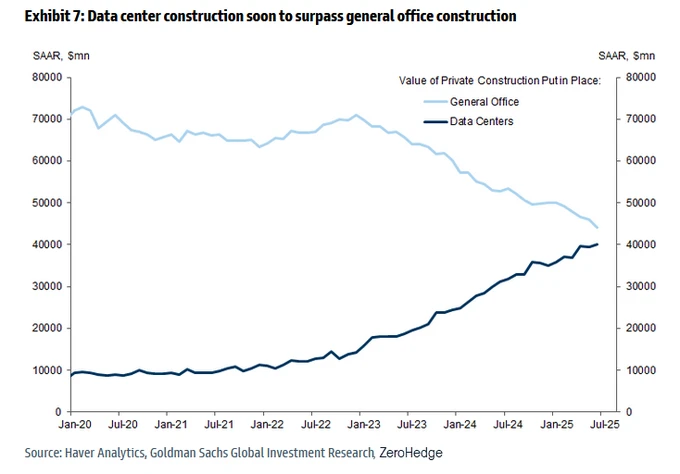

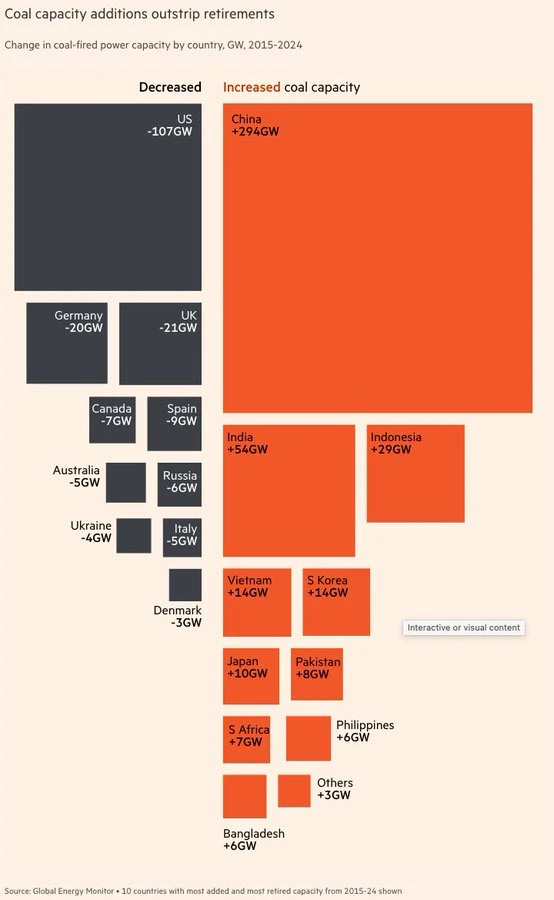

👉🏽As mentioned a couple of weeks ago, this is the future that the world is heading to. Few people realize it. Now ask yourself, looking at the chart. Where will the majority of our energy flow to, and is that a good thing? And how on earth, no pun intended, are we going to provide that, and with what type of energy? The only thing that pops out of my mind is: nuclear!

The most insane chart: the value of data centers being built will surpass all offices in construction within 6 months. Context: There are now $40 BILLION worth of US data centers under construction, up +400% since 2022. For the first time in history, the value of US data centers under construction will soon EXCEED office buildings. This is a historic shift.

👉🏽Last week, I shared the Dutch police guideline. The latest prime example of state arrogance and authoritarian madness.

Police statement: An internal police document on signs of radicalization through conspiracy theories has been shared on social media. Some passages from it may confuse without the proper context.

For the Dutch readers: www.politie.nl/nieuws/2025/augustus/19/00-reactie-op-politiedocument-radicalisering-en-extremisme-dat-uit-complottheorieen-kan-voortkomen.html

Police adjust the document regarding the benefits scandal, but do nothing in terms of reflection! Of course, an internal investigation into the leak is launched immediately.

So the police still do stand by these bizarre texts that turn ordinary citizens into half-terrorists; it just wasn’t meant for us to read them. So no mea culpa, just “too bad it ended up in the public domain.” Gotcha!

Something that is substantively unfit to be published is also substantively unfit to serve as a tool or guideline. There should not be a single topic on such a list. In fact, such a list should not even exist. This is not how you track down criminals — this is how you trivialize proven conspiracies, discredit criticism of authorities, and downgrade critics to potential criminals by default. Period!

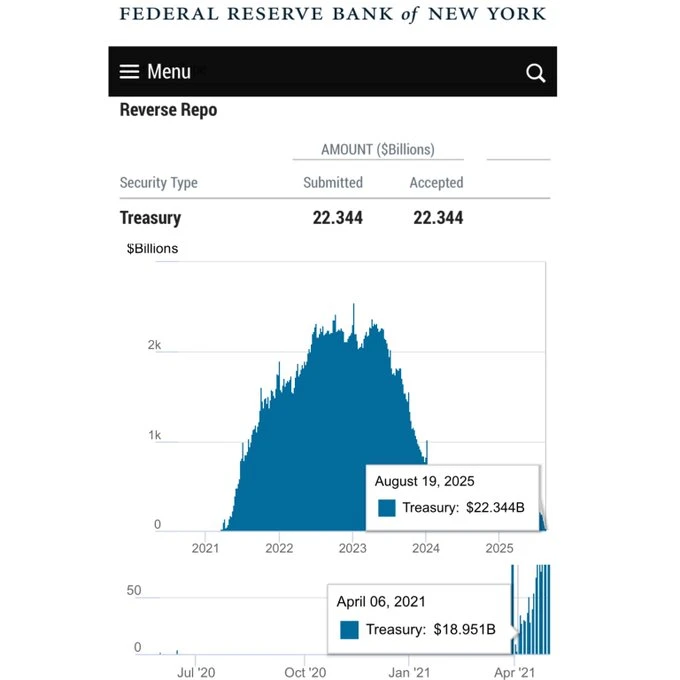

👉🏽Federal Reserve Reverse Repo drops to the lowest level in 1,596 days. What happens tomorrow?

On the 20th of August:

👉🏽Central banks are under growing pressure to keep interest rates artificially low to offset the cost of record government borrowing

FT: archive.ph/Kahs8 Fiscal dominance. As Lyn Alden would say, nothing stops this train!

Fiscal dominance is here: governments’ budget policies override central banks’ inflation targets. The result? Artificially low rates and volatile, higher inflation — a nightmare for savers and bondholders. Yet many asset managers still cling to the outdated 60/40 model. Bonds have shown negative real returns for 20 years. In today’s regime, holding them almost guarantees loss of purchasing power. The question is: when will this reality reach the boardrooms?

👉🏽Ukraine has reportedly lost 1.7 million men in the Russia-Ukraine war. Source: www.disclose.tv/id/u4eo89jq4q

Russian hackers breached the Ukrainian Armed Forces General Staff database, leaking the information: 118,500 deaths in 2022, 405,400 in 2023, 595,000 in 2024, and a record 621,000 in 2025.

The information was obtained by hacking the PCs and local network of the Ukrainian General Staff employees by hackers from Killnet, Palach Pro, User Sec, and Beregini.

They now possess terabytes of data on losses, personal details of the leadership of the Special Operations Command and the Main Intelligence Directorate, lists of all countries supplying weapons, and inventories of all weapons delivered.

Note: on the Russian side, roughly the same number of deaths are to be mourned. The human suffering caused to fill the pockets of the happy few is immeasurable.

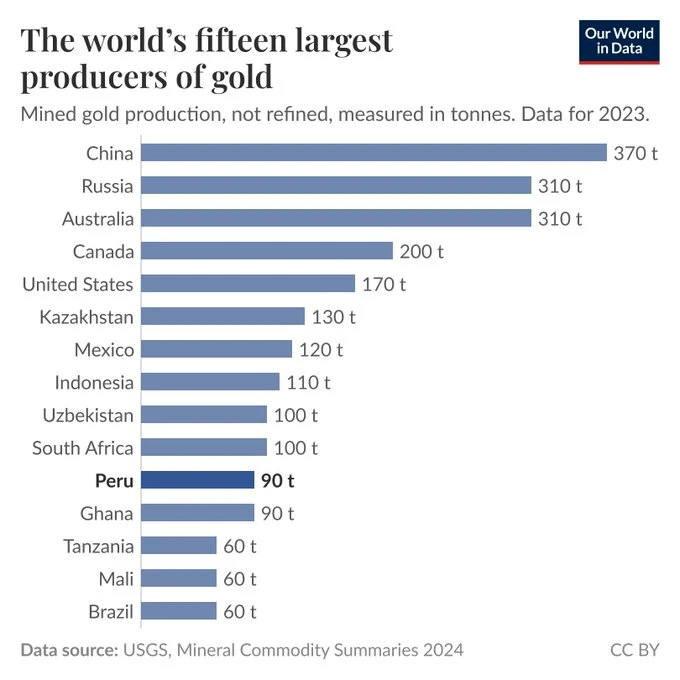

👉🏽Our World in Data:

"Gold export data suggests that Peru, one of the world’s largest producers, mines nearly as much informally as it does formally. According to official mining output records, Peru mined about 90 tonnes of gold in 2023, far ahead of any other South American country. That puts it within the world’s top 15 producers, just below the 10th place, as shown in the chart. However, this official figure captures only part of Peru’s gold economy. Customs export data shows a striking discrepancy: about 80 tonnes of unaccounted gold in 2023, according to the Peruvian Institute of Economics. That’s gold whose value appears in export statistics but not mine-output records — and it is almost as large as the official figure based on mine records. Some of this gap may be due to re-exports, inventories, or recycled gold. But given how big the discrepancy is, Peru’s authorities, researchers, and media see it as a practical indicator of the scale of informal and illegal mining. An article in The Economist, for example, compares Peru with other countries using this approach, and argues that gold has become more profitable than drugs for many gangs in South America. Illegal gold mining is widely recognized as a major issue in Peru and the region, frequently linked to environmental damage and organized crime. This context matters today: the steep recent increase in gold prices raises incentives around unregulated extraction and trade."

👉🏽TKL: "The US has now seen 446 LARGE bankruptcy filings in 2025, officially +12% ABOVE pandemic levels in 2020. In July alone, the US saw 71 bankruptcies, marking the highest single-month total since July 2020."

On the 21st of August:

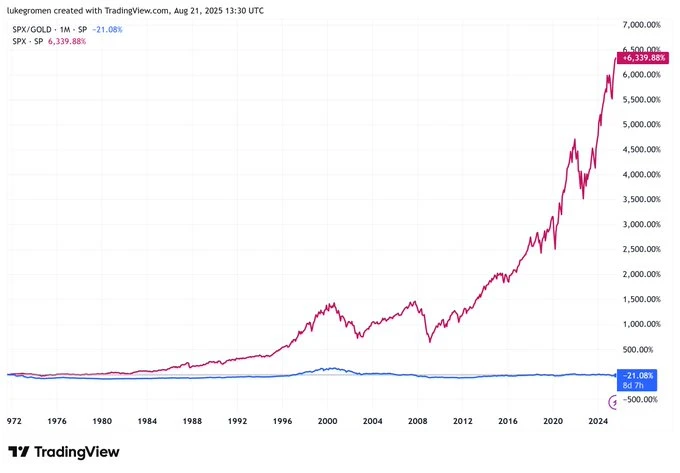

👉🏽Luke Gromen: 'Belated "Nixon closing the gold window anniversary" post: SPX priced in gold (blue) v. SPX priced in USD (red) since August 1971 when Nixon closed the gold window.'

Now do SPX priced in Bitcoin...and you will find your answer.

'Over the past half-century, stocks have not risen when measured in real money. Stocks appear to be rising—society appears to be getting wealthier—because the denominator in which their prices are measured (fiat USD) is continually debased. Price is going up because the money in which it's measured is dying. Arguably, the greatest illusion in modern society. And one of the largest contributors to wealth disparity... for the wealthy on average benefit from this phenomenon, while the poor and middle class remain neutral or are harmed. The great promise of Bitcoin—its great and noble ambition—is that, some years from now, it will perhaps have healed the institution of money in our civilization.' Well said by Eric Voorhees.

👉🏽The US and European Union have reached a trade deal and released a joint statement outlining terms: Tariffs: The US is to impose 15% tariffs on most EU imports. The US will lower auto tariffs once the EU passes matching tariff-cut legislation. From Sept 1, the US will apply only MFN tariffs on EU aircraft/parts, generics, chemical precursors, and scarce natural resources. EU to eliminate tariffs on all US industrial goods and grant preferential access for US seafood/agriculture.

Energy & Tech Purchases:

- EU to buy $750B in US LNG, oil, and nuclear products

- EU to purchase at least $40B in US AI chips

Investment & Cooperation:

- EU firms to invest $600B in US strategic sectors by 2028

- Both sides to negotiate rules of origin to ensure benefits remain bilateral

- Exploring cooperation on steel and aluminum market protections

- Joint commitment to tackle digital trade barriers; EU pledges not to adopt network usage fees

- Considering measures for secure supply chains, including tariff-rate quota solutions

Ergo: The EU is like, yes, daddy!!

👉🏽Democracy has arrived on the shores of the country with the largest oil reserves in the world.

👉🏽Vattenfall has chosen (in Sweden) to build medium-sized nuclear power plants. It will be either 5 units of 300 MW each from General Electric or 3 units of 500 MW each from Rolls-Royce. The project has been set up in collaboration with the Swedish industry. The plants will be located near the Ringhals nuclear power station.

Because of obstruction from NGOs such as XR and Greenpeace, all that endless compromising, and the elections, absolutely NOTHING is happening here in the Netherlands. As you can see, Vattenfall’s green stance is determined by the country in which it operates. In our country, they promote solar and wind energy every single day. They go whichever way the wind blows….

Anyway, we should do the same in the Netherlands. Place an SMR (Small Modular Reactor) in every region, and CO₂ emissions will drop to almost zero while ensuring complete energy and heat security.

On the 22nd of August:

👉🏽Netherlands: Owner-occupied homes nearly 9 percent more expensive in July than a year earlier | CBS

On the same day, a headline on a site called Nu.nl: "House prices rise to a new record of €486,000: supply is too small."

That is undeniably incorrect! And I have shared this with evidence numerous times in my Weekly Recap. This has nothing — absolutely nothing — to do with supply. It has everything to do with inflating the asset bubble through unlimited money creation by commercial and central banks. When new money is constantly being created and used to buy houses, you are literally pumping up the bubble. That money should be directed toward productive purposes instead — then you’d have massive growth in prosperity, affordable housing, and zero inflation. Absolutely zero. Banks create boom-bust cycles whenever it suits them. Every cycle shifts more power from the middle class and small businesses to the big banks, while tightening control over ordinary people. This is no coincidence — far from it.

Oh, just a tiny reminder:

Median US Home price in Bitcoin: (you can apply the same to the EU)

- In 2014: 600 BTC

- In 2016: 365 BTC

- In 2018: 50 BTC

- In 2020: 27 BTC

- In 2021: 5 BTC

- In 2025: 3.5 BTC

👉🏽Netherlands: They are going to remove 220,000 solar panels installed last year at Schiphol to cover them with special foil… so that pilots will no longer be bothered by sunlight reflections! A perfect example of climate madness in the Netherlands! How much is this stunt going to cost?

Roughly ~32 million. Yikes! Who is going to pay for that? The energy company, Schiphol, and the government.

The West is crippling itself by choosing more expensive natural gas energy. Increasing the cost of living of its citizens and increasing the operating costs of our companies. One of the multitude of ways we are robbing our young of their future.

Why am I saying that?

The world isn't quitting coal: Down in the rich world, but up more in the poorer world. There isn’t a transition away from fossil fuels and towards renewable energy, says Sir Dieter Helm, Oxford University; instead, it is an increase in all directions. Financial Times: "Why the world cannot quit coal Ten years after the signing of the Paris climate accord, demand for coal shows no sign of peaking."

Source: archive.ph/5BsrJ

It’s also worth noting:

- The rich world accounts for ~16% of the global population

- The developing world accounts for ~84% In other words, future energy demand, and coal demand in particular, will be dictated by the developing world.

Another mindblowing stat: 21st century China in five years burns more coal than Britain 1780-1980.

👉🏽FED CHAIR POWELL: "Risks in inflation are tilted to the upside, and employment risks are tilted to the downside." That's a long way to say "stagflation."

SUMMARY OF FED CHAIR POWELL'S SPEECH (8/22/25):

- Shifting balance of risks "may warrant adjusting policy"

- Suggests downside risks to employment are rising

- Labor supply has softened in line with demand

- Fed abandoning flexible average inflation targeting framework

- Can't take stable inflation expectations "for granted" The Fed is preparing for a September rate cut.

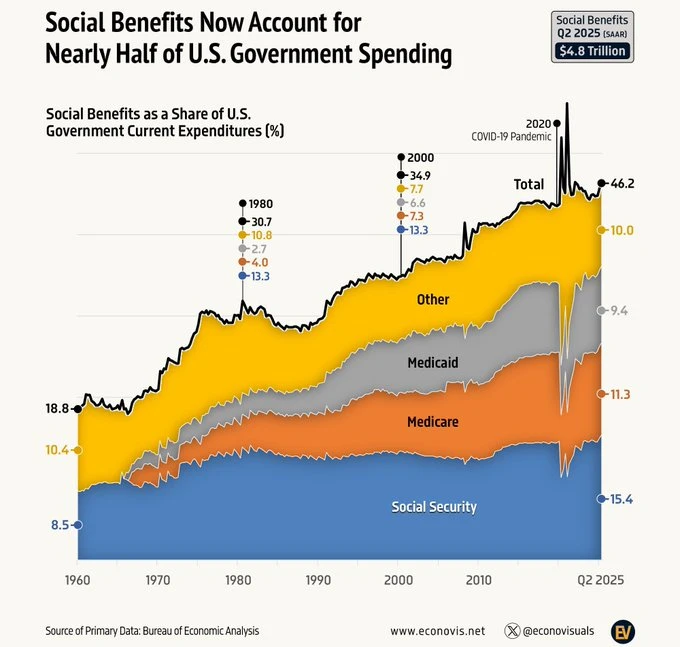

👉🏽'What a trend, just in case someone was wondering why the US has a fiscal deficit and debt problem. Any country with social benefits increasing at this rate would get in trouble.' - Michael A. Arouet

On the 25th of August:

👉🏽'France has done nothing to stabilize its fiscal deficit & debt/GDP. It already has the highest tax burden in Europe; higher taxes would throttle growth potential even more. With its political paralysis, it won’t cut spending either. The next confidence vote is coming. Good luck, Euro.' -Michael A. Arouet

🎁If you have made it this far, I would like to give you a little gift:

Lyn Alden's August newsletter is out. It analyzes the impacts of slightly tighter fiscal and slightly looser monetary policy going forward.

www.lynalden.com/august-2025-newsletter

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃