🧠Quote(s) of the week:

Pledditor: "Bitcoin influencers" getting paid in shares to promote stocks is no different than shitcoin influencers getting paid in shitcoins to promote shitcoins. The same perverse incentives exist.

This is why there are cycles in the market. The industry is irrelevant. The people are different, but their nature is the same. Greed and Grift. What will happen next? Well, I don't have a crystal ball, but something like this.. Bitcoin Treasury companies will be the next FTX/ Luna. Just need a couple of them to implode and cause a cascade.

"BTC TREASURY COMPANIES They want you to think you're a shareholder, but you're actually just a cuckholder" - Pledditor

🧡Bitcoin news🧡

Before we start with the recap, a short announcement:

Noderunners conference, November 1st.

This is your chance to join the most hardcore Bitcoin maximalists in Europe. No shitcoin talk. No VCs, Bitcoin ETF/stonks/treasury crowd. No compromise. Just pure Bitcoin signal from the brightest minds in the space.

Network with Lightning developers, node runners, miners, and the orange-pilled elite who are actually building the Bitcoin future.

So does your heartbeat orange?

Fixing the world on your mind?

Join us! Plebs, talks, workshops, beer & more!

Tickets: noderunners.network/en

On the 30th of June:

➡️Strategy has acquired 4,980 BTC for ~$531.9 million at ~$106,801 per bitcoin and has achieved BTC Yield of 19.7% YTD 2025. As of 6/29/2025, we hodl 597,325 Bitcoin acquired for ~$42.40 billion at ~$70,982 per Bitcoin.

➡️River: 'You can run the best business in the world, but still lose billions to inflation. Businesses, it's time to protect your profits with Bitcoin.'

On the 1st of July:

➡️Publicly traded DDC Enterprise closes $528 million financing to advance its Bitcoin treasury strategy.

➡️Italian banking giant UniCredit to offer European clients access to BlackRock's Bitcoin ETF in a newly structured product - Bloomberg

➡️Multiple crypto firms, including Fidelity Digital Assets, have applied for national bank charters

➡️Bitcoin sets a new all-time high monthly closing price at $107,173.

➡️Bitcoin OTC balances have dropped to a 10-year low of 156,600 BTC. Source: The stats likely come from CryptoQuant, a reputable source for on-chain Bitcoin data, tracking OTC desk balances using address labeling and flow analysis. Their data shows balances at 156,600 BTC, a 10-year low, aligning with trends from 480,000 BTC in 2021 to 146,000 BTC in early 2025. While generally reliable, tracking all OTC activity is challenging, as some private transactions may be missed, per CryptoQuant's own caution.

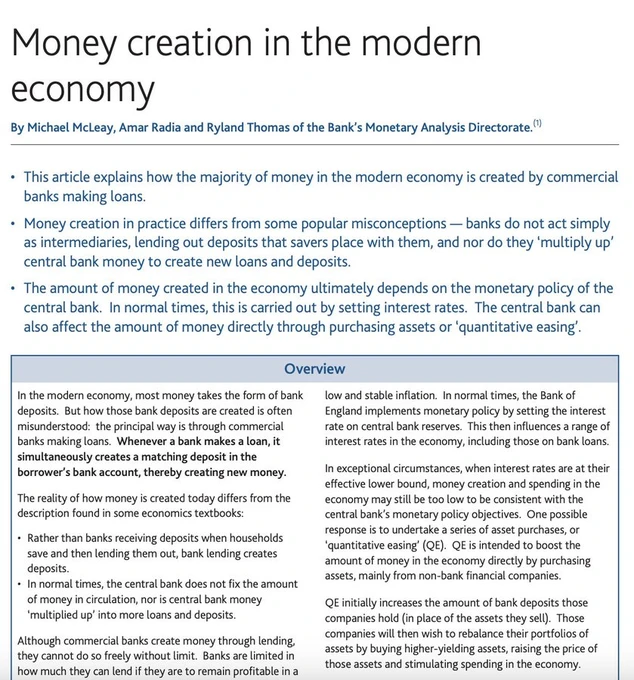

➡️Simply Bitcoin: "The Bank of England admitted in 2014 that banks create money out of thin air when they issue loans. Still think we’re the crazy ones for buying Bitcoin?"

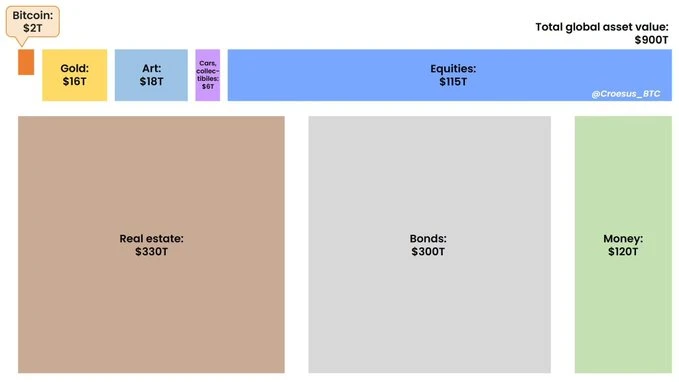

➡️Joe Consorti: "That little orange square will consume every other asset you see here. Bitcoin is competing against every single market. It is not a store of value. That's the trade. Speculative attack everything."

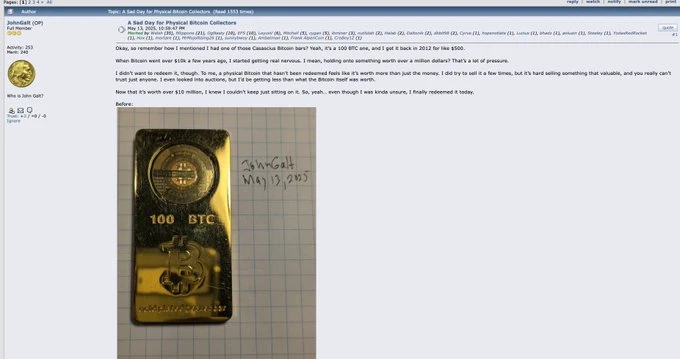

➡️This guy, OG Bitcoiner, bought a 100 BTC gold Casascius bar back in 2011 for $500 and then finally cashed out the seed phrase this year, ten million dollars profit. Absolutely wild! Balls of steel, insane foresight, unbeatable risk tolerance.

“Okay, so remember how I mentioned I had one of those Casascius Bitcoin bars? Yeah, it’s a 100 BTC one, and I got it back in 2012 for like $500. Now that it’s worth over $10 million, I knew I couldn’t keep just sitting on it. So, yeah… even though I was kinda unsure, I finally redeemed it today.” — John Galt.

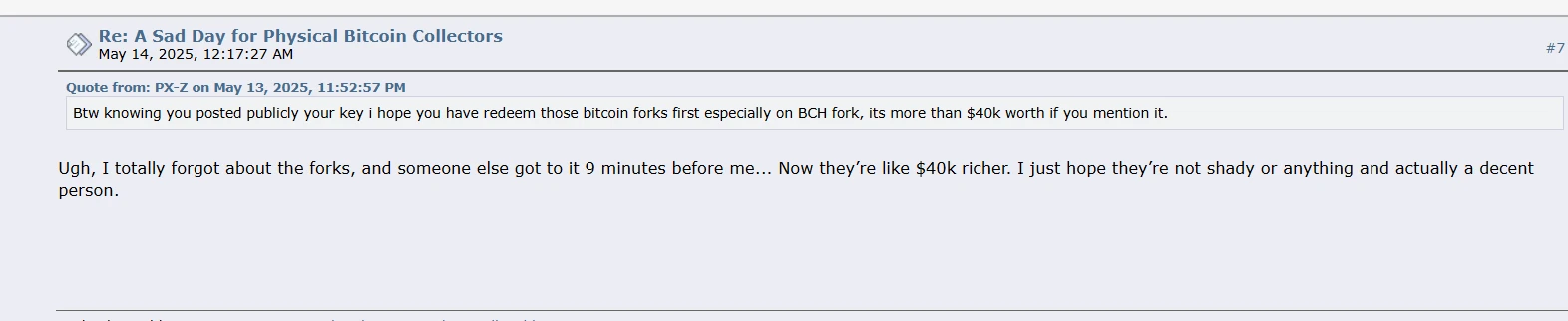

He posted the private key [:SDzWY6Wmr875zLvUKnLTsQXjVzsDUJ] publicly online after redeeming the 100 BTC, but then remembered that the key also unlocked the coins of every fork of Bitcoin since 2012. Somebody swept the wallet of $40,000 of Bitcoin Cash (BCH). That’s 0.4 BTC. No biggie.

NEVER POST YOUR PRIVATE KEYS

Source: bitcointalk.org/index.php?topic=5543336.0

➡️SoFi Bank's CEO, Anthony Noto, announces the launch of international payments, using Bitcoin to convert USD to foreign fiat currencies.

➡️As mentioned in last week's recap, The Wall Street Journal reports the Kingdom of Bhutan was able to pay government civil service salaries for years with their hydroelectric Bitcoin mining profits. www.wsj.com/podcasts/tech-news-briefing/how-a-tiny-himalayan-country-became-a-bitcoin-mining-paradise/62e76874-1e3d-4db6-b310-61812d5e0511

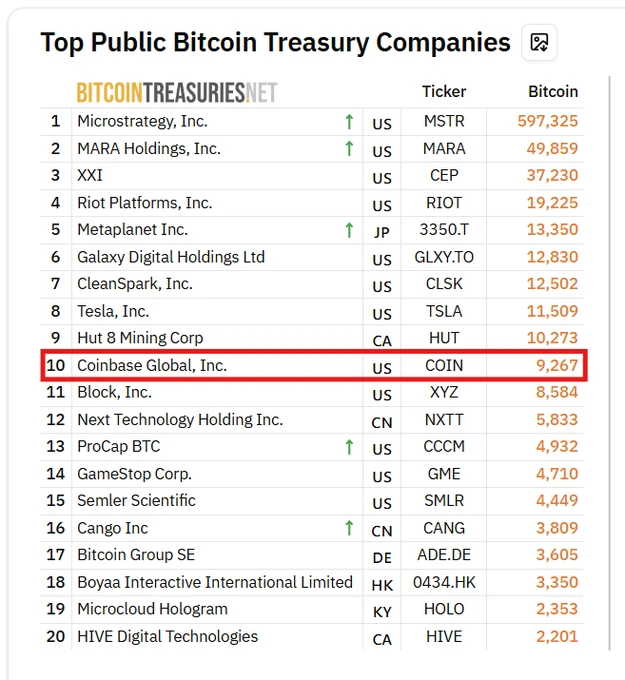

➡️Coinbase launched in 2012 when Bitcoin was $5. 13 years later, they hold just 9,267 BTC. That’s embarrassing. It's pretty simple. They spent their time and energy playing around with shitcoins versus focusing on Bitcoin.

➡️'Germany's largest banking group Sparkassen lifts its three-year digital asset ban and prepares to offer Bitcoin trading by summer 2026.' - Bitcoin News

➡️German banking giant Deutsche Bank to launch Bitcoin and crypto custody services - Bloomberg

➡️Design platform Figma just disclosed owning $70m in Bitcoin with board approval to buy another $30m in Bitcoin.

➡️Connecticut governor officially bans the state from owning Bitcoin or any digital assets. HFSP, DisConnecticut!

➡️Saylor: "Public companies acquired about 131,000 coins in the second quarter, growing their bitcoin balance 18%, according to data provider Bitcoin Treasuries. ETFs showed an 8% increase, or about 111,000 BTC, in the same period. www.cnbc.com/2025/07/01/public-companies-bought-more-bitcoin-than-etfs-did-for-the-third-quarter-in-a-row.html

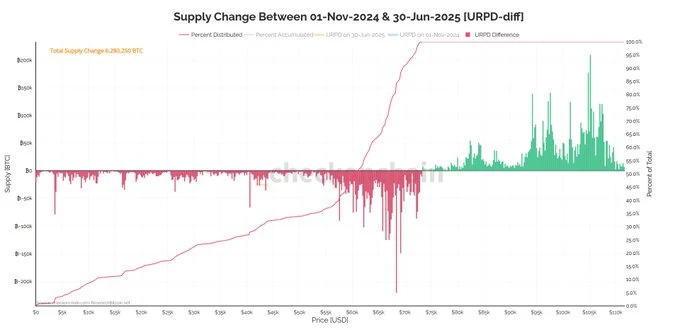

➡️ Checkmate: 'This chart shows how the Bitcoin supply changed since 1-Nov-24, before the rally to $100k.

Proportion of sellers:

10% from below $10k (HODLers)

38% below $55k (Last cycle buyers)

62% between $55k & $73k (2024 Chop traders)

HODLers are a third of the sellers.

Traders and TradFi money are two-thirds of it.'

On the 2nd of July:

➡️Billionaires Peter Thiel, the founder of PayPal, and Palmer Lucky, founder of Oculus, are preparing to launch a new U.S. bank serving Bitcoin businesses. The new bank will provide "traditional banking products, as well as virtual currency-related products and services".

Remember how I told Joe Rogan in 2024 that Bitcoin is such a big deal that society does not know how to process and recognise it immediately.

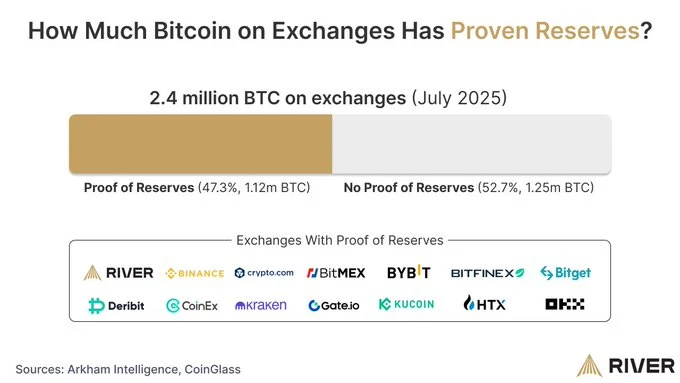

➡️River: "Proof of Reserves should be the standard for all Bitcoin exchanges. It helps prevent FTX-style paper bitcoin situations that affect even those who self-custody. Is your exchange not accounted for below? Ask for their reserves page. Don't trust, verify."

➡️U.S. M2 Money Supply hit a new all-time high. Historically, Bitcoin follows suit.

➡️'The largest single-building bitcoin mine in the world by hashrate has officially been completed in Texas. Spanning the equivalent of five football fields, the Vega mine covers 162,000 square feet of computers.' - Documenting Bitcoin

➡️MARA announces a target of 75 EH/s by the end of 2025, a 40% increase from 2024, supported by existing machine orders and a 3 GW low-cost power pipeline.

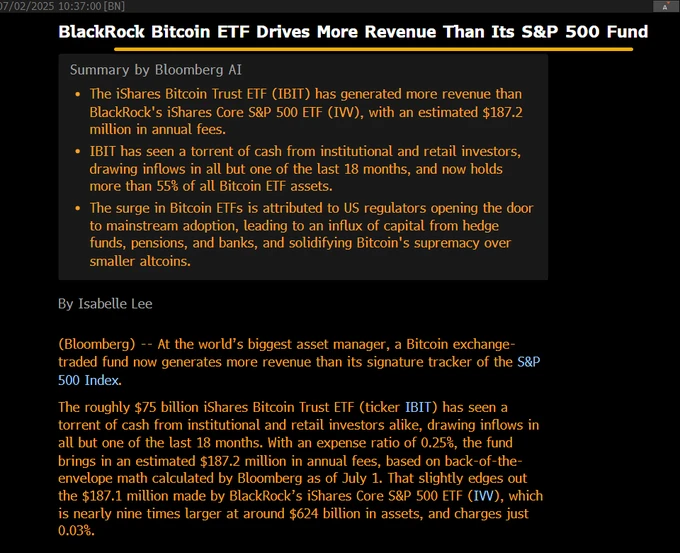

➡️Money talks. And ffs the Boomers are coming: BlackRock's Bitcoin ETF drives more revenue than its S&P 500 fund - Bloomberg

IVV (S&P) was launched in 2000, and IBIT (Bitcoin) just last year. Resisting Bitcoin is now insanely costly.

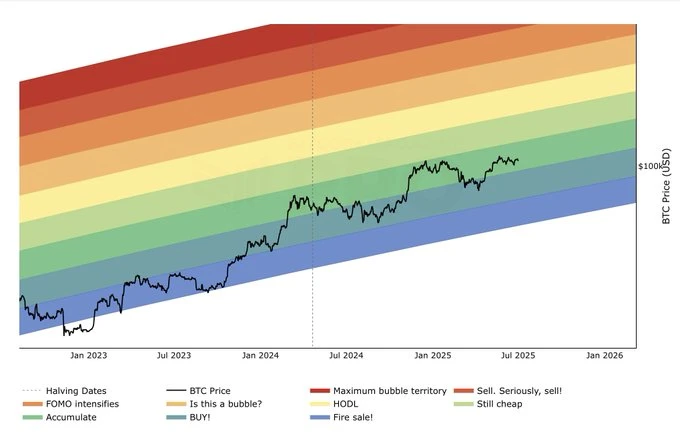

➡️Despite being 2% below a new all-time high, we are not even in the "Still Cheap" section of the Rainbow Chart.

"I wanna see the rainbow high in the sky I wanna see you and me on a bird flyin' away (flyin' away) And then I hope to see your smile every night and day (night and day)"

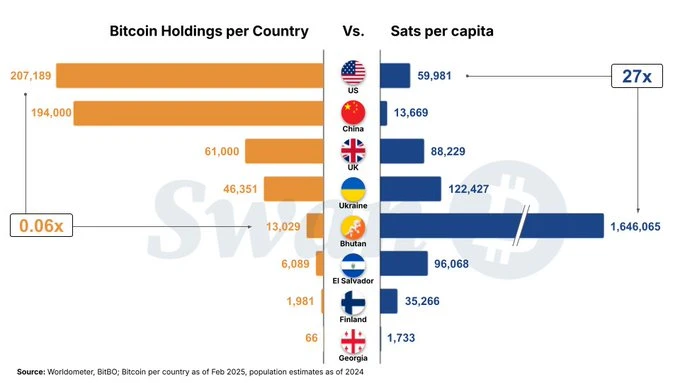

➡️Swan: "Bhutan has 27x more #Bitcoin per person than the U.S. Large countries may compete on total Bitcoin holdings, but ALL countries will compete on sats per capita."

➡️'Wallet of Satoshi is back in the US, this time, fully self-custodial. The largest Lightning wallet now runs on Spark. Beta is now live.' - Bitcoin News

➡️K33 Completes Purchase of Another 10 BTC. Full press release available here: k33.com/ir/article?slug=k33-completes-purchase-of-10-btc-1

➡️ Metaplanet: Q2 revenue from our Bitcoin Income Generation business rose 42.4% to ¥1.097B. This accelerating growth affirms the strength of our strategy—building a sustainable, scalable, and operationally efficient business on a Bitcoin standard.

Source: contents.xj-storage.jp/xcontents/33500/5dc446d6/33f7/492b/aa05/ea3ddc624850/140120250702507057.pdf

➡️Ledn: "It’s official. Ledn is now 100% bitcoin-only. One loan product, one focus: Unlocking liquidity while your Bitcoin stays secure and positioned for future growth."

On the 3rd of July:

➡️Troy Cross: "In March 2025, @NakamotoProjct surveyed 3,538 adults in the US. We found: -48m American adults own bitcoin -11m hold their own keys -Bitcoiners are more likely to be male, young, and non-white -They're politically diverse but right-shifted -They're "moral maximalists."

Read the full report here:www.thenakamotoproject.org/report

➡️ Last week, I shared the must-read article by Daniel Batten: "How The IMF Prevents Global Bitcoin Adoption (And Why They Do It)."

Fast forward to this week, Batten: The IMF rejected Pakistan's plan for 2000MW of Bitcoin mining. Yes, the IMF can and does dictate terms to sovereign nations that owe them $ Yes, this was anticipated. bitcoinmagazine.com/featured/how-the-imf-prevents-global-bitcoin-adoption-and-why-they-do-it

Bitcoin is the disruptor. IMF is the disrupted Nation states must anticipate what this means.

➡️'An unknown wallet recently sent $20K in BTC to Satoshi Nakamoto’s Genesis Block address. Arkham says the 0.185 BTC transaction was spotted on June 30. The wallet holds roughly $117B in dormant Bitcoin.' - Bitcoin News

➡️'Aaaaand BTC just hit a new ATH in Turkey. Weak currencies first. Then all of them.'' -Thomas Fahrer

➡️Gold miner Hamak Gold Limited announces it will add Bitcoin to its treasury. Gold mining companies are now buying bitcoin. You cant make this up. To all my gold, boomer friends out there, the time has come!

➡️Treasury Secretary Scott Bessent: Bitcoin is the most important phenomenon happening in the world.

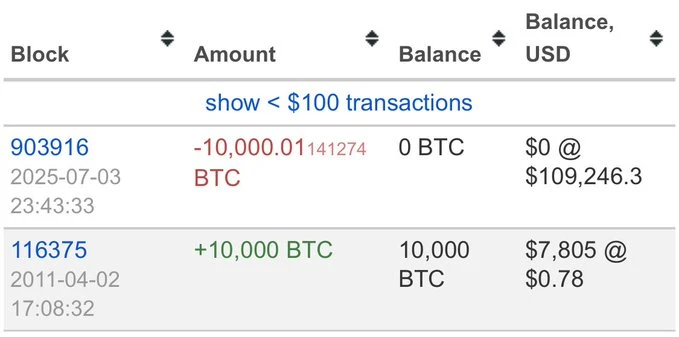

➡️A dormant Satoshi-era address moved 10,000 Bitcoin worth $1.09 billion after 14 years.

Beanie: "Imagine the balls it takes to not only hodl what is now $1.1 billion worth of Bitcoin for 14 years from a $7800 cost basis, but to just send it all out with a single click and no test transaction."

mempool.space/address/1HqXB9srhcnwhnhfXFoxt36qiiNY8gDwcK

This individual has moved 40,000 BTC that sat untouched for 14 years; he still has 20,000 BTC to move.

On the 4th of July:

➡️Bitcoin for Freedom: "4.45M addresses hold more than 0.1 BTC. Some sources claim each person, on average, has around 10 addresses. This means that around 500k-1M people own more than 0.1 BTC. That’s 0.01% of the global population."

Scarcity is real. The claim is largely accurate based on current data. As of July 2025, ~4.46M Bitcoin addresses hold >0.1 BTC (per BitInfoCharts). Estimates of average addresses per user vary (1-10+), leading to 0.4M-1M owners—about 0.005-0.01% of the global population (~8.1B).

Stacking one whole Bitcoin is now out of reach for most of the world's population. Bitcoin is divisible, and stacking 0.1 Bitcoin will be considered a major milestone in a few short years.

Simply Bitcoin: "If you hold 0.1 Bitcoin:

- Guaranteed top 2.63% globally (21M coins)

- Top 2.13% after subtracting ~4M lost coins

- Only 4.5M addresses hold >0.1 BTC → Top 0.56%

You're ahead of 99.4% of the world. Let that sink in."

➡️MARA increases Bitcoin holdings to 49,940 BTC, placing its $5.4B treasury second among public companies globally, behind Strategy.

➡️Christine Lagarde warns stablecoins could privatize money and weaken central banks.

That's the plan! Spoken like a central banker whose jurisdiction wants to launch its own digital currency and feels threatened. Central bankers doing “public good” is mental gymnastics even by her standards.

And regarding that Euro CBDC...

The European Union plans to introduce its central bank digital currency—the digital euro—in October of this year.

"To reassure people about the digital euro, Lagarde cites China as a 'success story" and says explicitly that the EU is following China's lead on Centralized Digital Currency. Here's why this matters, they are explicitly copying China's model: China's Central Bank Digital Currency (CBDC), the e-CNY, gives the People's Bank of China, for the first time, the surveillance powers to track all citizens' financial transactions in real-time.

Because their CBDC records every transaction, this gives the government detailed visibility into every citizen's financial activities. All larger transactions are traceable under laws like the Cybersecurity Law. This capability gives Chinese authorities the power to

- Monitor and control behavior

- Track spending to identify dissenters

- Enforce social compliance via the social credit system

- Restrict funds for critics

The technology makes mass surveillance and (further) erosion of civil liberties technologically possible, while providing Chinese authorities a tool for the state to exert unprecedented control over its population.

ECB will say, "Well, in theory that's true, but we will only use that ring of power to do good for the world."

If you are feeling uncomfortable with that level of power, you are right to trust your instinct." -Daniel Batten

The ECB says the Digital Euro is about “innovation.” Christine Lagarde says it’s to fight “decentralized protocols like Bitcoin.” Now read the above again...got Bitcoin?

Watch the clip here: x.com/wideawake_media/status/1941425924823482765

➡️Bitcoin miner Riot Platforms produced 450 BTC in June, down 12% from 514 BTC in May, with daily average output falling from 16.6 to 15 BTC. Still, Riot’s year-to-date production rose 76% compared to 2024.

➡️Daniel Batten: "In the past 50 years, countries like India, the Philippines, the Congo now owe their former colonial masters 189x what they owed in 1970" ~ @gladstein

(Thanks, IMF, World Bank) By providing countries like Bhutan a debt-free path to financial sovereignty, Bitcoin fixes this.

➡️A solo miner just mined an entire #bitcoin block worth over $350,000.

On the 6th of July:

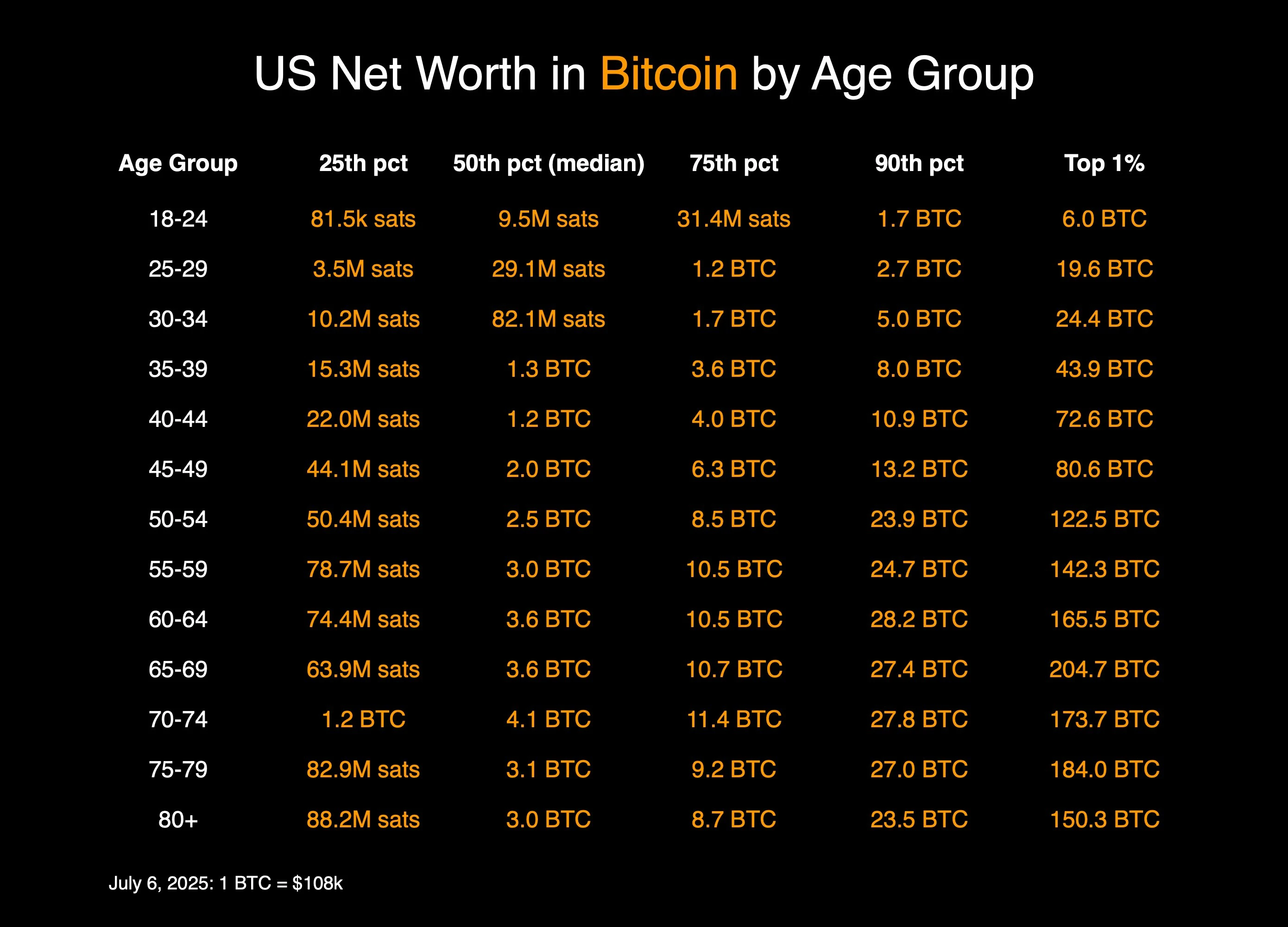

➡️How many BTC do you need to rank in the top 1% vs other people in your age group on total net worth?

US net worth *in terms of bitcoin…in case that wasn’t clear. Not how much bitcoin they’re actually holding, but just using bitcoin as a UoA to denominate all of their wealth.

These numbers will trend lower over time.

➡️'Public companies are buying Bitcoin at a rapid pace:

Public companies purchased 131,355 Bitcoins in Q2 2025, growing holdings by +18%, according to Bitcoin Treasuries data.

Furthermore, ETFs acquired 111,411 BTC, posting an +8% rise during the same period. This marks the 3rd consecutive quarter in which companies have bought more Bitcoin than ETFs.

Year-to-date, public companies have purchased 237,664 Bitcoins, double the 117,295 acquired by ETFs. Now, public companies hold ~855,000 Bitcoins, or ~4% of the total supply. Corporate demand for Bitcoin is incredibly strong.' -TKL

➡️'Bitcoin will get more valuable every year, as every other asset is in the fiat world and will get diluted every year. That's why I hold 0 Stocks, 0 Real Estate & have everything in Bitcoin! - Robin Seyr

On the 7th of July:

➡️The Smarter Web Company purchased 226.42 BTC and now has a total of 1,000 BTC.

➡️The Blockchain Group acquires 116 BTC (~€10.7M), increasing its holdings to 1,904 BTC.

Press release: www.theblockchain-group.com/wp-content/uploads/2025/07/20250707-TBG-CP-07-juillet-2025-EN-FINAL.pdf

➡️Strategy posts a $14.05billion unrealized gain in Q2 as Bitcoin rebounded and new accounting rules kicked in.

➡️Spain’s second-largest bank, BBVA, launches #Bitcoin trading and custody for all retail customers.

Just want to end this segment with the following picture...

- 2014: "Oh, I should have bought 100 BTC when it was still possible."

- 2018: "Oh, I should have bought 10 BTC when it was still possible."

- 2022: "Oh, I should have bought 1 BTC when it was still possible."

- 2026: "Oh, I should have bought 0.1 BTC when it was still possible."

💸Traditional Finance / Macro:

On the 6th of July

👉🏽Remember the famous Jaguar ad? And the winner is…. Jaguar by a mile in the Go Woke/Go Broke Global Competition. Congratulations Jaguar!!

Jaguar Sales Plummet By 97.5% After Awful They/Them Rebrand

www.zerohedge.com/geopolitical/jaguar-sales-plummet-975-after-awful-theythem-rebrand

🏦Banks:

👉🏽 no news

🌎Macro/Geopolitics:

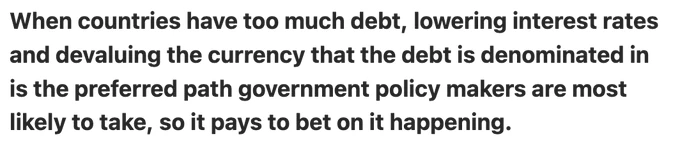

Before we start this segment, I want to share the following remark by Ray Dalio:

Could you please read everything below and come back to this statement? Got Bitcoin?

On the 30th of June:

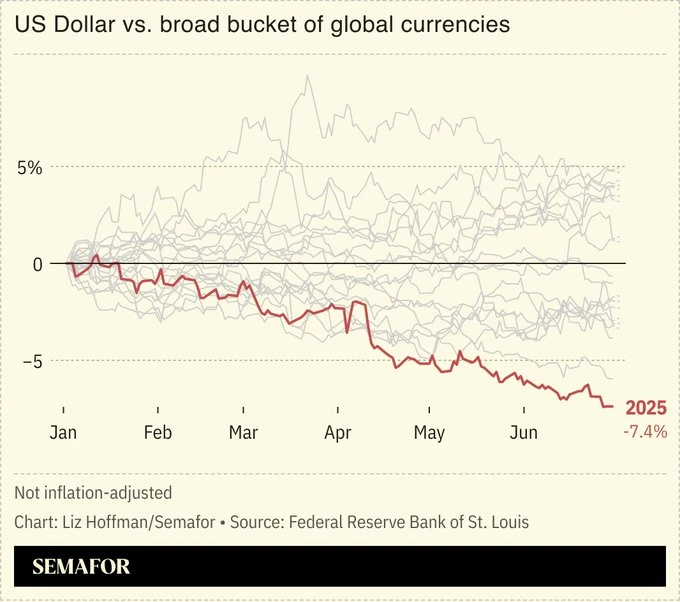

👉🏽The Euro has surged to its highest level against the U.S. dollar since 2018. Up 8%. Jameson Lopp: "The US dollar is on track for its worst year in modern history and may not be done falling yet. The greenback is down more than 7% this year, and Morgan Stanley predicts it could fall another 10%!"

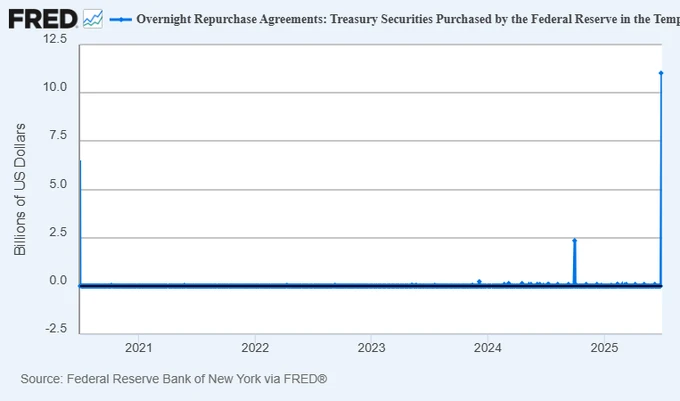

👉🏽Lyn Alden: 'This was the first material usage of the Fed's standing repo facility since the end of Q3 2024.'

On Sep 17, 2019, the REPO market catastrophically failed, forcing the Fed to intervene with $255B. Then, a once in 100 year "deadly virus" magically appeared 1 month later, allowing Jerome Powell to print $6 trillion and bail out the banking system in February 2020.

The Fed's Standing Repo Facility (SRF) lets banks borrow cash overnight by selling Treasury securities to the Fed, repurchasing them the next day with interest. This injects liquidity, stabilizing short-term funding markets. On June 30, 2025, SRF usage hit $11.025 billion, likely due to quarter-end funding needs, ensuring banks met obligations. However, it may signal stress, as private market funding was tight, prompting Fed reliance. While the SRF supports market stability, heavy use could hint at liquidity strains or policy tightness, though the small amount relative to total reserves suggests routine operation.

On the 1st of July:

👉🏽Debt under Democrats: goes up

Debt under Republicans: goes up

Neither of the major parties has been successful so far in addressing this issue.

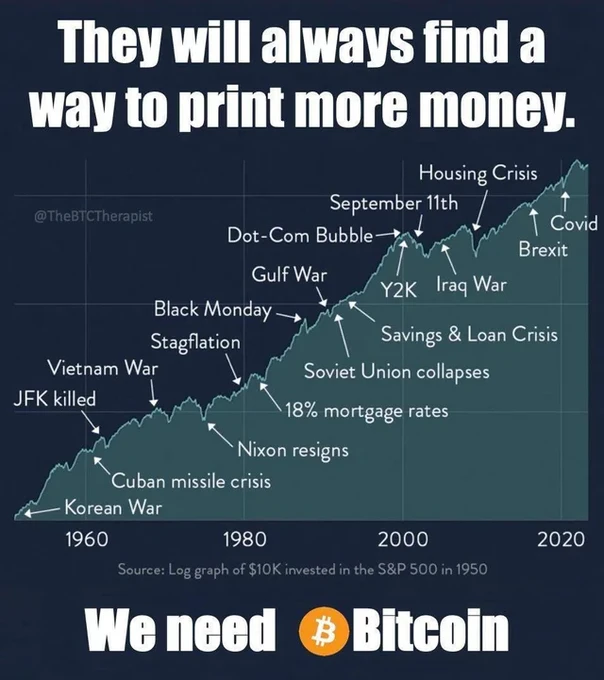

👉🏽'The US M2 money supply jumped +4.5% Y/Y in May, to a record $21.94 trillion. This marks the 19th consecutive monthly increase. It has now surpassed the previous all-time high of $21.86 trillion, posted in March 2022. Furthermore, inflation-adjusted M2 money supply rose 2.1% Y/Y last month, the largest increase since early 2022. Since 2020, the US M2 money supply has risen nearly $7 trillion, or ~45%. The US Dollar's purchasing power is in an eternal bear market.' -TKL

Anyway, may I remind you that it took over 200 years for the U.S. debt to reach $12 trillion. $12 trillion is how much we added in 4 years between 2020 and 2024. Oh well, cherrio!

👉🏽Balaji: 'The US is broke. The real debt is $175T+. And Elon Musk is 100% correct on the numbers. But the difficult step is the logical conclusion. There is no fix. It's a write-off. A national bankruptcy. And the default will be in the form of money printing.'

Trump’s “Big Beautiful Bill” is just more trickle-down bullshit.

Bessent: I admire Elon's leadership on rockets. I will take care of the finances. Kilmeade: He says $5 trillion is added to the deficit—you don't agree?

Bessent: I don't agree at all. This bill will set off growth like we have never seen before…And once you see the growth trajectory change to an upward bias, the bill more than pays for itself. We could be in surplus.

What boggles my mind is this idea of growth. How does the US grow if everyone is broke and indebted up to their ears?

Anyway, the Big Beautiful Bill will add $3.3 trillion to the deficit and increase the debt ceiling by $5 trillion. This will push the US debt to $42 trillion. This will involve the U.S. dollar losing purchasing power and inflation hedges soaring.

Ray Dalio on the matter:

"Now that the budget bill has passed Congress, we can see what the projections look like for deficits, government debt, and debt service expenses. In brief, the bill is expected to lead to spending of about $7 trillion a year with inflows of about $5 trillion a year, so the debt, which is now about 6x of the money taken in, 100 percent of GDP, and about $230,000 per American family, will rise over ten years to about 7.5x the money taken in, 130 percent of GDP, and $425,000 per family. That will increase interest and principal payments on the debt from about $10 trillion ($1 trillion in interest, $9 trillion in principal) to about $18 trillion (of which $2 trillion is interest payments), which will lead to either a big squeezing out (and cutting off) of spending and/or unimaginable tax increases, or a lot of printing and devaluing of money and pushing interest rates to unattractively low levels. This printing and devaluing is not good for those holding bonds as a storehold of wealth, and what’s bad for bonds and US credit markets is bad for everyone because the US Treasury market is the backbone of all capital markets, which are the backbones of our economic and social conditions. Unless this path is soon rectified to bring the budget deficit from roughly 7% of GDP to about 3% by making adjustments to spending, taxes, and interest rates, big, painful disruptions will likely occur."

Anyway, got Bitcoin?

👉🏽The United Kingdom faces the largest single-year exodus of wealth ever recorded, per Forbes.

On the 2nd of July

👉🏽The Netherlands: Government provides the largest contribution to economic growth in 2024 | CBS

How can a government contribute to economic growth if everything it does has to be paid for through taxes? In the Netherlands, the government "contributed" to 0.9% out of the 1.1% growth. The rest of the economy grew 0.2%. That's like including the growth of the cancer cells...

👉🏽Absurd: planes have to fly over Amsterdam because a hundred hectares of solar panels that dangerously reflect sunlight for pilots are being built near Schiphol.

Parool: "The cause is a massive solar park being built near Zwanenburg. A portion of the 75,000 panels causes glare that interferes with air traffic approaching the Polderbaan and Zwanenburgbaan runways.

Earlier this year, Schiphol closed the Polderbaan for several weeks between 10 a.m. and 12 p.m. because of this. As a result, other runways — primarily the Zwanenburgbaan and Buitenveldertbaan — were used more frequently. Due to a different position of the sun, the measure was temporarily lifted at the end of March."

archive.ph/j5G8R#selection-1315.0-1321.273

👉🏽U.S. Federal Housing and the Fannie Mae and Freddie Mac Chairman Calls on Congress to Investigate Jerome Powell.

👉🏽The US Bond Market has now been in a drawdown for 59 months, by far the longest in history.

👉🏽China's share of global wealth has grown by 500% since 2000. Signpost!

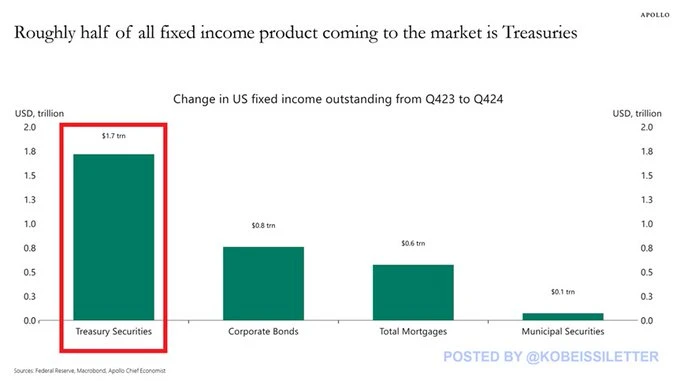

👉🏽TKL: US debt issuances are skyrocketing: In 2024, over 50% of all credit assets coming to the market were in US Treasuries. The US Treasury issued $1.7 trillion in debt last year, more than double the $800 billion issued by companies in the corporate bond market. By comparison, the value of total mortgages and municipal securities issued was $600 billion and $100 billion, respectively. To put this differently, investors are now allocating more of their capital to finance the US government than loans to firms and consumers. The deficit crisis is worse than ever before.'

👉🏽'Today, we are proposing to reduce the EU's emissions by 90% by 2040. This is a significant milestone on our road to net zero by 2050.

By setting this target, we want to:

- Ensure predictability and stability for investors

- Strengthen industrial leadership

- Guarantee energy security and resilience

- Create more jobs

- Drive innovation, prosperity, and competitiveness'

How to kill millions of jobs and destroy free societies.

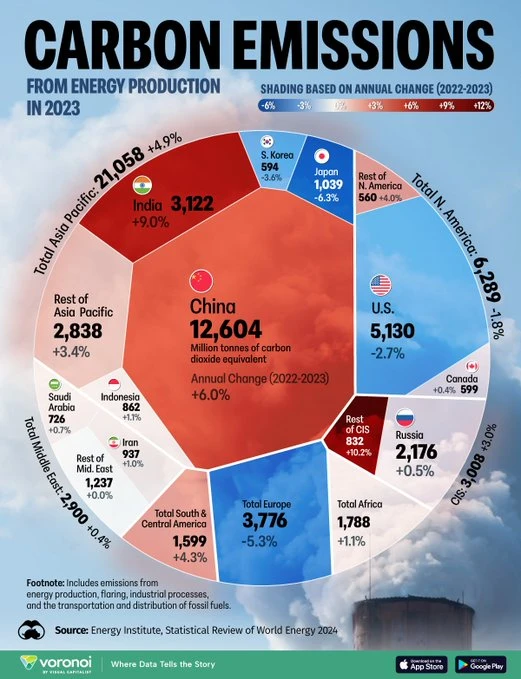

Despite immediate negative effects on EU prosperity and freedom, and failure to actually achieve "net zero", the effects of such effort on global temperature, weather, and climate would be too small to measure within the life expectancy of anyone alive today. Atmospheric CO2 levels will continue to rise unabated.

NiemandsKnegt: "Starting in 2031, €1,570 (!!!) billion annually… and signing on the dotted line NOW for a BINDING target WITHOUT even REALLY KNOWING exactly how much money will be needed... What could possibly go wrong... They’ve truly gone completely insane now..."

Source: archive.ph/LIAFa

Bjorn Lomborg:

"Either the EU fudges the stats or • The cost will rise so fast and high that most governments will be voted out • The rest of the world will sail past the EU, laughing • The actual climate impact will be trivial."

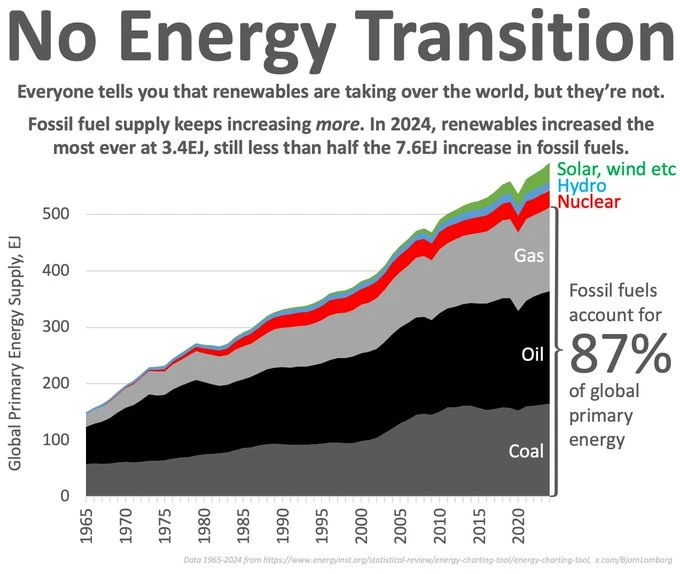

There is no energy transition to renewables. "Rather than replacing fossil fuels, renewables are adding to the overall energy mix," Energy Institute Statistical Review 2025.

Sources: www.energyinst.org/statistical-review www.energyinst.org/exploring-energy/resources/news-centre/media-releases/renewables-soar,-but-fossil-fuels-continue-to-rise-as-global-electricity-demand-hits-record-levels

Energy = growth = life The EU is done. Study some history!

This will continue to be true as the developing world expands its access and use of energy. The chart below is quite interesting and too few engaged in this discussion have looked at it, but it shows where the growth is today and how the West matters less each year for this conversation.'

Now, look at both pictures and ask yourself: Does it matter if you clue yourself on a highway or throw soup at art living in Europe?

On the 3rd of July:

👉🏽The Netherlands risks a fine of over half a billion euros if it scraps the CO₂ tax — “The Netherlands had promised the tax in exchange for money from the COVID recovery fund. The role of the VVD and CDA is ironic: they were in favor of strict conditions.” Source (in Dutch) FTM: archive.ph/4CmHj

On the 4th of July:

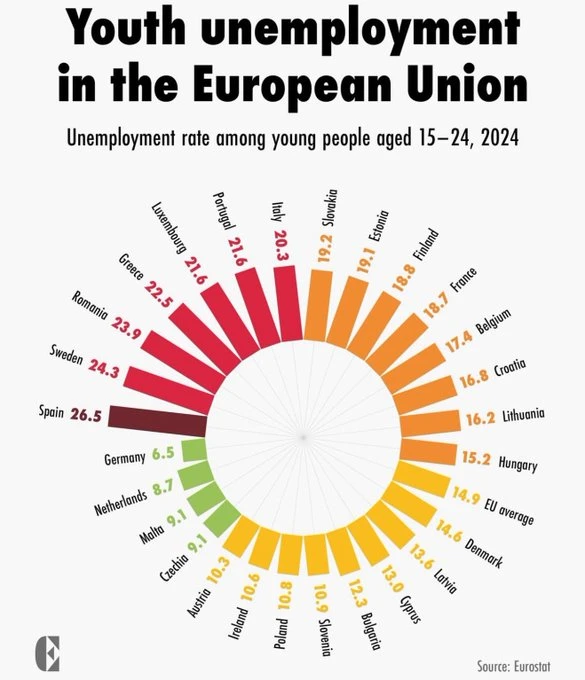

👉🏽High youth unemployment in Spain is well known, but what’s going on in Sweden? I thought that’s the famous paradise all US socialists dream of.' - Michael A. Arouet

Sweden has now announced it will launch a study to find out why the birth rates are collapsing to record low levels. What do you think is the reason? The above?

👉🏽ECB's Lagarde: Before the euro can enhance its role as a global currency, our economic systems need to become more efficient and integrated. Just madness. As if the international role of the euro is the ultimate goal, and political union just a means to that end. Just madness!

On the 5th of July:

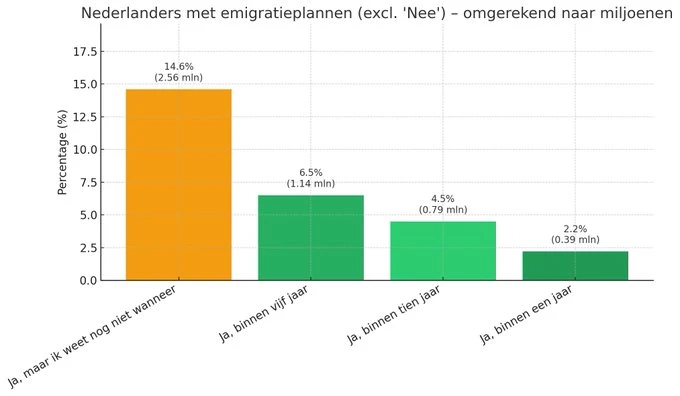

👉🏽The Netherlands: Number of Dutch people with emigration plans: 27.8% (4.87 million)

Even more striking: 4.87 million people are considering leaving the Netherlands. Too little future. Most of them have no migration background. The Netherlands is losing its appeal, especially for its own citizens. A sad observation and deeply concerning.

On the 6th of July:

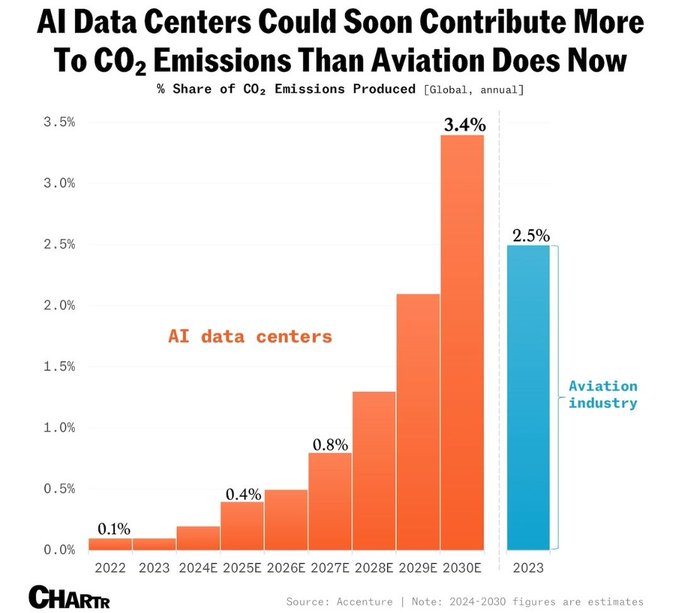

👉🏽Michael A. Arouet always oh so eloquent: "Dear climate activists, after you boycotted flying, may we assume that you will start boycotting TikTok and YouTube with all the AI-generated clips? You should also stop using Google, Instagram, and Facebook."

Given the share of internet applications in global CO2 emissions, we should logically stop tweeting/posting altogether. Right?

On the 7th of July:

👉🏽US DOJ and FBI conclude Jeffrey Epstein committed suicide and had no client list, Axios reports

Apparently, Ghislaine Maxwell is currently in prison for 20 years for sex trafficking underage girls to no one.

No more words needed...

🎁If you have made it this far, I would like to give you a little gift:

Lyn Alden: The Rise of Bitcoin Stocks and Bonds

www.lynalden.com/bitcoin-stocks-and-bonds

Set aside 15-20 minutes to read this carefully. Again a must read by Lyn.

"That is why I’m in agreement with both the cyberpunks and the suitcoiners."

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃