🧠Quote(s) of the week:

People don't understand. Because I own Bitcoin, life has gotten 50% cheaper over the last year. Groceries, vacations, gym memberships, rent... This is what life is like when you own money that goes up in value over time. Inflation goes extinct the moment you adopt Bitcoin.

'Before Bitcoin, I hated:

⇒ History

⇒ Geometry

⇒ Physics

⇒ Math

⇒ Language.

Now I couldn't be more excited about it... I literally Watch Documentaries and science channels like others on Netflix! Bitcoin Changes You!' Robin Seyr

🧡Bitcoin news🧡

On the 21st of July:

➡️'Let me explain how this works: Bitcoin goes up to $120k, a bunch of degenerates leverage long the breakout, the market makers eat their buys, then dump and liquidate the 25-100x leverage positions back to $116k. Spot price adjusts as arbitrageurs trade the difference. Meanwhile, 100 treasury companies are using the volatility to gather funds to buy more Bitcoin sustaining the price of spot and OTC. Price gradually moves back up as spot bids sustain from buyers that are price agnostic (most of the treasury companies) and TWAP buyers Eventually the coins available in this range disappear into stronger hands and the price moves up to the next area of sellers. Rinse, repeat.' - MikeWMunz

I think this is a pretty accurate breakdown and explanation of the Bitcoin price movement in conjunction with the role of arbitrage in the market.

➡️Super Bowl winner Saquon Barkley says Michael Saylor told him to go "all in" on Bitcoin. Barkley said he would take his whole contract in BTC if he could go back. - Bitcoin Magazine

On the 22nd of July:

➡️Financial Times: JPMorgan could start lending directly against cryptoassets such as bitcoin next year. “According to one person familiar with the matter, Dimon’s early comments about bitcoin — in which he also said he would fire any trader who traded it—had alienated some prospective clients who either had made their money through crypto assets or were long-term believers in their potential.”

➡️Elon Musk’s SpaceX moves 1,308 Bitcoin for the first time in 3 years.

➡️Electric vehicle manufacturer Volcon Inc. will allocate over 95% of a $500M private placement to implement a Bitcoin treasury strategy.

➡️PNC Bank announces a strategic partnership with Coinbase to develop an initial offering that will enable clients to buy, hold, and sell cryptocurrencies.

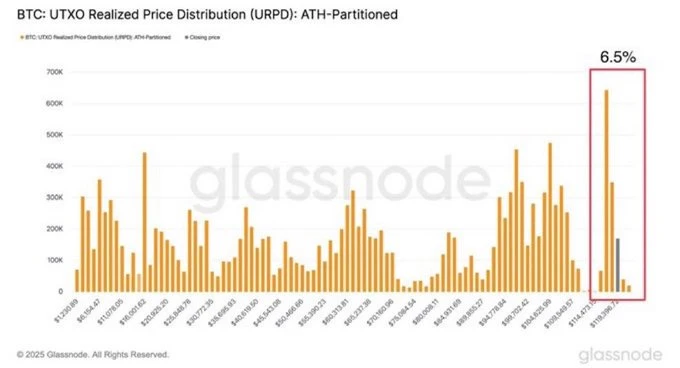

➡️'6.5% of the supply of Bitcoin has been purchased above $115k. The world is hungry for Bitcoin. We are preparing for the next leg UP. LFG!' - CarlBMenger

➡️Mexican real estate firm Grupo Murano to buy $1 BILLION worth of Bitcoin. They plan to build a $10 BILLION Bitcoin treasury within 5 years.

➡️$763 million Bitcoin treasury company Nakamoto files with the SEC to merge with publicly traded KindlyMD. Expects to complete the merge in 20 days. - Bitcoin Magazine

➡️Ohio Public Employees Retirement Fund (OPERS) Has Bought 21,499 Strategy₿ MSTR Stocks For 8.13 Million Dollars At An Average Price Of $378.49 Per Share In Q2 2025. Their Total Holdings are 101,880 Shares Worth Over 44 Million Dollars.

➡️California-based Cavitation Technologies enters Bitcoin mining with its Non-Thermal Plasma system for immersion cooling.

➡️Telegram’s Bitcoin and crypto wallet is now live for 87 million users across the U.S.

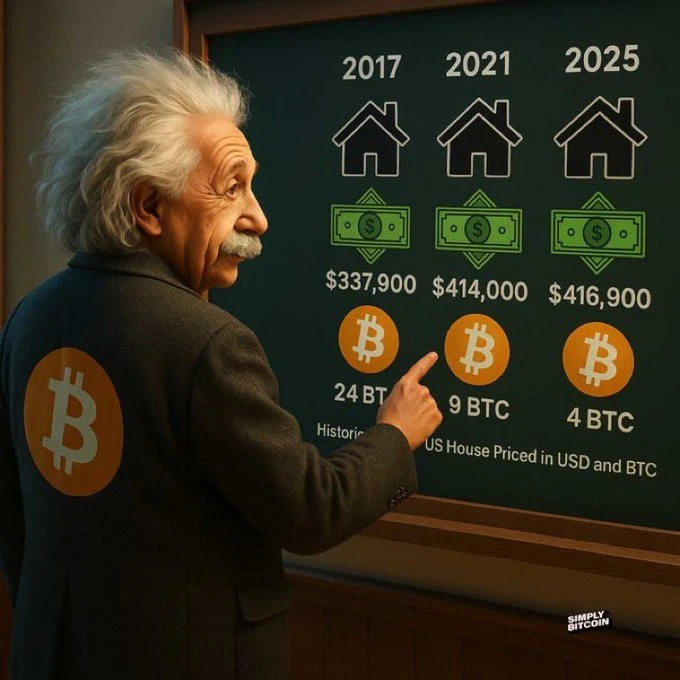

➡️ Priced in Bitcoin:

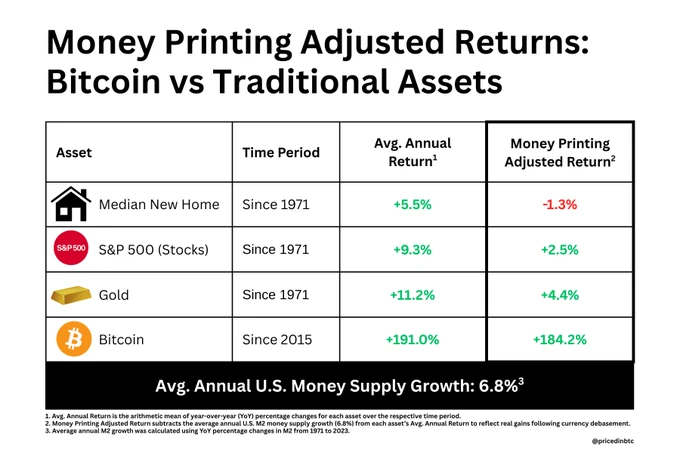

'₿rrr… only one asset outruns the printer. Since 1971, most assets have barely outpaced 6.8% annual money supply growth. The median U.S. house failed entirely to keep up with U.S. dollar debasement. ₿itcoin delivers real wealth preservation and generation.'

Just to give you a great insight into the above:

'On a gold standard like in 1971, your annual income would be a jaw-dropping $843,830 today. That’s right, OVER 13X what you’re slaving away for now!

The fiat system is a THIEF, and it’s laughing in your face while it steals your wealth! Don’t believe me? The numbers don’t lie, and they’re screaming the truth! Let’s break it down: In 1913, the average income was $800, or 38.7 oz of gold ($20.67/oz). Solid, honest money. By 1971, that soared to $10,500, equivalent to 248.7 ounces of gold ($42.22 per ounce). Real wealth, baby! Now, TODAY, June 5, 2025, the average income is $61,984, and gold is at $3,393/oz. That’s a pathetic 18.3 oz of gold! You’ve been gutted, your purchasing power is in the gutter!

If we were still on a gold standard like in 1971, your salary would be $843,830 (248.7 oz of gold x $3,393). That’s what you DESERVE, not this fiat garbage they’re paying you with! Inflation isn’t “economics”, it’s a SCAM designed to keep you poor while the elites print money for themselves!

Fiat is a silent KILLER of your wealth, and now this “Beautiful Spending Bill” is coming to vaporize what little you have left! Do you think your savings are safe?

They’re evaporating as we speak! Bitcoin is your ONLY shield. Like gold, it’s a middle finger to the central banks with its hard-capped supply. Stack sats NOW, or watch your future burn in the fiat dumpster fire! FiatHawk - Bitcoin is Hope (foto)

Small tiny disclaimer from my side: 'You wouldn't be able to make $843,000 a year on a 1971 gold standard. Because the value of gold wouldn't be the same. It's over $3K today because the dollar kept losing value. You would at least still earn 250 oz of gold per year. Now it is only 18. That is insane theft. Living standards should be improving and not deteriorating.'

But let's get this straight(!): In 1913, the income tax started with a top rate of 7%. Today, it’s 37% — a 5x increase. Since then, the dollar has lost 99% of its value. We’re now taxed exponentially more on money that’s barely worth anything. Still think the system isn’t broken? How much are you making anon? Got Bitcoin?

➡️Adam Back’s Bitcoin company BSTR now holds the 4th-largest corporate treasury.

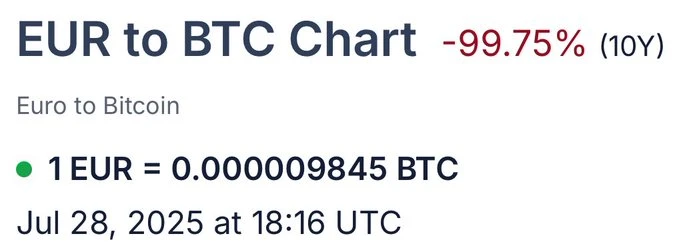

➡️'Friendly reminder that stocks HAVE NOT hit an all-time high...they've been in a perpetual bear market PRICED IN BITCOIN. S&P 500 (priced in ₿):

• 1 Year: –35.81% • 5 Year: –84.64% • 10 Year: –99.31%

Nasdaq 100 (priced in ₿):

• 1 Year: –34.08% • 5 Year: –83.08% • 10 Year: –98.84%' - Priced in Bitcoin

➡️Strategy just launched STRC, a new perpetual preferred product offering an initial 9% APY. The $33-trillion short-duration U.S. credit market can now flow into Bitcoin. All bets are off.

➡️Fastest assets in the world to reach $2 trillion:

-

Microsoft: 46 years

-

Apple: 44 years

-

Nvidia: 31 years

-

Amazon: 30 years

-

Bitcoin: 16 years

Adjusting for inflation to constant 2025 USD ($2T real value), the approximate times change slightly, but the ranking holds. Bitcoin remains the fastest, even in real terms.

On the 23rd of July:

➡️$50 BILLION Square just activated Bitcoin Lightning for its first merchants. 4 MILLION sellers are about to accept Bitcoin!

➡️Jeroen Blokland:

"Time for a little ‘Teletekst’ moment.

Funeral costs have increased by 40% over the past ten years. That’s 9 percentage points higher than general inflation. Many people can no longer afford their own funeral. Just let that sink in for a moment. A 40% increase over ten years is, to put it mildly, extreme.

By the way, I calculate general inflation at a 34% increase over the past decade—not 31% as NOS suggests—but that’s beside the point. Both figures are absurdly high. The fact that people can’t even afford their own funeral anymore, partly due to outrageous price hikes, is frankly heartbreaking.

Right now, no trains are running between Rotterdam and The Hague, yet next year, ticket prices are set to rise by up to 9%. NOS has already reported that food prices have soared. For A-brands, it’s even 40% or more in just five years. There is an increasing shortage of medications in the Netherlands, causing prices to rise further. Housing prices rose 9.3% in June compared to a year ago. As a result of the surging property prices and housing shortage, rents are happily climbing along with them.

So tell me— Do you still find it strange that I keep repeating that inflation risk is massively underestimated?

Or that I question the reliability of the official inflation rate, which is currently reported at 3.1%?"

For example, your house isn’t worth more; your money is just worth less. Few understand.

On the 24th of July:

➡️Japanese AI company Quantum plans to buy $356 million Bitcoin within the next 12 months.

➡️ Michael Saylor's STRATEGY plans to raise $2B for Bitcoin purchases, upsizing from $500M.

➡️Maartunn: 'Chris Larsen (Ripple co-founder) just dumped ~$200M worth of XRP in the past 10 days. Still buying? You're the exit liquidity. He's dumping on you. Think twice.'

On the 25th of July:

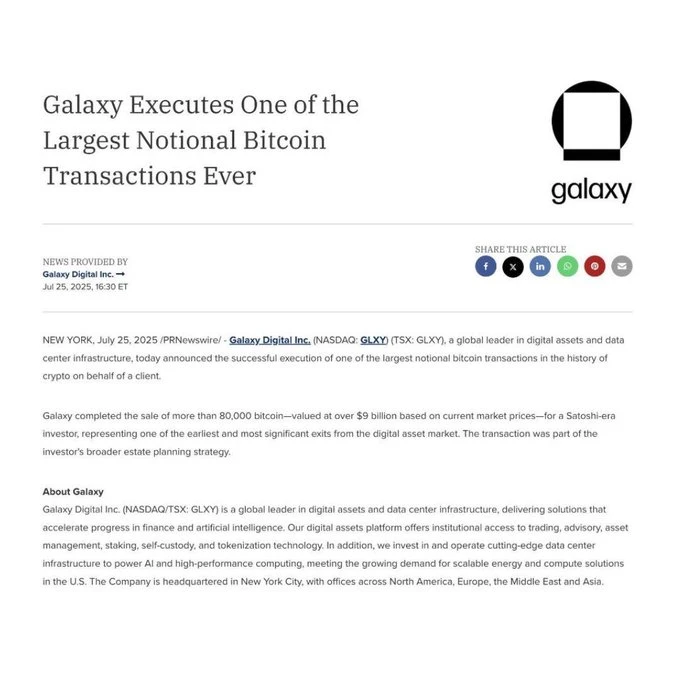

➡️Another whale from 2011 just woke up and sold 14,000 BTC.

➡️Galaxy has sold 70,000 of the 80,000 BTC, 10K more to go…

The current sell-off is linked to Galaxy Digital sending out 30,000 BTC to exchanges overnight. As mentioned in last week's Weekly Recap, the company received 80,000 Bitcoin from an ancient Bitcoin whale last week.

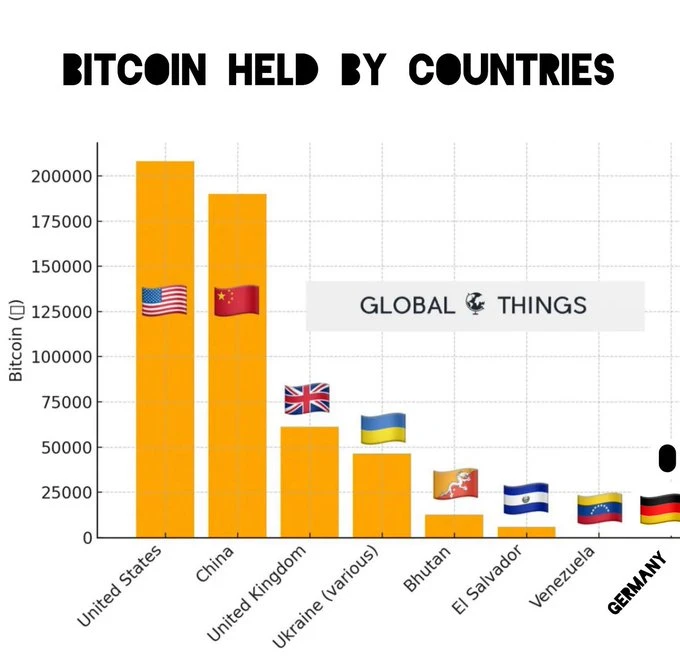

Summer 2024: Germany selling 50k Bitcoin sold in several days caused 10%/15% drawback.

Summer 2025: 30k Bitcoin sold in one day caused a -2.7%. In one year, Bitcoin has transformed from a fledgling risk asset into an institutional market ready for size. Institutional allocators have taken notice.

Imagine, Germany could be the 4th largest Bitcoin-holding country in the world.

Verdammt nochmal!

➡️The Smarter Web Company has just bought another $26.1 MILLION Bitcoin as part of its 10-year plan. They now hold 1,825 Bitcoin worth over $212 million.

➡️Bitmain's China subsidiary began shipping electronic components to its Delaware-based affiliate in June 2025, with 187,000 kilograms of electronic parts sent to the U.S., to comply with President Trump's tariff policies.

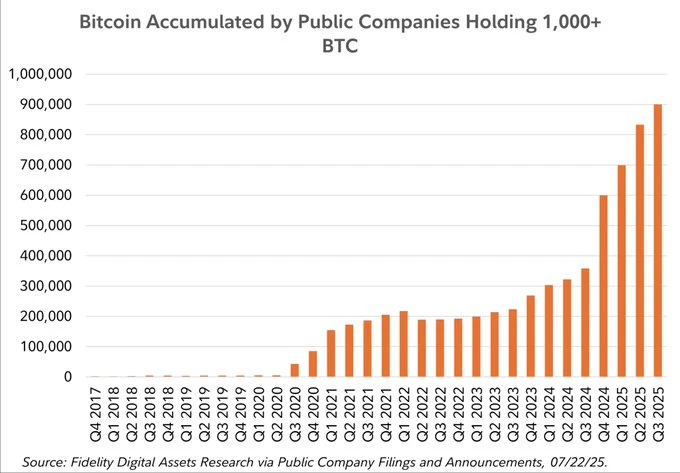

➡️Bitcoin Archive: "Public companies now hold nearly 900,000 Bitcoin, up 35% in just one quarter. Corporate Bitcoin adoption is here."

➡️The Bitcoin network performs about sixty-seven times more computations per second than there are grains of sand on Earth.

➡️Global Bitcoin Mining Hashrate Nearing Highs 915,000,000,000,000,000,000x per second.

➡️Bitcoin just absorbed billions upon billions worth of sell pressure, and we’re still up 10% on the month.

On the 26th of July:

➡️Galaxy confirms someone sold $9 billion worth of Bitcoin after buying it 14 years ago. Bitcoin absorbed that selling pressure like it was nothing.

~70k BTC got MARKET SOLD on an exchange (not OTC!), and Bitcoin only dropped $7k-$8k? 5 years ago, a sell-off like this would’ve nuked Bitcoin. Bitcoin is an extremely liquid market. This is the most bullish thing to happen in 2025. Insane fucking bullish.

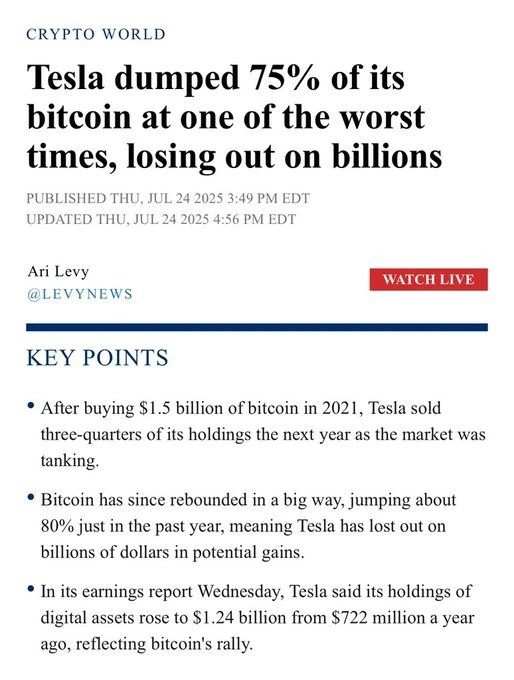

➡️ Tesla ufff:

➡️Only 5.25% of all the Bitcoin that will ever exist are left to be mined! Supply is vanishing... Tick tock.

➡️98 companies have raised $43 billion since June to buy Bitcoin and crypto. More than double all U.S. IPOs in 2025.

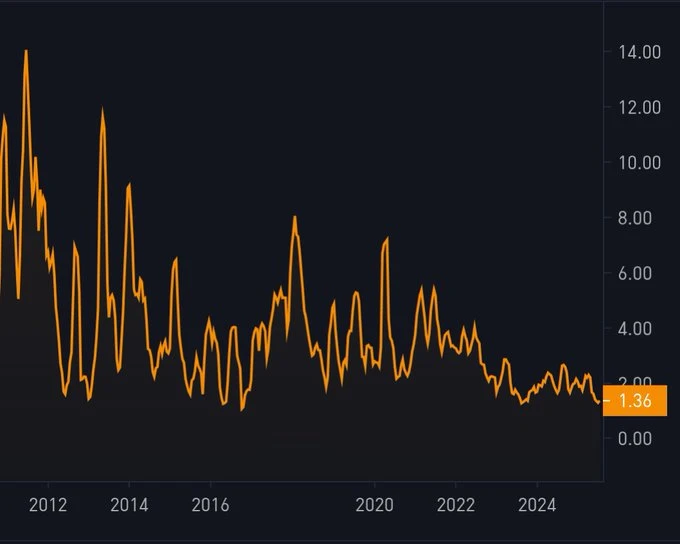

➡️Bitcoin volatility argument is slowly becoming a thing of the past.

On the 27th of July:

➡️ New Record Bitcoin Hashrate 921,000,000,000,000,000,000x per second.

On the 28th of July:

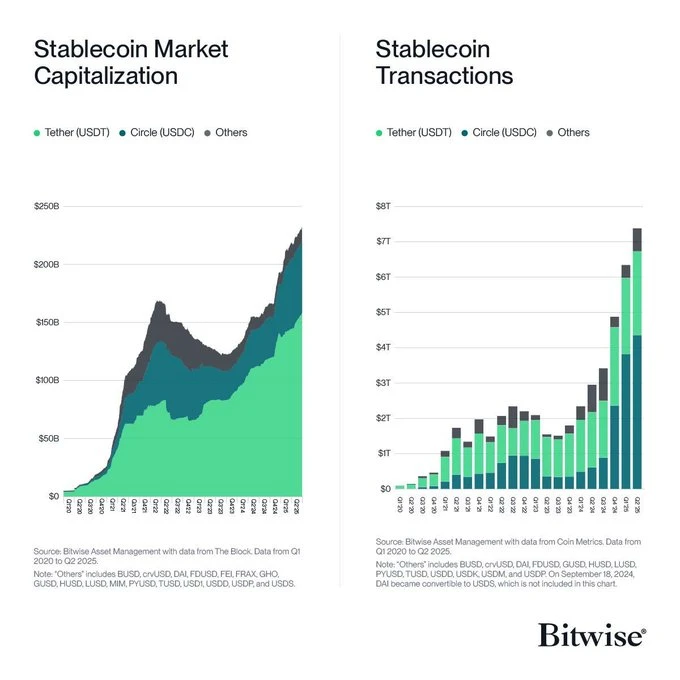

➡️ECB: From hype to hazard: what stablecoins mean for Europe "Stablecoins are reshaping global finance, with the US dollar at the helm. Without a strategic response, European monetary sovereignty and financial stability could erode. However, in this disruption, there is also an opportunity for the euro to emerge stronger."

Source: www.ecb.europa.eu/press/blog/date/2025/html/ecb.blog20250728~e6cb3cf8b5.en.html

Nope, this ain't a parody account. Financial stability...

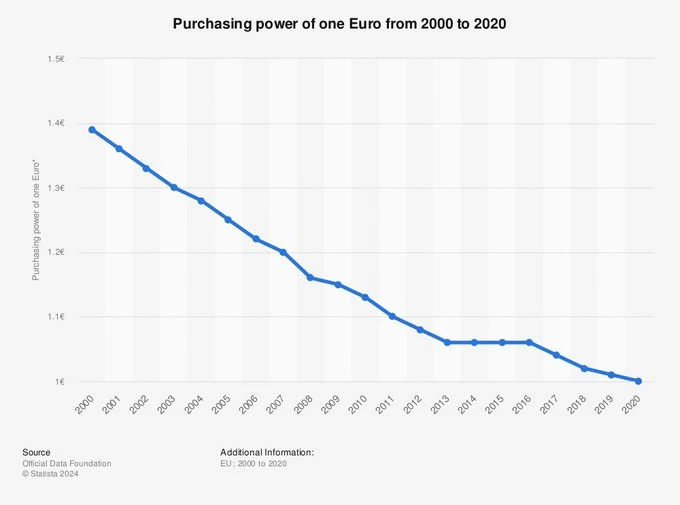

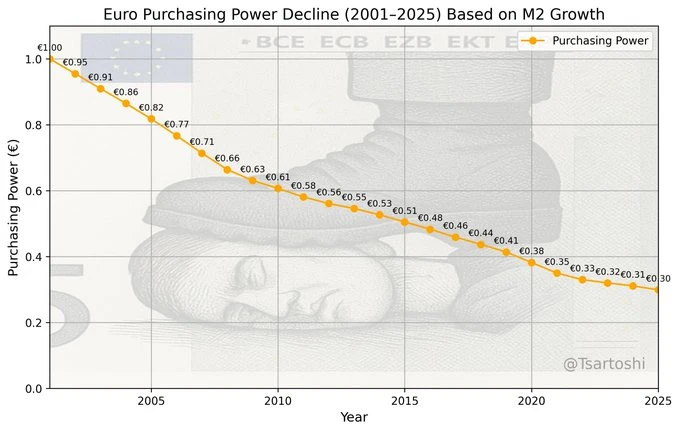

We have seen these strategic responses, and they brought some real stability!

And oh, by the way, is this emerging strong Euro in the room with us now?

ECB being the ECB: “We want to compete in DLT tech by making it more centralized…” "Stable coins, aka CBDCs.. digital control over your finances … programmable". Remember what they said in 2017, the same fucking dumbhead (authors). 'All cryptocurrencies are pointless and just used for money laundering.' 'Rat poison.'

Eli5 of TLDR: I'll summarize what Europe is crying over:

-> Dollar stables already make up about 99% (!!!!!) of the $250 billion global stablecoin market, while euro-pegged stables are a total of under €350 million

-> The new U.S. “GENIUS Act,” signed on 18 July 2025, makes playing around with stables way easier and smoother than the recent EU’s MiCA rulebook. It's obvious that companies will prefer to start their startups where they are less likely to get hit by regulations.

-> Monthly on-chain transactions with stablecoins have already hit $1.39 trillion, and it's still rising. If most of that volume stays dollar-denominated, Europe risks "outsourcing" payment flows to U.S. platforms."

Bitcoin and stablecoins threatening European sovereignty? How dare we create tools that give people BACK THE CONTROL OF THEIR MONEY? Remind us again how constantly devaluing fiat currency gives us financial stability?

EUROPE NGMI!

The ECB frames stablecoins as a threat to “sovereignty,” but what they really fear is losing monopoly control. People are choosing dollar-backed Stablecoins & Bitcoin because trust in fiat is eroding.

Now I hear you ask why USD-denominated stablecoins? The U.S. gained momentum with stablecoins for three main reasons:

- There is a lot of USD liquidity

- USD is in high demand

- Europe's negative rates make stablecoin business models nearly impossible

The future isn’t centralised, it’s decentralised.

Apparently, we need more regulations to save the European continent from freedom, competitiveness, and prosperity.

Over the past decade, the euro has lost 99.75% of its value against Bitcoin. The final chapter may be near as the euro drifts toward irrelevance.

Got Bitcoin?

➡️ Bitwise says “stablecoins are going parabolic.” That means billions in new liquidity are entering the system. And it’s heading straight for Bitcoin.

➡️Active supply has increased by nearly 900,000 BTC, while estimated lost coins have decreased by over 500,000 since the early 2024 approval of spot Bitcoin ETFs.

➡️'PayPal to allow merchants to accept crypto payments.' This would have been a 10% candle 4 years ago.

➡️Bakkt Holdings Inc. announces it will raise money to purchase Bitcoin. They previously had updated their investment policy to buy up to $1 billion in Bitcoin.

➡️Investors seeking to maximize their return-to-risk ratio should consider allocating up to 15% of their portfolio to Bitcoin, per Ray Dalio.

When Bitcoin was 10K, he said Bitcoin was so good that the government would ban it. Now at 100K, he says buy it. There's a lesson there.

💸Traditional Finance / Macro:

👉🏽No news

🏦Banks:

On the 22nd of July: 👉🏽Australia's richest and biggest bank is accused of replacing Australian workers with an Indian workforce, increasing its Indian staff from 2,854 in 2022 to 5,630 in 2024, while firing 2,581 native Australians during the same period.

Source: www.disclose.tv/id/2ajx38isvo

🌎Macro/Geopolitics:

On the 21st of July:

Trump releases 230,000 pages of documents on MLK's assassination, per U.S. Director of National Intelligence Tulsi Gabbard. Great, now let's see the Epstein Files.

On the 22nd of July:

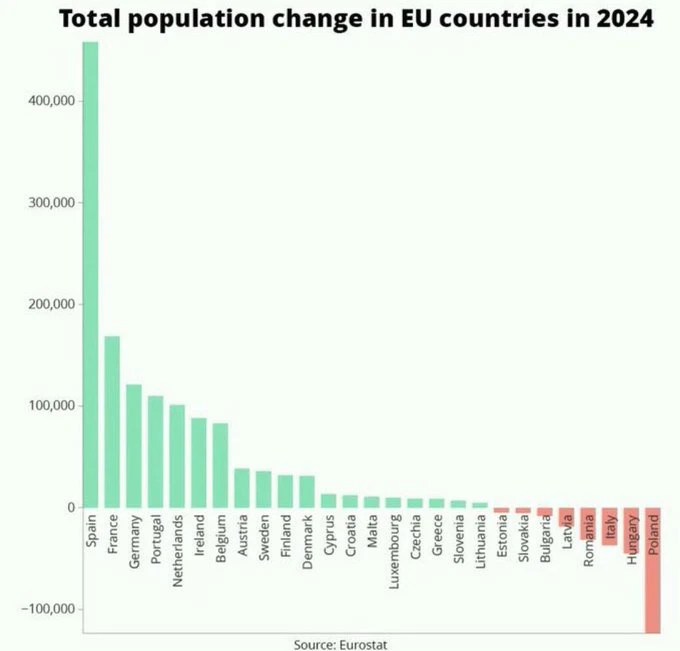

👉🏽Michael A. Arouet: "Spain has the highest youth unemployment rate in Europe, making it really tough for young people to start families. Can someone please explain the logic of Spain taking the most immigrants in Europe last year?"

👉🏽'Rate cuts are coming: Prediction markets now see a 40% chance of 2 interest rate cuts in 2025, for a total of 50 bps. Furthermore, there is even a 13% chance of 3 interest rate cuts this year, per Kalshi. The base case currently shows rate cuts beginning in September. Next week's Fed meeting will pave the path for a September rate cut.' - TKL

👉🏽Last week, I mentioned that Poland discovered the largest oil and gas field in its history near the German border.

Imagine if we turned the tap back on.

Imagine if we had never closed it in the first place.

Imagine if the Netherlands had set up a sovereign wealth fund with the gas revenues for future generations, just like Norway did.

Imagine if we spent the revenues on the Netherlands itself.

Without cheap energy, there is no prosperity.

It’s as simple as that. Just a matter of time.

There is still a total of approximately 550–600 Gm³ of gas in Groningen and the North Sea. At a market value of roughly €0.35 per cubic meter, that amounts to around €200 billion.

👉🏽Argentina Achieves Largest Energy Surplus in Over Three Decades. Argentina’s Economy Grows 5% in May, Marking 7th Straight Monthly Gain. On top of that, extreme poverty in Argentina has dropped another 18% during the past year, to a new low of 7.4%. Real wage growth is now outpacing inflation.

Don't believe me? Latest INDEC data shows extreme poverty fell to 8.2% by late 2024, with projections for further drops to ~7.4% in 2025 amid 5.5% GDP growth. Real wages are improving as inflation drops to 30-40% annually, outpacing it per OECD and BBVA reports. Milei's reforms are yielding results.

Argentina’s economy is growing faster than that of the United States. Argentina cuts Debt-to-GDP ratio by over 50% in only 19 Months under Milei.

Javier Milei is proving that free-market capitalism over crony capitalism & that free trade is the best path forward. Argentina is the only G20 country with a fiscal surplus.

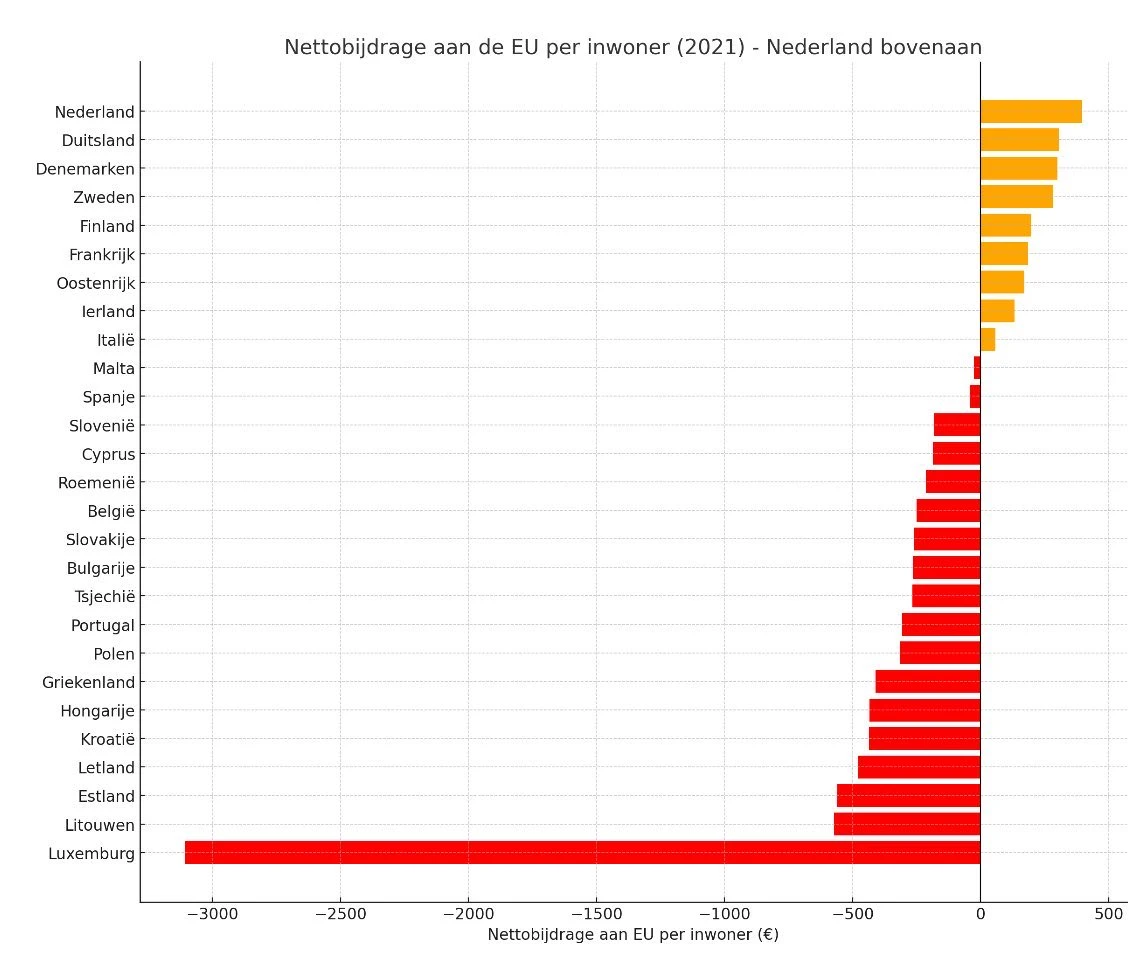

👉🏽Since the mid-1990s, the Netherlands has been the largest net contributor to the EU. That means for 30 years straight, the Netherlands has paid more into the EU each year than it receives back.

In 30 years, we have net contributed €180 billion to the EU.

The Dutch Court of Audit tracks how much the Netherlands contributes to the #EU and how much it receives in return. In 2023, the Netherlands received approximately €3 billion from the EU, but contributed €9 billion to the EU.

In return, we have to work the longest hours in the entire EU, and we have less and less say in our own country.

The last ten years in the EU according to this calculation:

📊 €850 billion paid

📥 €240 billion received

📉 Net loss: €610 billion

And the result according to this criticism:

⚡ Energy unaffordable

🏘️ Housing crisis

🌍 Immigration problems

👵 Elderly in poverty

💰 Pensions under pressure

🏭 Companies leaving

🍞 Food prices rising

🛑 Freedoms reduced

The appeal? 0.00.

Just to make it worse, I want to connect the above with the following:

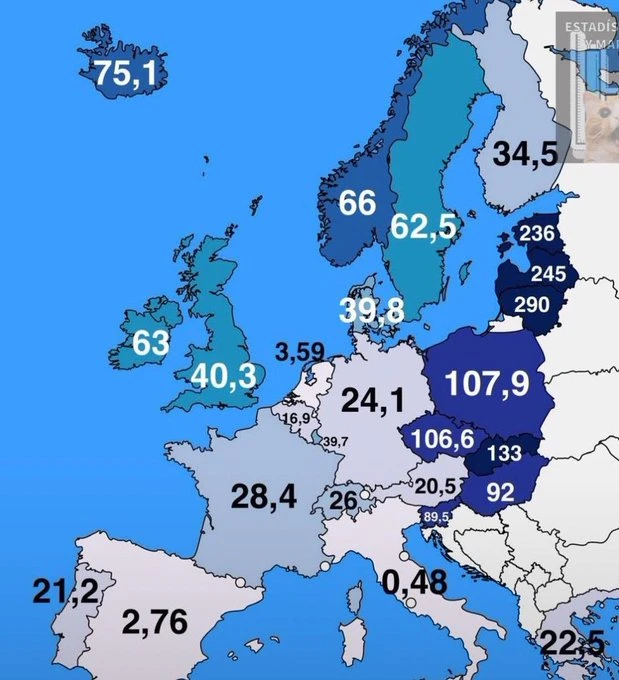

'Eye-opening, change in real wages between 1994 and 2024 in %. Just look at Italy and Spain, three lost decades. What were politicians smoking when they introduced the Euro there? - Michael A. Arouet

Source: ine.es

Maarten van den Berg:

Italy: just 0.48%

Spain: 2.76%

Net contributor Netherlands: only 3.59%

The euro is the greatest destroyer of wealth in modern Europe. And the Netherlands is the foolish pushover—“Malle Pietje”—of the eurozone.'

I was shocked about my country, the Netherlands.

Grok: "Yes, the numbers are accurate according to OECD data:

Italy: +0.48%,

Spain: +2.76%,

Netherlands: +3.59% real wage growth since 1994.

Non-euro countries like the UK (+40.3%), Sweden (+62.5%), and Norway (+66%) have performed significantly better, often thanks to greater monetary flexibility and stronger productivity growth.

The euro does indeed appear to act as a brake on prosperity in southern European countries."

It would mean that the wages didn't increase much over the years. Whilst costs rose exponentially. Now read the above again! Got Bitcoin?

👉🏽Santiago Capital: 'In today's edition of charts, you won't find in a Newsletter: Monetary Base (M0) Growth over last 25 years:

Brazil = 1,500%

Russia = 3,600%

India = 1,300%

China = 1,000%

For reference, US M0 growth = 800%...

EU = 900% '

Great comparison, why? This is an M0 to M0 comparison; it can't be any fairer than this, as this is the only thing Govs can control. Anyway, got Bitcoin, why? Can you name a single fiat currency that doesn't hyperinflate away?

👉🏽College tuition is up 700% since the 1980s. Overall, CPI is up 199%. Means that the value of college tuition is now way higher, right?

👉🏽Burkina Faso President Ibrahim Traoré has announced a bold plan to unite the African continent under one system. He said he wants to create the United States of Africa, where all African countries will come together as one. In his plan, there will be one government system, one currency, Afro Money, and one African passport. All Africans will be able to travel freely without visas. He also said the wealth of Africa should be shared equally among all countries, so no one is left behind.

Oh lord, I have heard this before and know the outcome. How long till they find weapons of mass destruction, or need to overthrow a tyrannical leader?

On the 23rd of July:

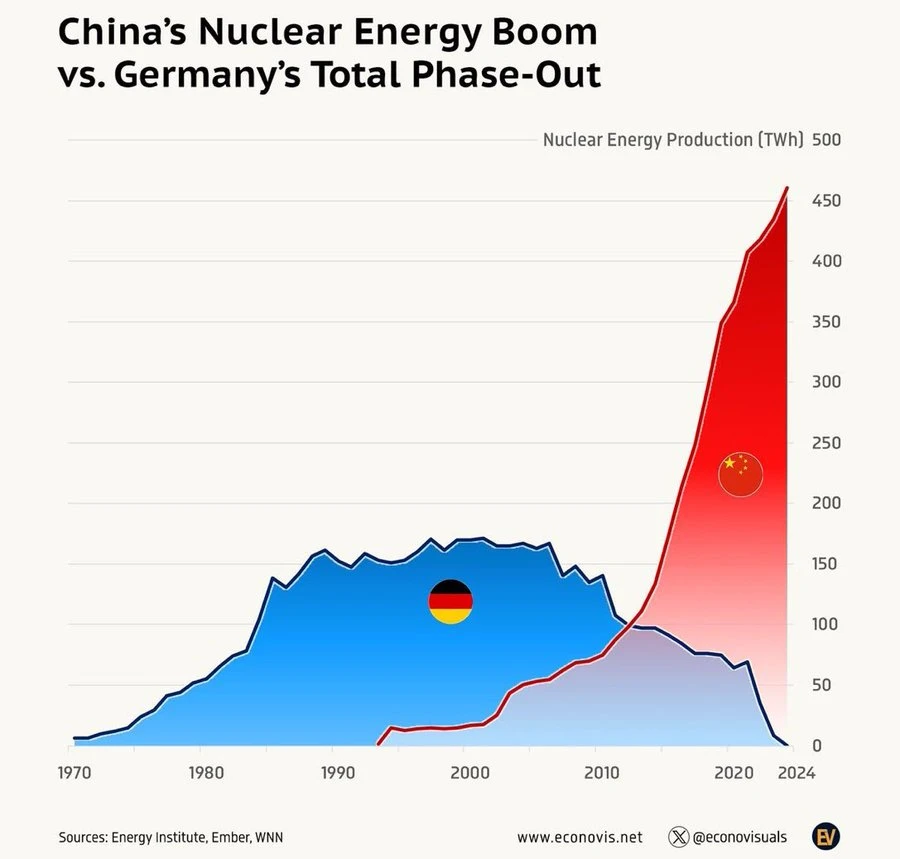

👉🏽'This chart makes me laugh each time I see it. Can you name a decision that caused more economic, geopolitical, and environmental damage than Germany‘s ideological decision to close its perfectly fine nuclear power plants?' - Michael A. Arouet

On the 24th of July:

👉🏽TKL: 'The US M2 money supply surged +4.5% YoY in June to a record $22.02 trillion. This marks the 20th consecutive monthly increase and the largest increase since July 2022. The surge brings M2 closer to the 2000–2025 average annual growth rate of 6.3%. Additionally, inflation-adjusted M2 rose by +1.8% YoY last month. For perspective, US M2 Money Supply was ~$8.46 trillion, or 62% lower, at the end of the 2008 Financial Crisis. The US Dollar's purchasing power is in a perpetual bear market.'

On the 25th of July:

👉🏽Rob Moore: 'ANOTHER Billionaire has QUIT the U.K.

That’s THREE of the top 10 richest people in the U.K., now GONE All in the last year. Labour. Wake up. What are you doing?! John Fredriksen, the latest to quit the U.K., says ‘Britain has gone to Hell’ He’s selling his London mansion & leaving like many of the millionaires & billionaires Another top ten richest in the U.K., James Dyson, has criticised Labour for stifling growth & Entrepreneurship Because the rich pay most of the tax, this just means everyone else’s tax will go up Starting at the Oct budget Please enlighten me, how is the U.K. going to have ANY growth with this madness?'

Soaking the rich doesn't work because they are wealthy enough to move...Socialism won't work.

The best thing about socialism is that capitalists leave and spread capitalism everywhere.

👉🏽The Tea app just had a major data breach, millions of selfies and driver’s licenses were leaked by a mysterious hacker. Tea is a women-only app where nearly 2M users anonymously share info and expose men. It’s currently the #1 app. The driver's licenses leaked today from the tea app have been uploaded to a searchable map.... This may be the worst PII leak I've ever seen.

So a bunch of girls signed up to talk shit about boys, and now their data is leaked- am I understanding this correctly? Yikes

👉🏽James Lavish: "Good morning. There's a dispute as to whether the Fed building renovations are costing a total of $2.7 billion or $3.1 billion. But hey, what's a mere $400 million discrepancy for an agency with 21,000 employees and annual operating expenses of $9.9 billion? Have a great day."

👉🏽Hello V for Vendetta:

UK Home Office to assemble an elite team of police officers to monitor social media for "anti-migrant sentiment" in a new investigations unit to "flag early signs of potential civil unrest" — Telegraph

The UK's Online Safety Act isn't just a 'sting'—it's a full-blown assault on free speech. With over 173,000 signatures demanding its repeal, it's clear Brits see through the 'safety' facade.

Mario Nawfal:

"Under Section 79, if you knowingly say something false online that causes 'non-trivial psychological harm,' you can be criminally prosecuted. Not fined. Not deplatformed. Prosecuted.

The state now decides what qualifies as “harm.” And whether you “meant it.” Intent is the courtroom battleground of every bad authoritarian law because it’s impossible to prove, and easy to abuse.

The act also demands that platforms monitor private messages, turning WhatsApp and Signal into snitchware.

It claims to fight abuse. But its language is so vague, so broad, and so subjective that it could just as easily be used to silence journalists, whistleblowers, and political dissent.

This isn’t online safety. It’s offline tyranny - ported to the cloud."

On the 27th of July:

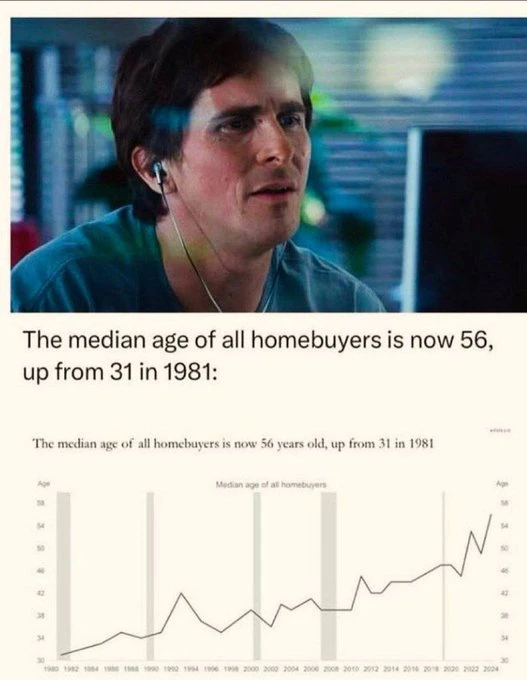

👉🏽The median age of all homebuyers:

👉🏽EU and US agree trade deal, with 15% tariffs for European exports to America The United States and European Union have agreed on a trade deal, ending a months-long standoff between two of the world's biggest economic partners. After make-or-break negotiations between President Donald Trump and European Commission President Ursula von der Leyen in Scotland, the pair agreed to a US tariff on all EU goods of 15%.

Arnoud Bertrand is spot on:

"The "deal" is: - The EU now gets charged 15% tariffs on its exports to the US when they commit to charging zero tariffs on US imports in the EU - The EU agrees to invest $600 billion in the US, for no other obvious reason than pleasing "daddy" - The EU will "purchase hundreds of billions of dollars of American military equipment" - The EU commits to buying 750 billion dollars worth of very expensive US LNG, specifically $250 billion for each of the next 3 years In exchange for all these concessions and extraction of their wealth they get... nothing. I'm not even exaggerating, that IS the deal: the EU gets nothing. This does not even remotely resemble the type of agreements made by two equal sovereign powers. It rather looks like the type of unequal treaties that colonial powers used to impose in the 19th century - except this time, Europe is on the receiving end. More worryingly, this sets a dynamic and a precedent: what do you think happens next from here? In the 19th century, were colonial powers content with their first unequal treaty? Of course not - one of the key rules of geopolitics is that weakness only encourages further exploitation. Again, this is Europe's century of humiliation."

In the EU, foreign trade is an EU-level competence, which makes sense; without it, a customs union and a free internal market wouldn’t be possible.

But when Ursula von der Leyen agrees that EU member states will buy hundreds of billions worth of goods from the U.S., that goes far beyond any democratic mandate because it directly affects national economic and fiscal policy! The European Commission is overstepping its bounds here.

And let’s be honest: striking a “deal” where you only make concessions… Maybe it's time we stop talking about the EU as a geopolitical power.

Lina Seiche: "It’s because the EU has no political leverage. It has outsourced its energy needs, neglected its defense, sabotaged its industry, regulated away any innovation, and generally failed to become an indispensable geopolitical player. In short, the EU needs the U.S. more than vice versa. Unfortunately, being the world champion in moralizing doesn’t buy you a seat at the table, and so the EU has become, for all intents and purposes, politically irrelevant."

Who is going to foot the bill for this “deal”? $750 billion for American LNG, $650 billion in direct investments in the U.S., and then weapons on top of that.

I doubt this was included in the exorbitant €2 trillion EU budget presented by Von der Leyen a few weeks ago. And even then, it was already unclear where all that money was supposed to go — and more importantly, who was supposed to pay for it. To me, it’s still completely unclear who’s going to cough up these billions. So now there is an agreement to transfer hundreds of billions of euros of capital from Europe to America. But from where? The committee has no capital. On whose behalf did you, Von der Leyen, give consent? Is the German Chancellor going to take this money there? Or the French President? Or the Dutch Prime Minister?

Ursula Von Der Leyen: "LNG from the US is more affordable and better than pipeline gas from right next door." Europe is destroyed..Really!

Anyone with common sense knows that gas from your neighbor — delivered through a pipeline built specifically for that purpose — is by definition MUCH cheaper...

So let's fact-check something. Now I am not including the closed gasfield in the Netherlands or the newly discovered gasfield in Poland. This has all to do with the fact that the EU is still importing Russian gas to Europe.

"Factscheck:

- Russian gas - $0.25/m³ (~€0.22/m³) on long-term contract. Sometimes cheaper.

- EU paid for U.S. LNG (Q1 2025) - Delivered cost € 1.08/m³ (~$1.20/m³) U.S.

So, US LNG delivered to EU markets is currently around 4‑5 times more expensive per m³ than Russian pipeline gas was in 2018.

This huge gap reflects added liquefaction, shipping, and regasification costs, and likely reflects broader market dynamics and pricing arrangements (Henry Hub indexation plus fees).

Bad for the climate (Ask yourself how do we import that U.S. LNG and kill EU industry...."

First, Europe gets plastered with hideous wind turbines and shuts down its own gas fields — only to then spend €750 billion buying energy from the U.S., shipped over on polluting vessels… Makes perfect sense, right?

Is it clear to you?

Anyway, got Bitcoin?

Hours, only hours after pledging landmark trade talks, the EU had admitted it doesn't have the power to deliver on a promise to invest $ 600 billion in the United States economy. HAHA!

www.politico.eu/article/eus-600bn-us-investment-will-come-exclusively-from-private-sector

👉🏽Michael A. Arouet:

"I would really like to say something positive about Europe‘s future, but it’s really tough. Bureaucracy, overregulation, and a left mindset there simply throttle innovation and entrepreneurialism. Europe is on a path to becoming an open-air museum. Prove me wrong."

👉🏽The US Treasury will borrow $1.6 trillion in the second half of 2025. $1.007T in Q3. $590B in Q4. That’s nearly $18 billion per day in new debt.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Why This Bitcoin Bull Market Is Different | Checkmate Checkmate breaks down Bitcoin's market structure, why treasury companies are flooding in, and whether the four-year cycle has finally broken.

They get into how institutional money is reshaping on-chain dynamics, why long-term holders are behaving differently this cycle, and what the recent 80,000 BTC move signals about dormant supply.

Checkmate also explains the risks and opportunities of corporate treasury plays, premium-to-NAV dynamics, and how the rest of this bull market could play out.

In this episode: Treasury company dynamics Why Bitcoin’s drawdowns are structurally different this cycle The rise of institutional-sized transactions and empty mempools What the 80,000 BTC sale tells us about long-dormant coins The quantum debate

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃