🧠Quote(s) of the week:

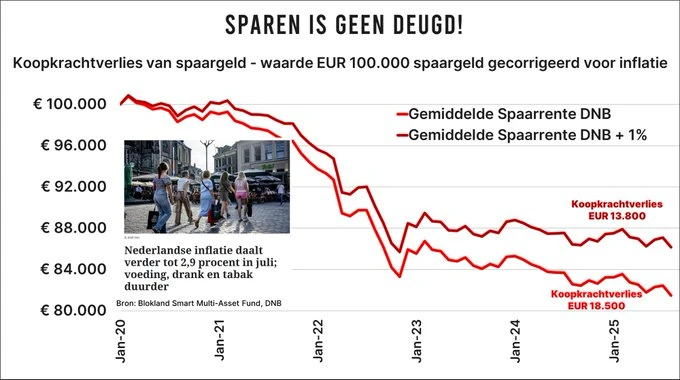

Jeroen Blokland:

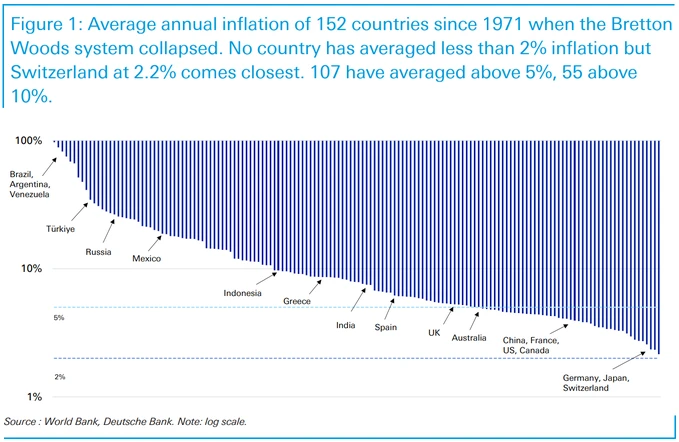

"Although I appreciate De Telegraaf’s headline, 'Dutch inflation continues to fall', I see inflation a little differently. Here are the facts: At 2.9%, inflation was still too high in July. In the last four years (48 months), Dutch inflation has been above 2% a total of 44 times (!). The average inflation rate over the past four years—brace yourself—was 5.2%. Every €100,000 in savings (we have a total of €600 billion in savings) has lost €18,000 in purchasing power since 2020 at a ‘normal’ interest rate. With that money, and the (low) interest you’ve received, you can now buy 18% fewer groceries and other goods. Current savings rates at the major banks range roughly from 1.0% to 1.5%. Every single day that prices rise faster than your interest rate, the purchasing power of your savings decreases. These are facts, hard numbers, reality. Of course, you can argue whether the reported inflation figures are accurate (chances are they’re not) or point out that you can get an extra percent of interest at underperforming Klarna (the chart shows you’d still lose 14% of your purchasing power), but I think this post speaks for itself. In a world full of debt, artificially low interest rates, high inflation, and infinite money creation, look for investments that do yield returns in today’s financial system. Have a great day!"

Got Bitcoin?

🧡Bitcoin news🧡

Study Bitcoin:

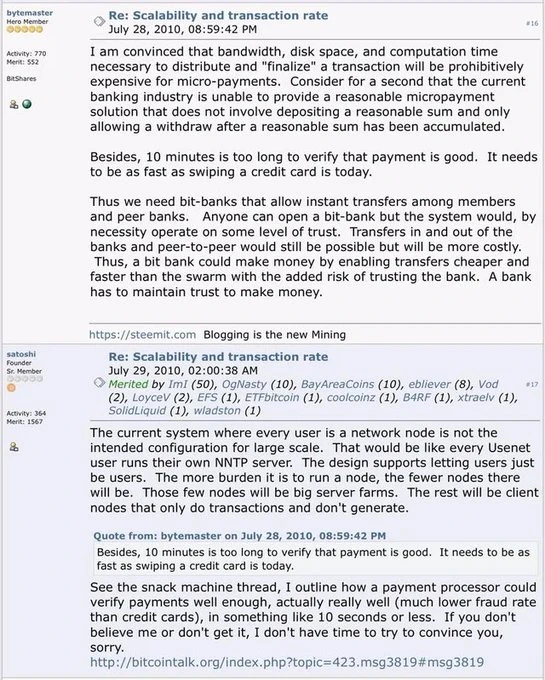

On the 28th of July:

➡️80,000 BTC is roughly the number of BTC dumped by the LFG during the $LUNA ponzi collapse in 2022 that sent us plunging into a bear market. Now it gets absorbed like (Snyder/Cavill) Superman taking a bullet. It should tell you where we are now vs where we were then.

➡️Grok 4 Heavy, the most advanced AI model in the world, predicts Bitcoin to hit $400,000 in 97 days.

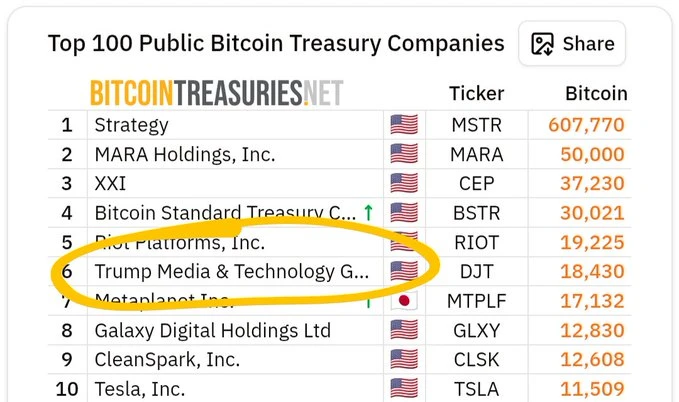

➡️Vijah Boyapati: "We went from the entire state apparatus being adversarial to Bitcoin to the 6th largest Treasury company being owned by the President's family. Not priced in."

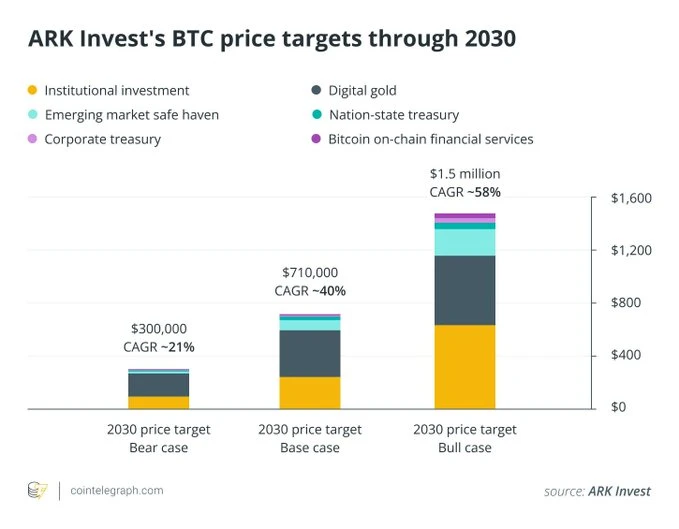

➡️Cathie Wood's Ark Invest predicts $1.5 million Bitcoin by 2030.

➡️Documenting Bitcoin: "Fifteen years ago today, the mysterious creator of Bitcoin, Satoshi Nakamoto, posted their most famous quote: ‘If you don't believe me or don't get it, I don't have time to try to convince you, sorry.’ At the time, you could buy a bitcoin for 6 cents."

On the 29th of July:

➡️Strategy has acquired 21,021 BTC for ~$2.46 billion at ~$117,256 per bitcoin and has achieved BTC Yield of 25.0% YTD 2025. As of 7/29/2025, we hold 628,791 Bitcoin acquired for ~$46.08 billion at ~$73,277 per Bitcoin.

On the 30th of July:

➡️America’s largest public bitcoin mining company, MARA, reports record-breaking quarter with revenue increasing 64% year-over-year to $238 million.

➡️In 2023, JPMorgan Chase CEO Jamie Dimon said he's "deeply opposed" to Bitcoin and it's for criminals. Today, JPMorgan partnered with Coinbase "to accelerate crypto adoption."

On the 31st of July:

➡️Trump’s Digital Asset Director says, "We understand the importance of this Strategic Bitcoin Reserve." "We do believe in accumulation."

➡️Here we go again, the IMF Bitcoin fud: Bitcoin consumes as much electricity as Argentina, but isn't counted in GDP because it doesn't create traditional goods or services. The updated System of National Accounts classifies crypto assets as national wealth for better economic measurement. Source: t.co/aEn9t98Snu

Let's break that statement down, shall we?

'That's 0.07% of global energy use (comparable to many other random industries, and often using otherwise wasted/stranded energy). Its service is that it gives people an alternative for when the IMF comes and makes a deal with your country's government to devalue your currency.' - Lyn Alden

Great reply by Daniel Batten with sources + context:

"Misleading statistic because much of Bitcoin's energy usage is often from stranded, wasted sources that others cannot utilize. It has also been shown in 20 peer reviewed papers and 7 independent studies to stabilize and decarbonize grids, mitigate methane and lower electricity prices and is 52.4% sustainably powered (unlike the much lower sustainable power mix of the banking industry, and gold mining - which Bitcoin provides viable and technologically superior alternatives to) source: x.com/DSBatten/status/1923014527651615182

Contrary to the implications of this tweet, Bitcoin has 19 well documented usecases that create value to society.

Source: x.com/DSBatten/status/1833875802326175939 Important context: Bitcoin threatens the IMF with disintermediation in 5 ways, which I have categorized previously here --> x.com/DSBatten/status/1873558000230978046

and the IMF has a reputation for openly opposing Bitcoin, repeatedly citing "concerns" that have consistently failed to materialize. (source: bitcoinmagazine.com/featured/how-the-imf-prevents-global-bitcoin-adoption-and-why-they-do-it) Its perspective on Bitcoin is neither neutral nor objective."

Bitcoin is a highly circular economy asset since it can be used over and over again indefinitely, with very low friction of order 1% in transaction fees. It's a superior monetary technology and asset, superior to SDRs since it is not losing, but gaining in purchasing power, is available to all, and has a highly decentralized triple-entry ledger fully replicated to tens of thousands of nodes. And it is the most efficient tool available in turning energy into a lifeline for those suffering under policies imposed by the IMF. Nothing beats Bitcoin's energy-to-lifeboat ratio.

Anyway, got Bitcoin?

➡️Congress green-lit a $3.4 trillion spending package through the Big Beautiful Bill. What does that mean for Americans? Your dollars are on the path to devaluation. Excellent post (x.com/River/status/1950961213833134278) , and article on where the US dollar is going and why BTC is the most secure long play we have.

river.com/learn/how-does-money-printing-work

➡️El Salvador and Bolivia sign a deal to integrate Bitcoin and crypto into Bolivia’s financial system. Crypto activity in Bolivia surged 6x after lifting its 2024 ban. Now the nation is working with Bukele’s team to build an economy.' - Bitcoin Archive

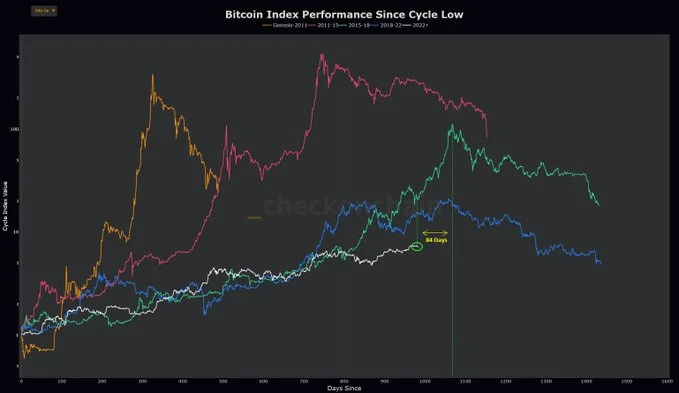

➡️Bitcoin-based Bitcoin’s Acceleration Phase continues with five new ATH closes in July. Momentum from Q2—where 54 of 91 days saw high profit and high volatility—appears intact. We’ll continue to watch closely for signs of a potential blow-off top.'- Fidelity

➡️Algeria bans all Bitcoin and cryptocurrency activities, including trading, ownership, and mining. Violations face 2-12 months in prison and/or fines of 200,000-1,000,000 dinars ($1,500-$7,700).' -Bitcoin News

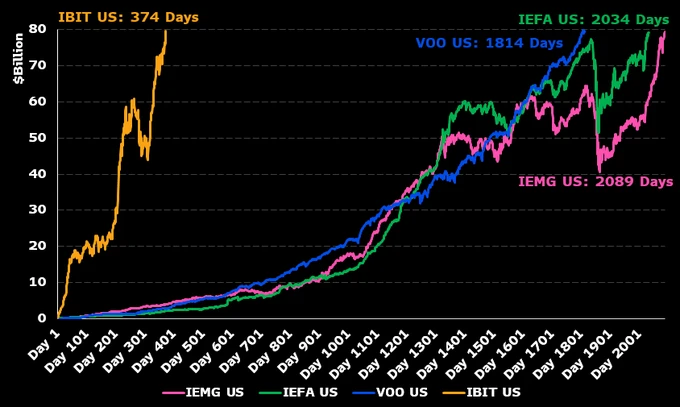

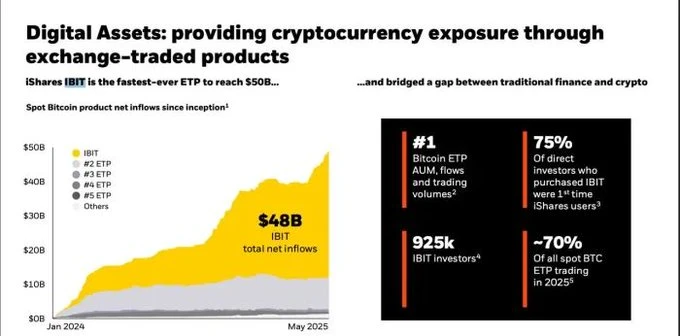

➡️ BlackRock's Bitcoin ETF is the fastest-growing ETF ever. 80B AUM in just over a year. Unheard of. Meanwhile, Vanguard refuses to offer a Bitcoin ETF to its clients. Are they even a real business?

One disclaimer, though. One of the biggest MSTR shareholders -> Vanguard.

➡️Charles Edwards: 'Institutional net buying just breached 97% of all transactions. The last time net buying by the pros was this high was August 2020. Those who know, know.'

Unique alpha indicators are only available at Capriole.com/Charts.

➡️The United States SEC Chairman Paul Atkins today says, “The right to have self-custody of one's private property is a core American value. I believe deeply in the right to use a self-custodial digital wallet to maintain personal crypto assets.”

➡️Bitcoin whales bought 1% of the total supply in the last 4 months. Big money is stacking.

➡️Balaji: By 2035, you will have the Democrats side with the Chinese Communists, and Republicans will become Bitcoin Maximalists after MAGA maximalism. After Orange Man, Orange Coin. Statement is from a great podcast:

➡️The White House Releases New Report Comparing Bitcoin and Crypto to the Railroads and the Internet.

➡️Clean energy provider PowerBank to establish a Bitcoin treasury, partnering with Intellistake for security, custody, and Bitcoin operations.

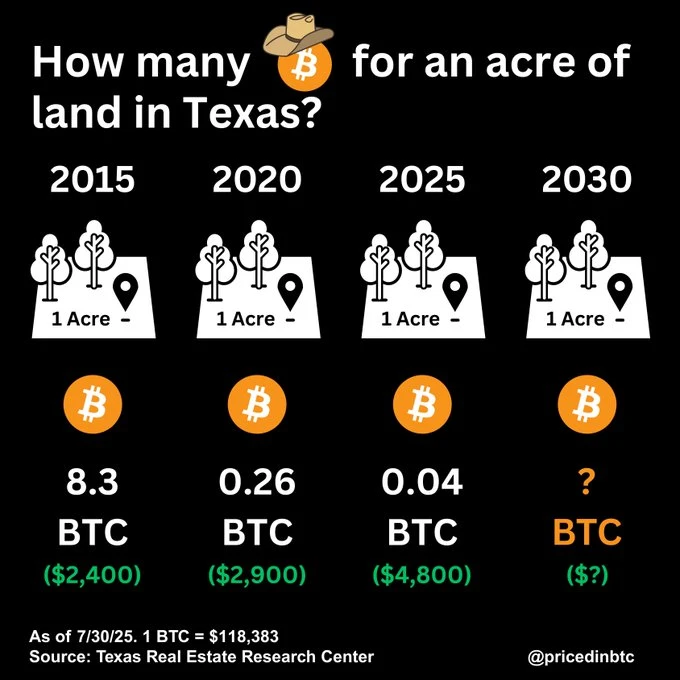

➡️Priced in Bitcoin:

"How many Bitcoins for an acre of Texas land?

2015 → 8.3 BTC ($2,400)

2020 → 0.26 BTC ($2,900)

2025 → 0.04 BTC ($4,800)

Land in fiat: +100%

Land in BTC: –99%

At this rate, by 2030, you’ll get a ranch for a fraction of a coin."

➡️Crypto bank Anchorage Digital just bought $1.2 BILLION Bitcoin.

➡️Michael Saylor's STRATEGY files $4.2B STRC offering, plans to buy more Bitcoin with proceeds.

Proposed IPO of $500 million Upsized to $2.52 billion due to demand Largest perpetual preferred IPO since 2009 Files to sell another $4.2 billion All of this in 11 days, by the way. $30T in short-duration credit has been starving for yield. Bitcoin is fixing it.

On the 1st of August:

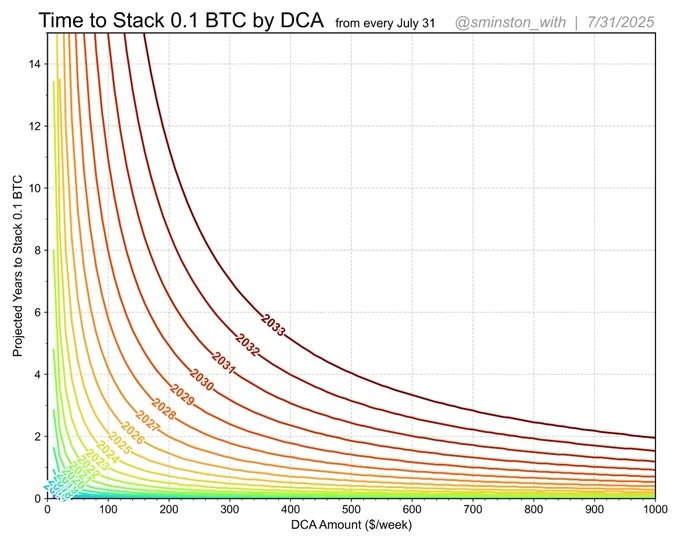

➡️Sminston With: How long will it take you to stack 0.1 BTC if you start with $100/ week now? 2 years.

If you start on July 31, 2030, it will be 11 years.

If you start in 2033, when Bitcoin is $1M, even stacking $1000/ week will take 2 years to stack 0.1.

Something to ponder on. There is no timing the market with ₿, it’s all about time in the market. Buy what you can, when you can, and save in Bitcoin. Simple. Not always easy. Start today, when time is on your side.

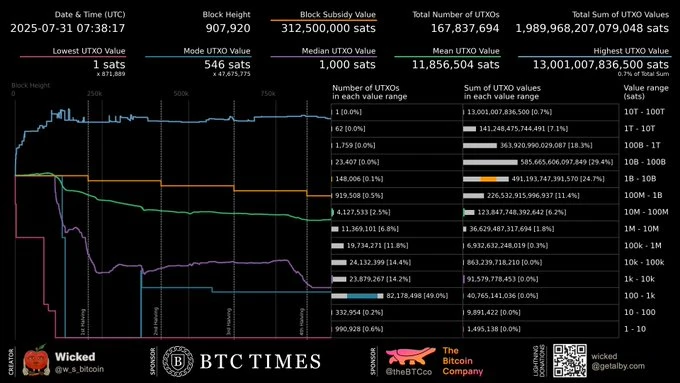

➡️Wicked: The largest Bitcoin UTXO holds over 13 trillion sats (130k+ BTC) and is locked in a P2WSH 3-of-5 multisig with all 5 of its public keys exposed. If you had a quantum computer and wanted to cause the most chaos, this would likely be one of your primary targets.

➡️Charles Edwards: Bitcoin Energy Value just hit a new record of $135K. Never before has price moved so gradually along the undervalued bound as the fair value of Bitcoin grows consistently with time. Two key findings:

- The market is growing conservatively (no hype)

- Bitcoin is unbelievably still undervalued today

➡️Bitcoin achieves its highest monthly close ever at $115K.

➡️'BlackRock Bitcoin ETF hits 1 million investors 75% are new clients. IBIT holds $87B 70% of all spot Bitcoin ETF trading. It seems like Bitcoin is taking over TradFi.' - Bitcoin Archive

➡️Garrit Goggin: 'The last time the Buffett Indicator was this far above trend, the HUI rose 222%, Gold 24%, and the Nasdaq 100 fell 64% over the following 3 years.'

When valuations get this stretched, history doesn’t whisper, it yells. Oh, and this time we have Bitcoin.

➡️OnChainCollege: 'From a cycle timing standpoint, Bitcoin is at a similar point to the 34% correction in 2017 that was just 84 days before the cycle top. From there, the price did a 6x. Short-term noise ≠ long-term trend.'

On the 3rd of August:

➡️China has officially banned cryptocurrency trading, mining, and related services. Again! haha

➡️Bitcoin hard drive worth $950M lost forever. James Howells ends 10-year search. After 12 years, James Howells, the man who accidentally threw away a hard drive with 8000 Bitcoin in 2013 (now worth $950M), has finally ended his search. The hard drive will be worth ~$8B by 2030, mark my words! I know, kinda a bold claim. But why not?

On the 4th of August:

➡️Although this is more something for the segment Macro/Geopolitics, I wanted to share the following tweet by Jeroen Blokand:

"Print this chart and hang it on your wall! Since the collapse of the Bretton Woods gold standard, NO country has managed to keep inflation at 2%. ZERO, NONE! Not Japan, not Switzerland, just nobody. Use this chart to update your knowledge and understanding of central banks and the 'value' of your currency. Enjoy your day!"

But by all means, entrust your savings and pension to (central) bankers. They never lie about inflation or Keynesian sectarian pseudo-scientific topics. Oh well, spend fiat, save Bitcoin. Whilst doing that, study Bitcoin.

💸Traditional Finance / Macro:

On the 31st of July

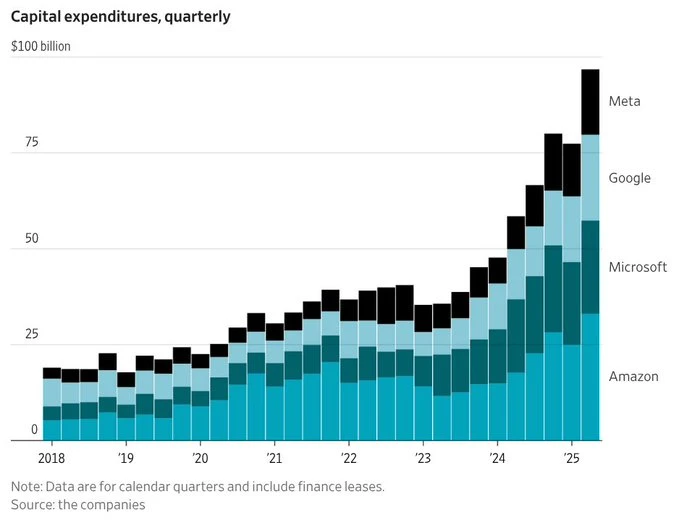

👉🏽Andy Constan: "Eating all the GDP. A bigger share of a massively bigger pie. Hope the pie keeps growing ( it won't grow as fast) and hope the rest of the GDP can keep spending on cloud and AI services while continuing to grow earnings."

👉🏽Nancy Pelosi (Google her if you don't know her!) makes $174,000 dollars a year yet has a net worth of $413 million. Her portfolio did a 78% return in 2024. She’s either insider trading or the greatest investor of our era.

Just to make it even more visual:

Nancy Pelosi outperformed Warren Buffett over the last 10 years. Pelosi’s stock portfolio grew by 720%. Buffett's stock portfolio grew by 185%. Pelosi had almost 4 times the gains. Buffett is known as one of the greatest managers of all time. Politicians having access to non-public information and being allowed to trade stocks is the real crime here.

👉🏽Berkshire Hathaway’s cash position is now 30% of its total assets.

On the 1st of August:

👉🏽Over $1.1 trillion wiped out from the US stock market today.

On the 3rd of August:

👉🏽The AI investor: 'Nvidia - 76-78% of employees are now millionaires, with approximately 50% having a net worth over $25 million. Fun fact: unlike other big tech, Nvidia is not enforcing a strict return-to-office policy and instead embraces a flexible work approach.'

Oh, by the way, the 76-78% figure is from 7 months ago, when the share price was "only" $102.

🏦Banks:

👉🏽UK Banks to withhold payments £800 and above for 24 hours up to four days for a private individual. It will be released after 24 hours, following AI checks. source: archive.ph/Cvyl2

The State wants total control. This will make privately selling a car or something similar impossible. It's already impossible to withdraw money from your own bank account if you don't give a good enough reason.

They can funnel billions and billions with zero accountability or oversight, but it's YOU sending over £800 that's the problem. For your own safety, of course. This isn’t fraud prevention, it’s exit control. That’s not protection, it’s a warning. They’re sealing the doors before the panic starts. Your money. Not your control. Time to rethink who really owns your wealth. This is why we use Bitcoin. Hold Bitcoin. Hold your keys.

🌎Macro/Geopolitics:

On the 27th of July:

👉🏽The median age of all homebuyers:

On the 28th of July

👉🏽Elon Musk is now officially worth $405.6 billion, projected to become the world’s first trillionaire by 2027.

👉🏽Ursi strikes again. EU leader, von der Leyen, announces partnership with Bill Gates to vaccinate 500 million children globally by 2030. Modern 5th Generation Warfare! Vaccinate against what disease, or does it not matter? 500 million. That’s not medicine. That’s a campaign. That’s not healthcare. That’s control. Since when does one unelected billionaire hold the keys to the immune systems of half a billion kids? This isn’t about saving lives.

On the 29th of July:

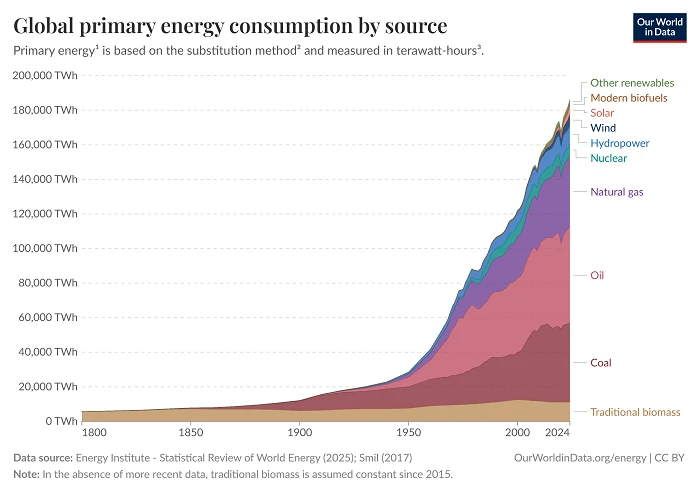

👉🏽After 40 years and almost $5T in investment in alternative energy, look at the chart:

The picture is worth way more than a thousand words. So much climate hypocrisy. The real shame of this chart is that nuclear should be at least 20% by now. But no, we can't have cheap, reliable energy because people were too easily scared by propaganda.

If the developed world had spent the last 40 years investing trillions in the mass construction of nuclear fission power stations instead of renewables, human output of CO² and methane would be far lower today than it is.

The real question we all should ask ourselves is: How much more taxpayer dollars/euros do you really want to spend on the green dream?

On the 31st of July:

👉🏽Argentina just announced that foreigners who make significant investments in the country can now apply for citizenship.

👉🏽Netherlands: Approximately 60% of your gas and electricity bill consists of taxes, just like with gasoline. And you’re paying that with money that has already been taxed. In June, the average electricity price was €0.25 per kWh. The surcharge from excise duties and taxes on the purchase price was 138%. For gas, the markup was even more disproportionate: with an average price of €1.19 per m³, it was 194%!

The money (taxes) has to come from somewhere. Apparently!

Stable energy = cheap energy.

Cheap energy = competitiveness.

Competitiveness = prosperity.

👉🏽UK: Flooding the country with more migrants was the punishment for Brexit.

Most of the recent years' immigration to the UK has come from outside the EU. So it has NOTHING to do with the EU or Brexit, but rather the UK itself deciding to import lots of immigrants from the 3rd world.

Michael A. Arouet: 'Isn’t it ironic that many Brits voted for Brexit because of migration?'

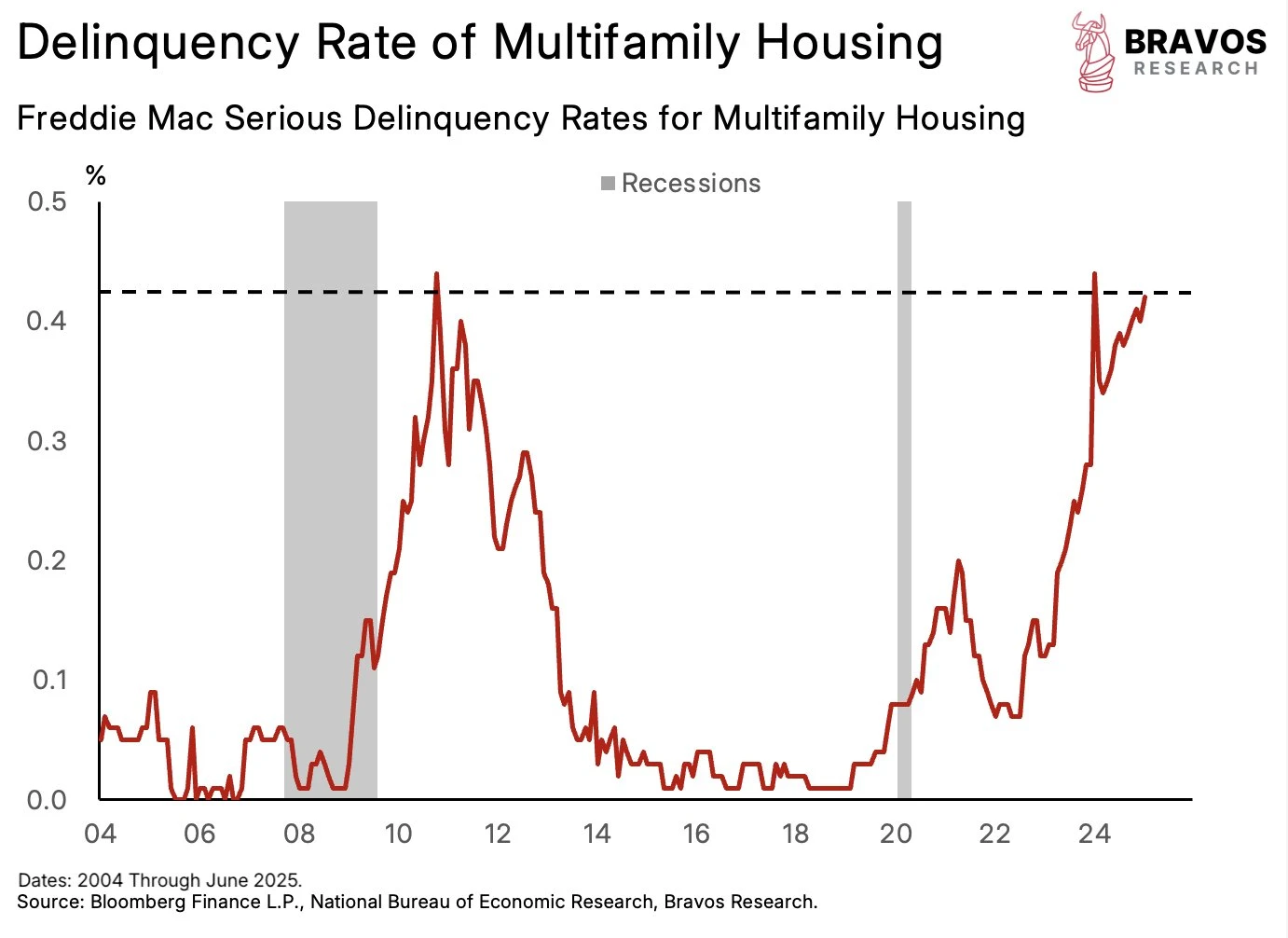

👉🏽US Housing Defaults have just hit the highest level since 2011. It’s high time to load up on Bitcoin.

👉🏽New Zealand reverses ban on oil and gas extraction |

A ban was previously imposed by radical Jacinda Ardern, heroine for progressive “nutters.” Making a country completely dependent on foreign energy, prices skyrocketed.

For the Dutch readers: www.nu.nl/economie/6364224/nieuw-zeeland-maakt-verbod-op-olie-en-gaswinning-ongedaan.html

👉🏽Tether now holds $106b of US treasuries directly, making it a larger creditor to America than G7 countries Germany ($102b) and Italy (under threshold). If it were a country, its direct holdings would make it the 19th-largest foreign holder in the world.

👉🏽Jaguar Land Rover CEO Adrian Mardell to step down after leading 'woke' rebrand and EV transition. Shocking, NOT! Get woke, go broke!

They simultaneously turned off the younger generations while losing the old men who actually drove these. Here is an idea: why not put Sydney Sweeney in a Jaguar? It is just that simple! Sydney on the hood and a V8 under the hood.

Don't believe me...it's just marketing like back in the days.

Numbers NEVER lie.

Here are 2 different campaign results:

American Eagle’s Sydney Sweeney ad:

- AE made $300m in a day

- $65m in free media exposure

Jaguar LGBTQ ad:

- Sales in Europe plunged 97.5% in April

- From 180k sold in 2018 to 27k last year

This has nothing to do with Sweeney (or the message behind the campaign), who is a racist Nazi. It is just marketing, and the buyers have spoken! It looks like the market has its own scoreboard, and it's calling out the plays loud and clear. Woke is dead, ESG is dead, climate cultism is dead.

👉🏽U.S. Treasury just bought back another $2 billion of its own debt.

On the 1st of August:

👉🏽'We must receive some MASSIVE downward jobs revisions. May’s jobs report was revised down by 125,000, from +144,000 to +19,000. June’s jobs report was revised down by 133,000, from +147,000 to +14,000. That’s 258,000 jobs that just vanished from the data in 2 MONTHS.' -TKL

The 3-month average job growth is now just 35K.

Nothing vanished; they were never there to begin with. I have shared numerous times in the last 3years. Data Fraud. That's what's been happening since at least 2021.

Meanwhile, Fed's Bostic: 'Doesn't think jobs data would have changed this week's FOMC decision.

👉🏽El Salvador approves indefinite presidential reelection and extends presidential terms to six years.

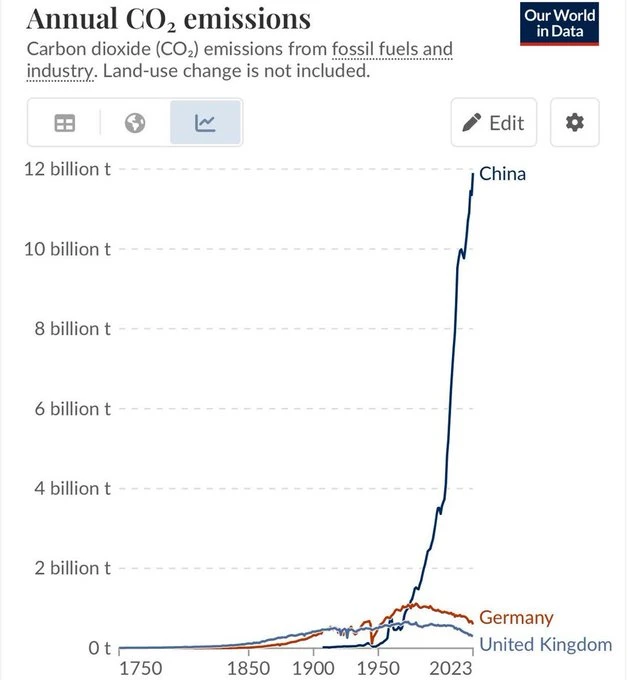

👉🏽'As disappointing as it may sound to all left degrowth enthusiasts, the West is not the problem. They are simply Marxists disguised as environmentalists. Even „climate activists“ throwing tomato soup at Mona Lisa will have a limited impact. Why don’t they go to Asia to protest?'

The EU produces just 6% of global emissions — yet we’re spending trillions to “fix” it.

Outsourcing industry abroad doesn't mean you are saving the planet.

It’s not about nature. It’s about control. A self-righteous class of technocrats dictating how you live, what you drive, what you eat, and how warm your house can be—while flying private jets to climate summits and outsourcing pollution to countries they’ll never visit. Just look at what they did to the Amazon in Brazil for the climate summit. It’s not the environment they’re protecting—it’s their bureaucratic machinery, their political careers, their NGO cronies.

The real emissions come from the institutions themselves: endless reports, fake targets, greenwashing contracts, and climate panic used to justify every new restriction. It’s not about sustainability. It’s about submission. And the only thing that’s getting recycled is the same lie, over and over again. It’s not about the climate. It’s about control. Climate communism!

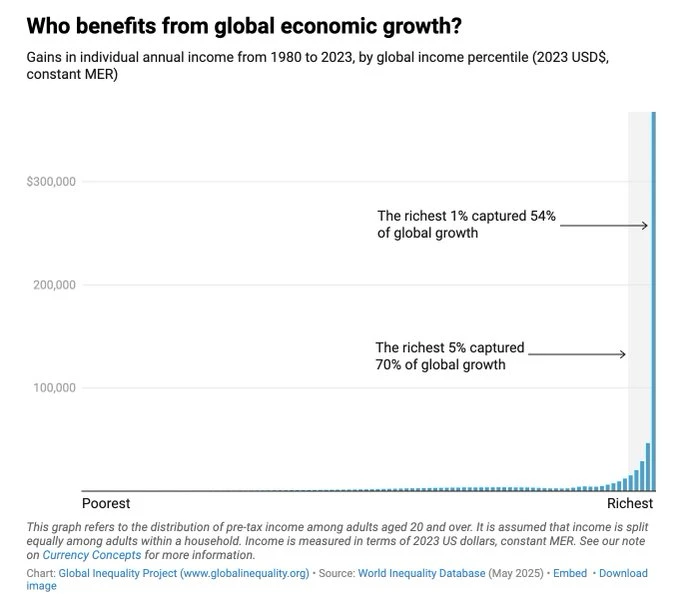

👉🏽Have you heard about the consequences of government spending, money printing, deficits, debt growth, and the financialization of the economy? No? I have news for you, then.

From 1980 to 2023, the richest 1% captured 54% of global growth. Don't tell me global inequality is getting better.

Now, probably you are reading this on your laptop or on your iPhone. You are part of that 1%, as is anyone with a salary of around $45k. How does it feel to be part of a global elite, and when are you going to recognise your greed and give your money to those less fortunate? Bear in mind, though. GDP per capita can be very high, but the people are still very poor, because most of that wealth is owned by the elite few, and they do not spend it building modern world-class infrastructure for the people.

Now, another fun stat: From 1980 to 2023, roughly 1.3 billion people were lifted out of extreme poverty globally (at $2.15/day line), per World Bank estimates. This net reduction, from ~2 billion to ~700 million, was driven mainly by growth in China and India, despite rising inequality.

👉🏽The AI infrastructure build-out is so gigantic that in the past 6 months, it contributed more to the growth of the U.S. economy than /all of consumer spending/ The 'magnificent 7' spent more than $100 billion on data centers and the like in the past three months alone.

We’ve moved from an age where computers were plentiful to an age where it is scarce, and meanwhile, demand continues to rise. The only way forward here is to add capacity. In other words, the economy is in the toilet except for rampant production of the thing that is going to put the banking system in the toilet.

On the 2nd of August.

👉🏽Eye-opening, change in real wages between 1994 and 2024 in %. Just look at Italy and Spain, three lost decades. What were politicians smoking when they introduced the Euro there?

👉🏽This chart tells the story of where we are heading really well.

Now read the above again (on the 1st of August) regarding AI.

On the 3rd of August:

👉🏽Netherlands:

Fortunately, our money is being well spent...

June 24, 2025:

Caretaker Minister of Defence Ruben Brekelmans announces: €500 million for drones in Ukraine.

August 2, 2025:

Ukrainian anti-corruption agencies reveal fraud in drone purchases.

I kid you not! 30% gone due to corruption... For the Dutch €8.4 billion, that would mean €2.52 billion vanished through corruption... Your and my tax money...

Thanks to Ruben Brekelmans and Gijs Tuinman!

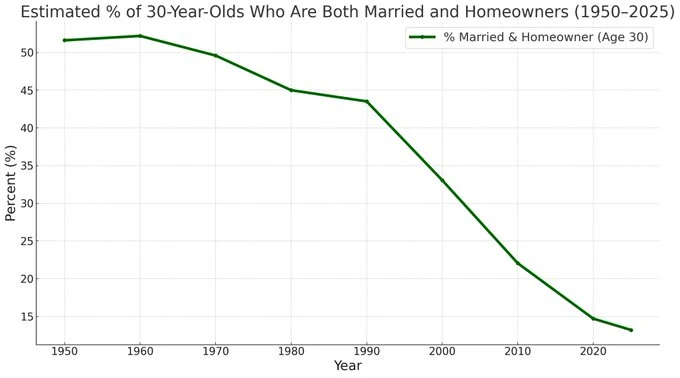

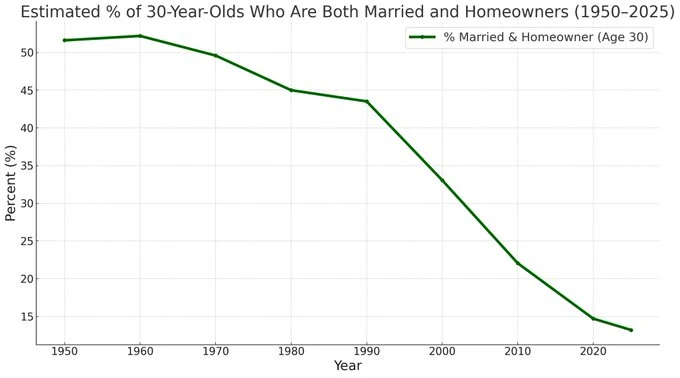

👉🏽Married + home by 30 years old:

1950: 50%

1960: 52%

1970: 48%

1980: 45%

1990: 43%

2000: 35%

2010: 25%

2025: 12%

From the peak in 1960 (which is 52%) to 1990 (which is 43%), we see about a 10% decrease. From 1990, however, to 2025, we see a huge 30% decrease. That's 3x the rate. It's insane. Nothing destroys a civilization like hyperinflation in housing and runaway home prices. Very few people want to start families when they can't afford a home. A few generations down the line, people stop trying to work harder because they know they'll never reach a moving target. They stop believing in capitalism and slowly believe in socialism, or opt out entirely and leave the system or country. The desperate strategy by the Federal Reserve (for boomers, by boomers) to smooth asset prices will create dreaded societal and financial instability in the long run.

Signüll on X: "most ppl don’t realize that there’s no climbing out of this. Once it becomes cultural & baked into the collective psyche, it’s pretty much over. Reversing it would take an act of god or some once-in-a-century black swan. Otherwise, it’s like trying to pull an aircraft out of a flat spin with 900 feet of altitude & no engines left."

"When the ordinary thought of a highly cultivated people begins to regard 'having children' as a question of pros and cons, the great turning-point has come. For Nature knows nothing of pro and con.” —Spengler

On the 4th of August:

👉🏽Eye-opening chart, S&P 490 has had no earnings growth since 2022. Is the economy really strong?

👉🏽Javier Milei has achieved a $64 billion surplus so far this year. Meanwhile, the United States is projected to have a $1.9 trillion deficit for the year 2025.

I am just going to leave this here: How the EU always gets away with it From fraud to nepotism to revolving doors between the public sector and industry, the stench of impunity is pervasive.

If even Politico is saying this, you know how bad it is: www.politico.eu/article/european-union-corruption-pfizergate-ursula-von-der-leyen-impunity

They can do whatever they want and get away with it every time! Throwing away €1.2 trillion every year. (Von der Leyen wants to upgrade that to €2 trillion every year.) Paid for by the European citizens. Corruption goes unpunished.

'Government transparency is not a luxury or a courtesy—it's the foundation of a legitimate democracy; without it, power corrodes, corruption thrives, and the very idea of public trust collapses.' - Rob Roos

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoind Did: The State of Bitcoin Adoption | Troy Cross & Ella Hough

Troy Cross and Ella Hough break down the state of Bitcoin adoption across the U.S. and the globe, revealing what the data really says about Bitcoin’s political alignment, institutional shift, and cultural future.

We get into the surprising statistics around self-custody, what Gen Z actually thinks about Bitcoin, and whether American bitcoiners can become a meaningful political force.

In this episode:

- Who owns Bitcoin

- What Gen-Z think of Bitcoin

- The myth of political consensus around Bitcoin

- Bitcoin as a language of truth across culture, time, and power

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃