🧠Quote(s) of the week:

James Lavish: "If you want to protest anything, protest central bank monetary manipulation that steals purchasing power from you daily. And the way to do that is by buying Bitcoin."

The great promise of Bitcoin—its great and noble ambition—is that, some years from now, it will perhaps have healed the institution of money in our civilization.

🧡Bitcoin news🧡

Photos hosted by Azzamo (azzamo.net)

On the 25th of August:

➡️The Bitcoin Fear and Greed Index is now almost back at "Fear" - Bitcoin Magazine Pro

On the 26th of August:

➡️Semiconductor firm Sequans to raise $200 MILLION to buy Bitcoin for its treasury.

➡️By opening 401ks to alternative investments, the Trump administration just unlocked a $7 trillion market for Bitcoin. "This isn't regulatory capture, it's almost regulatory surrender."

Bitcoin News: "Did you know that new SEC Chair, Paul Atkins, has disclosed owning $6 million in crypto?'

➡️86% of Strategy’s 3,081 BTC purchase this week came from tapping the ATM and selling common MSTR shares.' -Bitcoin News

➡️Bitcoin News: "In its inaugural 'Bitcoin Long-Term Capital Market Assumptions, Bitwise lays out its bull case. Bitwise predicts Bitcoin could hit nearly $3 MILLION by 2035. Base case: $1.3M Bear case: $88K Bull case: $2.97M Too bullish or too bearish?"

➡️As shared last week, but a great reminder: If you hold Bitcoin for 3+ years, your odds of losing money are basically 0%.

On the 27th of August:

➡️A Bitcoin whale sent 750 BTC worth approximately $83 million to Binance, according to Nansen. They bought it 12 years ago for $322. Many whales have been selling recently. Once the market absorbs this supply, Bitcoin is likely to move higher.

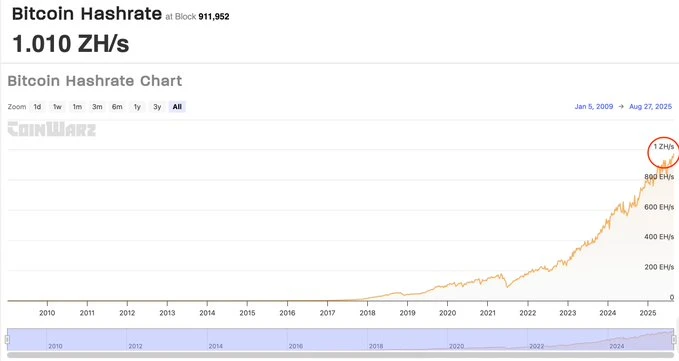

➡️Bitcoin Archive: "Bitcoin total hash rate reaches a new all-time high. Hash precedes price."

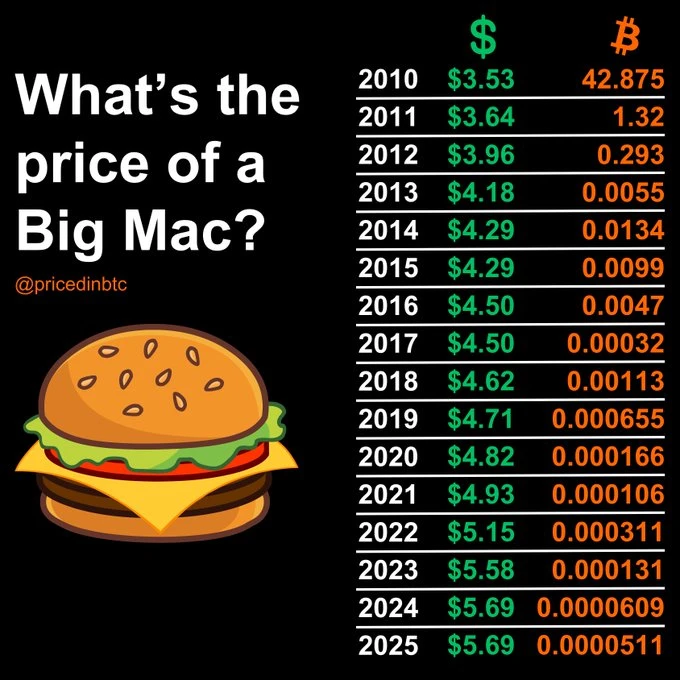

➡️Priced in Bitcoin: "The Big Mac Index, Priced in BTC.

2015: ₿0.0099

2020: ₿0.000166

2025: ₿0.0000609

In 10 years: -99% in BTC, while USD +33%. Everything priced in bitcoin tends to zero.

On the 29th of August:

➡️River: Every Bitcoiner started as a critic. But as we pay attention and dig deeper, one by one, we change our minds. And all of them end up capitulating!

➡️Lyn Alden: "There's so much drama/chatter about bitcoin's boring price action. Just grinding generally upward with higher highs and lows. Since this has roughly been my base case (bullish but boring), I went and wrote a sci-fi book during this time. You can just kind of skip boring things."

➡️How can this be…I was told they only use Bitcoin to launder money.

On the 30th of August:

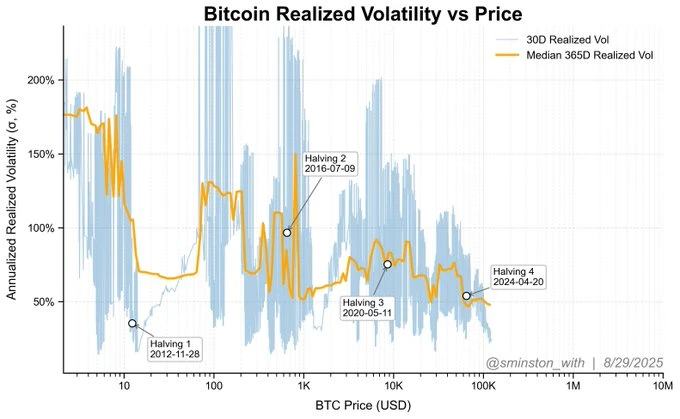

➡️Reminder: Bitcoin's volatility has been trending down since its inception. The trend also follows price, which Bitcoin has scaled by 7 orders of magnitude. Moving toward $1M Bitcoin will represent moving into a fully mature asset class, from which the early investors (you) will have greatly benefited, especially while enduring the stormy seas. Showing: Bitcoin's annualized 30-day volatility as a % (along with the rolling median). Bitcoin’s volatility: the ultimate chart.

Both Bitcoin volatility and returns have unquestionably followed a clear, diminishing pattern, which is logical and expected for a financial asset and network undergoing a stabilization process.

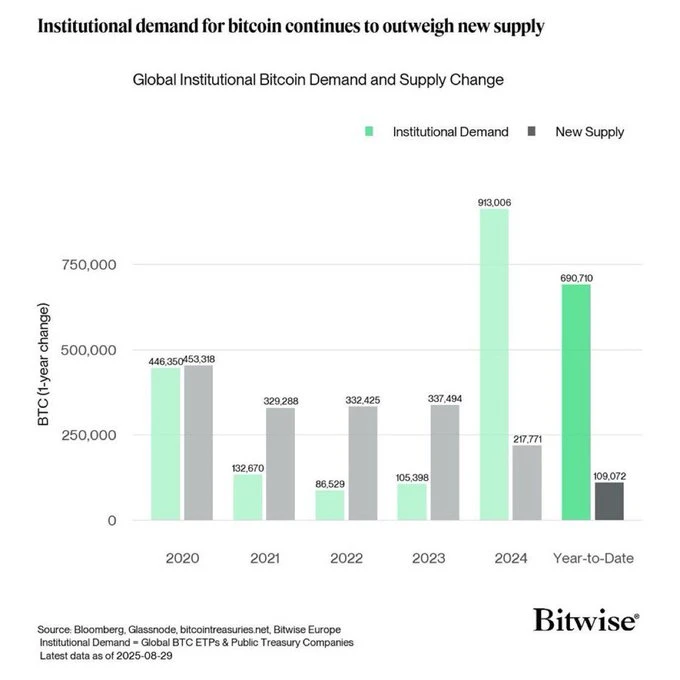

➡️ Institutions bought 690,710 BTC this year vs only 109,072 BTC mined. – Bitwise: That’s 6x more demand than supply.

➡️'New York’s Bitcoin bar @PubKey is rolling out a new deal: all payments made in Bitcoin get 21% off. That’s beers, burgers, dogs, and merch, everything on the menu.' -Bitcoin News

➡️West Main Self Storage buys an additional 0.088 #Bitcoin and now holds a total of 0.43 BTC.

On the 30th of August:

➡️Bitcoin Archive: "Bitcoin whale who sold 24,000 BTC last week just sent another 2,000 BTC to an exchange. Watch out for volatility again this weekend."

➡️"El Salvador has begun redistributing its National Strategic Bitcoin Reserve into multiple unused addresses, each capped at 500 BTC. The move enhances long-term security and reduces exposure to quantum threats by keeping public keys hashed and unused." -Bitcoin News

On the 31st of August:

➡️BLACKROCK: "If every millionaire in the U.S. asked their financial advisor to get them 1 Bitcoin, there wouldn’t be enough."

On the 1st of September:

➡️Michael Saylor's STRATEGY could join the S&P500 as early as this Friday. Passive index funds would be forced to buy billions in Bitcoin exposure.

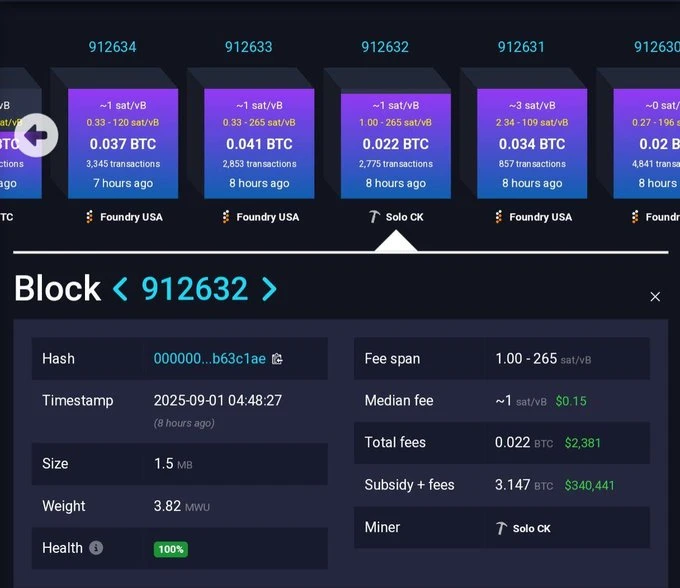

➡️Solo miner mines an entire Bitcoin block worth $340,000. They won the Bitcoin lottery.

➡️The world's third-largest hydroelectric power plant in Paraguay turns renewable hydropower into Bitcoin.

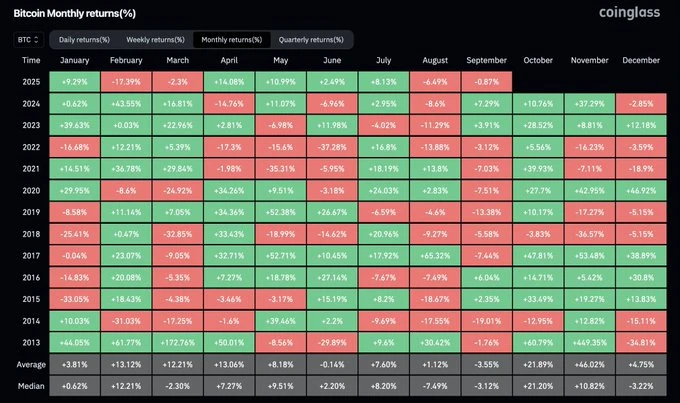

➡️'Bitcoin closed August in the red for the 4th consecutive year. September is historically Bitcoin’s weakest month. Watch for a bottom this month before a surge in Q4.' - Bitcoin Archive

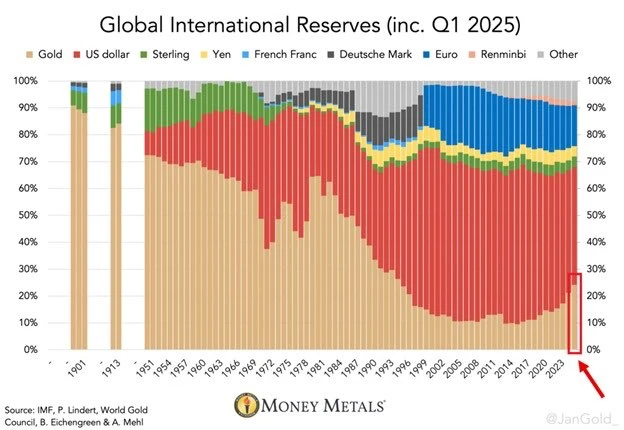

➡️The dollar is losing reserve currency status. It’s down to 42% of global reserves, and gold is rapidly rising. - Balaji

Some context: Gold's share of global international reserves rose 3 percentage points in Q1 2025, to 24%, the highest in 30 years. This marks the 3rd consecutive annual increase. Meanwhile, the US Dollar's share declined ~2 percentage points, to 42%, the lowest since the mid-1990s. The Euro share remained roughly unchanged at ~15%. Gold is now the world’s second-largest reserve asset after surpassing the Euro in 2024. Gold is seeing historic levels of demand.

Something Bitcoin flavour to add on.

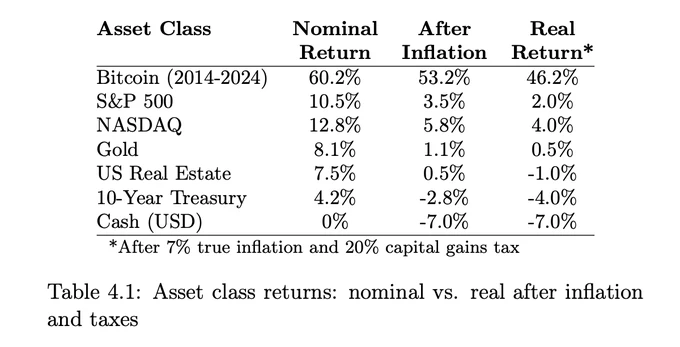

What do you need besides this table, really? More Bitcoin! All aside, Bitcoin % will be max 20-30% in the next decade. Considering the alternatives, still the best.

Show this to your co-workers, friends, or family members if they ask you how to get started with investing. There is only one answer...

💸Traditional Finance / Macro:

On the 25th of August:

👉🏽TKL: "Earnings of the Magnificent 7 companies have surged +145% since ChatGPT was introduced in November 2022. By comparison, profits of the remaining 493 S&P 500 firms have increased just +4% over the same period.

Furthermore, the Mag 7’s EPS has risen 700% since 2020, while the remaining S&P 500 components have seen +31% EPS growth. That marks 22 TIMES higher earnings growth in just 5.5 years. Over the last decade, the Magnificent 7 has seen a massive +2,134% growth in earnings. Magnificent 7 stocks are making history."

On the 29th of August:

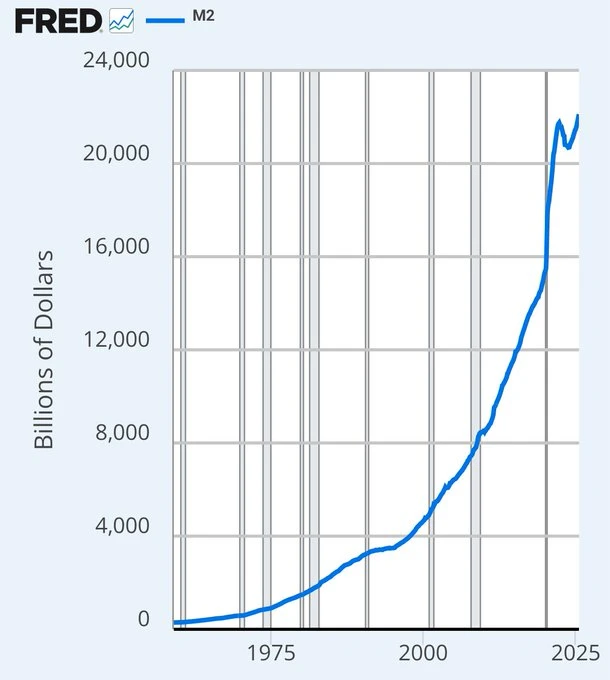

👉🏽Roberto Rios: 90% of all SPY gains for the last 30 years have happened since the Fed started QE. NINETY. PERCENT.

🏦Banks:

👉🏽No news

🌎Macro/Geopolitics:

On the 25th of August:

👉🏽'US Government to take ownership in more companies.' - Watcher Guru Jippieeeee, the United States of Communism!

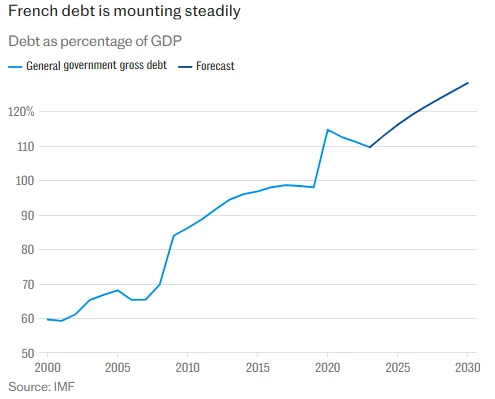

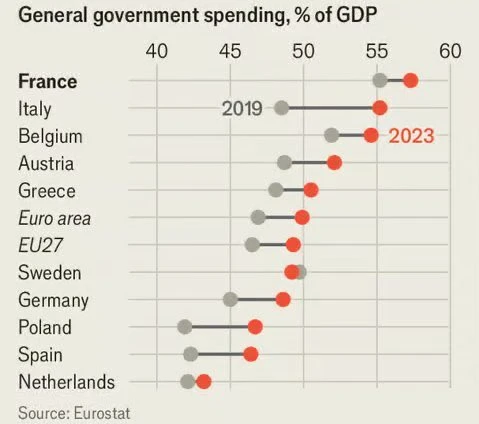

👉🏽'France has done nothing to stabilize its fiscal deficit & debt/GDP. It already has the highest tax burden in Europe; higher taxes would throttle growth potential even more. With its political paralysis, it won’t cut spending either. The next confidence vote is coming. Good luck, Euro.' -Michael A. Arouet

On the 26th of August:

👉🏽Michael A. Arouet: "France has done nothing to stabilize its fiscal deficit & debt/GDP. It already has the highest tax burden in Europe; higher taxes would throttle growth potential even more. With its political paralysis, it won’t cut spending either. The next confidence vote is coming. Good luck, Euro."

👉🏽Japanese Bond Market. Japan’s 30-Year Government Bond yield has just surged to a new all-time high of 3.195%, nearly double its long-term average of 1.72%.

Why is this important? Locally in Japan, the yield surge signals higher borrowing costs amid massive public debt (over 250% GDP), pressuring the BOJ for policy tweaks, raising rates for consumers/companies, and risking fiscal strain or equity dips. Globally, it could spur repatriation of Japanese investments from foreign bonds (e.g., US Treasuries), lifting worldwide yields, unwinding yen carry trades, and adding volatility to currencies and markets.

👉🏽Timmermans officially charged in Germany for the disappearance of billions. The Dutch media, of course, remain completely silent. Bear in mind, he is the leader and a member of the Labour Party (PvdA).

The European Taxpayers Association (TAE) has filed a criminal complaint against former EU Commissioners Frans Timmermans (64, Commissioner for Climate Action) and Virginijus Sinkevičius (34, Commissioner for the Environment). The four-page complaint (obtained by BILD) has been submitted to the Munich public prosecutor’s office and concerns allegedly non-transparent and possibly unlawful allocation of funds to non-governmental organizations (NGOs) by the European Commission during its 2019–2024 term. At the same time, the document has also been sent to the European Public Prosecutor’s Office in Luxembourg.

Source: m.bild.de/politik/inland/milliarden-fuer-ngos-verschwendet-untreue-anzeige-gegen-eu-kommission

According to TAE, there is suspicion that €7 billion in EU funds were allocated without sufficient oversight, in some cases even to influence the European Parliament. This allegedly involved lobbying against the interests of the Commission, including in the context of the Mercosur agreement. The Taxpayers Association is calling for criminal prosecution and warns of a legal vacuum within the EU. “The allocation of public funds must be transparent and accountable,” says Taxpayers Association president Michael Jäger (62).

👉🏽Netherlands: 'According to statistics, around 500 Dutch companies moved activities abroad between 2018 and 2020, resulting in the loss of about 7,900 jobs. The main reasons were strategic (41%), labor costs (36%), other savings (25%), or market access (20%). These cases mostly concern manufacturing, high-tech, and services, though specific company names are often kept anonymous in reports. The trend continues, driven by taxes, regulation, and energy prices.' - Grok

x.com/i/grok/share/nObLUeGotTyyK3CWNoLTcCZtm

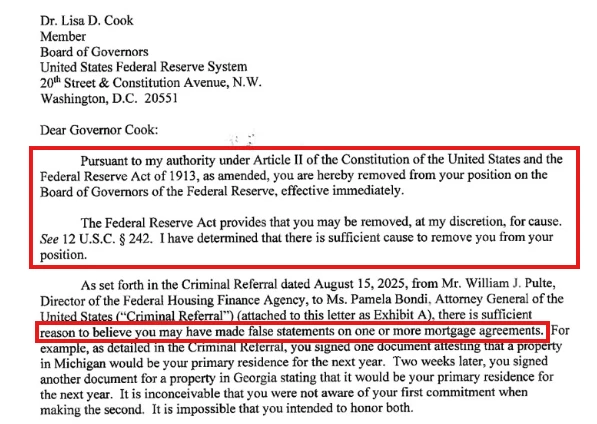

👉🏽TKL: "President Trump just signed an Executive Order which 'fired' Fed Governor Cook due to a 'Criminal Referral." Never in the 111-year history of the Fed has a President fired a Fed Governor.

On August 25th, Trump published an Executive Order: It cites Article II of the Constitution and the Federal Reserve Act, claiming she can be removed “for cause.” The alleged “cause” is a criminal referral accusing Fed Governor Cook of false statements on mortgage documents.

Read here for more: x.com/KobeissiLetter/status/1960336381814710639

👉🏽Germany Reconsiders Welfare State to Fund Ukraine - “The welfare state that we have today can no longer be financed with what we produce in the economy,” German Chancellor Friedrich Merz said in a recent meeting.

As Hester Bais points out: "Friedrich Merz was, from 2016 until March 2020, senior advisor and chairman of the supervisory board at BlackRock Asset Management Deutschland AG. As an advisor, he provided BlackRock with strategic guidance, managed client relations, and established contacts with German government authorities. BlackRock is one of the key players in Worst Bank Scenario."

I highly recommend reading her book Worst Bank Scenario.

He doesn't serve the citizens. He serves Big Finance. Warfare = Big Finance Welfare = Citizens

👉🏽A member of the commando that blew up the Nord Stream pipeline has now been identified — Zeit

German prosecutors recently arrested a Ukrainian man, identified as Serhii K., in Italy in August 2025 on suspicion of coordinating the attack, but this is a single suspect in what is believed to be a larger, well-planned operation. A recent development: In August 2025, Italian police arrested a 49-year-old Ukrainian man on suspicion of coordinating the sabotage of the Nord Stream pipelines. A leading role: While he is not thought to have been one of the divers, prosecutors believe he played a leading role in coordinating the operation. The investigation continues: The German investigation into the pipeline sabotage is ongoing, with prosecutors intending to charge any suspects with anti-constitutional sabotage and causing an explosion.

So now it seems like the whole “Russian sabotage” story was just a cover-up to protect NATO and Ukraine. In reality, the sabotage was theirs all along. Remember, blowing up Nord Stream isn’t a one-nation job; there are much bigger players behind the curtain.

As always, stay sceptic...

Regarding trust and being sceptical...

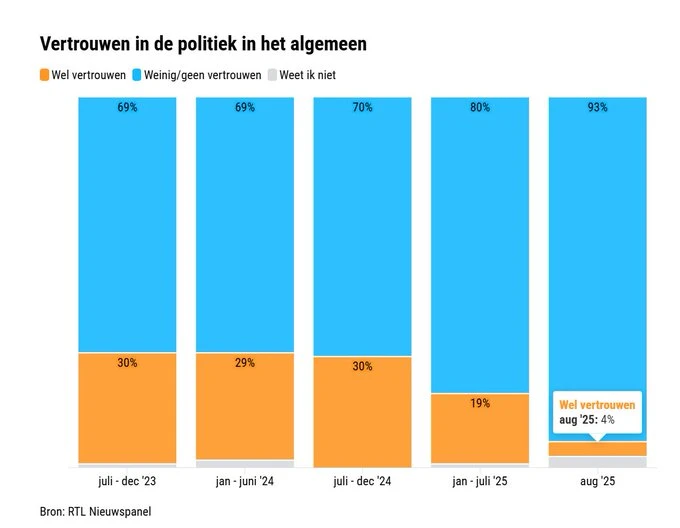

👉🏽Only 4 (FOUR) percent of the Dutch still have trust in politics. Source: RTL Niewspanel

I am not surprised. Polarization is tearing our society apart, and there isn’t a single party doing anything about it.

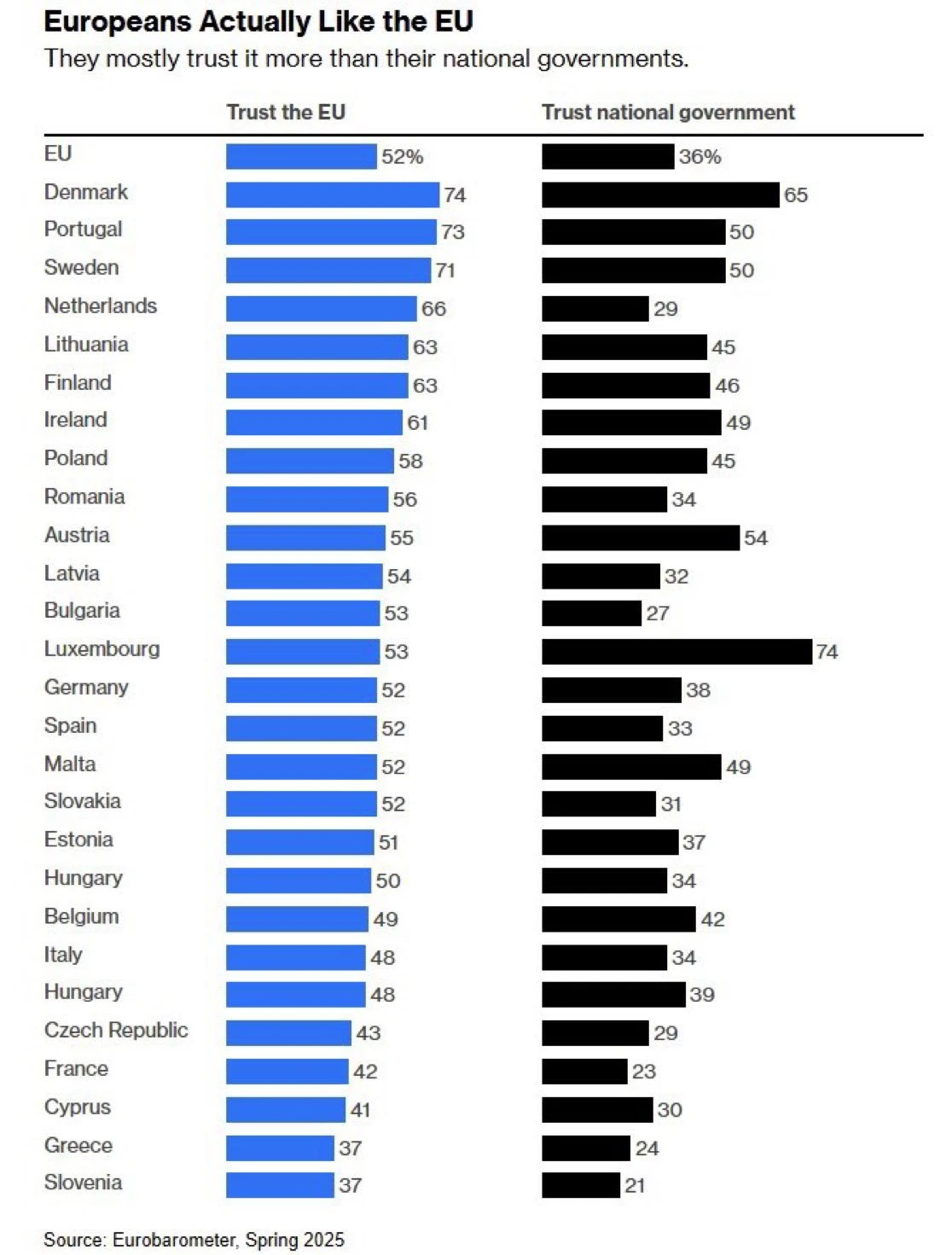

Jeroen Blokland: "Why the Dutch have relatively high trust in Europe, I really don’t understand. The increasing power of Brussels is hardly a blessing. Not for Dutch politicians, who are left with even less clout, and not for citizens, who are faced with more and more regulations without truly being able to vote on them."

On the 29th of August:

👉🏽French borrowing costs spike as the country faces the second collapse of its government within a year. May I remind you that France is the EU's 3rd largest economy. Putaaaaiiiinnnn!!! France may need an IMF bailout, warns finance minister The Netherlands can no longer remain in the same monetary union as France.

Quite a decent election theme. I can already tell you this... the party will debate or discuss this.

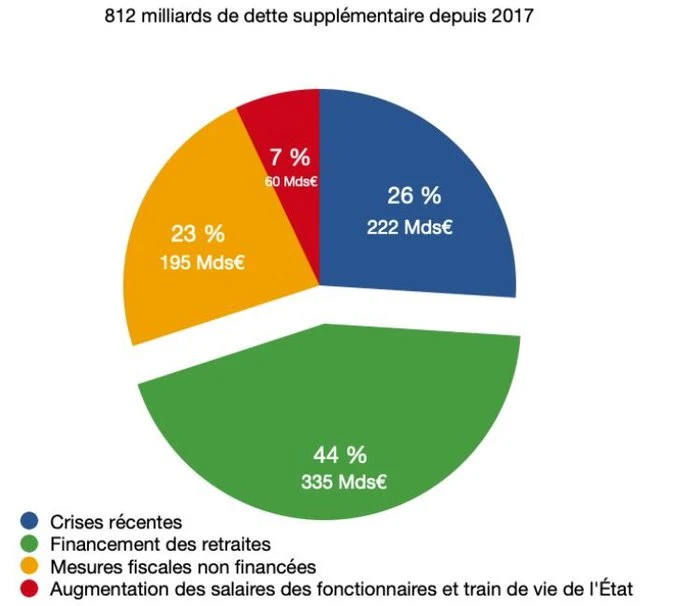

Michael A. Arouet: "Eye-opening chart, let me translate it for you. 44% of new debt in France since 2017 has been spent on pensions. France doesn’t have any room left to keep accumulating debt as we go forward. Good luck with telling the French that their beloved pensions system is bankrupt."

For the Dutch readers a great thread by Holland Gold: "Waarom is deze Franse ramkoers zo onafwendbaar? En slepen ze de Nederlandse belastingbetaler uiteindelijk dieper de problemen in?" threadreaderapp.com/thread/1961474379872702848.html

Yair Einhorn: The same thing is happening in Germany, where the pension system is a disaster waiting to happen! According to this excellent FT, Germany is already spending a great portion of its GDP on pensions & this is only going to increase. At the same time, Germany is expected to lose 9% of its working force by 2040!

France, Germany, Spain(less), Portugal, for example, are all into this mess, an inverting demographic pyramid ruining the Biggest legal "Ponzi scheme". "Pay me now, I´ll give it to you later", that is what the nowadays pension system promises, but since the relation between active population and pensioners is decreasing, this becomes unsustainable.

The European Central Bank readies its Money-Printing Bazooka. Stack Bitcoin accordingly.

Just another great EU example:

👉🏽Michael A. Arouet: "Absurdity of the Euro in one chart. During the 25 years before the currency union, the Italian Lira lost 83% against the German Mark; the next 25 years, they have been pegged to each other. What were the politicians smoking when they introduced the Euro in Italy?"

The EU is one big Ponzi scheme from the moment it switched from economics to ideology.

👉🏽"July PCE inflation, the Fed's preferred inflation measure, rises to 2.6%, in line with expectations of 2.6%. Core PCE inflation rises to 2.9%, in line with expectations of 2.9%. Core PCE inflation is now at its highest since February 2025. Yet, rate cuts are coming." -TKL

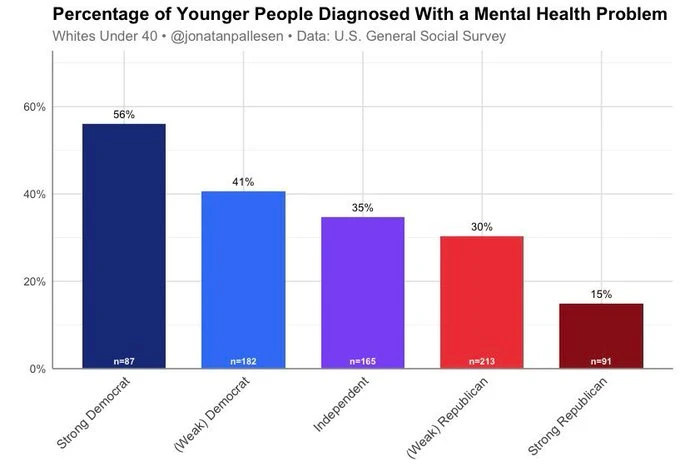

👉🏽Wild Chart:

The data is from the U.S. General Social Survey (GSS), a nationally representative probability sample of non-institutionalized U.S. adults conducted by NORC. This chart filters to white respondents under 40, with sample sizes: Strong Democrat (n = 87), Weak Democrat (n = 182), Independent (n = 165), Weak Republican (n = 113), and Strong Republican (n = 91). Likely from a recent wave like 2022 (total GSS sample ~3,500). The same problem – different parties – is likely to confront Europe as well.

👉🏽 Gold prices surge above $3,500/oz as markets price-in rate cuts into rising inflation.

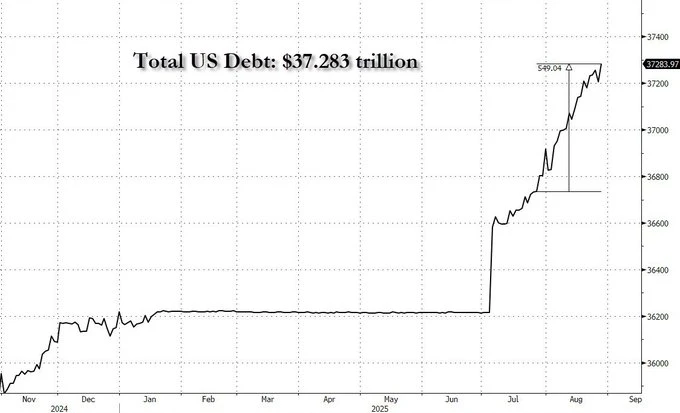

👉🏽For those wondering, US debt is up $550 billion in the past month.

On the 30th of August:

👉🏽US M2 money supply hits a new all-time high of $22.1 TRILLION.

👉🏽Most EU states already spend around 50% of their GDP, and not all boomers have even retired yet.

Michael A. Arouet: "Government spending in all European countries has been going up, but France really sticks out. Despite the highest tax burden in Europe, it runs 6% fiscal deficit during good times. Without deep structural reforms of pensions and government spending, France will face a debt crisis."

Really, you should read Hester Bais ' book: Worst Bank Scenario.

On the 1st of September

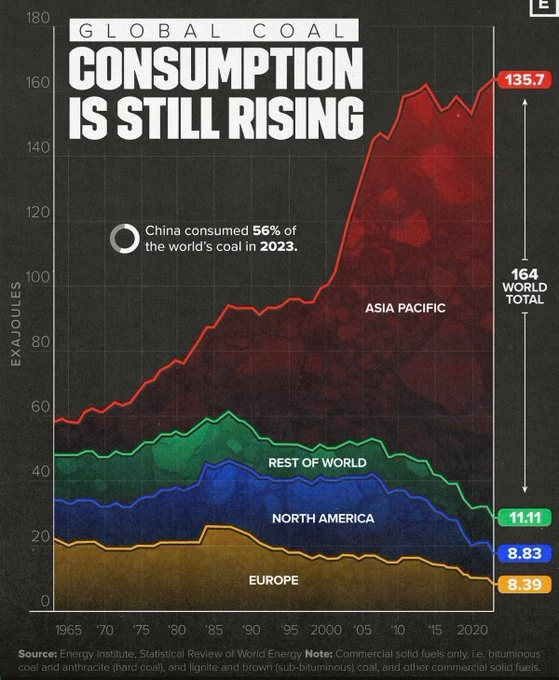

👉🏽Herhaling: Nederlandse CO2 uitstoot. EU CO2 uitstoot. Mondiale CO2 uitstoot. Bron: ourworldindata.org/grapher/annual-co2-emissions-per-country?time=1900..latest&country=OWID_WRL~OWID_ASI~OWID_EU27~USA~NLD

👉🏽Walter Bloomberg: "ECB'S LAGARDE SAYS I AM LOOKING VERY ATTENTIVELY AT FRENCH BOND SPREADS SITUATION."

Ergo...we are fucked!

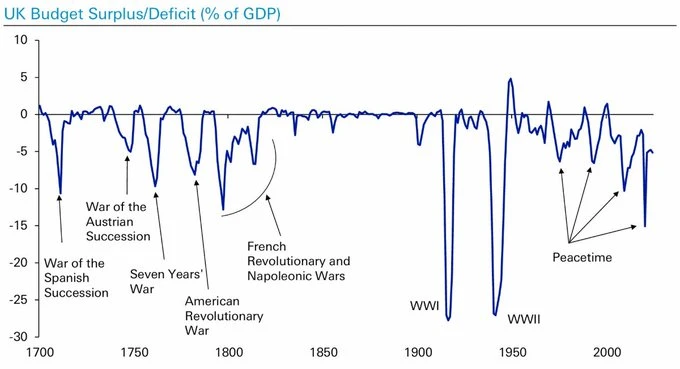

👉🏽TKL: 'The UK's bond market is collapsing: Today, the yield on a 30Y Bond in the UK rose to 5.64%, its highest level since 1998. Yields in the UK are now 15 TIMES higher than they were at the 2020 low, just 5 years ago.'

This chart says it all: The UK has been running wartime fiscal deficits as a % of GDP despite the last war on UK soil being WW2. The UK is literally seeing deficits as a % of GDP that are at French Revolutionary and Napoleonic War levels. What is happening here?

👉🏽I have said it before, and I will say it again, the EU's Green Deal is just a communist agenda to break and control us. Once you realize this has nothing to do with climate and everything to do with shifting economic power away from the West, everything will make sense.

Michael A. Arouet: "Can someone please explain how Europe, with its Net Zero approach, is supposed to save the planet? Does it really make sense from a geopolitical and economic perspective to deindustrialize?"

Someone on X explained it perfectly: " Europe must reindustrialise with new sectors. Start with chips, which need zero cheap labour and infinite capital. Financial services are backed by the largest economy. Software, which requires intellectual capital. Nuclear, which requires engineering and ultra-high-end manufacturing." - Kristoffer Laurson

🎁If you have made it this far, I would like to give you a little gift:

For those who haven't gotten a chance to read Broken Money, remember that she has a 30-minute animated video of it as well:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃