🧠Quote(s) of the week:

The individual has always had to struggle to keep from being overwhelmed by the tribe. If you try it, you will often be lonely, and sometimes frightened. But no price is too high to pay for the privilege of owning yourself. -Friedrich Nietzsche

Bitcoin is not making you richer, it's preventing you from getting poorer. Pour one out for those without protection from poverty. - Jameson Lopp

🧡Bitcoin news🧡

Officially watch your mouth, season!

On the 7th of July:

➡️Semler Scientific bought another $20 million Bitcoin! Semler Scientific now holds 4,636 Bitcoin.

On the 8th of July:

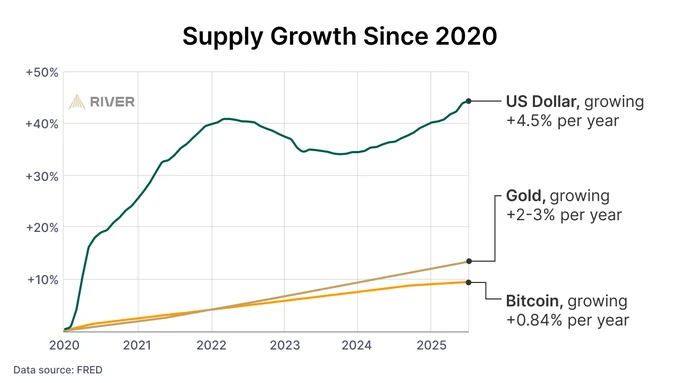

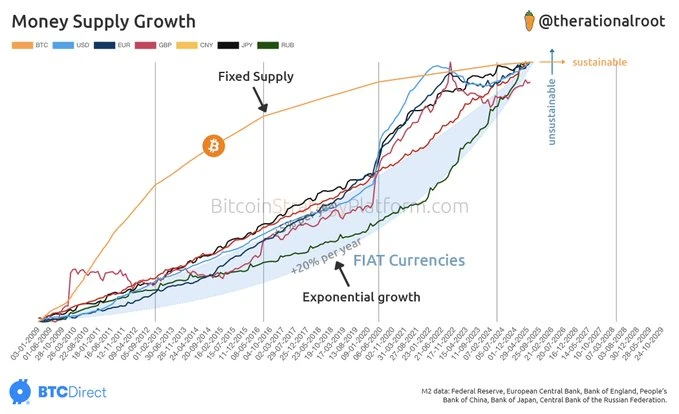

➡️River: The endless dollar loop is happening again.

New spending bill --> more debt --> more dollars created.

Time to inflation-proof your future with Bitcoin.

To follow this up, a great tweet by The Rational Root:

"If big government and inefficiency were just a Democrat/Republican issue, why do all countries in the world face the same problem? Starting the America Party is a noble initiative, but I hope it helps address the root cause. The root cause isn’t the ruling party, it’s money supply growth. When governments control the money supply, they’re always incentivized to print more and grow inefficient. Fix the money, fix America."

➡️The creator of Twitter and Cash App, @Jack Dorsey, just released a Bluetooth messaging app called ‘Bitchat’ that doesn't need the internet or cell service. Within an hour, users have started sending bitcoin using the peer-to-peer encrypted mesh network.

The app stores transactions until reaching an online device to broadcast to the Bitcoin network, making it ideal for blackouts, emergencies, and off-grid use.

➡️BlackRock's Bitcoin ETF now holds over 700K Bitcoin. That's 3.5% of the total circulating supply.

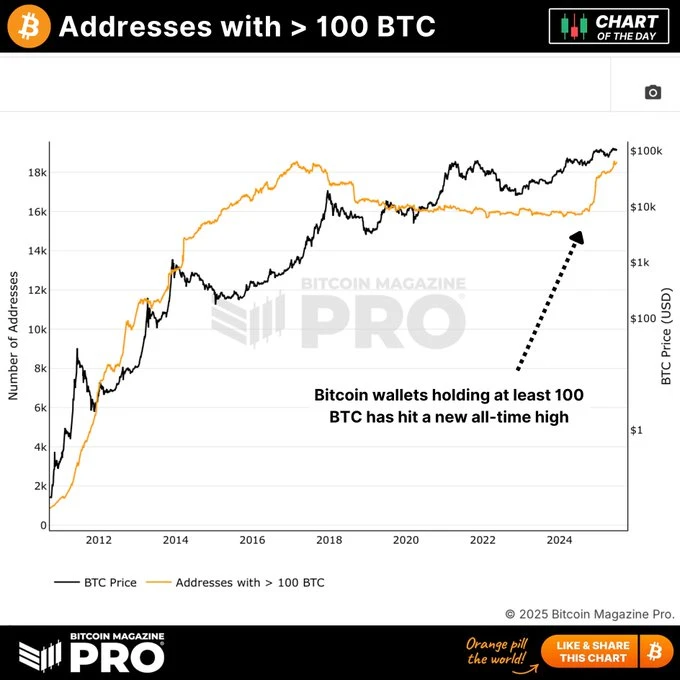

➡️'Lots of big money accumulating BTC right now, we've just seen the amount of wallets holding at least 100 BTC hit a new all-time high! Whales are accumulating, are you?' -Bitcoin Magazine Pro

➡️Ego Death Capital closes $100 million fund to invest in Bitcoin companies. Source: www.axios.com/2025/07/08/ego-death-100-million-bitcoin-companies

➡️Genius Group purchased 28 BTC and now has 148 BTC in total.

➡️Holding Bitcoin has been profitable for over 99.8% of its history.

On the 9th of July:

➡️Daniel Batten: IMF backtrack spotted!

"What is happening in Pakistan is one of the most important geopolitical events of the year, and Western media is asleep at the wheel. The IMF has just been forced to soften its opposition to bitcoin in Pakistan, by making it seem like they will go through a legitimate due diligence process first (and then reject it).

Context: IMF has transparently opposed bitcoin in 4 countries and in both the cases where the country went ahead anyway (Bhutan, El Salvador) the economy has thrived, not only making a mockery of IMF "instability concerns" but shining the light ever more strongly back at them for the real reason for their bitcoin opposition: it threatens their relevance. Geopolitical theatre at its finest, and Bitcoin is on center stage."

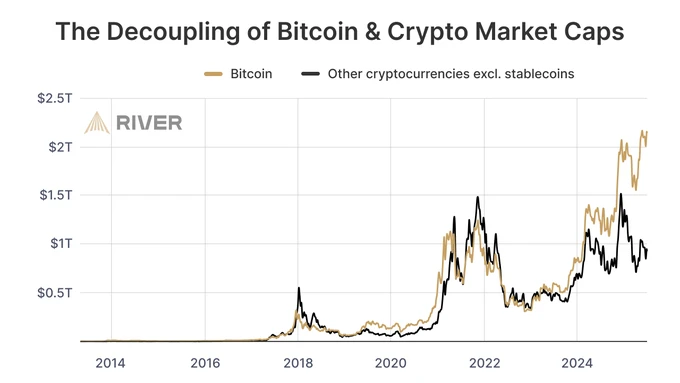

➡️River: The world is beginning to wake up to this simple truth:

Bitcoin, not crypto.

➡️Strategy's Bitcoin holdings are up 57% $24.2 billion in profit.

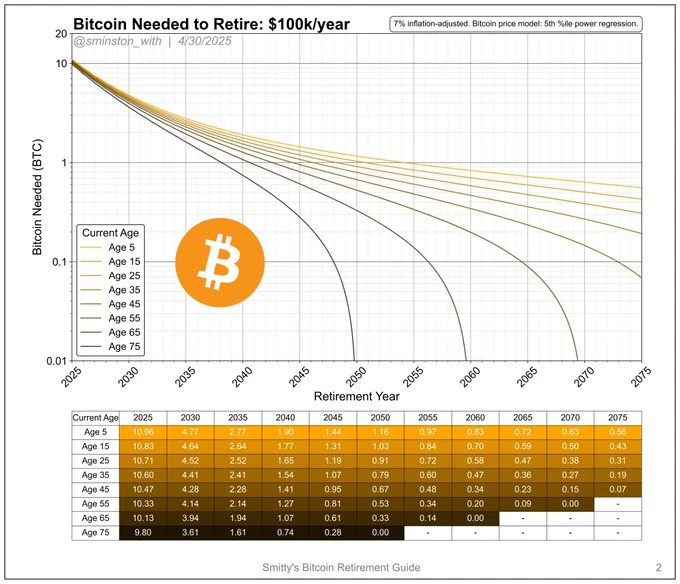

➡️I have shared the following already a couple of times.

Sminton With: Smitty's Bitcoin Retirement Guide - annual expense scenarios, assumed future 7% average annual inflation, and does not account for taxes.

➡️Corporations purchased 159,107 Bitcoin worth over $17.4 BILLION in Q2, 2025. Demand is increasing, supply is decreasing.

➡️ Airline giant Emirates to accept Bitcoin for flights.

➡️ Just when you thought politicians couldn't get any dumber:

U.S. Senate bill calls for sanctions on El Salvador's Bitcoin strategy. Targets Bukele's regime, BTC purchases, exchange activity, and alleged sanction evasion.

This is why you want to be sovereign as a country. Sovereign nations? Sure, but Uncle Sam loves playing world cop when his petrodollar feels the heat. Classic empire vibes. Currently, El Salvador has an almost $400 million unrealized profit on their Bitcoin holdings.

➡️'Nearly half (49%) of Gen Z say planning for the future feels pointless, so they’re choosing to spend freely this summer. At the same time, over 40% of 18–29 year olds have zero retirement savings. Gen Z needs Bitcoin.' - Bitcoin News

On the 10th of July:

➡️Bitcoin is just 7% away from flipping Amazon to become the 5th largest asset in the world.

➡️Bitcoin miners transaction volume share drops to 3.3%, the lowest in nearly two years.

➡️Saifedean with another truth bomb:

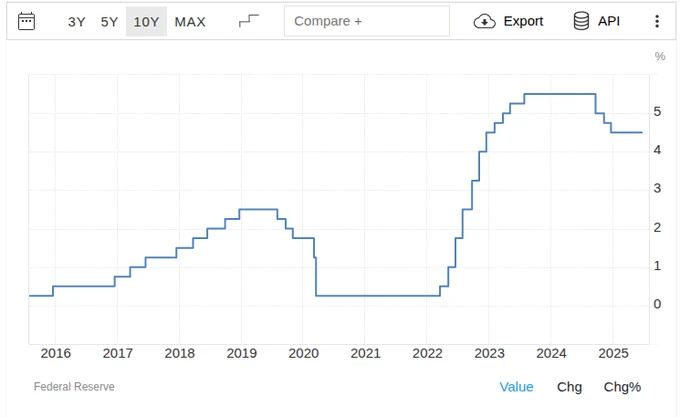

"The Fed started raising rates in March 2022 with Bitcoin at $42k. 40 months later, Bitcoin is up 167% to $112k & all the poor Fiatbros who said Bitcoin is a "low interest rate phenomenon" still have to listen to Fed announcements every month like serfs listening to their lord."

Highly recommend you read his books to free yourself from the FIAT mind.

Highly recommend you read his books to free yourself from the FIAT mind.

➡️mETH: before and after don't do shitcoins friends, it's bad for you

When you know, you know!

➡️M2 Money Supply Model says BTC is lagging by 20%. If the correlation holds, price should teleport to $130K.

➡️Alphractal's Bitcoin Repetition Fractal Cycle model predicts this cycle's peak for October 12-16, 2025.

➡️ Publicly traded K Wave Media secures $1 billion capital capacity to buy Bitcoin.

➡️Sequans has launched their #Bitcoin treasury with an initial purchase of 370 BTC. The French semiconductor firm plans to accumulate over 3,000 BTC in the coming weeks.

➡️By the end of today, you'll probably have used your bank account — maybe to buy groceries, pay rent, or send money to a friend. Even better, to receive your salary. It's something many of us take for granted. Mobile Phones.

However, for more than a billion people globally, transactions only happen with cash. That means carrying around physical notes and coins, traveling long distances just to send or receive money, and facing the constant risk of losing it or having it stolen.

The absence of formal banking services adds yet another hurdle for people in poverty. But in recent years, “mobile money” has transformed how many people access financial services. You can see the growth of mobile money accounts in the chart." - Our World in Data

I truly believe Bitcoin will play a pivotal role transforming our world and opening up new opportunities to have ownership of "your" money, especially in developing countries.

➡️FORBES: “What we’re seeing is a long-overdue recalibration from speculation to structural adoption." “Bitcoin’s new all-time high is a signal of growing institutional maturity and global confidence in crypto as an asset class.”

➡️A digital euro would complement cash by offering its equivalent for digital transactions, emphasised Piero Cipollone in his speech at Banka Slovenije. It would also enhance Europe’s sovereignty, resilience, and innovation potential in payments, while protecting privacy.

That’s just a load of horseshit! Haha privacy? And what the F is he talking about...for all intents and purposes, the euro is already digital. If you’re reading this, study Bitcoin.

Daniel Batten: "A digital Euro would, in the words of ECB's president, emulate the "success" of China's state surveillance tool the digital e-CNY, and in the words of BIS GM Agustín Carstens, give "total control" to the central bank, "and the means to enforce it".

It is unwanted, unrequested, unneeded by EU citizens in general, and serves only the interests of the ECB to maintain its influence on monetary policy.

War is peace

Freedom is slavery

The Digital Euro protects privacy."

On the 11th of July:

➡️German government's decision to sell 50,000 Bitcoin at $54k cost them $3.1 billion in missed profits.

➡️BITCOIN vs US DOLLAR (2025) BTC: +24% USD: -14%

Holding USD instead of Bitcoin in 2025 would have cost you 38%.

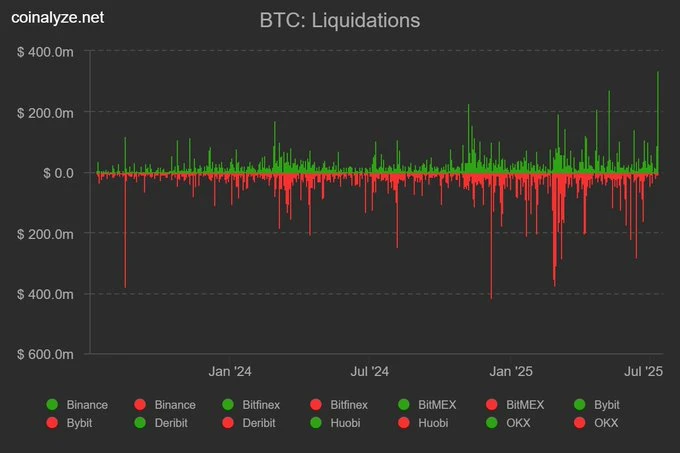

➡️$1,100,000,000 worth of Bitcoin and crypto shorts got liquidated in the past 24 hours.

This was the biggest Bitcoin shorts liquidation event in years.

On the 13th of July:

➡️'Pay later' firm Klarna to integrate cryptocurrencies into platform as it positions to become a digital bank ahead of an IPO in late 2025 - Financial Times

Klarna has:

• 85 million users

• $100b of volume.

• 500K merchants.

On the 14th of July:

➡️Joe Consorti: $1.3 BILLION IN SHORTS were liquidated in less than 60 seconds. Bitcoin skipped straight past $120k and went directly to $121k. At $2.39 trillion, Bitcoin is now officially larger than Amazon, and is the world's 5th largest asset. Remember this day.

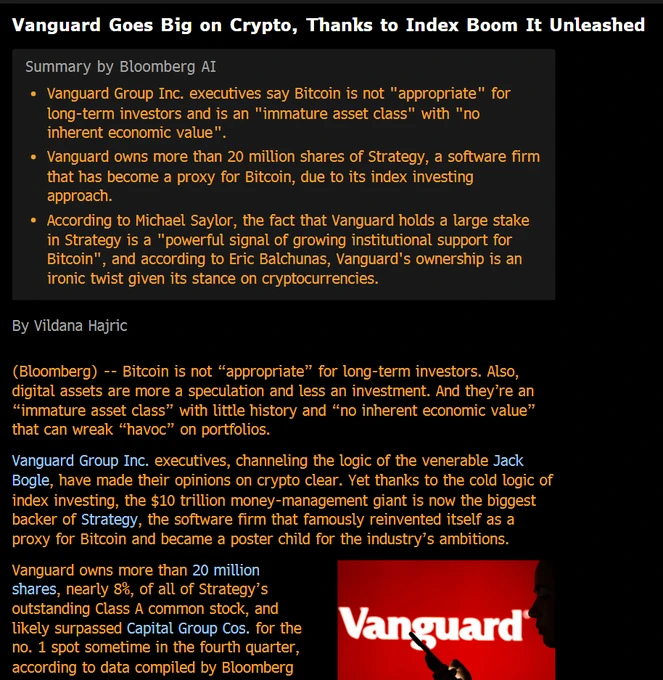

➡️Vanguard is now the biggest shareholder of Michael Saylor’s STRATEGY.

"Vanguard: Bitcoin is immature and has no value.

Also Vanguard: Buys 20M shares of MSTR, becomes top backer of Bitcoin’s loudest bull.

Indexing into $9B of what you openly mock isn't strategy.

It’s institutional dementia. " - Matthew Sigel

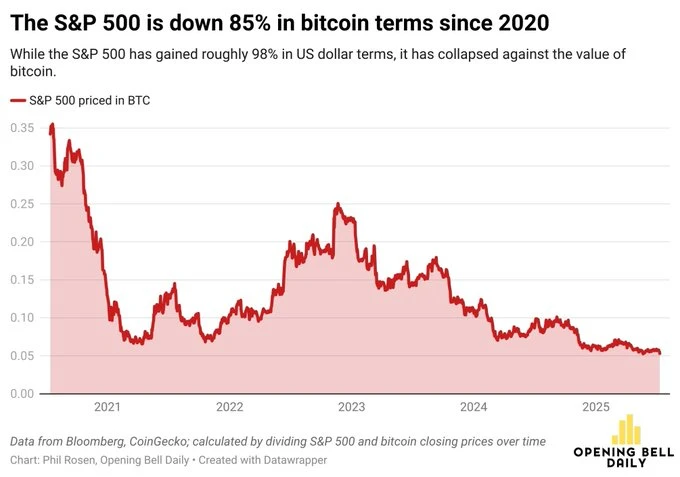

➡️'The S&P 500 is up nearly 100% in dollar terms since 2020. But priced in Bitcoin? It’s down 85%. The real benchmark has changed.' - TFTC

➡️Federal Reserve just issued a joint statement with 2 regulators confirming that banks can offer Bitcoin and crypto custody.

💸Traditional Finance / Macro:

On the 9th of July

👉🏽NVIDIA is currently worth 14% more than the entire UK economy. NVDIA is larger than the Staples, Energy, Utilities, REITs, and Materials sectors (not combined).

Just 3 years ago:

Nvidia was $11.20 (now $164)

Meta was $90 (now $736)

Netflix was $187 (now $1,277)

But your salary didn’t change.

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

On the 8th of July:

👉🏽'The US Dollar has rarely ever been this oversold: The US Dollar index is trading 6.5 points below its 200-day moving average, the largest margin in 21 years.

This marks a sharp reversal from January 2025, when the index was 4.5 points above its 200-day average. So far this year, the US Dollar Index has dropped -10.1%, its worst year-to-date performance since 1973.

Meanwhile, speculative short positions on the US Dollar by asset managers and leveraged funds have reached their lowest level since mid-2021, according to JP Morgan.

Is the US dollar overdue for a bounce?' -TKL

👉🏽Luke Gromen: "Another symptom of 'USD Dutch Disease', & why the US can no longer go to war without Chinese REEs. "You get our industrial base, skilled trade know-how, control of global commodity assets, & ownership of US stocks; we get record stock indices, debt/GDP & wealth inequality."

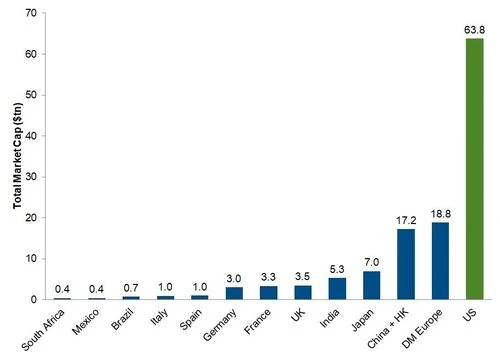

The US stock market has a market capitalization of $63.8T, which is more than the other markets listed below combined at $61.6T.

Chart: Goldman Sachs

On the 9th of July:

👉🏽Argentina and U.S. reportedly approve trade deal granting 80% of Argentine Exports Tariff-Free Access.

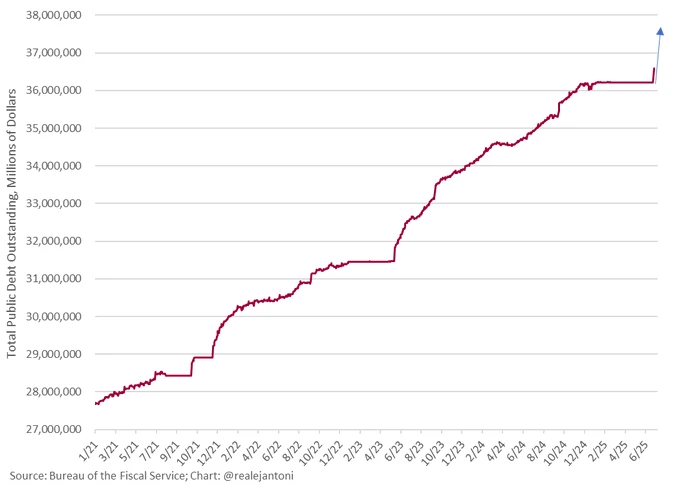

👉🏽And so it begins... Debt jumps $366 billion in one day:

👉🏽A Rotterdam oil terminal and a PVC factory in Limburg are ceasing their operations. Both companies say they are heavily affected by competition from other parts of the world. With this decision, they join a growing list of industrial companies that no longer see a future in the Netherlands.

The Green Deal is bearing fruit. Our industry is moving to countries with fewer regulations and cheaper energy. What remains? An impoverished Netherlands without a manufacturing sector.

Source: www.nu.nl/economie/6361869/opnieuw-sluiten-twee-industriele-bedrijven-de-deuren-in-nederland.html

👉🏽'The US stock market capitalization-to-GDP ratio has hit a record 208%. Since the April low, this ratio has surged ~43 percentage points, officially surpassing the February high of 206%. The ratio has also DOUBLED over the last 9 years. By comparison, at the 2000 Dot-Com Bubble peak, this metric was at 142%, while the long-term average is ~85%. ' - TKL

Meanwhile...

"Currently, 27% of US student loan borrowers in households with an annual income of less than $49,999 are behind on payments. Among families earning between $50,000 and $99,000, 21% are behind. Even in households making over $100,000, 10% are delinquent. Overall, a record 45 million people now hold a federal student loan, and the total student loan balance hit $1.8 trillion in Q1 2025, an all-time high. Among all those required to make payments, 24% are delinquent. The student debt crisis is real." - TKL

On the 10th of July

👉🏽The Netherlands: "Next cabinet starts at a disadvantage: national debt is on track to rise to 126 percent by 2060.

€98 billion to Ukraine, €185 million for the NATO summit, €20 billion per year in asylum and migration costs.

Crazy, isn’t it, that you end up in the red like that...

On the 13th of July:

👉🏽The Netherlands will be RATIONING electricity to ease stress from the power grid. How is something like this happening in Europe in 2025?

Meanwhile:

On the 14th of July:

👉🏽President Milei has raised the tax threshold for self-employed individuals from $6,300 to $75,000 annually, potentially representing the largest tax cut in decades! This boost for small businesses aligns with his push for deregulation.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin All Time High: Has the Cycle Broken? | Rational Root

Root is a Bitcoin on-chain analyst and the author of the "Bitcoin Strategy Platform" Substack. In this episode, they discuss the current state of Bitcoin’s bull market, why Root believes there’s no basis for a prolonged bear market, and how institutional demand is changing Bitcoin’s price dynamics. They cover Bitcoin’s structural adoption through ETFs, treasury companies, and sovereign buyers, and why these may limit downside volatility. They also get into the psychological stages of the market, why 100k could now serve as Bitcoin’s new baseline, and how macro factors like interest rate cuts and Trump’s policies might influence the next leg up.

Watch it here: youtu.be/3f6_IoWML-w?si=GY_XKr3spr5RCdQA

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃