🧠Quote(s) of the week:

Now, what is inflation?

Luke Gromen: "An (accidental) gauge of actual US inflation in recent years: Two genetic brothers, JJ Watt (left) and TJ Watt (right), only 5 years apart in age, playing the same sport, the same position on the field, in the same stadiums, to the same crowds...and yet the younger brother makes nearly as much in 3 years as older brother did in 12 years."

While I largely agree with the point, there are other factors contributing to NFL inflation than just monetary inflation. Still, this should help more athletes, fans, and even owners see the light. Get paid in Bitcoin! Get deals paid in Bitcoin.

A screaming indicator that shows both the employer and employee are being harmed by the debasement of the currency. Russell Okung, Saquon Barkley, and Odell Beckham already showed the solution for the NFL and the NFL Players Association -- embrace Bitcoin. Now a matter of time and effort until momentum pushes past the tipping point.

🧡Bitcoin news🧡

On the 14th of July:

➡️BlackRock's spot Bitcoin ETF is now the company's most profitable ETF, Bloomberg reports.

➡️Bitcoin is up ~1,700% since comedian Daniel Sloss called it “Beanie Babies for tech bros” when it was trading at $6.5K

➡️“Ethereum is going parabolic!”

Ethereum is going parabolic:

This is for everyone hyping the Ethereum "pump" right now. I don’t believe we’re heading into another full-blown altseason. Maybe we’ll see some temporary outperformance vs. Bitcoin, but nothing like 2017. Humanity is stupid, but not that stupid. Right?

On the 15th of July

➡️'Millionaire inflation is real. In 2000, there were 14.7 million millionaires. Today, there are over 60 million. Back then, there was hypothetically more than 1 Bitcoin per millionaire. Today? Just 0.35 BTC each. And it’s dropping.' -Bitcoin News

➡️Daniel Batten: "The old guard is fading. A new generation is growing in power, and is gaining ascendancy in EVERY political party. The game is no longer to be pro or anti-Bitcoin, but to frame how Bitcoin fits with your values."

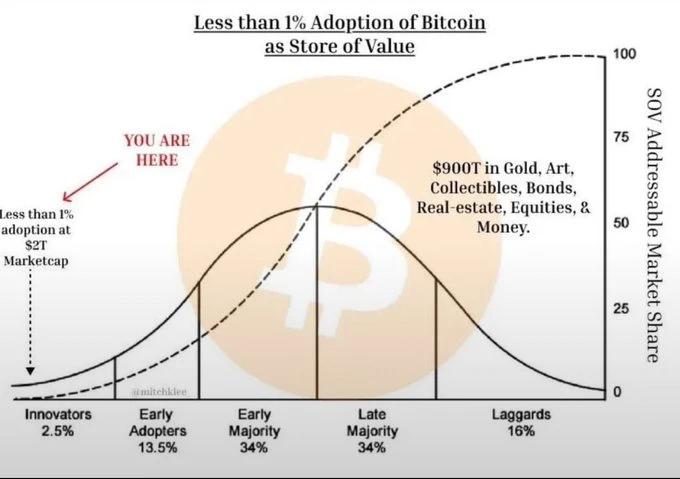

➡️We are very, very early. Bitcoin's adoption curve.

Bitcoin's total addressable market (TAM) is the world’s balance sheet. All $900T of it. So long as Bitcoin has the most attractive characteristics as a store-of-value asset in the investable landscape, this will remain so. Bitcoin is a black hole on the world's balance sheet.

Mitch Klee: "Currently 0.22%. LESS THAN 1% ADOPTION. Currently, a 2 trillion dollar asset and its total addressable market for SOV is $900 trillion. Since Bitcoin is both valued in USD and a monetary network, it's best to measure adoption in total market capitalization. Bitcoin is still very young, released in 2009. Layer 2s are still being built. As a monetary network, there is much work to be done if we want to support billions of people. But Flywheels are strong. I don't think anyone realizes how early we are. We've just tapped the surface of development for multiple layer 2s. (The internet has 7) As more adoption happens, more money for development feeds into the flywheel."

It's not too late to take Bitcoin seriously. Need proof? Just look at the Bitcoiners: they keep buying. You didn't "miss out" on Bitcoin; you just weren't here from the beginning. But you can still be early today.

➡️Long-Term Holder supply dropped by 100k Bitcoin over the past 24 hours. 100k BTC. No wonder we went down to $117k.

➡️$400B banking giant Standard Chartered has officially launched Bitcoin and crypto trading for institutional clients.

➡️Bitcoin just recorded its highest daily candle close ever: $119,135.

New all-time high.

➡️Cantor Fitzgerald close to $4 billion SPAC deal with Adam Back "to buy billions of dollars" of Bitcoin.

➡️ECB: Applications for the design contest for our future banknotes are now open! Are you a graphic designer residing in the EU? Submit your application by noon CET on 18 August.

"The new designs for the future EU banknotes are in, beautifully fitting the given assigned theme of 'European culture". Which one is your favorite?" - Bitsaga

Foto credit: Michaël Roerade

x.com/ecb/status/1945076445732123051

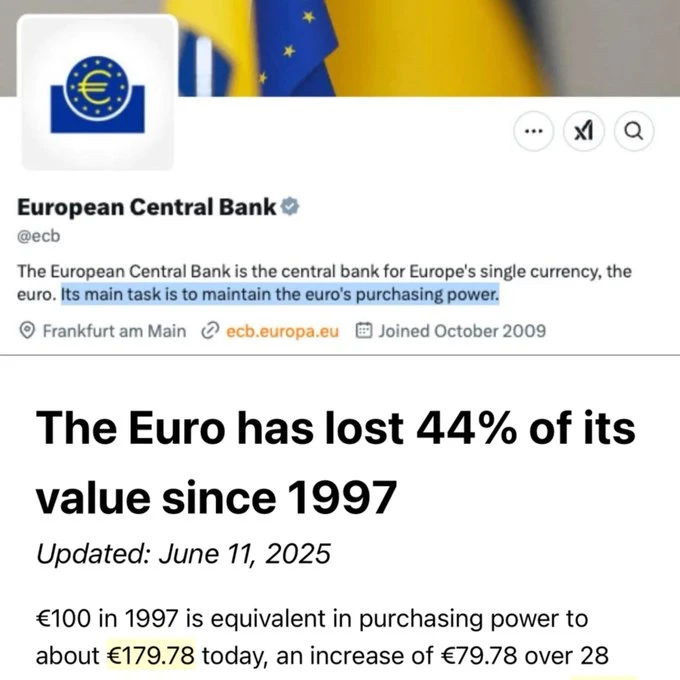

Look at the comments, gotta love it! The ECB has one main task: to maintain the euro's purchasing power.

Anyway, got Bitcoin?

➡️Retail investors are buying more Bitcoin than miners can produce. Shrimps, Crabs, and Fish are stacking 19,300 BTC/month while miners only release 13,400. This quiet supply crunch is fueling Bitcoin’s run to new ATHs.

➡️Bitcoin’s MVRV z-score is still well below historical top levels. Plenty of room to run.

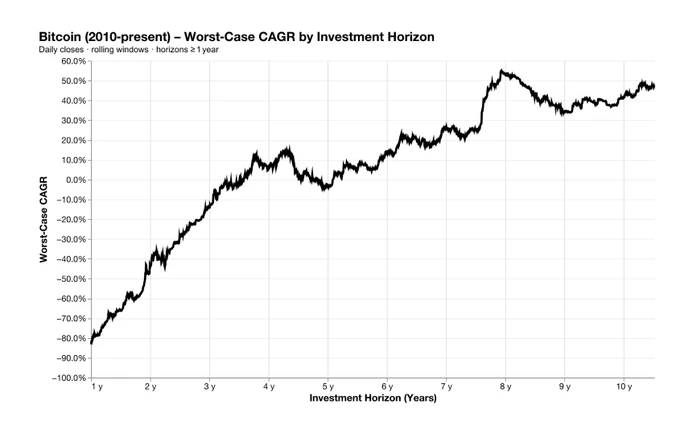

➡️Pierre Rochard: "You have to hold BTC longer than 5 years to be guaranteed a CAGR > 0%, according to the historical worst-case scenario. Longer than 6 years for >20% Bitcoin CAGR. Bitcoin is long-term savings technology."

On the 16th of July:

➡️ US Marshals reveal the government now only holds 28,988 Bitcoin worth $3.4 billion, instead of the estimated ~200,000 BTC.

If true, this is a total strategic blunder and sets the United States back years in the Bitcoin race. The Biden Administration sold 170,000 BTC, and the Trump administration is finding out about it now…? The USA has 29k BTC left. They will not be the leading Bitcoin country anymore if they don’t change that quickly.

If the Bitcoin Act passes, the government will be buying 1 MILLION Bitcoins on the spot market!

More on the nation-state Bitcoin Race:

➡️Daniel Batten:

A tale of 2 countries:

In 2018, Bulgaria sold 213,500 BTC for "state expenditures", including buying a squadron of military planes. The bitcoin sold is now worth 79% of Bulgaria's public debt. They could have been almost debt-free.

But they chose to increase debt burdens in return for depreciating relics of the industrial-military complex.

Meanwhile, Bhutan, around the same time, started mining Bitcoin. It's now worth 50% of their GDP, and they just put up salaries of govt workers by 50-65%. Be like Bhutan, not Bulgaria.

➡️US potentially sold its Bitcoin? Bitcoin doesn’t care.

Crypto Bills stalled in Congress? Bitcoin doesn’t care.

War in the Middle East? Bitcoin doesn’t care.

➡️House will pass all three Bitcoin and crypto bills (Genius Act, Clarity Act, and Anti-CBDC Act) over the next two days

On the 17th of July:

➡️Convano Inc (6574.T), a Japanese nail salon operator, has officially launched its Bitcoin treasury strategy and plans to purchase JPY 400 million (~$2.7 million) worth of BTC within July. The company established a dedicated “Bitcoin Strategy Office,” led by Director Taiyo Azuma.

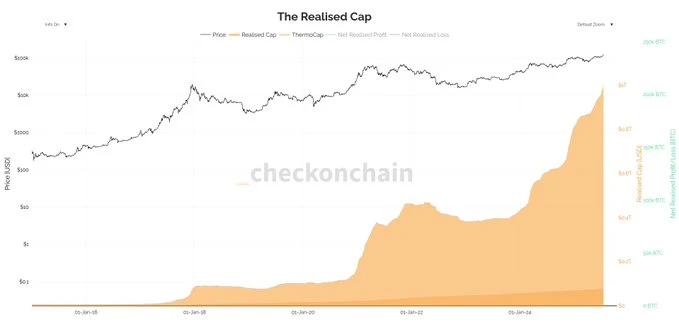

➡️Checkmate: The Bitcoin Realised Cap just hit $1 trillion. This is the ultimate metric for adoption, as it captures the wealth and capital saved in BTC. A massive milestone.

➡️'Trump is preparing to open the $9 trillion US retirement market to crypto, gold, and private equity. An executive order expected this week would allow 401(k) plans to include alternative assets, marking a major shift in how Americans can invest their savings.' -Bitcoin News

Americans hold $9 trillion in 401K savings.

On the 18th of July:

➡️TOM LEE: "Bitcoin has become a $2 trillion asset. Never in financial history has anything reached $2 trillion and disappeared."

➡️ A Satoshi‑era whale just moved 80,000 BTC (~$9.5 B) to Galaxy Digital after 14 years of dormancy. Diamond hands! And yes, that is some sellside pressure.

➡️'French lawmakers propose a five-year trial to let energy producers use surplus nuclear power for Bitcoin mining, aiming to reduce waste and increase revenue.' - Bitcoin News

➡️President Trump will sign the first-ever digital asset bill into law today (Genius Stablecoin Act), A historic moment for crypto regulation. Trump says Bitcoin could be the greatest revolution in financial technology since the internet itself.

But make no mistake, and I will quote Parker Lewis:

"This bill is about regulatory capture, not innovation, and the fact that this was prioritized over Bitcoin tells you Washington is still controlled by special interests. There is a great quote from Bull Durham, "you couldn't hit water if you fell out of a fucking boat!"

The Genius Act forces every legal “digital dollar” through state-approved issuers under full government control. Ergo: CBDC

➡️Chris Larsen has dumped 9 figures worth of XRP this year alone. Satoshi is still sitting on $115B.

Something to ponder on...

Alex Gladstein:

"If you invested $10k into XRP on January 4, 2018, 7.5 years ago, you’d have… about $10k. Not even outpacing inflation. If you invested $10k in BTC on the same day, you’d have $75k Be careful out there…"

➡️Semler Scientific purchases 210 BTC ($25M), increasing its holdings to 4,846 BTC ($577.9M), per SEC filing.

These 6 members of the Bitcoin for Corporations have collectively added 5,643.5 BTC to their corporate treasuries.

➡️ Bitcoin has entered the "ignition phase" of a bull market, where price momentum builds before significant gains, per analytics platform Bitcoin Vector.

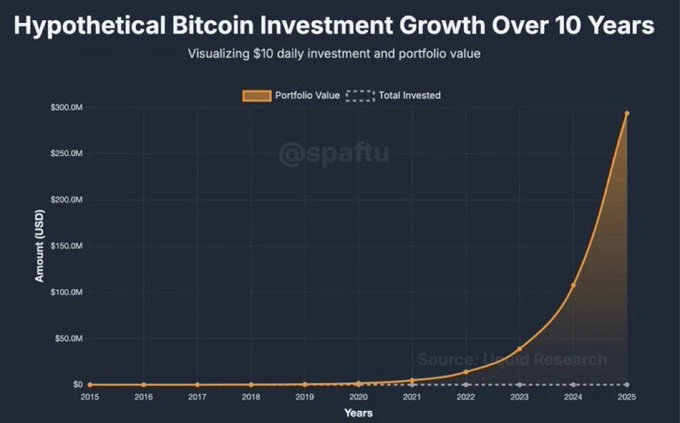

➡️People say BTC is too volatile and risky:

• Last year: up 87%

• Last 2 years: up 300%

• Last 5 years: up 1,200%

• Last 10 years: up 43,500%

➡️

James Lavish: "Or, said another way, gold has been around for thousands of years, yet Bitcoin has only been around for 15 and is already worth 10% of gold's total value."

➡️Legendary Nostr developer Pablof7z is working on a native iOS Cashu wallet that synchronizes your Ecash across devices and makes backups using Nostr. Enter your nsec, and your money appears!

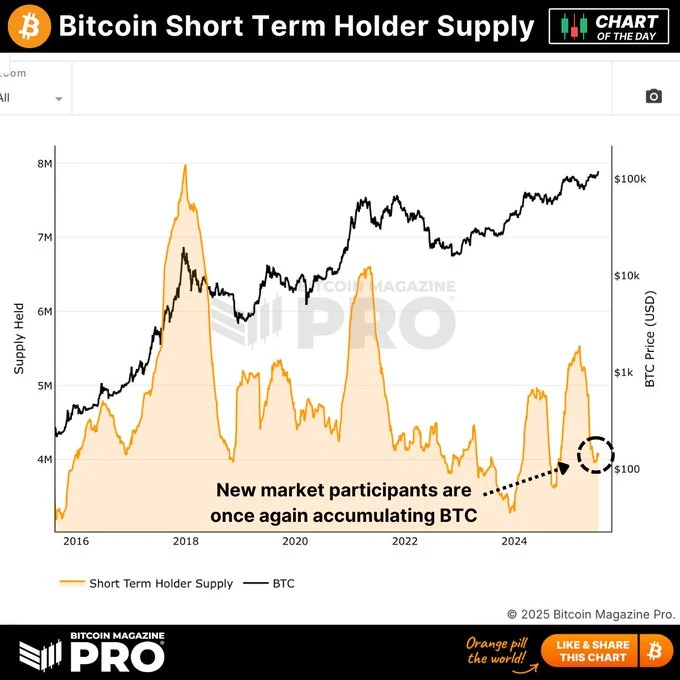

➡️"We're now seeing the supply of BTC held by short-term holders once again begin increasing, indicating new market participants are once again accumulating Bitcoin! Is this the start of retail FOMO?" - Bitcoin Magazin Pro

➡️Jack Dorsey's Block to join the S&P 500 on July 23rd. They hold 8,584 Bitcoin on their balance sheet

On the 19th of July:

➡️Michael Saylor's STRATEGY now holds $71 BILLION in Bitcoin, ranking #9 among all S&P 500 treasuries. They’ve leapfrogged Exxon, NVIDIA, PayPal, and CVS...with only Bitcoin.

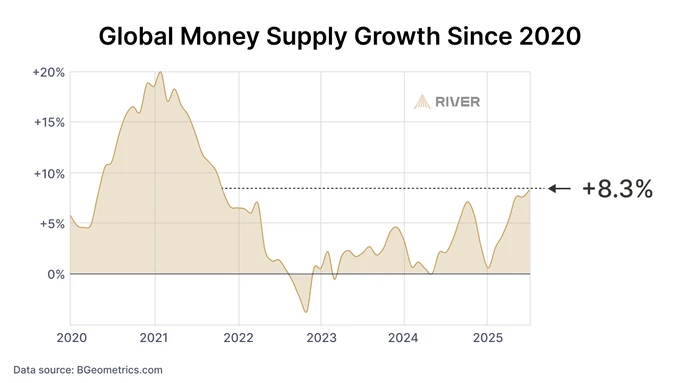

➡️Bitcoin now has the highest correlation with global money supply at 0.51. More than gold (0.50), S&P 500 (0.45), or bonds (0.15).

➡️'Bitcoin’s Realized Cap has topped $1 trillion for the first time ever, with 25% of that added in 2025 alone. Unlike market cap, Realized Cap values each coin at its last moved price, offering a clearer view of actual investor inflows.' - Bitcoin News

On the 20th of July:

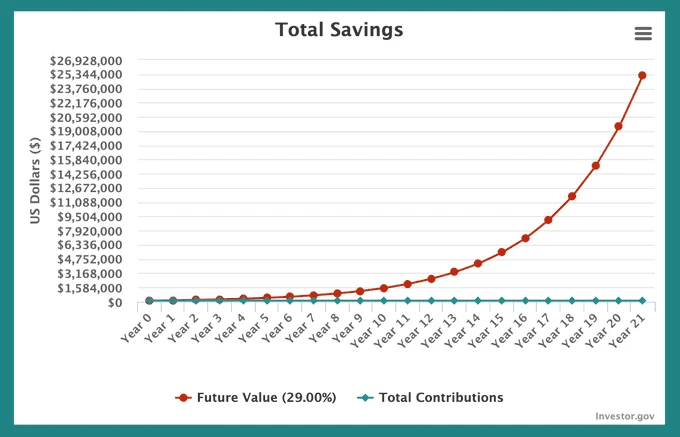

➡️ $120K investment in Bitcoin growing at 29% CAGR will become $25M in 21 years. And all you have to do is buy and HODL.

Bitcoin's historical CAGR from its first traded price of $0.003 in March 2010 to ~$118,000 today (July 20, 2025) is approximately 213% over 15.33 years. That's indeed much higher than 29%. Future returns may vary, but the track record is impressive. HODL wisely.

P.S...: the 29% is from Saylors' 24 model.

➡️Saylor says he’ll be buying the top forever for a reason. Even if you bought 1 BTC at the top of every cycle, you’d have turned $90,000 into $470,000. A 420% gain by being consistently wrong with the worst timing imaginable.

➡️UK may sell over £5 billion worth of seized Bitcoin - The Telegraph Chancellor Rachel Reeves may sell £5B+ in BTC seized from a 2018 Chinese Ponzi scheme — including 61,000 Bitcoin. The Home Office is building a framework to liquidate the stash and plug a fiscal gap. The Westminster class are dinosaurs who don’t get the future. The UK should be implementing Reform’s Crypto Bill and increasing its Bitcoin reserves.

I'm sure they won't regret it. Just ask Deutschland!

The 61,250 Bitcoin, reportedly to be sold by the UK according to The Telegraph, were seized from Jian Wen and associates in a 2018 Chinese fraud case and remain legally contested. Chinese authorities and victims demand their return, and no sale can occur until the legal process is resolved, per Bitcoin journalist DecentraSuze

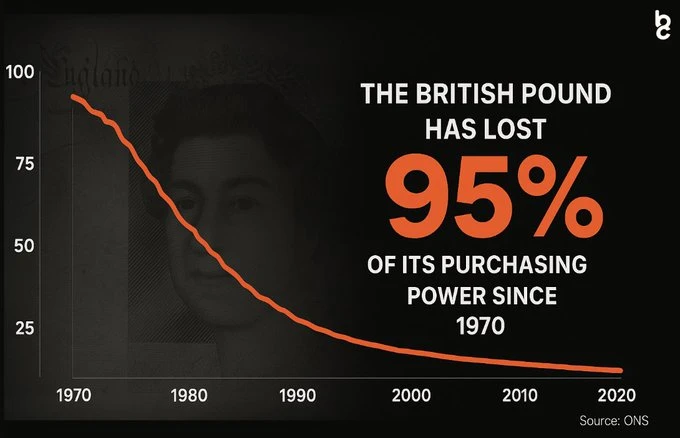

Anyway, the British Pound has lost 95% of its purchasing power since 1970. You might want to hodl them bitties!

➡️74% of all Bitcoin is now held by long-term holders, a 15-year high. Nobody’s selling.

➡️On July 15, miners sent 16,000 BTC to exchanges, the largest single-day outflow since April, signaling they may be cashing in on recent gains. Such a supply surge could be putting short-term pressure on Bitcoin’s rally.

➡️Grok4 just updated long-term BTC targets:

• 2025: $175,000

• 2030: $950,000

• 2040: $7,200,000

• 2050: $34,000,000

Endgame? Bitcoin replaces nation-state treasuries.

On the 21st of July:

➡️The President of the United States is posting Bitcoin Twitter classics on social media. We are in a new era of adoption.

x.com/DocumentingBTC/status/1947263212602183857

➡️Bitcoin Archive: "Trump Media has accumulated $2 BILLION in Bitcoin and Bitcoin-related securities. Trump Media plans to continue acquiring Bitcoin and to convert its options into spot Bitcoin."

The President of the world's largest economy posted a video of Peter van Valkenburgh, Director at Coincenter, explaining Bitcoin and announced a $2B Bitcoin purchase. Probably nothing.

➡️River: We're seeing the fastest money supply growth in years. If you held Bitcoin over the past year, you outperformed money debasement by 10x.

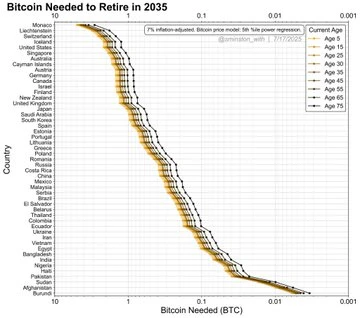

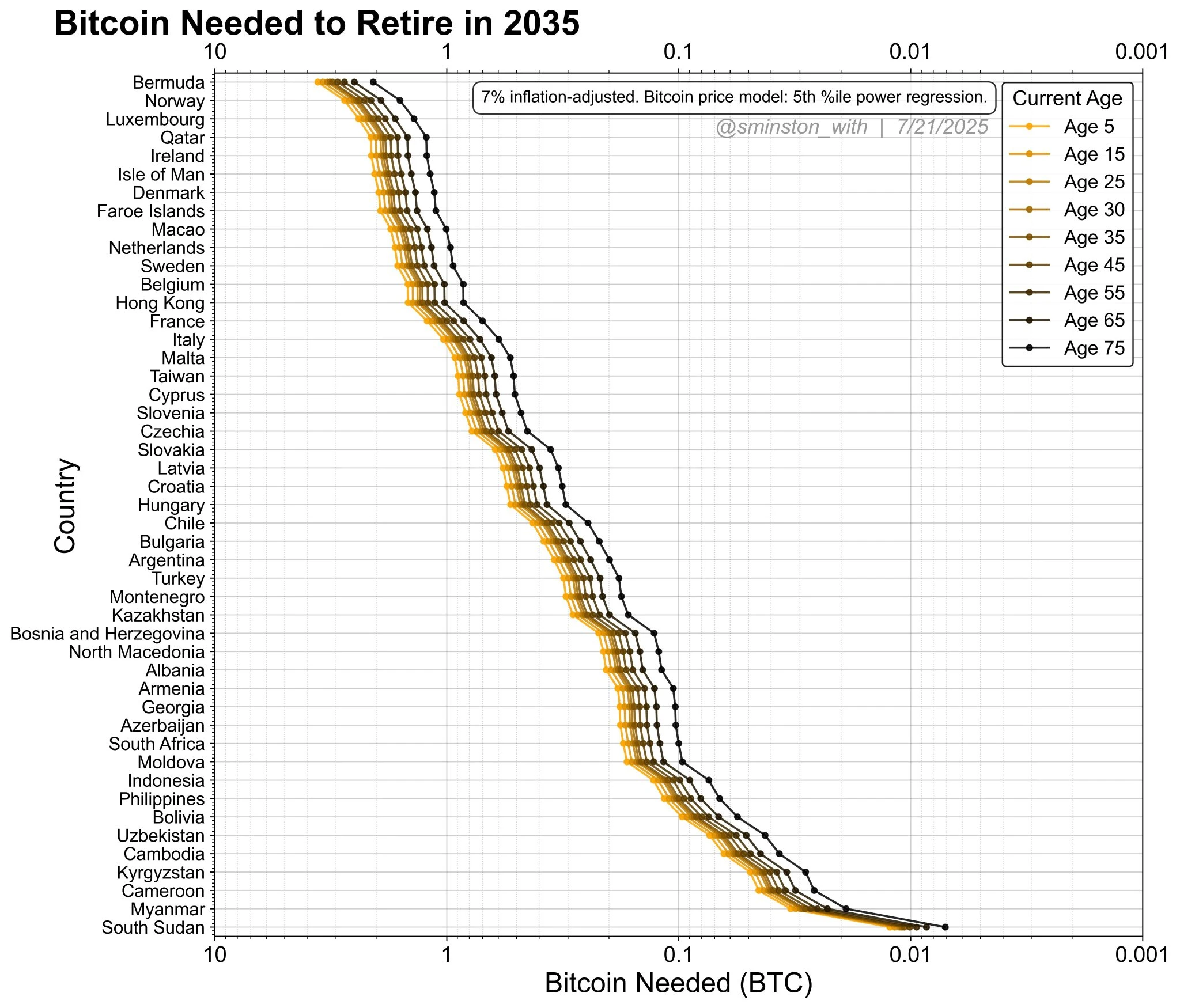

➡️Sminston with: "Average 2035 BTC Retirement by country, 2 easy-to-read plots:"

Most people on Earth will need less than 1 Bitcoin to retire by 2035, but the gap by country is massive.

Big assumption #1: 7% annual M2 expansion (inflation) rate. Will add error, thus will be updated in a future version.

Big assumption #2: Annual expenses are based on each country's average annual income (in USD). Data source: worlddata.info

➡️Genius Group increases its Bitcoin treasury to 200 BTC. They aim to reach 1,000 BTC by the end of 2025 and 10,000 BTC within 24 months.

➡️Sequans has just purchased an additional 1,264 Bitcoin for $150 million. They now hold 2,317 BTC worth $273.2 million.

➡️Strategy has acquired 6,220 BTC for ~$739.8 million at ~$118,940 per bitcoin and has achieved BTC Yield of 20.8% YTD 2025. As of 7/20/2025, we hodl 607,770 Bitcoin acquired for ~$43.61 billion at ~$71,756 per Bitcoin.

➡️Global Bitcoin Mining Hashrate Increases Above 900,000,000,000,000,000,000x Per Second

💸Traditional Finance / Macro:

On the 18th of July

👉🏽Honda announces a 30% increase in motorcycle production in Argentina

🏦Banks:

👉🏽No news

🌎Macro/Geopolitics:

On the 14th of July:

👉🏽President Milei has raised the tax threshold for self-employed individuals from $6,300 to $75,000 annually, potentially representing the largest tax cut in decades! This boost for small businesses aligns with his push for deregulation.

👉🏽Germany: The citizen fund distributed (earned by the citizens of Germany) goes to 47.8% to foreigners!

Shocking: More than 80 percent of welfare recipients in Germany are either foreigners or have a migration background. As Denmark has rightly understood, this sooner or later means the end of the welfare state as we know it."

"The citizens' benefit in #Germany is primarily a 'migrant benefit'. It's similar in Austria. Anyone who wants to end the exploitation of the welfare state must either push for remigration or drastically roll back the welfare state, since locals hardly need it anyway!"

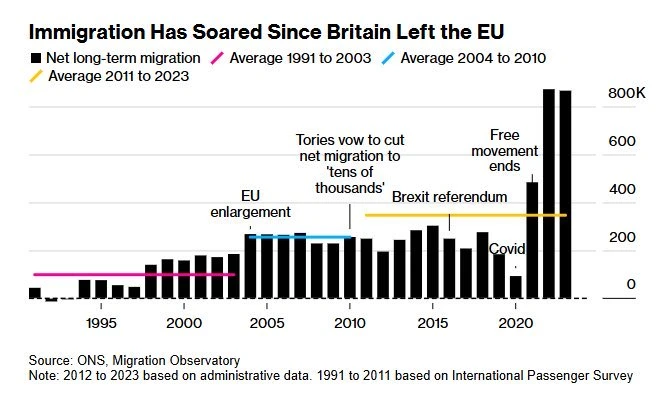

👉🏽Michael A. Arouet: 'Isn’t it ironic that many voted for Brexit to reduce immigration? How did this happen?'

👉🏽EU pitch for tougher climate action gets short shrift in Beijing “Together, we can write a success story,” said EU top official Teresa Ribera at the start of the sixth high-level climate and environment dialogue in Beijing. Source: www.euractiv.com/section/eet/news/eu-pitch-for-tougher-climate-action-gets-short-shrift-in-beijing

On the 15th of July:

👉🏽'The Bank of Japan currently has a policy rate of 0.50% and Japan has a Debt-to-GDP ratio of 250%+. Meanwhile, Germany has a policy rate of 2.25% (4.5x higher) and a Debt-to-GDP ratio of just 62% (1/4 of Japan's). However, 30Y Government Bonds in Germany and Japan both yield ~3.2%. If you think Japanese bond yields are high, the market says we are just getting started.' -TKL

More on bonds:

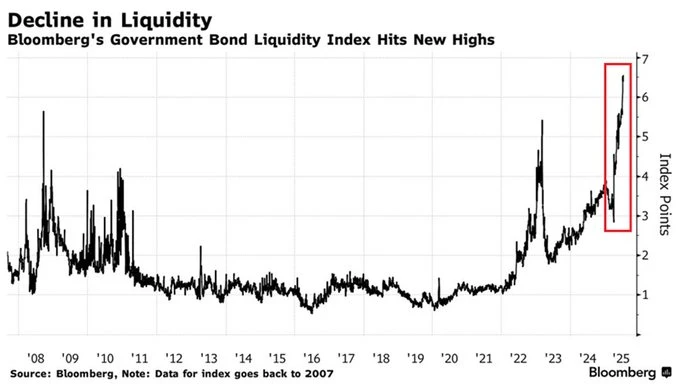

👉🏽Government bond liquidity has never been worse: The Bloomberg Government Bond Liquidity Index hit a record 6.5 points on Monday. A higher reading in this index means LESS liquidity for global bond markets. The index has DOUBLED over the last several months, as government spending surged in the US and Japan. This means liquidity is now worse than during the 2008 Financial Crisis. As a result, long-term government bonds are selling off, with Japan’s 30Y bond yield hitting 3.15%, the second-highest level since its debut in 1999. At the same time, the 30Y Treasury yield is approaching 5.00% for the first time since May.

👉🏽June CPI inflation rises to 2.7%, above expectations of 2.6%. Core CPI inflation rises to 2.9%, below expectations of 3.0%. CPI inflation in the US is now up for 2 straight months for the first time since January 2025. The Fed pause will continue.

👉🏽Netherlands: "ING economist Marieke Blom: 'The Netherlands could also benefit from lower costs with eurobonds'"

The interest rate on government debt is only partly determined by national finances; it's largely dependent on market depth. See, for example, Switzerland, the U.S., or the Netherlands.

Wealth taxes can be raised, as people with assets have benefited significantly.

In short, the economist wants to borrow more, take on more debt, and live on credit. "Nothing new under the sun."

Let’s take on joint debts worth billions with countries known for their financial unreliability. What could go wrong?

The future of the Netherlands and the EU must not be left out of the upcoming election campaign. There are three alternatives:

Continue down the path of further federalization A Dutch exit (Nexit) Reform the EU into a flexible alliance of sovereign states."

Why is that necessary?

👉🏽Well, here you go:

"The current multiannual budget of the European Union amounts to €1,200 billion. Brussels now wants hundreds of billions more for the period after 2028. "This week, she unveiled an ambitious plan: new EU taxes, €400 billion in eurobonds, and a €2 trillion budget."

EU chief Ursula von der Leyen calls it ‘the most ambitious budget ever.’ The President of the European Commission wants to allocate significantly more funds for defense and the economy.

‘We want to triple the budget for border control and migration,’ said Von der Leyen."

Source: archive.ph/PGZgS#selection-339.0-349.91

This European Commission is megalomaniacal and is endangering European cooperation with exactly these kinds of plans!

The Netherlands must say NO!

The EU and a fair Dutch contribution should be a major theme in the upcoming elections.

Which party will pick up the mantle?!"

To make it even worse: 👉🏽The EU wants to decrypt everyone's private data by 2030 to ensure that law enforcement has "lawful and effective" access to data:

The EU Commission presented a Roadmap on how it intends to ensure that law enforcement has effective and lawful access to citizens' data. Politicians seek to establish a precedent for the decryption of private data. The Roadmap is part of the ProtectEU strategy, first unveiled in April 2025

Source: www.techradar.com/vpn/vpn-privacy-security/the-eu-wants-to-decrypt-your-private-data-by-2030

Anyway, got Bitcoin?

On the 17th of July:

👉🏽Keir Starmer announces that the UK is lowering the voting age from 18 to 16 in all UK elections.

Take a wild guess why he is doing this. Teenagers will be mercilessly propagandized and politicized. What a disaster. Socialism, for example, voting for Starmer or Corbyn, makes sense when your brain isn’t fully developed.

If you are wondering why they did this, only 55% of children born in 2023 were White British, 31.8% of live births were to non-UK-born mothers, and 37.3% of live births were to parents where at least one was born outside the UK. Pretty obvious.

Someone on X, Nivolo Inocenti: "Meaning, there has to be a revolution before Gen Alpha comes of voting age. The oldest Gen Alpha (2013 born) would be 16 in 2 years. I hope you all understand what I'm implying here. Voting will not save Britain, or the West."

👉🏽"Chinese gold demand is skyrocketing: Chinese gold ETF demand hit a record 45 tonnes in Q2 2025, up from 18 tonnes in Q1. This brings the total H1 2025 demand to 63 tonnes, an all-time high. As a result, total ETF holdings jumped +74% YoY to 200 tonnes. Meanwhile, China’s central bank added +2 tonnes in June, lifting official reserves to a record 2,299 tonnes. Furthermore, Goldman Sachs estimates that China unofficially bought 15 tonnes in May on the London market, 8 times the officially reported figure. China’s appetite for gold has never been stronger." TKL

Meanwhile, Russia is to begin trading gold on the St. Petersburg exchange. Russia is about to launch its own gold trading platform, completely independent of the London Stock Exchange and the LBMA — effectively severing its gold pricing from the Western financial cartel. This is a direct shot at the heart of the global financial order! Are China and Russia the only two countries with gold left to back their currency?

On the 18th of July:

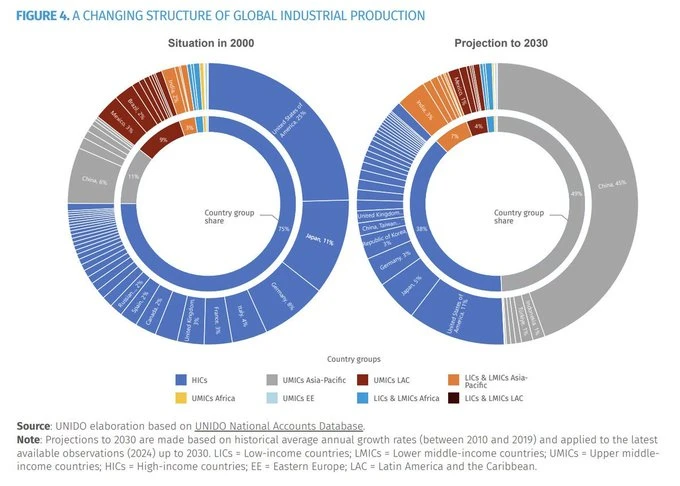

👉🏽In 2000, China accounted for 6% of global manufacturing. In 2030, China is projected to account for 45% of global manufacturing. This kind of shift is unprecedented in the modern world economy.

👉🏽TKL: Foreign investor holdings of US Treasuries jumped +$32.4 billion in May, to $9.05 TRILLION, the second-highest on record. The increase almost fully reversed April’s decline of -$36.0 billion.

Foreigners now own 31.7% of the US Treasury market, the highest share since June 2022. Canada was the biggest buyer, adding a net $65.8 billion and bringing its total holdings to a record $430 billion.

Japan, the largest holder, increased its holdings by ~$500 million, to $1.14 trillion, the highest since March 2024. The second-largest, the UK, bought $1.7 billion, lifting its holdings to a record $809.4 billion.

Meanwhile, China’s stockpile, the third-largest, declined $900 million, to $756.3 billion, the lowest since January 2009.

Keep watching the bond market."

👉🏽Economic suicide dressed in eco-virtue:

The EU is now promising to cut carbon emissions by 90% in just 15 years. The cost by mid-century could be more than $3 trillion every year, more than all current public spending in the EU.

nypost.com/2025/07/17/opinion/europe-is-committing-economic-suicide-with-climate-change-cult

👉🏽Serbia’s Foreign Minister indicates a plan to address its ageing population, with a “labor mobility agreement” issuing 100,000 work permits, with Ghana’s Foreign Minister aiming to send “thousands of our young people to work in Serbia.”

Oh boy! Yes, 23% unemployment among youth, yet they want to import over 100,000 people PER year into a tiny country. That will displace and replace the locals literally overnight.

Serbia’s youth population (age 15-29) is 16% of Serbia's population, or 1.08 million. Serbia’s youth unemployment rate is 24.1% Meaning Serbia has ~260,000 young people who already don’t work. Why TF would you import 100,000 MORE young people from a foreign country… That will displace and replace the locals literally overnight. People who don’t speak your language and don’t share your culture?

What could possibly go wrong? It doesn't make any f**ing sense.

Someone on X, @SuperSrb3, "Serbs just spent the entire 1990s fighting and having wars against people that are 99.99999% identical to them, all over national sovereignty and demographics of territory.. Now they are MASS importing people that are the complete Opposite of Serbs in every possible way."

On the 19th of July:

👉🏽Historic Gains for Argentine Workers as Salaries Outgrow Profits as Share of GDP. Saying no to socialism makes your country thrive. It’s simple.

On the 21st of July:

👉🏽Poland discovers the largest oil and gas field in its history near the German border, with 33 million tons of oil and 27 billion cubic meters of natural gas.

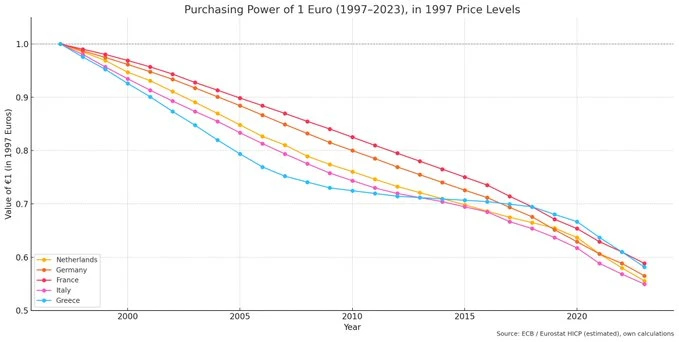

👉🏽Maarten van den Berg: "This is the purchasing power of one 1997 euro over the last 25 years. The Euro is more than a currency. It is a prosperity destroyer."

👉🏽Gold prices surge toward $3,400/oz and are now up +27% year-to-date. Gold and Bitcoin are telling you all you need to know.

🎁If you have made it this far, I would like to give you a little gift:

Jeff Booth | AI, Bitcoin, & The Collapse Of The Fiat Economy

What if the entire economy is built on a lie? Jeff Booth argues that our credit-based system fights the natural deflation of free markets through endless money manipulation, and why Bitcoin creates the first truly global free market. They explore how AI accelerates abundance, why most people are stuck in “Fiatland,” and how Bitcoin adoption will transform everything from housing to global power structures. In this episode:

- Why inflation isn’t natural — and what deflation really means

- How AI and Bitcoin together rewrite the rules of the economy

- The cultural divide between “Fiatland” and Bitcoin

- Why the Global South may leapfrog the West in Bitcoin adoption

- How to prepare for the transition to a Bitcoin economy

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃