🧠Quote(s) of the week:

"Normie: “I don’t trust Bitcoin.”

Also normie:

- – $800 car repair = financial crisis

- – 5% raise = reason to celebrate

- – No assets, just liabilities, and vibes

- – Spends $9/day on coffee

- – Thinks the dollar is money."

Adam Livingston

I truly believe that on a Fiat currency standard, you work 45 years to enjoy 10. On a Bitcoin standard, you work for 10 years to enjoy 45. A compelling contrast, choose your own standards!

🧡Bitcoin news🧡

On the 16th of June:

➡️French lawmakers propose an amendment to integrate Bitcoin mining with France's energy system, using surplus nuclear power.

On the 18th of June:

➡️The Libertarian Party just posted the Bitcoin Genesis Block.

➡️Healthcare firm Prenetics buys $20 million worth of BTC and adopts Bitcoin treasury strategy.

On the 19th of June:

➡️French National Assembly rejects proposal to designate Bitcoin mining as a state activity, utilizing France's surplus energy for government-operated Bitcoin mining.

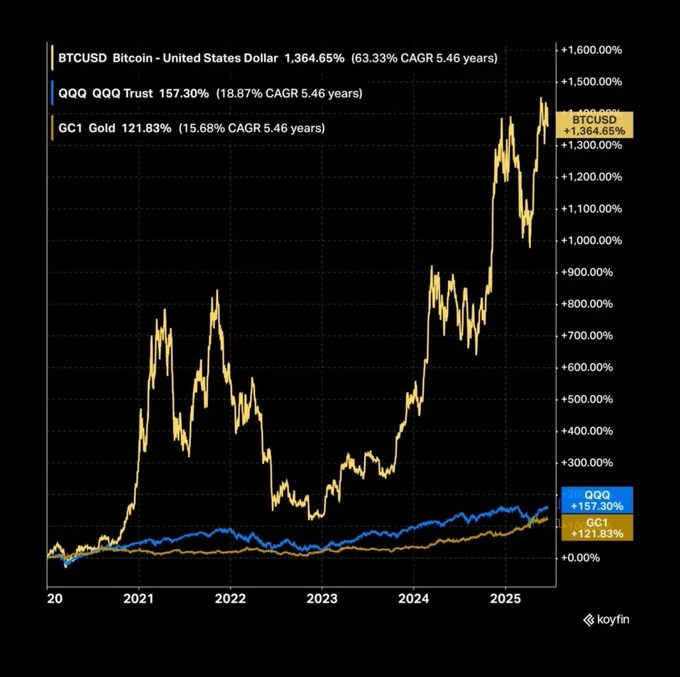

➡️The return of Bitcoin, Nasdaq, and Gold since 2020. There is no second best! - CarlBMenger

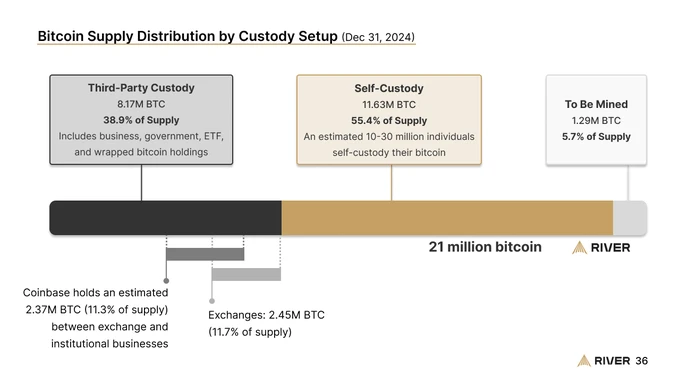

➡️ River: 'An estimated 55% of all bitcoin is held in self-custody. If you’ve never tried, let today be the day when you learn how to do it! Start small and take your first step, check our guide in the post below:

river.com/learn/how-to-get-started-self-custody

It’s actually very simple. You don’t need to buy a fancy wallet. A basic one just works well. Just put some effort, time, and energy into it. The only real protection? Cold storage. Holding your own keys. Because trustless money only works… When you stop trusting exchanges.

➡️The BTC Treasury Holdings of Public Companies has surpassed 830,000 BTC worth over $82 BILLION! How long before we see over 1,000,000 BTC being held on company balance sheets?

➡️Bitcoin has stayed above $100,000 for over 40 consecutive days! Who would have thought that 4 years ago?

➡️Digital asset manager K33 AB announces a direct share issuance to raise at least SEK 85M ($8M) to acquire up to 1K BTC.

➡️$5 billion Cardone Capital acquired another 150 Bitcoin worth $15.6 million

➡️The Smarter Web Company (SWC) bought 104.28 Bitcoin, investing £8.1 million to boost its Bitcoin treasury to 346.63 coins under its 10-year financial vision.

➡️30% of all dollars were created in the last 5 years. Bitcoin is the solution.

➡️91% of Japan’s multi-chain wallet users say they are open to switching to Bitcoin-only mobile wallets if they offer stronger security, according to a new Diamond Hands survey.

➡️Prenetics makes history with a $20 million Bitcoin allocation — becoming the first healthcare company to adopt a corporate BTC strategy.

➡️Banking giant ‘Sberbank’ issues Russia's 1st Bitcoin-backed bonds.

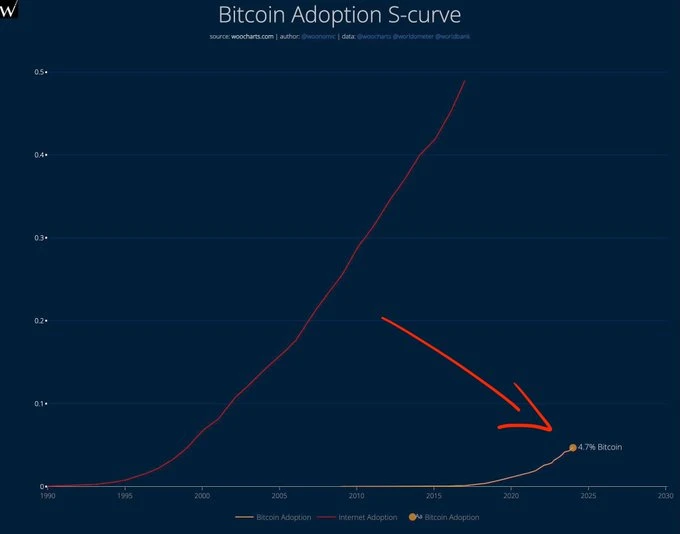

➡️I will keep posting the following chart. Bitcoin is at 4.7% world adoption, the same as Internet Adoption in 1999. We are so early.

➡️Sminston With: "Bitcoin spends roughly half its time in a bubble and half its time crab-crawling. If you separate the two, and you fit the lower half of the data to a power law, the correlation/accuracy is 99.73%. - - - Therefore, if you completely ignore the bubbles and pretend they will never exist again, the BTC price would STILL be slated to hit USD 1M in December 2034. Given that there ARE bubbles, and given that they are clearly less predictable and more poorly understood, expect that we will hit $1M sometime well before this, perhaps years ahead of 2034. $1M any time between 2029 and 2034 seems very reasonable. Don't be cute - keep stacking and realize the next 10 years is a prime window for wealth generation thanks to Bitcoin."

Forget the price tag of $1M, just ignore the bubbles is exactly what everyone should do and just focus on the Bitcoin long cycle.

Even if Bitcoin never entered another bubble again, it would still be on track to hit: $1,000,000 per BTC by December 2034

This is the power of network effects + scarcity + time.

And remember, $1M then is a far cry from $1M now. Most likely 550k-650k in today's dollars, but hard to know for sure.

On the 20th of June:

➡️'Since early 2025, Bitcoin's daily transaction volume has significantly decreased, now ranging between 320K and 500K, down from previous cycle highs, according to data from Glassnode.' -Bitcoin News

➡️Parataxis Korea has entered into a definitive agreement with biotech firm Bridge Biotherapeutics to establish a "Bitcoin-native treasury platform" in South Korea’s public markets.

➡️Norway to temporarily halt Bitcoin mining facilities using the most energy-intensive technologies, per Reuters. Digitalization Minister Karianne Tung says Bitcoin mining uses significant electricity with minimal local economic benefits.

Daniel Batten: Norway’s Temporary Bitcoin Mining Ban: A Step Backward? Norway has announced a temporary ban on Bitcoin mining, citing high energy use and minimal local benefits. But both claims don’t hold up to scrutiny.

In a country powered largely by hydropower, Bitcoin miners actually help balance the grid by using surplus energy that would otherwise be wasted. Their operations have even been rewarded by the government for reducing CO₂—since their waste heat replaces fossil-fuel heating.

As for local benefits? Evidence suggests the opposite of what officials claim. In regions where mining was banned, electricity prices jumped 20%. Miners help stabilize grids, support food independence in a heavily import-reliant nation, and contribute to communities through job creation, workforce training, and even lower property taxes.

Globally, 16 countries have reversed similar bans after recognizing the unintended negative impacts. While much of the world is embracing Bitcoin mining for its grid-stabilizing and decarbonizing potential, Norway appears to be moving in the opposite direction.

Will this ban help Norway? If “help” means higher emissions, wasted renewables, and higher energy prices—then perhaps. Good luck, Norway.'

For more in-depth: x.com/DSBatten/status/1936089808415134033

➡️'Construction progress of the 100-megawatt hydroelectric HIVE bitcoin mine in Yguazú, Paraguay' - Documenting Bitcoin

➡️Kindlymd and Nakamoto announce an additional $51.5 million in pipe financing to support #bitcoin treasury efforts.

On the 22nd of June:

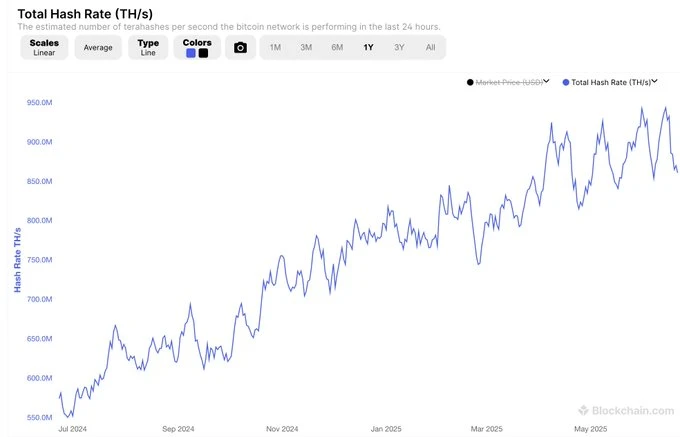

➡️SageM: 'Holy Sh**! The global hash rate dropped like a rock around the same time nuclear sites were bombed by the US. Could it be Iran has nuclear-powered asics as a way to convert energy into Bitcoin under the radar to fund their operations?'

Short answer, No, this is just Texas (ERCOT) curtailment.

Hashrate is down over 37% since Friday. Price is down 7% This is roughly equivalent to a 30% improvement in miner profit margins. A mined Bitcoin got 37% cheaper. A Bitcoin on an exchange got 7% cheaper. Mining gives you exposure to the spread between price and hashrate.

Long answer - Daniel Batten: No this is not because Iran is secretly mining large swathes of Bitcoin using nuclear energy. Firstly, drops like this are common (see chart below) and are more likely due to ERCOT curtailment (being paid to shed load, or getting a price signal it's uneconomical to mine). Second, Iran's one nuclear reactor (Bushehr) has only 1000MW capacity, 5% of the Bitcoin network. Even if they used that 100% for Bitcoin mining, which they do not, and it was rendered 100% inoperable, you'd only see a 50 EH/s drop.

➡️Bitcoin Dominance is at its highest level since January 2021.

➡️Wicked: Current cost basis of daily dca'ers who started saving in bitcoin at each halving...

1st Halving = $398

2nd Halving = $5,125

3rd Halving = $29,397

4th Halving = $76,761

On the 23rd of June:

➡️Publicly traded Panther Metals plans to buy £4 million of Bitcoin for its Treasury.

💸Traditional Finance / Macro:

👉🏽'Global equities SELL SIGNAL has been almost triggered: Institutional investors' cash level as a share of assets fell to 4.2% in May from 4.8% in April. According to the BofA rule, cash allocations at or below 4% historically indicate a “sell signal” for global equities.'

'Institutional investors have been selling US stocks almost every week in 2025: Professional investors sold $4.2 BILLION in US equities in the first week of June. The 4-week average of selling reached $2.0 billion. They continue to dump stocks' -Global Markets Investor

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

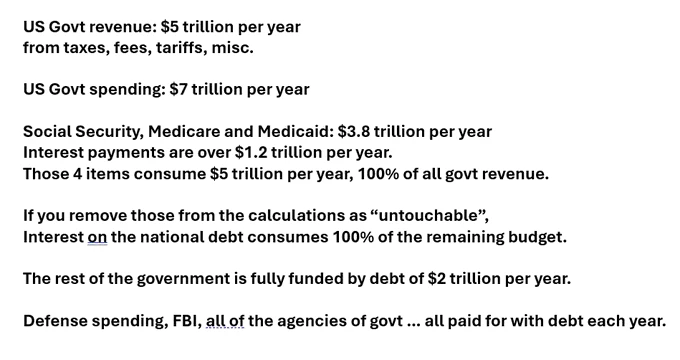

Over the last 10 years, US Federal Government Tax Revenue has increased 60% to over $5 Trillion while Government Spending has increased 97% to over $7 Trillion.

The result: a doubling of the US National Debt from $18 trillion to $36 trillion.

World Debt:

On the 19th of June:

👉🏽16 billion login credentials leaked in the world's largest data breach, affecting Apple, Google, Facebook, Telegram & more. Likely stolen via malware targeting user devices, not company hacks.

Protect yourself by:

• Using strong, unique passwords

• Enabling 2FA

• Using a password manager

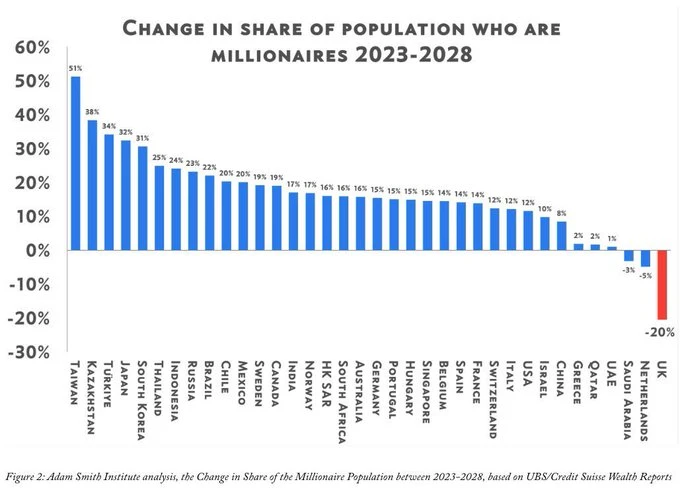

👉🏽Michael A. Arouet: "The UK on its way to become a socialist paradise. The only issue is, under socialism, everyone is equally poor, not equally wealthy."

'Average wealth in Britain fell the second most of any major economy in 2024, according to a closely followed global study, piling fresh scrutiny on the country’s battle to stem an exodus of its wealthiest residents and kickstart its flagging economy. According to UBS’s annual Wealth Report, mean household wealth in Britain fell 3.6 percent over the course of last year, reversing a trend of healthy growth that has seen it swell by over six percent since the start of the decade. The only country that eclipsed the UK households’ wealth drop was crisis-ridden Turkey, which is in the grips of a self-inflicted economic crisis that in 2024 saw inflation top 75 percent and interest rates reach an eye-watering 50 percent. Average wealth in the Eurasian economy fell over 14 percent in real terms, the study said' - City A.M.

source: www.cityam.com/uk-suffers-second-highest-fall-in-wealth-of-any-major-economy-in-2024

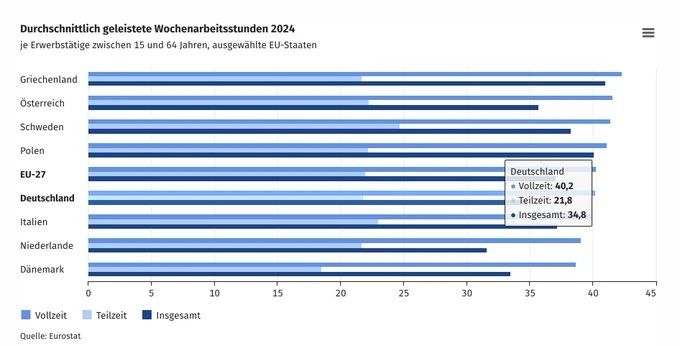

👉🏽'In Germany people work fewer hours than most European neighbors. On avg, Germans work just 34.8 hours per week, well below the EU average of 37.1 hours. The reason? A high number of part-time workers. If you look only at full-time employees, Germans work 40.2 hours per week, almost exactly in line with the EU average of 40.3. In 2024, 29% of working Germans aged 15 to 64 had part-time jobs – a rate only surpassed by the Netherlands (43%) and Austria (31%). The EU average was just 18%.' - Holger Zschaepitz

👉🏽The Swiss National Bank cut its policy rate to 0 % on Thursday, citing easing inflation, a stronger franc, and uncertainty from US trade policy. Money printers across the globe are getting warmed up.

👉🏽EndGame Macro: 'The Bank of Japan—once the world’s most aggressive monetary expander—is now shrinking its bond holdings at a historic pace, with a ¥6.2 trillion drop in Q1 alone.

This marks a fundamental shift in global liquidity dynamics. For decades, the BOJ quietly underpinned the global carry trade, suppressing volatility and enabling leverage through ultra-loose policy. Now, it’s reversing course just as global markets face sustained higher rates and increasing geopolitical capital fragmentation.

The timing is especially striking: despite Japan’s deflationary pressures, the BOJ is tightening. Whether this signals a currency defense, concern over imported inflation, or an exit from long-standing yield curve control, the message is clear—monetary anchors are loosening. And the deeper question looms: if even Japan is stepping back, who will be the buyer of last resort as deficits rise across the U.S., Europe, and emerging markets?'

👉🏽Microsoft is laying off 8,000 people on July 2nd 14,000 jobs are gone in 2 months 30% of Microsoft’s code is now AI-generated. Geoffrey Hinton - Godfather of AI: 2026 is the year we see vast unemployment due to AI.

👉🏽The 2% NATO guideline costs each Dutch taxpayer €1,105 per year. The 5% NATO guideline costs each Dutch taxpayer ~€2,750 per year.

👉🏽'The US economic surprise index dropped to -23 points on Tuesday, the lowest in 9 months. The economic surprise index measures economic data coming in above or below consensus estimates. Outside of 2024, this marks the largest decline in 3 years. This month, industrial production, retail sales, ISM Manufacturing, and Services PMIs have all come in below expectations. Data continues to suggest slowing economic activity in the US.' -TKL

👉🏽The U.S. plans to ease capital rules that require big banks to hold a certain amount of capital against their total leverage exposure. Got Bitcoin?

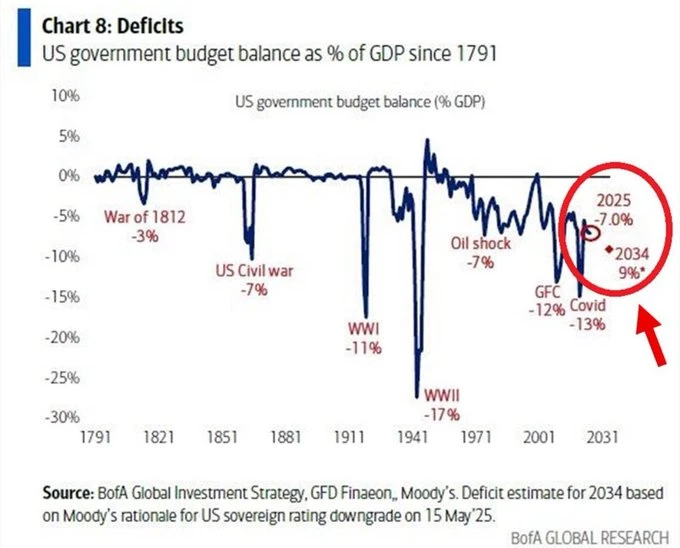

👉🏽US budget deficit to hit 9% of GDP by 2034, a level historically seen only during wars or severe crises. This projection assumes no recession and no lower interest rates. Fiscal insanity is the new normal.

Social Security, Medicare, Medicaid: $3.8 trillion per year

Interest payments: $1.2 trillion per year.

Those 4 items consume $5 trillion per year, 100% of all govt revenue. Everything else the US govt does is paid for with $2 trillion (or more) debt each year.

If a family did this, they’d be broke. D.C. needs a budget and some common sense.

👉🏽The precious metal, gold, made up around 20% of global official reserves at the end of 2024, overtaking the euro’s 16%, the central bank said in a report. Source: WSJ

👉🏽Iran has threatened to close the Strait of Hormuz in response to continued Israeli attacks. Currently, ~20% of global oil and ~30% of global LNG passes through the Strait of Hormuz.

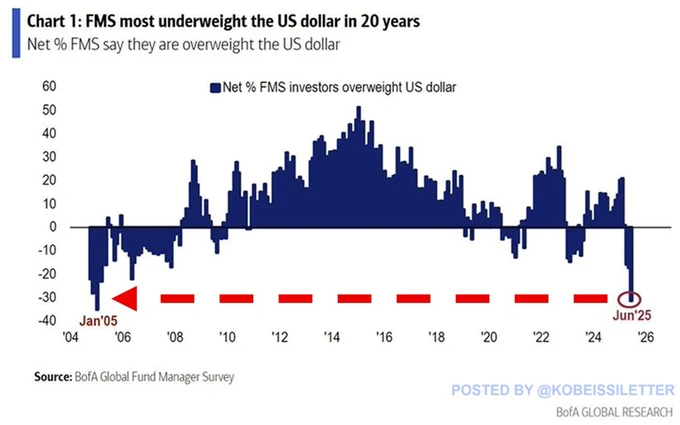

👉🏽' A net 31% of institutional investors are underweight the US Dollar, the most in 20 years, per Bank of America. This has declined by ~52 percentage points over the last 5 months. Furthermore, asset managers and leveraged funds' net positioning on the US Dollar has fallen to near its lowest in 3 years. As a result, the US Dollar index has declined 9% year-to-date, marking its worst performance this century. This puts the US Dollar now on track for its biggest drop in the first half of the year since 1986. The US Dollar is historically unpopular right now.' -TKL

👉🏽Jerome Powell keeping rates at 4.25% after every other central bank has cut them almost to 0%. Trump fuming!

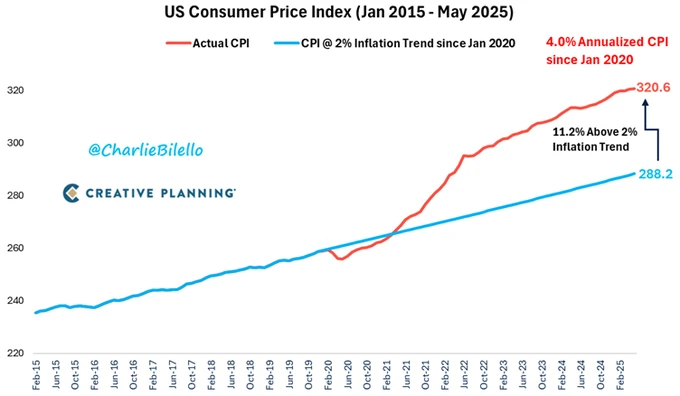

Charlie Bilello: 'Monetary policy should remain tight until the 11% additional inflation we've had since January 2020 above the 2% trendline is erased. There's no point in having an inflation target if you're not going to adhere to it. The Fed should not cut rates at all this year.'

Meanwhile liquidity floodgates open as 3 central banks unexpectedly cut rates in under 24 hours. Source: www.zerohedge.com/economics/liquidity-floodgates-open-3-central-banks-unexpectedly-cut-rates-under-24-hours

👉🏽Zelenskyy: 'I had a productive meeting with Christine @Lagarde, President of the European Central Bank. I’m grateful for her visit and the budgetary support. It is crucial that this assistance continues and helps provide a sense of normalcy for our people, wherever possible, despite the war. We discussed the prospects of using frozen Russian assets to meet Ukraine’s needs, macro-financial stability, cooperation with partners, and European integration. I thanked her for the $50 billion loan provided this year under the G7’s ERA initiative. We are strengthening our coordination with European institutions even further.'

What is she, the president of the ECB — you know, the one responsible for monetary policy — doing there!? For fuck sake! The president of the “independent” ECB should refrain from political statements and actions. But we’ve seen for some time now that the ECB has effectively become an extension of the Brussels bureaucracy.

On the 20th of June:

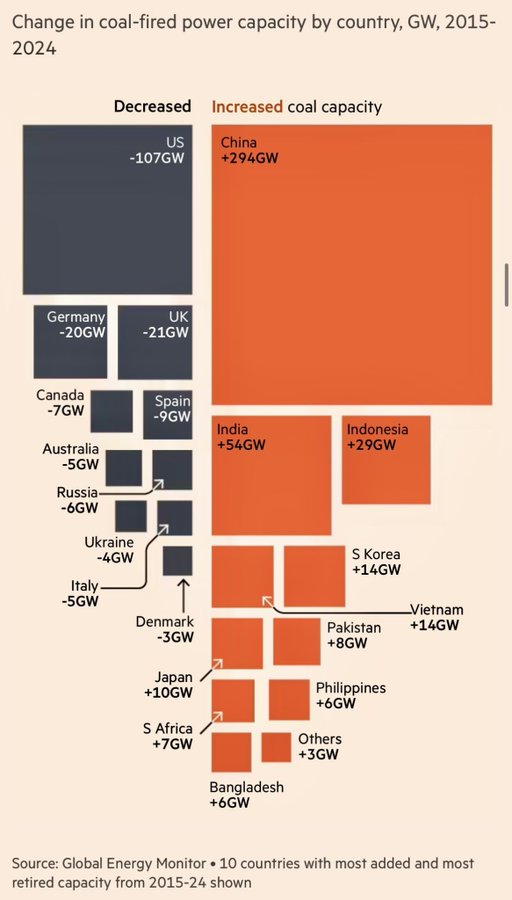

👉🏽How is the energy transition going?

👉🏽'Shocking stat of the day: Annual interest expense on US debt has reached $1.2 TRILLION over the last 12 months. In other words, the US is now paying $3.3 BILLION in interest per day. Annual interest expense has now surpassed health and defense expenditures by ~$300 billion. Interest costs are also now the second-largest government expense, just ~$300 billion below Social Security. As a result, interest payments reflect ~18% of all taxes paid, just shy of a record 19% seen in the 1980s when interest rates were as high as 19%. Interest on federal debt is our biggest crisis.' -TKL

👉'US Home Prices have increased 94% over the past ten years, more than double the increase in US wages. This is the most unaffordable housing market in history.' - Charlie Bilello

🎁If you have made it this far, I would like to give you a little gift:

Lyn Aldens June 2025 newsletter is now available, and focuses on 3 misconceptions about US debt and deficits:

www.lynalden.com/june-2025-newsletter

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃