🧠Quote(s) of the week:

Adam Livingston:

"Most people think Bitcoiners are delusional. In truth, we're time travelers.

Inhabiting a future where capital is unconfiscatable, monetary policy is immutable, and time is no longer for sale. Satoshi pulled the future forward.

We see the cracks in Fiat not because we're paranoid, but because we’ve read the footnotes of history and decided not to take part in the same timeline. We see inflation not as “temporary,” but as structural violence against the productive class.

We know wars aren’t funded by votes, they’re funded by printing presses. We understand that assets don't go up... currencies go down. While others budget for retirement, we budget for sovereignty. We're ahead of the curve, charting our own path and writing our own version of history."

I have shared the following numerous times. Plus, ffs, forget about the price or price targets. If you understand this, you’re halfway there and heading the right way…: dergigi.com/2021/01/14/bitcoin-is-time

And remember, although we can have a low time preference, we still only get this life once. Find the right balance between stacking sats for the future while also spending to live a worthwhile life now. Time is scarce.

🧡Bitcoin news🧡

"If you're taking out loans to buy Bitcoin or using loans to delay selling Bitcoin, you're essentially running a personal Bitcoin treasury company." - Jimmy Song

Congrats, you're now the CFO of your own Bitcoin treasury company, except the loan terms are not as good. It's better and easier to just stay humble and stack sats.

On the 23rd of June:

➡️Norway’s Green Minerals adopts Bitcoin treasury strategy and scoops up $1.2b worth of $BTC.

➡️'80% of cryptocurrency sent to Iran comes from "global exchanges," says TRM. Not "DeFi". Not "unhosted wallets." So, how do Iranians circumvent compliance? By signing up with fake IDs. And where do you get a fake ID? From hacked KYC databases. AML is nonsense.' -L0laL33tz

➡️Bitcoin Magazine: Senator Cynthia Lummis & former Congressman Mike Rogers said we must pass an "exemption to allow Americans to use Bitcoin for small everyday purchases without triggering burdensome tax reporting."

➡️Texas to purchase $10M worth of Bitcoin for a state reserve. This is the start of game theory! Source: Coindesk

➡️Strategy has acquired 245 BTC for ~$26.0 million at ~$105,856 per bitcoin and has achieved BTC Yield of 19.2% YTD 2025. As of 6/22/2025, we hodl 592,345 Bitcoin acquired for ~$41.87 billion at ~$70,681 per Bitcoin.

➡️The Blockchain Group confirms the acquisition of 75 BTC for ~€6.9 million, the holding of a total of 1,728 BTC, and a BTC Yield of 1,231.7% YTD Press Release: t.co/GYy0u4AxZ7

On top of that, the Blockchain Group announced a capital increase totalling ~€4.1 million at an average price of ~€5.085 per share as part of its “ATM-type” capital increase program with TOBAM to pursue its Bitcoin Treasury Company.

On the 24th of June:

➡️Japan’s Financial Services Agency proposed to bring crypto assets under the Financial Instruments and Exchange Act. This could legalise Bitcoin ETFs and cut tax on crypto gains.

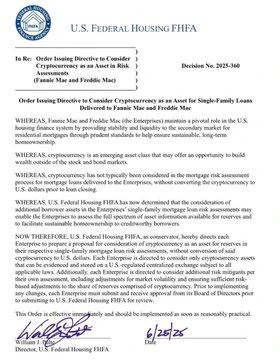

➡️US govt to look into allowing Bitcoin and crypto holdings to be considered when assessing mortgage finance eligibility - US Director of Housing

➡️'Metaplanet approves a $5B capital contribution to its Florida-based U.S. subsidiary, Metaplanet Treasury Corp, to accelerate the “555 Million Plan,” supporting Metaplanet’s goal of acquiring 210,000 bitcoin by the end of 2027.' - Bitcoin News

➡️Belgravia Hartford Announces 100% Bitcoin Directed CAD 10M ($7.29 million) Private Placement Financing to Accelerate Growth of Bitcoin Treasury Holdings

➡️Anthony Pompliano: 'I announced a $750 million fundraise this morning as part of a $1 billion merger. The goal is to build a leading bitcoin-native financial services firm.' As mentioned in one of my previous recaps, this is the same guy who tried to get you on that BlockFi rocketshit..

Pledditor: "The guy who came out of nowhere last cycle to peddle referral links and bought the top in BlockFi and FTX's venture rounds now wants to become your money manager. It's a rocketship, bro! Get on board~~"

➡️The Federal Reserve to scrap "reputational risk" as a component of bank exams. No more de-banking for holding Bitcoin or having the "wrong" opinions.

➡️Bitcoin News: 'Leading Land Rover and Jaguar restoration company ECD Automotive Design, Inc. has secured a $500M equity facility with ECDA Bitcoin Treasury LLC to support ECD’s Bitcoin treasury strategy.'

➡️The Smarter Web Company purchased 196.9 BTC and now has a total of 543.52 BTC.

➡️Panther Metals announces that they purchased their very first 1 BTC. One more Bitcoin Treasury to add to the list.

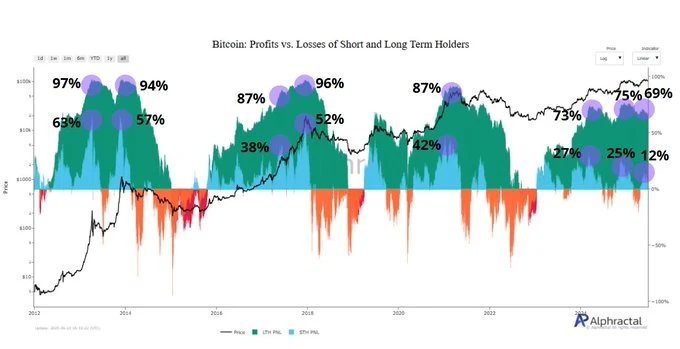

➡️In past Bitcoin cycles, long-term and short-term holders profited, with STHs capturing up to 63% of gains. This cycle, STH profits fell to 12%, while LTH profit supply rose to 75%, according to data from Alphractal.

On the 25th of June:

➡️Arizona PASSES Bitcoin Reserve bill HB2324. The Arizona House passed HB 2324 (34-22) after Senate approval (16-14). Pending Governor Hobbs' approval, the bill allows the State Treasurer to create the "Bitcoin and Digital Assets Reserve Fund". If signed by Governor Hobbs, it will be the state's second reserve bill passed into law.

➡️Barclays Bank buys $131m of BlackRock’s Bitcoin ETF. But bans customers from using cards on cryptocurrency. Funny, isn't it?

➡️ Bitcoin PR machine: "Bitcoin is a global, scarce, decentralised asset that's not associated with any one country.” - BlackRock's Head of Digital Assets, Robert Mitchnick

➡️“The telephone has too many shortcomings to be seriously considered as a means of communication.” — 1876 Western Union internal memo

“I believe in the horse. The automobile is a transitory phenomenon" ~Kaiser Wilhelm II ~1905

"There's no reason anyone would want a computer in their home" ~Ken Olson, co-founder of DEC, 1977

“By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.” ~Paul Krugman (nobel prize winning retard) 1998

“There’s no chance that the iPhone is going to get any significant market share.” ~Microsoft CEO Steve Ballmer, 2007.

"In 10 years, Bitcoin will be closed down" ~Jamie Dimon, Jeffrey Epstein's Banker, 2025

Meanwhile, as mentioned in one of my previous recaps, JPMorgan is offering Bitcoin services to its clients. Again, I would question how the CEO of a bank can legally/fiduciarily have his company engaged in the Bitcoin ecosystem, as he believes it’s a fraud.

➡️BIS Claims Stablecoins Fail As Money, Calls For Strict Limits On Their Role. Source: www.zerohedge.com/crypto/bis-claims-stablecoins-fail-money-calls-strict-limits-their-role

Also, BIS: actively researching how to make their own. TLDR: Shaking in their boots.

Lyn Alden is spot on:

"If they fail as money, then there’s no need for “strict limits” on them. They would just stagnate on their own. What actually worries central bankers is that they are attractive to many people in the world as money."

Oh, and to add to the above... Who's going to tell them that the "fails as money" logic applies to all fiat? This is after JPM files for a stablecoin.

➡️'US Federal Housing Finance Agency orders Fannie Mae and Freddie Mac to count Bitcoin & crypto as an asset when assessing mortgage eligibility. HUGE!' -Bitcoin Archive

This was the only way to slow a sudden and violent $350T exodus out of property and into Bitcoin. Millions of BTC now no longer need to be sold. Many investors are soon going to find out that they can start using the best-performing asset of the last decade as collateral.

River: "The assets are only counted for a mortgage if stored at a regulated US exchange. This may become a driving factor for all exchanges to finally implement Proof of Reserves."

➡️Alex Thorn: "Bitcoin dominance has been rising consistently for a year after 16 years and tens of millions of altcoins, Bitcoin is still two-thirds of the entire crypto market makes you think."

➡️This week in corporate Bitcoin adoption: These 9 members of @BitcoinForCorps have collectively added 11,958.45 BTC to their corporate treasuries.

➡️Fidelity: Bitcoin and the wider digital assets landscape continue to evolve, and institutional strategies should too. Stay informed with our curated summer reading list. Find all our Bitcoin-focused pieces featuring exclusive insights from our Research team: www.fidelitydigitalassets.com/topics/digital-assets-and-traditional-investing?ccsource=owned_social_bitcoin_page_x

➡️H100 Group Acquires 19.38 BTC and now has a total of 200.21 Bitcoin.

➡️Green Minerals, a mineral miner in Norway, purchased its first 4 BTC. Last Monday, they announced the adoption of a Bitcoin Treasury Strategy with goals of up to $1.2 bn in BTC.

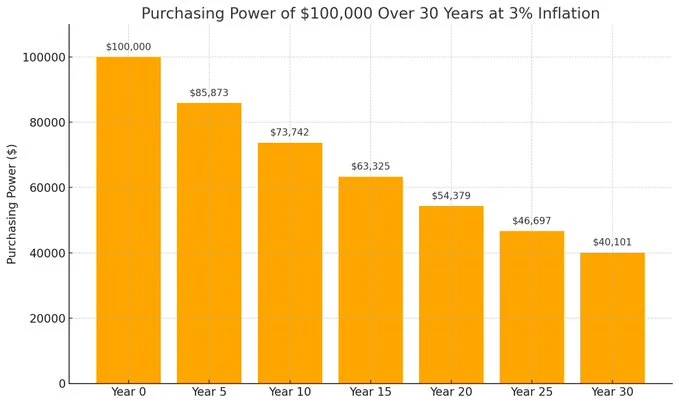

➡️River: The savings account is an illusion. It gives millions a false sense of security, while inflation quietly drains their wealth. This is why we save in Bitcoin.

➡️CEO of America’s largest Bitcoin mining company, Marathon’s @Fgthiel, gave a keynote speech at the Bitcoin Policy Summit in Washington, D.C.

➡️NEW paper: Integrating Bitcoin mining with biorefineries can Avoid waste by creating an additional revenue stream that could lower prices for bio-based products. Support renewable energy growth by acting as a flexible, off-grid power sink that reduces flare emissions.

Source: www.mdpi.com/2079-8954/13/5/359

Daniel Batten:

Key findings for Policymakers/Regulators: Support early adoption and renewable energy access to boost green industries, but avoid restrictive taxes that drive miners away. General Findings: This shows mining can align with sustainability, using renewable energy to make biorefineries viable, proving Bitcoin’s potential beyond energy consumption. Strategic timing and cost management are key to success.

➡️Worst move ever?

Bit Digital is transitioning into a “pure play Ethereum staking and treasury company.” It will sell its 417 Bitcoin, shut down its Bitcoin mining operations, and redeploy the proceeds into ETH. Swapping Bitcoin for Ethereum and ditching Proof-of-Work? Oh well, 'weird way to announce you're going out of business'.

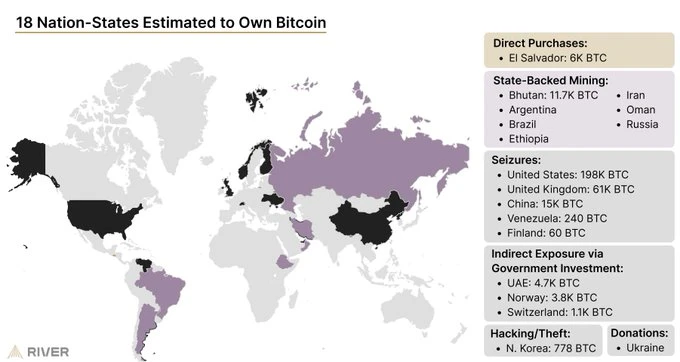

➡️River: 18 Nation States are estimated to own Bitcoin.

➡️Hut 8 Corp. doubles its Bitcoin-backed credit facility with Coinbase Credit from $65M to $130M, extending the maturity to July 15, 2026.

On the 26th of June: ➡️'Ledger is phasing out the Ledger Nano S, the best-selling crypto hardware wallet in history. They caution that ongoing support for the Nano S is not guaranteed and are urging users to upgrade, requiring them to re-enter their seed phrase into a new device. This process exposes users to phishing risks. A Ledger data leak has already led to a surge in targeted scams, including fake but official-looking letters sent by mail, prompting users to enter their seed phrase into fraudulent devices.' - Bitcoin News

In other words, be safe and choose a different hardware wallet to avoid phishing and to prevent Ledger from retiring your new device. Play shitcoin games win shitcoin prizes. Best practices - Bitcoin Only, Open source, Airgapped.

➡️The IMF now classifies Bitcoin as a capital asset!

➡️One month after Pakistan announced Bitcoin reserve intentions, Pradeep Bhandari, spokesperson for India’s ruling BJP party, called for a Bitcoin reserve pilot. Hello, game theory.

➡️Bluebird Mining, a gold miner, increased its goals and now aims to raise a minimum of £10 million ($13.7 million) to start its "digital" gold strategy and buy Bitcoin. Yesterday, they announced a £2 million funding facility, but they received unprecedented multiple offers. They are also looking to get listed on OTCQB.

On the 27th of June:

➡️Bakkt Holdings Inc. files investment policy update saying it may buy $1 billion in Bitcoin.

➡️Documenting Bitcoin: "University of Texas Leases Land to Mine Bitcoin and Generate Cash for Hundreds of Thousands of Students."

Source: www.chaincatcher.com/en/article/2185593

➡️"Bitcoin is digital gold. It's in the US's best interest to accumulate as much BTC as we can possibly get," - Executive director of the Presidential Council of Advisers for Digital Assets, Bo Hines.

Bitcoin News: "If the US unveils a Bitcoin accumulation plan this summer, it could trigger a global arms race, with nations scrambling to secure sovereign BTC before it’s too late."

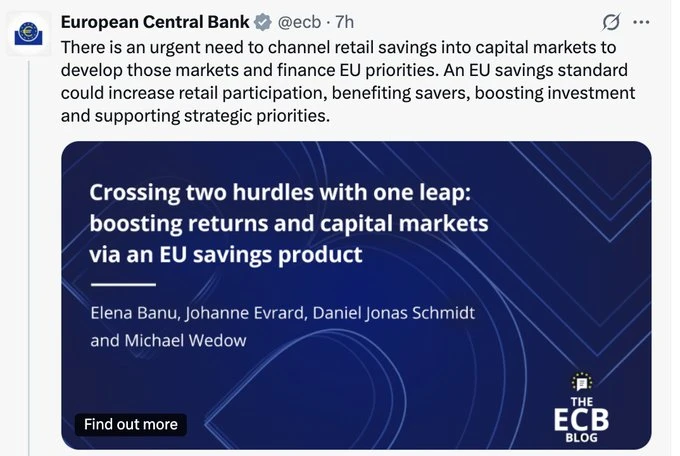

➡️ECB: Moving closer and closer to communism.

www.ecb.europa.eu/press/blog/date/2025/html/ecb.blog20250627~e439c6cd07.en.html

Daniel Batten: "Today, we urgently need to take retail (your) savings, and deploy them into capital markets that finance EU (our) priorities." 100 years ago, the US government forced private citizens to redeem their gold for a low rate, so this is not without precedent.

"Urgent need" to "channel retail savings into EU capital markets"; article mentions "tax incentives" five times.

For the normbies / no coiners....

Read: Your money, which is yours, could be put to much better use by us. Because you will not voluntarily give it to us, we will create legislation that you don't understand, that will enable us to decide what is done with your money.' Ergo, the European Central Bank wants to use retail savings to “finance EU priorities”. Bitcoin is the only money they can’t steal from you.

I am hard pressed to think of anyone in Europe doing a better job of demonstrating the clear and immediate use case for Bitcoin to all European citizens than the ECB. This might just be the best Bitcoin marketing campaign yet!

Got Bitcoin?

➡️Daniel Batten: How The IMF Prevents Global Bitcoin Adoption (And Why They Do It) 'For 3 months, I've quietly been working on exposing what the IMF has done behind the scenes to prevent nation-state Bitcoin adoption. It's out in the open now': bitcoinmagazine.com/featured/how-the-imf-prevents-global-bitcoin-adoption-and-why-they-do-it

Incredible article, must read!

The IMF is more than this story. It is the catalyst for many anti-sovereign policies. Once you understand how powerful a weapon debt is, you realize that it's more powerful than any army because it works by stealth, and people underestimate its strength. Once a nation takes a loan, it loses part of its sovereignty. Share this article and the unethical behavior of the IMF as many times as possible.

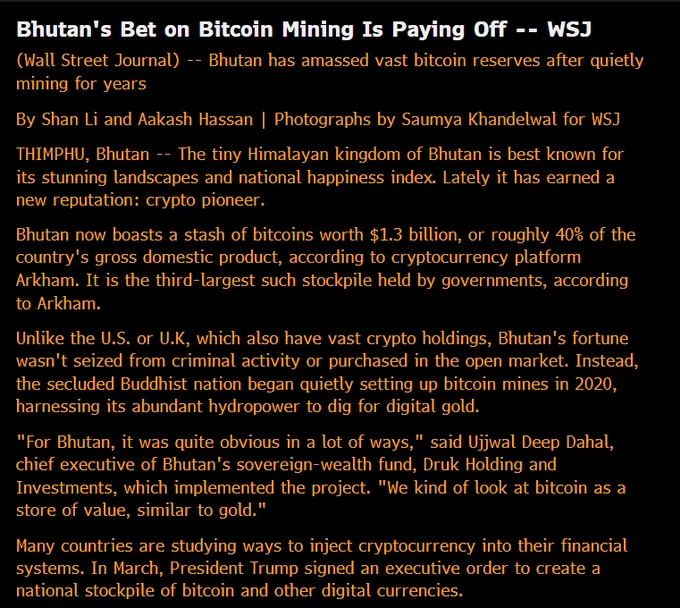

➡️Bhutan says it will now HODL its bitcoin reserves for the long term instead of liquidating to fund government spending - WSJ

Bhutan now holds $1.3 BILLION Bitcoin, which is 40% of its GDP!

➡️Bitcoin long-term holder supply surged by a record 800K BTC in the past 30 days, with only six instances of a 750K BTC increase in Bitcoin’s history, per CryptoQuant data.

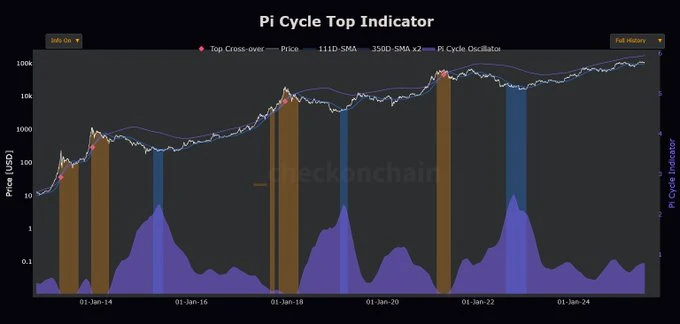

➡️On-Chain College: "Every cycle, this cross marks the Bitcoin top. Either this time is different, or there’s a lot more bull run left to play. Sit tight."

➡️Ric Edelman, who advises over $250B in wealth, just raised his Bitcoin allocation recommendation to as high as 40%. Why? “Four years ago, we feared government bans. Now, every member of the president’s cabinet owns Bitcoin.” In 2021, he recommended a 1% allocation...

On the 28th of June:

➡️Documenting Bitcoin:

"Next ₿itcoin Halving Progress ▓▓▓▓▓░░░░░░░░░░░░░░░░ 30% Loading…

Please Hodl

Current Block: 902,995

Halving Block: 1,050,000

Blocks Remaining: 147,005

Days Remaining: 1,021 days"

➡️Ethiopia made over $55 million in just 10 months by mining Bitcoin. This electricity would otherwise have gone to waste because Ethiopian Electric Power (EEP) hasn't yet built the transmission lines to supply all that electricity generated. So, in the meantime, the dam authorities sell electricity to Bitcoin mining companies, contributing 18% of EEP's total revenue last year. With the extra profit, they fast-track the building of new transmission lines so they can get that extra electricity to people sooner. It's an incredible and inspiring story, backed up by data.

bitcoinbirr.org/assets/files/The-StateofBitcoinMininginEthiopia-BitcoinBirr03.13.2025.pdf

** On the 29th of June:**

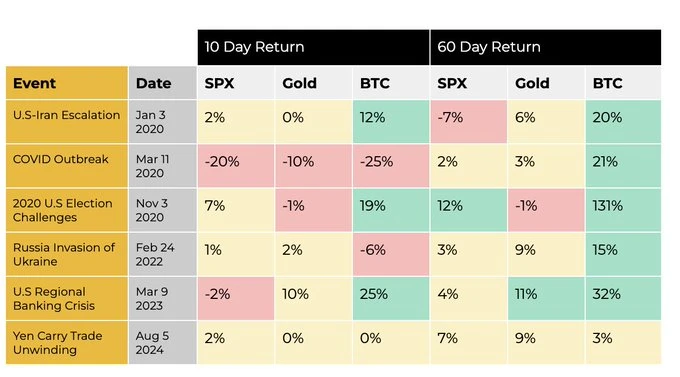

➡️Binance Research says BTC has historically bounced back after major geopolitical events, averaging a 37% return 60 days post-event since 2020.

On the 30th of June:

➡️National Bank of Kazakhstan Governor says they are working to establish a Bitcoin reserve. Kazakhstan's National Bank supports creating a Strategic Bitcoin Reserve and will engage with parliament to prepare the necessary legal framework.

➡️Germany's largest banking group, Sparkassen, to launch Bitcoin and crypto trading services. +370 local savings banks +50 million customers. The Sparkasse will enter the trading and custody of Bitcoin in Germany within the next 12 months!

The implementation will take place via @DekaBank, which already holds its own crypto custody license.

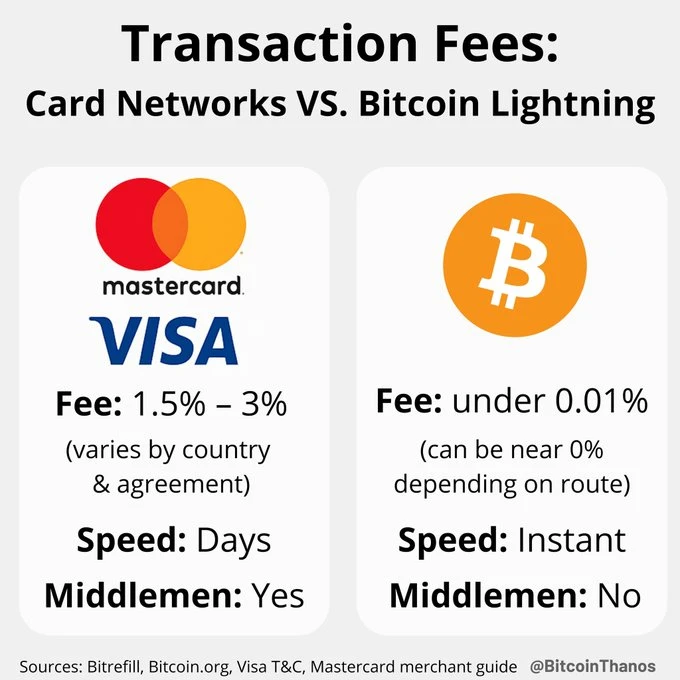

Just want to end this segment with the following picture...

Faster. Cheaper. Borderless. Bitcoin

💸Traditional Finance / Macro:

On the 27th of June:

👉🏽Biggest. Rebound. Ever

🏦Banks:

👉🏽No news

🌎Macro/Geopolitics:

Before we begin this segment, consider the following thought.

"Tonight, I'm asking all of you... to put our financial house in order... and not drown us under a tidal wave of debt..." - Ronald Reagan, 1985

Debt rose $1.86 trillion during the presidential term.

"We’ve got to get the deficit down, because if we don’t, the debt’s going to keep going up, and that’s a burden on our kids and grandkids." - G.W.H.Bush, Oct 2, 1990

Debt rose $1.55 trillion during the presidential term.

"Tonight, I come before you to announce that the Federal deficit, once so incomprehensibly large that it had 11 zeros, will be simply zero." - Bill Clinton, Jan 27, 1998

Debt rose $1.4 trillion during the presidential term.

"My budget pays down the national debt by $2 trillion over the next decade." - Apr 28, 2001 - G.W.Bush, 2000

Debt rose $6.1 trillion during the presidential term.

"We have to live within our means, reduce our deficit, and get back on a path that will allow us to pay down our debt." - Barack Obama, 2011

Debt rose $8.34 trillion during the presidential term.

"We’ve got to get rid of the $19 trillion in debt. ... Well, I would say over eight years." - Donald Trump 1.0, 2016

Debt rose $8.18 trillion during the presidential term.

"Every single program I’m proposing will be paid for. Not a single penny will add to the deficit" - Joe Biden, Oct 2020

Debt rose (at least) $6.65 trillion during the presidential term.

"It’s our turn to prosper and in so doing, use trillions and trillions of dollars to reduce our taxes and pay down our national debt, and it’ll all happen very quickly. - Donald Trump 2.0, 2020 Debt rise during presidential term: TBD

Left, right, Republican, Democrat... Shameful. It rose under every president except Clinton.

Or, as Lyn Alden would say...

NOTHING STOPS THIS TRAIN

On the 23rd of June:

👉🏽Lagarde: Accelerating progress towards a digital euro is a key priority. It would help safeguard Europe’s bank-based financial and monetary system by strengthening Europe’s strategic autonomy and ensuring an innovative and resilient European retail payments system.

Hmm interesting! So… CBDCs are no longer about financial inclusion. Now they are about… protecting banks? Go figure!

ECB going full speed towards digital Euro, despite no demand, no need, no benefit

Daniel Batten: "Translation: Lagarde: Accelerating progress towards absolute Central Bank control via a digital Euro is a key priority. It would help safeguard the ECB against decentralized sound money disintermediating us while ensuring we can better surveil and censor private citizens."

👉🏽Germany and Italy pressed to bring $245bn of gold home from the US. Germany and Italy are facing calls to move their gold out of New York following President Donald Trump’s repeated attacks on the US Federal Reserve and increasing geopolitical turbulence. As Alex Gladstein pointed out correctly: 'Shades of the summer of 1971 when France literally sent a battleship to NYC to collect its gold from America, right before Nixon defaulted on the dollar, leading to a massive USD devaluation'

Daniel Batten is spot on regarding the difference between Gold & Bitcoin: "Transporting gold is high risk and very expensive. So is verifying its authenticity. Custodying it with another nation, even more so. If only we had a better store of value that is portable, easy to verify the authenticity of, and does not have to be custodied with a 3rd party." Source: archive.ph/Nig8k

On the 24th of June:

👉🏽FED CHAIR POWELL'S TESTIMONY (6/24/25):

- Fed is well-positioned to wait and see on rate cuts

- Tariffs likely to push up inflation, weigh on economy

- No immediate signal of interest rate cuts provided

- Labor market "conditions have remained solid"

- Inflation has eased but "remains somewhat elevated" Powell is not ready to cut rates.

👉🏽Charlie Bilello: The average home price in the US is up over 50% in the last 5 years, more than double the increase in wages. The widening gap between prices and incomes has led to the least affordable housing market in history.

👉🏽Argentina Outgrows China: 5.8% Annual Growth Beats China’s 5.4% in First Quarter.

Another great stat...According to the 2025 Global Peace Index by the Institute for Economics and Peace, Argentina has emerged as South America’s most peaceful nation, climbing five spots to rank 46th globally with a score of 1.768. Uruguay and Chile follow at 48th and 62nd, respectively. The report highlights Argentina’s reduced homicide rates, lower social unrest, and stable governance under President Javier Milei, despite economic adjustments. Globally, Iceland leads as the most peaceful country, while Russia ranks last. Colombia and Venezuela lag in the region due to ongoing conflicts and high crime rates, underscoring Argentina’s notable achievement in fostering regional stability. Source: 2025 Global Peace Index

Argentina’s poverty rate drops from 54.8% to 31.7% in 18 months under Javier Milei.

“Nothing is more securely lodged than the ignorance of the experts.” — Friedrich Hayek

Since taking office in December 2023, President Milei has wielded his promised "chainsaw" to slash public sector jobs, fulfilling a key campaign pledge to reduce state spending. The cumulative job cuts from December 2023 to May 2025 show a total reduction of 50,591 positions. The centralized and decentralized federal administration lost 29,499 jobs, state-owned companies 15,592, and military/security personnel decreased by 5,500 staff. Deregulation Minister Federico Sturzenegger noted that this translates to an annual savings of USD 2 billion. Milei’s aggressive downsizing reflects his libertarian commitment to economic liberty and long-term growth. Source: Ministry of Deregulation

On the 25th of June:

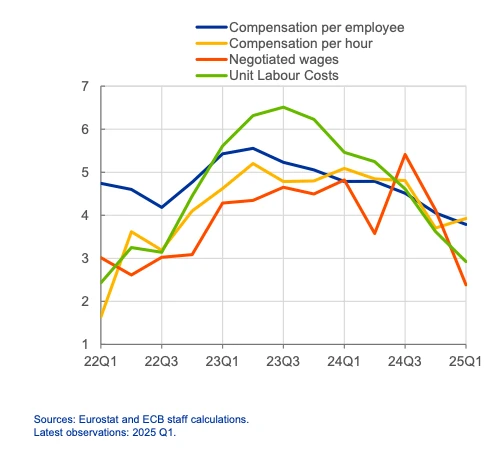

👉🏽'Wage growth in the €zone has fallen substantially and is expected to slow further.' -Phillip Heimberger

When your employer gives you a 2.8% raise that doesn’t even cover the rise in inflation, does that feel like a slap in the face, or are you cool with it?

When your employer gives you a 2.8% raise that doesn’t even cover the rise in inflation, does that feel like a slap in the face, or are you cool with it?

👉🏽'The US Treasury posted a $316 billion budget deficit in May, the third-largest on record. This comes as total government outlays rose 3% from YoY, to $687 billion, per ZeroHedge. And, while tariff revenue surged 270% YoY, to a record $23 billion, it barely made a dent in the deficit. In the first 8 months of Fiscal Year 2025, the budget gap now stands at $1.37 trillion, the third-largest in history. The 12-month federal deficit now stands at $2.0 trillion, or 6.7% of GDP, up from 6.1% a year ago. The deficit spending crisis is worsening.' - TKL

Last year, Trump floated the idea of adopting Bitcoin to help pay off the US government's $35T debt. It’s $37T now. Better get moving.

To make it even worse, and no, I don't want to make it doom and gloom, but these are just facts... The United States has a spending problem...

👉🏽TKL: "A leading indicator in the US job market suggests higher unemployment rates are ahead: The gap between those saying jobs are “plentiful” and “hard to get” declined to 11.1%, the lowest since early 2017, excluding the pandemic spike. In other words, US consumers' perceptions of the labor market have deteriorated to their lowest level in 4 years. In previous business cycles, this has been a leading indicator for unemployment. It now suggests the unemployment rate could rise to ~6.0% in the coming months. The labor market is clearly losing momentum."

👉🏽Urgent plea from Dutch energy executive: ‘Small nuclear reactors essential for sufficient power, a radical change of course is needed’ Source: archive.ph/mPgV2

Isn't it unacceptable that a top executive in the energy sector is only realizing this now, while any reasonable person saw it coming years ago? And the worst part is, they could have been there already… If only there hadn’t been decades of leftist idealistic opposition standing in the way of nuclear energy, there would have been several power plants in the Netherlands by now.

👉🏽Nato members agree on 5% defence spending target. archive.ph/NzPVQ

This NATO summit is a weapons manufacturer's wet dream.

'Economically, this commitment by NATO members to military spending of 5% of GDP seems to me unwarranted. I'm not aware of any study showing such huge spending needs for each member. Politically, it will be costly by generating immense unpopular pressure to cut social spending.' - Phillip Heimberger I am not so sure about cutting social spending. But yeah, something has to give, especially in the EU...

'Something’s Gotta Give: The EU’s Budget Dilemma The European Union is at a crossroads.

•€800 billion for defense over the next years to respond to rising geopolitical threats.

•€800 billion annually to revive the economy and restore competitiveness.

•€1 trillion committed to the European Green Deal over a decade.

•€600 billion allocated to climate-related projects through the EU budget and NextGenerationEU.

But here’s the hard truth: resources are finite, and priorities are shifting. Energy security, defense, and economic resilience are becoming existential imperatives. As the EU recalibrates for a new era of global competition and conflict, green policies and decarbonization may take a back seat—not by choice, but by necessity.

When push comes to shove, will the EU double down on sustainability, or will realpolitik force a pivot?' - Velina Tchakarova

👉🏽The U.S. dollar is down 10% in just 6 months — its worst first half in 40 years.

👉🏽TKL: President Trump's 90-day tariff pause now only has 13 days remaining. This means, without any new trade deals, on July 9th, tariff rates will rise as follows: 1. Country-specific "reciprocal tariffs" return 2. Tariffs of up to 50% on EU imports, 3. 30% tariffs on Chinese imports remain in effect 4. Global 10% baseline tariffs remain in effect. The S&P 500 is now ~1,200 points higher than it was on April 9th, when the 90-day pause was announced. The trade war will soon take the spotlight again.'

On the 27th of June:

👉🏽'May PCE inflation, the Fed's preferred inflation measure, rises to 2.3%, in line with expectations of 2.3%. Core PCE inflation rises to 2.7%, above expectations of 2.6%. PCE inflation is now rising for the first time since February 2025. The Fed pause will continue.' - TKL

👉🏽U.S. "heavily depleted" 15-20% of its global THAAD anti-missile stockpile in just 11 days defending Israel from Iranian missiles, costing over $800 million.

Source: www.disclose.tv/id/jg35i88aur

👉🏽Stack Hodler: "The dollar is now down 22% vs. the Swiss Franc since the Covid money-printing bonanza of 2020. And it's down 55% vs. the Franc since 2000.

US debt-to-GDP: 123% (up from 57% in 2000)

Swiss debt-to-GDP: 38%

The US really blew it with the forever wars."

👉🏽Is El Salvador becoming the new Singapore of Central America?

El Salvador makes history with the world’s first sovereign order of $NVDA B300 AI chips following Bukele’s meeting with Hydra Host CEO.

President Bukele just secured the WORLD'S FIRST SOVEREIGN quote for cutting-edge B300 chips following a meeting yesterday with Aaron Ginn, CEO and Co-founder of Hydra Host! These aren't just any chips - they're the most advanced artificial intelligence processors on the planet, and they're headed straight to El Salvador's National AI Lab.

Source: diarioelsalvador.com/el-salvador-adquirira-los-chips-de-ia-mas-avanzados-del-mundo/669202

On the 28th of June:

👉🏽Charlie Bilello:

- Stocks: all-time highs

- Home Prices: all-time highs

- Bitcoin: all-time highs

- Money Supply: all-time highs

- National Debt: all-time highs

- CPI Inflation: averaging 4% per year since 2020, double the Fed's "target"

- Fed: expected to cut rates 3x by the end of this year

👉🏽US job numbers have been revised down by a massive 219,000 so far in 2025.

April -30,000

March -108,000

February -49,000

January -32,000

22 out of the last 28 months have been revised down since the beginning of 2023. At this point, you can't believe the data. And people ask why I don't trust the job numbers...

👉🏽Burkina Faso has generated $18 BILLION from gold mines since Ibrahim Traore took office.

On the 29th of June:

👉🏽The new budget reconciliation bill (aka Big Beautiful Bill) proposes to raise the debt ceiling from $36.146 trillion to $41.146 trillion. Or another $5 trillion.

On the 30th of June:

👉🏽The Euro has surged to its highest level against the U.S. dollar since 2018. Up 8%.

👉🏽US Treasury Secretary Bessent: 'This is a start in controlling US debt.' …but we will start by raising the debt ceiling by $5 trillion. As I mentioned at the start of this segment...nothing stops this train.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin did: "Jeff Walton is a financial analyst, a former reinsurance broker, and the Founder of True North.

In this episode, we break down the rise of Bitcoin treasury companies, why Strategy is playing an entirely different game, and how Saylor’s new financial instruments are creating a Bitcoin-native yield curve. We also discuss how these instruments could absorb trillions from the fixed income market and what that means for Bitcoin’s long-term price floor.

We get into the risks of corporate treasury models, why some of the new entrants look like the 2017 ICO market, whether these structures could lead to reflexive crashes in a bear market, and the future of equity in a Bitcoin-denominated world." www.youtube.com/watch?v=cUeU-S4H31c

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃