Click Here For The Audio Version

When I first heard about the Bitcoin peer to peer network, I was skeptical. I didn't know what cryptography was. I didn't understand much of the math. I read the white paper because I heard about it on a podcast. The Gambler's Ruin problem was about the only thing in the I understood. I only was able to create a wallet because Andreas Antonopoulos said accepting Bitcoin required nothing more than writing down twelve words.

I didn't "buy Bitcoin." I took posted a legacy address on Twitter. "Can someone please give me a little bit of this Bitcoin thing?"

It was something to that effect anyway. A nym sent me a bitcoin tip using ChangeTip. "Here's $1.50 worth of Bitcoin. Buy yourself a cup of coffee." It wasn't self custodial, but this anon showed me that you can just send people bitcoin with a tweet, when Twitter was hackable like nostr . It encouraged me to fall deeper down the rabbit hole. After about a week of sleep deprived obsession, I sent the small amount of Bitcoin to my self custodial wallet.

Holly Shiitake mushrooms Batman! It works! A stranger sent me cash money over the Internet, an online payment without needing a bank, government, or gold. That's pretty radical. It seemed like kind of a big deal. 311,000 blocks before that(2009) the legacy financial system almost really died, unlike the 450 times the mainstream media declared bitcoin dead.

This wasn't just some phoney bologna story on The Joe Rogan Experience. It was a peer-to-peer network like Gnutella and Tor I was broke, but this taught me Bitcoin was something I could earn.

That's how my dad taught me about money. He woke up at 4 in the anti-meridian, busted his ass so he could cash his check at the grocery store. Brought home the bacon, bread, and stashed the leftover cash for the week. The money didn't really need to go into the bank because you could spend it anywhere, even on utilities.

He wasn't an agorist. He did side jobs for cash-money. He would give me a couple bucks to spend whenever his machine impaired ear drums heard the ice cream truck. That's my earliest memory of cash-money, buying ice cream off the ice cream truck. I was a sucker for PacMan shaped ice cream bars.

We watched the Dodgers every now and then. One time, on the way to the horse trough style urinals, my dad whispered, "look down."

It was a green piece of rectangular paper with a portrait of the 18th president of the United States. I snatched it as fast as I could. Fifty bucks richer. As any five year old knows, cash is a bearer instrument. As the saying goes, "Finder's keepers, losers weepers." Whoever holds the cash can spend the cash. Whoever holds the bitcoin keys can spend the bitcoin.

That's how bitcoin works. There is no physical cash, only a record of the transfer of ownership from one digital signature to another digital signature. All the Bitcoin exists on a peer to peer network. Digital signatures are timestamped using a hash cash like system. In The Bitcoin Standard, Saifedean Ammous compares this time stamping cash system to the limestone on the island of Yap. The Islanders used these solid rocks as money. The rocks are almost impossible to move. Since they couldn't move them or get more to the island without doing a tremendous amount of work, ownership was transferred by word of mouth. If the owner of a rock proclaimed the stone has a new owner, word got around. The time chain works the same way. The digital signatures are like the transferring the ownership by word of mouth of on the island of the bitcoin peer-to-peer network. This island happens to be world wide.

Digital signatures require a public private key pair. In Bitcoin, the public key is called an Xpub. This xpub is used to derive all of the Bitcoin addresses associated with the key. If someone finds your xpub on the floor of Dodger stadium, they will not be able to spend your sats, but they will know how many you have. Most people at Dodger stadium are pretty cool, but there are some bad apples. You don't want someone who knows how much Bitcoin you have to threaten you with a baseball bat. That's why it's important to keep the amount you own a secret.

If someone finds your private key, it is like finding the $50.00 bill on the floor of Dodger stadium. There's a chance, if you lose it, you can find it, but don't hold your Dodger Dog scented breath. If you remember nothing else, remember this: Anyone with your private key can spend your Bitcoin, therefore, you must keep it secret.

🍌0000🍌0000🍌0000🍌0000🍌0000🍌0000🍌0000🍌0000🍌0000🍌0000🍌0000🍌

These days, most people hear about BTC stocks, MNAV, and endless supply of shills that promise the greatest thing since bananas on a block chain. Bananas timestamped on a peer to peer network is a phrase that doesn't make any sense because bananas can't enter the world wide web island. If the can’t get on the island, they can’t get stamped from that island. Although bananas on a blockchain are not possible, the timechain could work as an alternative financial system if the fiat financial system stops working.

I wasn't able to buy a cup of coffee right away. It would be another 420,000 blocks(8 years), but the experience taught me what bitcoin is, peer-to-peer electronic cash. You don't need to wait that long because many brick and mortar stores accept Bitcoin these days. If you live somewhere in the United States, chances are you can find a place that accepts bitcoin for goods and services. Don't listen toYouTuber traders because they talk about [cantollionares( fee.org/articles/the-cantillon-effect-because-of-inflation-we-re-financing-the-financiers). doing cantillionare things.

As the old adage goes, "don't invest in anything you don't understand. " If you don't understand what Bitcoin is, how can you invest in bitcoin? You can't. You can buy BTC, which is a promise to pay a certain amount of bitcoin as priced in dollars.

I use some KYC services because I am ideologically opposed to fractional reserve banking. I would prefer to never use credit cards or banks, but after COVID, totalitarianism came back due to popular demand. I went to a baseball game, a past time as American as Apple Pie. They didn't take cash. It had a sign that read, CREDIT CARDS ONLY. The same thing happened at a local coffee shop. I decided that if I will be forced to use credit cards in meat space, I was going to keep as little fiat in my bank account as possible.

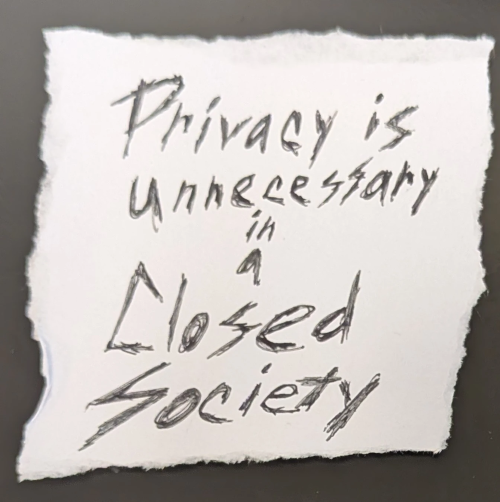

If they don't want you in the country for saying stuff they don't want you to say, they kick you out like Edward Snowden. If they don't like the code you write, they throw you in a cage like the Samourai wallet developers. A society with digital ID's to "protect the children" is not the open society the Cypherpunks were defending. There's no place to hide, no open society to flee too.

The conspiracy minded part of my brain begins to think the Plandemic created dirty money(paper fiat) to ramp up the panopticon infrastructure. Get everyone business to ban cash and cash only business are no longer welcome in the closed society of KYC Only signs.

Contrary to popular belief, debt burdened states do not like p2p e cash. They may like BTC ETFs. They may love monetizing the debt with stablecoins, but despise peer-to-peer electronic cash. Like Lyn Alden famously said, "nothing stops this train." It doesn't matter who you vote for. Nothing stops the train. Bitcoin held in provably full reserve in self custody is the only viable tool we have to exit this unstoppable train.

Questions And Actions

If you've sold fiat for Bitcoin, but have never bought anything but fiat with Bitcoin, then how can you understand what you own?

Bitcoin a peer to peer electronic cash system is not a store your u spendable wealth with Blackrock system. Bitcoin is freedom money for people who want to be free from the socialist panopticon .

The first step in understanding bitcoin is the same as the first step to understanding fiat. If you're reading this, you probably don't run towards the ice cream truck when you hear the ice cream song. The first step to learning how to use any currency in to spend a little.

To spend Bitcoin, or [sats]( www.investopedia.com/terms/s/satoshi.asp), find a store that accepts bitcoin near you using BTCmaps.org or the Cash App if you have it. It's a popular app on the United States, but many of the popular apps allow you to send payments over the lightning network. Is it KYC Free? NO, but the purpose of this series is to teach people who have more sats than they are comfortable with on an exchange how to save Bitcoin in a self-sovereign way.

If that describes you, buy a cup of coffee, an ice cream bar, or a cheeseburger from Steak N Shake. The point of this exercise is not to teach you how bitcoin works, calculate the CAGR, or create a time-locked multi signature wallet. You need to learn how to crawl before you can walk. The purpose of this exercise is to show you bitcoin is peer-to-peer electronic cash that can be used for goods and services.

Marc from the Full Reserve Podcast.

This website is made possible by these nostr clients