It's often said among bitcoiners that conventional fiat currency is a Ponzi scheme. This gets repeated so frequently that it's practically become a meme. Maybe you're reading this because you know someone who is really into Bitcoin and keeps saying it.

The goal of this post is to explain precisely - using verifiable facts and data - why this is simply a fact, not merely a meme. What you choose to do with this information is up to you. But whatever you do, you will be more informed about how money is created and how much influence your bank has over the process in the modern world, and given how essential money is to all of us, being informed about it can only be a good thing.

What is fiat currency?

Fiat money does not simply mean "money that isn't a cryptocurrency." Although the term was rarely heard outside of economic circles before the advent of Bitcoin, it is an economic term derived from the Latin for order or decree. And yet its prevelance is a very recent invention!

Remember that the gold standard was only abolished by Richard "Not A Crook" Nixon in 1971. Before this historic event, money was used to represent something of true scarcity and value. You could take your money to the bank and exchange it for gold, for example.

Today, although your notes may have language printed on them implying that they are still IOU's, they are backed by nothing - and that's literally the textbook definition of fiat currency.

To quote good ol' Wikipedia:

Fiat money is a type of currency that is not backed by a commodity, such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was quite rare until the 20th century, but there were some situations where banks or governments stopped honoring redeemability of demand notes or credit notes, usually temporarily. In modern times, fiat money is generally authorized by government regulation.

Fiat money generally does not have intrinsic value and does not have use value. It has value only because the individuals who use it as a unit of account – or, in the case of currency, a medium of exchange – agree on its value. They trust that it will be accepted by merchants and other people.

Fiat money is an alternative to commodity money, which is a currency that has intrinsic value because it contains, for example, a precious metal such as gold or silver which is embedded in the coin. Fiat also differs from representative money, which is money that has intrinsic value because it is backed by and can be converted into a precious metal or another commodity. Fiat money can look similar to representative money (such as paper bills), but the former has no backing, while the latter represents a claim on a commodity (which can be redeemed to a greater or lesser extent).

So to be clear, the very definition of fiat currency is that it is money backed by nothing without any value beyond state enforcement and enough people going along with aforementioned state enforcement.

What is a Ponzi scheme?

Briefly, it's also important we understand what exactly a Ponzi scheme is. It has a specific definition and is not merely interchangeable with "a scam."

To quote a nicely succinct definition:

A Ponzi scheme is a fraudulent investing scam which generates returns for earlier investors with money taken from later investors.

I don't think I need to expand on this too much as it's a very simple concept. A Ponzi scheme can only continue to operate as long as it continues to convince new investors to put money into it. There is no real business going on behind the scenes to generate new wealth aside from attracting more and more people to keep participating.

Already, you can probably see the connection between this and the definition of fiat money above.

But hold onto your hats, because this gets much deeper.

How is new money created?

If I ask you right now, who creates new money and introduces it into the economy, what answer comes to mind? I'm guessing, for most, even some of the most financially savvy, your answer is that this is a stupid question - everyone knows new money is created by central banks such as the U.S. Federal Reserve, the European Central Bank, or the Bank of England.

This is incorrect.

The vast majority of fiat money in the global economy - roughly between 80-90% - is commercial bank money.

What does that mean?

To quote from the Bank of England themselves:

Most of the money in the economy is created, not by printing presses at the central bank, but by banks when they provide loans.

...

Therefore, if you borrow £100 from the bank, and it credits your account with the amount, ‘new money’ has been created. It didn’t exist until it was credited to your account.

...

Banks create around 80% of money in the economy as electronic deposits in this way. In comparison, banknotes and coins only make up 3%.

Yes, quite simply, it means that new money is created within the economy almost entirely through the creation of debt. This also means that "loans" are not actually "loans" because banks do not "lend" you anything. The idea of a bank loaning you money from deposits is a pure fantasy. It is fiction. It does not exist. Fiat currency is produced by debt. This is how the entire global fiat economy operates.

You don't need to just take my word for it. Or even the BofE's word. I quote directly from the IMF themselves on this one:

In modern neoclassical intermediation of loanable funds theories, banks are seen as intermediating real savings. Lending, in this narrative, starts with banks collecting deposits of previously saved real resources (perishable consumer goods, consumer durables, machines and equipment, etc.) from savers and ends with the lending of those same real resources to borrowers. But such institutions simply do not exist in the real world. There are no loanable funds of real resources that bankers can collect and then lend out. Banks do of course collect checks or similar financial instruments, but because such instruments—to have any value—must be drawn on funds from elsewhere in the financial system, they cannot be deposits of new funds from outside the financial system. New funds are produced only with new bank loans (or when banks purchase additional financial or real assets), through book entries made by keystrokes on the banker’s keyboard at the time of disbursement. This means that the funds do not exist before the loan and that they are in the form of electronic entries—or, historically, paper ledger entries—rather than real resources.

This is absolutely vital to understand. The vast majority of fiat money flowing in the world economy - and, indeed, all of the money paid digitally into your bank account - is issued not by a central bank, but exists only because of debt. In turn, this debt cannot exist without banks simply pulling funny money out of thin air, as they have no reserves to lend from. And even if they did, remember, fiat currency is itself void of any intrinsic value.

To quote from a Standford and Poors research paper:

Banks lend by simultaneously creating a loan asset and a deposit liability on their balance sheet. That is why it is called credit "creation" -- credit is created literally out of thin air (or with the stroke of a keyboard). The loan is not created out of reserves. And the loan is not created out of deposits: Loans create deposits, not the other way around.

In turn, this also increases the instability of the economy by creating - or at the very least, significantly exacerbating - boom and bust cycles. To quote again from the previously linked IMF article:

First, if banks are free to create new money when they make loans, this can - if banks misjudge the ability of their borrowers to repay - magnify the ability of banks to create financial boom-bust cycles. And second, it permanently ties the creation of money to debt creation, which can become problematic because excessive debt levels can trigger financial crises, a fact that has since been corroborated using modern statistical techniques (Schularick and Taylor, 2012).

A few important points to take from this:

-

Banks do not actually "loan" anyone anything. They are not taking liquidity from deposits and lending it to you. They are typing numbers into a computer, creating funny money, then charging you interest to pay it back. The majority of this debt creation happens through mortgages. If you have a mortgage, you will likely spend most of your working life paying it off with much of those payments simply going towards interest before you begin to touch the principle, even though the bank "lent" you the money merely by typing some numbers into a spreadsheet without lending you any actual assets they hold.

-

Because of this, as the S&P and IMF both explain above, debt creation is an asset on their balance sheet, as there would be no money for anyone to deposit or spend if the banks weren't creating it with debt.

-

As also emphasised above by the IMF, as virtually all fiat money creation in the economy relies on the creation of new debt, and this is inherently unsustainable, it leads to unstable economic conditions including recessions.

-

In addition, every economic instituion is financially incentivised not for you to pay in cash, but to get yourself further into debt, and in turn for essential goods (housing, food, energy) to cost as much as possible so you are in as much debt as possible, and neither governments nor central banks can get in the way of this for fear of causing deflation.

-

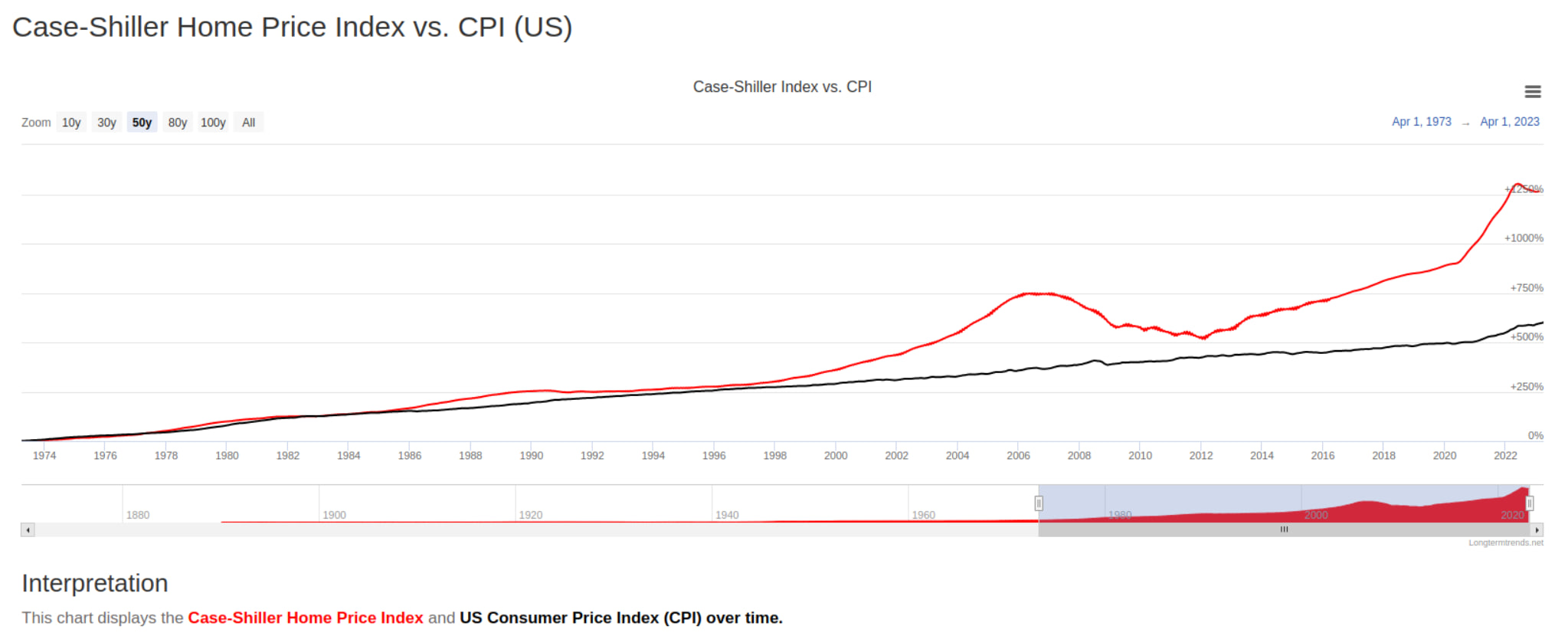

Banks can and do abuse their power to create money with debt to cause bubbles which in turn earn them more profit. For instance, before the 2008 financial crash, mortgages were granted without any reguard for the associated risk, which in turn resulted in a real estate bubble. To this day, housing inflation remains on significantly than CPI or wage increases - and keep in mind, CPI dramatically understates the true level of inflation. Most of this has taken place within the past decade.

-

To really hammer down this point: the structure of the fiat monetary system depends almost entirely on everyone being perpetually in debt and it is unable to survive if no one is in debt. If everyone lived within their means, the vast majority of the new monetary supply would literally cease to exist. So if you were wondering why central banks kept interest rates at such unsustainably low levels for so long, and are now increasing them rapidly as the sole method of fighting record high inflation, you have your answer.

Fractional reserve banking

Modern banking is referred to as a fractional reserve system. In other words, banks must keep a certain percentage of the total amount of money they create as actual cash reserves held with the central bank.

Indeed, the Bank of England makes this claim in the link above:

Can banks create as much money as they like?

No, they can’t.

Regulation limits how much money banks can create. For example, they have to hold a certain amount of financial resources, called capital, in case people default on their loans.

However, the reserve requirement for banks was abolished by the Bank of England in 1981. And in 2020, the Fed followed suit:

As announced on March 15, 2020, the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.

Indeed, much of the world no longer imposes any reserve requirements on private banks.

At this point, you understandably may be thinking "but private banks do still keep reserves at the central bank, and this surely must impose limits on their ability to create money... right?"

Not really.

Although regulations around central bank reserves still exist, they do not restrict a bank's ability to create debt, and therefore fiat money. I quote once again from S&P:

Reserves play a pivotal role in money creation but not in the way often envisaged. The money multiplier view of the world envisages the central bank creating reserves and the reserves multiplying into new lending. That is, reserves constrain bank lending. That would seem compelling. If banks are subject to minimum reserve requirements (requiring them to hold reserves in a certain proportion to their deposits, and deposits are the balance-sheet counterpart to loans at the point of credit creation), then, by restricting the amount of reserves that the central bank supplies, it should be able to control the amount of credit.

But modern central banking doesn't work this way. Central banks don't constrain the amount of bank reserves they supply. Rather they supply whatever amount of reserves that the banking system demands given the reserve requirements and the amount of deposits that have been created.

It's as simple as that. As explained above, while private banks are required to keep deposits at central banks, the flexible nature of the new laws and regulations that replaced reserve requirements mean that the central banks do not limit the size of deposits, and a larger deposit means a bank can make more money.

There is in effect no real limit to the amount of new money banks can create aside from their own willingness to wrecklessly "lend out" funny money.

And as 2008 taught us, there's no shortage of willingness.

At this point you might be asking: "what's the point of central bank deposits at all if the private banks can just do whatever they want anyway?"

I'll quote an in-depth answer from the same S&P report below, but the TL;DR version is simply these reserves are only used by the central bank if the demand for physical cash increases significantly. As long as most people keep their money in a bank - any bank - the reserves are totally irrelevant. Even if you borrow $10,000 from Bank A and send it straight to Bank B, this has zero effect on Bank A because, of course, it was never "real money" held by Bank A to begin with:

Reserves go down when banknotes increase. Banknotes increase when borrowers take the money they borrowed out of the bank and part or all of the money remains in cash, rather than being re-deposited in the banking system. For an individual bank, the link between reserves and loans is an indirect and largely uncontrollable one. Individual banks can try to "get rid of" their excess reserves by making new loans, and, to the extent that the deposits so created leave their bank and, importantly, do not return as new deposits (the bigger the bank the less likely this condition is to hold), this will work for them. But for banks as a whole, new lending leads to a reduction in reserves only to the extent that the deposits created move into cash in circulation. Take an extreme case where the deposits created by the new loan just move from one deposit account to another; then there is no reduction in reserves.

Notice how difficult it is to find an ATM these days? How many branches have shut down? It's getting harder and harder to deposit or withdraw cash. And, of course, there's the oncoming threat of CBDCs heading our way, but that's a whole other can of worms I won't touch in this post.

Does that sound like a Ponzi scheme to you?

Let's review the typical traits of a Ponzi scheme:

- An operation backed by no real business activity aside from sustaining itself by getting new deposits

- It in reality does nothing of any tangible value despite presenting itself as otherwise

- Intentionally complex investment model that abstracts its true nature from clients

- As a result, clients cannot determine what is actually being done with their money

- It cannot pay out money belonging to existing clients if it doesn't continue getting new deposits

Remember here that for the purposes of banking accounting, loans create deposits. We have already established that if demand for new loans were to stop, 80-90% of the new monetary supply in the world would cease to exist, so the entire system relies upon this circular model where banks must create new debtors to remain viable. It is not just individual banks we are talking about here - it is the macro banking system and the entire nature of fiat currency itself.

With this in mind, I cannot see how fiat currency is not a Ponzi scheme.

How is Bitcoin different?

In the words of Satoshi:

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.

And these are precisely the issues Bitcoin set out to address.

Bitcoin has a fixed supply of 21 million. There can never be more than 21 million Bitcoins mined. Therefore, Bitcoin simply does not have inflation.

Not only does this supply cap ensure scarcity and, over a long time horizon, make Bitcoin one of the most (if not the most) rapidly appreciating assets on the planet, but it is also backed by something tangible and scarce: energy.

This is an element of Bitcoin often attacked in the media for environmental reasons, but the media misrepresents basic facts. Most Bitcoin mining uses either renewable energy or excess energy. Excess energy is a source of power that is produced as a byproduct of electricity generation and is normally wasted. Bitcoin miners harness excess and renewable energy largely because it simply makes economic sense.

One especially notable example is El Salvador generating power from volcanos specifically for the purpose of Bitcoin mining, announced alongside the passing of the bill that classified Bitcoin as legal tender within the country. This is a form of geothermal electricity production, described by the US government as a "vital, clean energy resource." The next step, which is currently underway, is the development of an entire volcano powered Bitcoin City financed through Bitcoin backed "Volcano Bonds."

Therefore, the market's demand for Bitcoin is incentive's adoption and development of clean renewable energy and funding an entire city.

With that out of the way, the original point: energy has intrinsic value, it is necessary for every human on the planet, it is scarce. Bitcoin is therefore arguably a form of commodity money: a currency that is created from and backed by a scarce commodity with intrinsic value.

And this is only looking at it from the perspective of comparison to an inflationary debt reliant Ponzi scheme.

Bitcoin itself has unique properties, the most notable of which is the decentralised nature that ensures it is outside of any state control, or indeed control by any other single party such as private and central banks.

It's time for Plan ₿

What sounds better: a currency free of state and private corruption, under the control of the people, and backed by proof-of-work, or a state controlled inflationary currency backed by nothing but debt that simply creates more of itself, the unsustainable Ponzi scheme of creating new debt to create new money without intrinsic value, until it topples over and creates yet another global recession resulting in market crashes, mass unemployment, and defaults on all that debt, before the whole cycle repeats again and again?

I hope this case makes itself.

As I said, do with this information as you will. But I hope if nothing else you've learned something about where your money comes from and how banks work.

Where can I learn more about this?

The documentary 97% Owned focuses entirely on how money is made and how the fiat financial system works. It's available to watch in full on YouTube and I highly recommend it.

There are many documentaries about Bitcoin, but I am personally a fan of this one.